|

市場調查報告書

商品編碼

1536845

海上 AUV/ROV:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Offshore AUV And ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

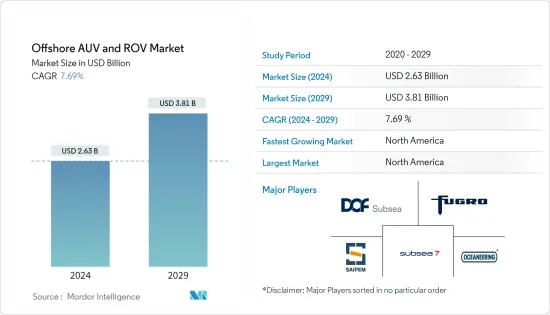

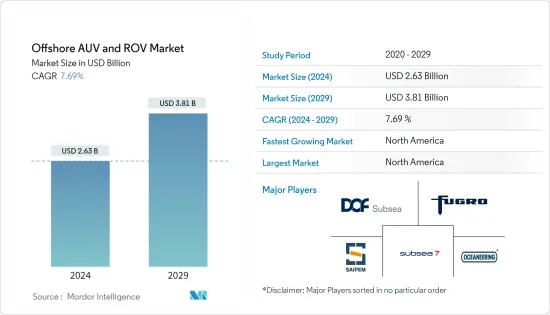

預計2024年全球海上AUV/ROV市場規模將達26.3億美元,2024年至2029年複合年成長率為7.69%,2029年將達38.1億美元。

主要亮點

- 從中期來看,海上石油和天然氣生產活動的增加、離岸風電行業的成長以及石油和天然氣退役活動的增加等因素預計將在預測期內推動海上AUV和ROV市場的發展。

- 另一方面,未來計劃加強對氣候變遷關注或禁止海洋探勘活動的國家預計將抑制市場成長。

- 然而,技術創新和進步預計將增加 AUV 和 ROV 在石油和天然氣、離岸風電和探勘等行業的海上活動中的使用。從長遠來看,AUV 和 ROV 的技術進步預計將為公司提供大量機會。

- 北美預計將出現顯著成長,大部分需求來自美國和墨西哥等國家。

海上AUV/ROV市場趨勢

石油和天然氣領域主導市場

- AUV 和 ROV 用於海底基礎設施建設、監測和探勘任務的定位和引導。探勘航行器在海上石油油氣工程的應用包括引導鑽井作業、海底觀測、定點採樣、導管架安裝相關輔助工作、油氣管道安裝、海上設施維護等。

- 由於世界主要經濟體仍然嚴重依賴石油產品,對石油和天然氣的依賴正在增加。石油天然氣工業在國際政治、經濟上具有巨大影響力。

- 2022年,全球石油產量與前一年同期比較增加4.18%至9,384.8萬桶/日。世界人口的增加反映在初級能源消耗的增加上,從2011年的520.90艾焦耳增加到2022年的604.04艾焦耳。

- 世界上許多潛在的碳氫化合物蘊藏量都位於海底。碳氫化合物產業已經開發出適合海底條件的技術,以成功發現和生產石油和天然氣。

- 石油和天然氣鑽機可在深達兩英里的水中作業。許多深水井和管道系統都依賴無人水下航行器進行安裝、檢查、維修和維護。

- 最近,一些國家積極參與海上石油和天然氣領域,進行投資以增加海上油田的產量。

- 2022 年 5 月,殼牌和巴西國家石油公司與 Saipem 簽訂契約,在兩個先導計畫,包括對兩家能源公司營運的巴西近海兩個超深水油田進行檢查宣傳活動。

- 此外,2022年8月,印度石油天然氣公司與埃克森美孚公司簽署了一份合作備忘錄(HoA),以在該國東海岸和西海岸進行深水探勘。兩家公司將專注於探勘東部近海的克里希納戈達瓦里盆地和高韋裡盆地以及西部近海的卡奇-孟買盆地。

- 因此,鑑於上述幾點,預計在預測期內,石油和天然氣領域對海上AUV和ROV的需求將大幅成長。

北美地區預計將實現顯著成長

- 北美地區是全球最發達的海上石油和天然氣工業之一,主要重點領域是墨西哥灣和阿拉斯加近海的巨大蘊藏量。隨著鑽井深度逐年增加,蘊藏量也大幅增加,導致投資增加。

- 由於其高工業化水平和積極的研發投資,預計北美在預測期內將成為海上 AUV 和 ROV 的最大市場之一。

- 由於美國在國防領域和 AUV/ROV 研發方面投入巨資,石油和天然氣、航運和可再生能源等其他相關近海領域也將從研究市場的技術進步中受益匪淺。這使得該地區處於 AUV/ROV 技術的前沿。該地區的 AUV 和 ROV 製造商將其產品出口到世界各地。

- 該地區是全球最發達的海上石油和天然氣工業之一,主要重點領域是墨西哥灣和阿拉斯加近海的巨大蘊藏量。隨著鑽探深度逐年增加,技術可採蘊藏量顯著增加,投資力道不斷增加。

- 隨著美國大力投資擴大油氣產能,墨西哥灣已成為全球AUV和ROV需求熱點。截至 2022 年,墨西哥灣地區的產量分別占美國海上和碳氫化合物總產量的 97% 和 15%。該地區是世界上海上鑽井鑽機部署最集中的地區之一,包括生產和鑽探平臺、海上船舶、管道網路以及其他石油和天然氣基礎設施。

- 隨著 AUV 和 ROV 技術變得越來越便宜,美國石油和天然氣生產商擴大使用 AUV 和 ROV 來獲取海底資產和海面資料並執行日常維護作業。儘管 ROV 和 AUV 的初始成本比潛水作業更高,但它們可以透過完成相同工作量所需的時間更少來降低整體計劃營運成本。

- 因此,主要石油和天然氣公司通常會在墨西哥灣簽訂多份 AUV 和 ROV 服務合約。 2022 年 9 月,DOF Subsea USA訂單與該地區主要石油和天然氣營運商簽訂了墨西哥灣的多份合約。 DOF Subsea 營運的符合瓊斯法案的船舶將每年使用約 180 天,在多個地點執行各種活動,包括檢查、維護、修理、輕型工作和試運行支援。

- 墨西哥傳統上擁有蓬勃發展的碳氫化合物工業。然而,與美國相比,墨西哥近海領域的平均鑽井深度相對較低。因此,墨西哥石油和天然氣業者從潛水員輔助服務轉向 ROV 和 AUV 等無潛水員服務的經濟獎勵較少。

- 然而,隨著墨西哥政府尋求重振碳氫化合物產業並提高國內碳氫化合物產量,該國的石油和天然氣產業預計將獲得重大投資,特別是來自國家石油和天然氣公司 PEMEX 的投資。 2022年3月,PEMEX的探勘與生產部門PEP宣布已獲得淺水Uçukil油田的探勘核准,根據基準和增量情景,投資額為1.07億美元至4.78億美元。

- 同樣,墨西哥承諾在未來幾年投資 12 億美元開發兩個新的海上區塊。預計在預測期內,海上領域的大規模投資將推動墨西哥海上 AUV 和 ROV 市場的發展。

- 因此,鑑於上述幾點,預計北美地區AUV/ROV市場在預測期內將顯著成長。

近海AUV/ROV產業概況

海上 AUV/ROV 市場已減少一半。市場的主要企業(排名不分先後)包括 DOF Subsea AS、Fugro NV、Subsea 7 SA、Saipem SpA 和 Oceaneering International Inc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 市場規模與需求預測(美元),~2028

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 美洲、亞太地區和中東/非洲的海上石油和天然氣探勘活動增加

- 海上可再生技術的發展

- 抑制因素

- 禁止多地區海上探勘生產活動

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章市場區隔

- 車輛類型

- ROV

- AUV

- 車輛類別

- 作業車輛類別

- 輕型作業車

- 中型作業車

- 重型作業車

- 觀察車類

- 作業車輛類別

- 最終用戶使用情況

- 石油和天然氣

- 防禦

- 調查

- 其他用途

- 活動

- 鑽井/開發

- 建造

- 檢查、維修和保養

- 退休

- 其他活動

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 丹麥

- 挪威

- 俄羅斯

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 東南亞國協

- 其他亞太地區

- 南美洲

- 巴西

- 委內瑞拉

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 奈及利亞

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- DeepOcean AS

- DOF Subsea AS

- Helix Energy Solutions Group Inc.

- TechnipFMC PLC

- Bourbon

- Fugro NV

- Subsea 7 SA

- Saipem SpA

- Oceaneering International Inc.

- Teledyne Technologies Incorporated

第7章 市場機會及未來趨勢

- AUV/ROV 市場的技術進步

簡介目錄

Product Code: 52273

The Offshore AUV And ROV Market size is estimated at USD 2.63 billion in 2024, and is expected to reach USD 3.81 billion by 2029, growing at a CAGR of 7.69% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as rising offshore oil and gas production activities, growing offshore wind power industry, and increasing oil and gas decommissioning activities are expected to drive the offshore AUV and ROV market during the forecast period.

- On the other hand, countries planning to increase their focus on climate change and banning offshore exploration activities in the future are expected to restrain market growth.

- Nevertheless, innovation and technological advancement are expected to increase the utilization of AUVs and ROVs in offshore activities in industries such as oil and gas, offshore wind, research, etc. The technological advancements in AUVs and ROVs are expected to offer a considerable opportunity for companies in the long term.

- North America is expected to witness significant growth, with the majority of the demand coming from countries such as the United States and Mexico.

Offshore AUV And ROV Market Trends

Oil and Gas Segment to Dominate the Market

- AUVs and ROVs are used for positioning and guidance for sub-sea infrastructure construction, monitoring, and survey missions. The applications of underwater vehicles in offshore oil and gas engineering include guide drilling work, undersea observation, fixed-point sampling, auxiliary work involved in jacket installation, laying of oil and gas pipelines, and maintenance of offshore facilities.

- The dependence on oil and gas increases as major economies globally still rely heavily on petroleum-based products. The oil and gas industry displays immense influence in international politics and economics.

- In 2022, global oil production recorded 93,848 thousand barrels per day, with an increase of 4.18% over the previous year. The increase in the global population was reflected in an increase in primary energy consumption, which stood at 604.04 exajoules in 2022, up from 520.90 exajoules in 2011.

- Many of the potential global reserves of hydrocarbons lie beneath the sea. The hydrocarbon industry developed techniques suited to conditions found in offshore sites, both to find oil and gas and produce it successfully.

- Oil and gas drilling rigs may operate in water depths of two miles. Many of these deepwater wells and pipeline systems rely on unmanned underwater vehicles to help perform installations, inspections, repairs, and maintenance.

- Several countries have recently been active in the oil and gas offshore sector and have been witnessing investments in increasing production from offshore fields, hence creating an opportunity for AUVs and ROVs.

- In May 2022, Shell and Petrobras contracted Saipem to use its FlatFish subsea drone for two pilot projects involving the inspection campaigns of two ultra-deepwater fields offshore Brazil operated by the two energy companies.

- Furthermore, in August 2022, Oil and Natural Gas Corp., an Indian oil explorer and producer, entered into a Heads of Agreement (HoA) with ExxonMobil Corp. for deepwater exploration on both the east and west coasts of the country. In the eastern offshore, both oil explorers plan to focus on the Krishna Godavari and Cauvery basins, and in the western offshore, they will focus on the Kutch-Mumbai region.

- Therefore, owing to the above points, the demand for offshore AUVs and ROVs is expected to grow significantly in the oil and gas sector during the forecast period.

North America is Expected to Witness Significant Growth

- The North American region has one of the most well-developed offshore oil and gas industries globally, with the primary areas of focus being the vast reserves in the Gulf of Mexico and offshore Alaska regions. As drilling depths have increased over the years, the volume of technically recoverable reserves has increased significantly, which attracted growing investments.

- Due to the high level of industrialization and investments in research and development, North America is expected to be one of the largest markets for offshore AUVs and ROVs during the forecast period.

- As the United States has invested heavily in the defense sector and the R&D of AUVs and ROVs, other related offshore sectors, like oil and gas, shipping, and renewable energy, have profited immensely from the technological advancements in the market studied. Due to this, the region is at the forefront of AUV and ROV technology. AUV and ROV manufacturers in the region export their products globally.

- The region has one of the most well-developed offshore oil and gas industries globally, with the primary areas of focus being the vast reserves in the Gulf of Mexico and the offshore Alaska region. As drilling depths have increased over the years, the volume of technically recoverable reserves has increased significantly, which attracted growing investments.

- As the United States invested heavily in expanding its oil and gas production capacity, the Gulf of Mexico has become a global hotspot for AUV and ROV demand. As of 2022, the Gulf of Mexico region was responsible for 97% and 15% of the US offshore and total hydrocarbon production, respectively. The region has one of the highest global densities of offshore rig deployment and consists of other oil and gas infrastructure, like production and drilling platforms, marine vessels, and pipeline networks.

- As ROV and AUV technology has become increasingly affordable, oil and gas producers in the United States have been investing in ROV and AUV services to obtain data and carry out routine maintenance work on subsea assets and surfaces. Despite the higher upfront cost compared to diving crews, ROVs and AUVs need less time to complete the same amount of work, which reduces overall project OPEX.

- Due to this, major oil and gas companies routinely deal out multiple contracts for ROVs and AUV services in the Gulf of Mexico. In September 2022, DOF Subsea USA announced that the company had been awarded multiple contracts in the Gulf of Mexico by leading regional oil and gas operators. The Jones Act Compliant vessel(s) operated by DOF Subsea will be utilized for around 180 days over a one-year term, performing a range of activities, including inspection, maintenance, repair, light construction, and commissioning support at multiple field locations.

- Traditionally, Mexico had a strong hydrocarbon industry. However, the average drilling depths in Mexico's offshore sector have been relatively lower than that of the United States. Due to this, Mexican oil and gas operators have fewer financial incentives to switch from diver-assisted to diverless services, such as ROVs and AUVs.

- However, as the Mexican government looks to revitalize the hydrocarbon sector and boost domestic hydrocarbon production, the country's oil and gas industry is expected to see large investments, especially from state oil and gas utility PEMEX. In March 2022, PEP, the E&P wing of the PEMEX, announced that it received approval for the exploration of the Uchukil block in shallow waters with an investment of USD 107-478 million based on the baseline and incremental scenarios.

- Similarly, Mexico also committed to investing USD 1.2 billion in the development of two new offshore fields in forthcoming years. Such large investments in the offshore sector are expected to drive the offshore AUV and ROV market in Mexico during the forecast period.

- Therefore, owing to the above points, the North American region is expected to witness significant growth in the AUV and ROV markets during the forecast period.

Offshore AUV And ROV Industry Overview

The offshore AUV and ROV market is semi-fragmented. Some of the key players in this market (in no particular order) include DOF Subsea AS, Fugro NV, Subsea 7 SA, Saipem SpA, and Oceaneering International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Offshore Oil and Gas Exploration Activities in the American, Asia-Pacific, and Middle-East and African Regions

- 4.5.1.2 Growing Offshore Renewable Technologies

- 4.5.2 Restraints

- 4.5.2.1 Ban on Offshore Exploration and Production Activities in Multiple Regions

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 ROV

- 5.1.2 AUV

- 5.2 Vehicle Class

- 5.2.1 Work-class Vehicle

- 5.2.1.1 Light Work-class Vehicle

- 5.2.1.2 Medium Work-class Vehicle

- 5.2.1.3 Heavy Work-class Vehicle

- 5.2.2 Observatory-class Vehicles

- 5.2.1 Work-class Vehicle

- 5.3 End-user Application

- 5.3.1 Oil and Gas

- 5.3.2 Defense

- 5.3.3 Research

- 5.3.4 Other End-user Applications

- 5.4 Activity

- 5.4.1 Drilling and Development

- 5.4.2 Construction

- 5.4.3 Inspection, Repair, and Maintenance

- 5.4.4 Decommissioning

- 5.4.5 Other Activities

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Denmark

- 5.5.2.4 Norway

- 5.5.2.5 Russia

- 5.5.2.6 France

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 ASEAN Countries

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Venezuela

- 5.5.4.3 Argentina

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 DeepOcean AS

- 6.3.2 DOF Subsea AS

- 6.3.3 Helix Energy Solutions Group Inc.

- 6.3.4 TechnipFMC PLC

- 6.3.5 Bourbon

- 6.3.6 Fugro NV

- 6.3.7 Subsea 7 SA

- 6.3.8 Saipem SpA

- 6.3.9 Oceaneering International Inc.

- 6.3.10 Teledyne Technologies Incorporated

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in the AUV and ROV Market

02-2729-4219

+886-2-2729-4219