|

市場調查報告書

商品編碼

1635486

亞太地區浮體式海上風電:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia-Pacific Floating Offshore Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

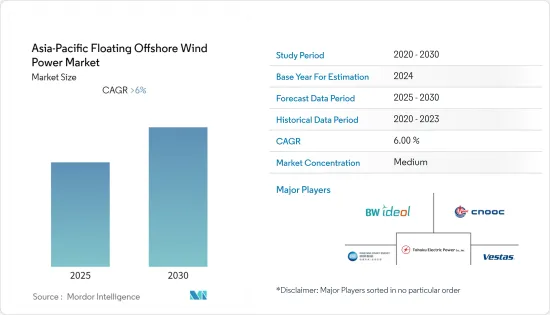

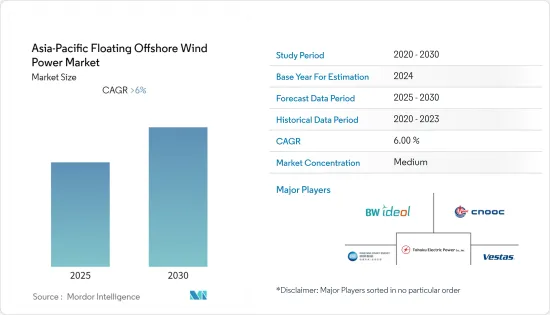

亞太地區浮體式海上風電市場預計在預測期內複合年成長率將超過6%。

主要亮點

- 短期內,由於亞洲各國政府熱衷於擴大國內可再生能源產能,以及提高離岸風力發電,亞太浮體式海上風電市場預計將成長。

- 另一方面,來自其他可再生能源的激烈競爭預計將威脅浮體式海上風電市場的成長。

- 然而,日本、台灣和韓國等許多國家正在重點發展浮體式海上風電市場,預計這將創造許多利潤豐厚的市場機會。

- 由於政府計劃擴大其浮體式海上風電投資組合,預計中國的成長速度將更快。

亞太地區浮體式海上風電市場趨勢

亞洲國家即將推出的計劃預計將推動市場發展

- 許多亞洲國家都看到了利用浮體式海上風電技術的潛力。例如,日本政府最近確定浮體式海上風電潛力約為424吉瓦,是固定式離岸風力發電潛力的三倍。因此,日本對其使用有許多計劃。

- 截至2021年,日本目前的風力發電量為8.2TWh。日本已經制定了雄心勃勃的計劃,到 2030 年安裝約 10GW 的離岸風力發電容量,到 2040 年安裝 30-45GW。這一目標也正在透過浮體式海上風電發電工程來實現。

- 例如,2022年5月,BW Ideol和東北電力公司同意在岩手縣久慈市海岸聯合開發一座浮體式海上風電場。該計劃目前正處於可行性研究階段。

- 此外,2022年11月,韓國政府宣布了一項新計劃,將在該國建造世界上最大的浮體式海上風電場,裝置容量約為6吉瓦。政府已宣布計劃為此計劃投資400億美元。計劃將建於韓國東南部工業城市蔚山海岸附近。

- 預計此類發展將在未來幾年推動亞太地區浮體式海上風電市場的發展。

中國預計將經歷顯著成長

- 預計到2021年,中國離岸風力發電裝置容量將成為全球第一。 2021年,該國離岸風電運作容量達到27GW。如果我們看到固定式離岸風力發電領域如此令人印象深刻的成長,那麼浮體式海上風電也應該被忽略。

- 該國的風電佔有率約為655.6太瓦時,是可再生能源中最高的。中國政府制定了多項計劃來增加這一佔有率,並安裝浮體式海上風電場。中國目前在浮體式海上風電裝置容量方面排名第五,約5.5兆瓦,目標是到2026年裝置容量約477兆瓦。因此,許多新發電廠即將被添加到投資組合中。

- 一個例子是中海油期待已久的深海浮體式海上風發電工程將安裝在中國廣東省華北海域400英尺(約1.5公尺)深處。該發電廠目前正處於開發階段,預計將於 2023 年投入運作。

- 此外,2021年12月,另一個浮體式海上風力發電廠計劃開始運作。 5.5MW離岸風力發電計劃「三峽銀陵號」浮體式風力發電機成功運作。本計劃由中國三峽風電和明陽智慧能源共同開發。

- 這些發展預計將使中國成為亞太地區浮體式海上風電市場的領導者。

亞太地區浮體式海上風電產業概況

亞太地區的浮體式海上風電市場較為分散。主要企業(排名不分先後)包括 Vestas Wind Systems A/S、Tohoku Electric Power Co、BW Ideol、MingYang Smart Energy 和 CNOOC Ltd。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 按水深

- 淺水(小於30m)

- 過渡水(30m-60m)

- 深水(60m以上)

- 按地區

- 中國

- 印度

- 日本

- 其他亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Vestas Wind Systems A/S

- Tohoku Electric Power Co Inc.

- BW Ideol

- Mingyang Smart Energy

- CNOOC Ltd

- Ocean Winds

- Aker Offshore Wind

- Shell Plc.

- Green Investment Group

- Tuv Sud Indonesia

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 92844

The Asia-Pacific Floating Offshore Wind Power Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- Over the short term, the Asia-Pacific floating offshore wind power market is expected to grow as the governments of the Asian countries are keen on expanding the renewable energy capacities in their respective countries, and due to the increased flexibility in offshore wind operations.

- On the other hand, the aggressive competition from other renewables is expected to put a threat to the growth of the floating offshore wind power market.

- Nevertheless, the focus of many countries like Japan, Taiwan, and South Korea on the development of a floating offshore wind power market is expected to create many lucrative opportunities for the market.

- China is expected to witness a faster growth due to the government's plans to expand the floating offshore wind portfolio.

APAC Floating Offshore Wind Power Market Trends

The Upcoming Projects in the Asian Countries Expected to Drive the Market

- Many Asian countries have identified their potential to exploit the floating offshore wind power technology, specifically when the availability of water depths for fixed bottom structures is narrowing. For example, the Japanese government recently identified around 424GW of floating offshore wind potential, which is three times more than its fixed bottom potential. Thus, the country has made many plans for its exploitation.

- Japan's current wind power generation capacity stands at 8.2TWh, as of 2021. The country has already set an ambitious plan to deploy around 10GW offshore wind capacity by 2030 and between 30 and 45GW by 2040. The goal is attempted to be achieved by floating offshore wind projects as well.

- For example, in May 2022, BW Ideol and Tohoku Electric Power agreed to jointly develop a floating offshore wind power plant off the coast of Kuji city in Iwate prefecture in Japan. The project is currently in the feasibility study stage.

- Furthermore, in November 2022, the South Korean government announced a new plan to build the world's biggest floating wind farm in the country, with around 6GW capacity. The government disclosed the planned investment as USD 40 billion for the project. The project will be off the coast of the industrial city of Ulsan in the south-east of the country.

- Such developments are expected to steer the floating offshore wind power market in the Asia-Pacific region in the coming years.

China Expected to Witness Significant Growth

- China was positioned to be the leader in the offshore wind installed capacity at the global level, in the year 2021. The operational offshore wind capacity in the country was recorded as 27GW in 2021. When the country made such remarkable growth in the fixed bottom offshore wind power sector, the floating offshore wind power is not left to be noticed.

- The country's wind power generation share was around 655.6TWh, the highest among all the renewables. The Chinese government has made umpteen plans to increase the share along with the floating offshore wind power installations. China currently stands in the fifth position in the installed floating wind capacity with around 5.5MW capacity; the country has targeted around 477MW of capacity by 2026. Thus, many new plants are on the way to be added to the portfolio.

- As an example, the country is eagerly waiting for the CNOOC Deep Sea Floating Offshore wind project, which will be in a water depth of 400 feet in the northern waters of South China of the Guangdong province. The plant is currently in the development phase, and it is expected to be operational by 2023.

- Additionally, in December 2021, the country got another floating offshore wind farm project commissioned. The Yangjiang wind project with a capacity of 5.5MW was successfully put into operation with a floating wind turbine called as Sanxia Yinling Hao. The project was developed by China Three Gorges and Mingyang Smart Energy.

- Owing to such developments, the country is forecasted to be the frontrunner in the Asia-Pacific floating offshore wind energy market.

APAC Floating Offshore Wind Power Industry Overview

The Asia-Pacific floating offshore wind market is moderately fragmented. Some of the key players (in no particular order) include Vestas Wind Systems A/S, Tohoku Electric Power Co Inc., BW Ideol, MingYang Smart Energy, and CNOOC Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Water Depth

- 5.1.1 Shallow Water (Less than 30m)

- 5.1.2 Transitional Water (30m to 60m)

- 5.1.3 Deepwater (More than 60m)

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems A/S

- 6.3.2 Tohoku Electric Power Co Inc.

- 6.3.3 BW Ideol

- 6.3.4 Mingyang Smart Energy

- 6.3.5 CNOOC Ltd

- 6.3.6 Ocean Winds

- 6.3.7 Aker Offshore Wind

- 6.3.8 Shell Plc.

- 6.3.9 Green Investment Group

- 6.3.10 Tuv Sud Indonesia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219