|

市場調查報告書

商品編碼

1636140

印度合約物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)India Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

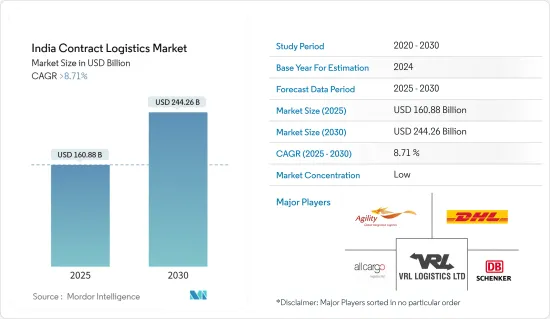

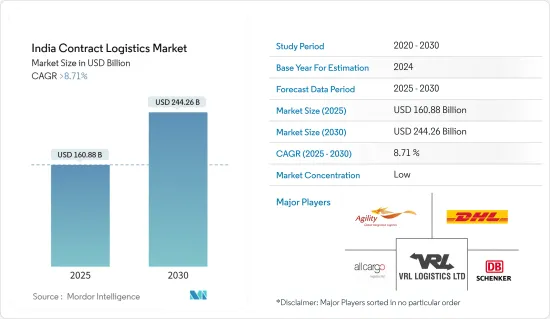

印度合約物流市場規模預計到2025年將達到1,608.8億美元,預計2030年將達到2,442.6億美元,預測期(2025-2030年)複合年成長率將超過8.71%。

主要亮點

- 隨著印度經濟持續崛起,合約物流的需求迅速增加。電子商務正在改變格局,客戶優先考慮其核心競爭力,對客製化解決方案和成本效率的需求不斷增加。這種不斷變化的格局迫使參與企業跳出框框進行適應。過去十年,印度的合約物流領域經歷了重大轉型,這在很大程度上是由該國經濟崛起所推動的。這個快速成長的市場的吸引力甚至吸引了外國參與企業的注意。

- 例如,2023年8月,CMA CGM旗下子公司CEVA Logistics收購了孟買Stellar Value Chain Solutions 96%的股份,成為頭條新聞。這項策略性舉措凸顯了合約物流日益成長的重要性,特別是電子商務、汽車、食品、消費品、時尚、零售、醫療保健和製藥等不同領域的履約服務。 Stellar目前在印度21個城市擁有70多個設施,總面積達770萬平方英尺。

- 都市化、經濟發展和新興的中產階級正在刺激印度國內的消費。這種激增延伸到家庭用品、汽車、消費品和奢侈品,並推動零售業合約物流的成長。

- 此外,電子商務已成為加強印度合約物流業的基石。行動商務的興起、創新的付款方式、電子商務向農村地區的擴張以及人工智慧和自動化的採用等趨勢正在重塑線上銷售的動態。這一轉變不僅將加強線上銷售,還將擴大合約物流行業的成長。此外,巨量資料分析、物料輸送設備和先進的追蹤行動應用程式等尖端干預措施正在徹底改變印度的合約物流格局。

印度合約物流市場趨勢

乘著印度內部資源物流電子商務與數位轉型的浪潮

在供應鏈敏捷性、數位創新和電子商務繁榮的需求激增的推動下,印度的內部資源物流行業必將大幅擴張。大型公司主要主導這一領域,但隨著技術降低傳統的進入壁壘,中型公司也正在進入這一領域。電子商務的快速成長促使許多公司開發內部物流能力,以加快交付速度並更好地控制客戶體驗。隨著物流業的發展,在電子商務快速發展的推動下,對服務的需求迅速增加。印度電子商務物流市場的主要促進因素包括網際網路普及率的提高、最後一英里配送的興起、由於有吸引力的折扣而增加的網路購物偏好以及網上雜貨物流範圍的擴大。

據預測,2030年,印度電子商務產業規模將激增至3,250億美元。到 2024 年,第三方物流供應商將在未來七年內處理約 170 億件貨物。印度擁有約9.3616億網路用戶,其中約3.5億是積極參與交易的資深線上用戶。 2023 年 12 月,印度電商巨頭 Flipkart 準備在新資金籌措中籌集 10 億美元,母公司沃爾瑪預計將融資 6 億美元。在此輪融資的基礎上,Google LLC 將於 2024 年 5 月向 Flipkart 注資 3.5 億美元。此次資金籌措主要由 Flipkart 的大股東沃爾瑪公司主導,旨在擴大 Flipkart 的業務,並為更廣泛的印度客戶群實現其數位框架的現代化。此外,兩家公司還正在製定一項策略,以加強 Flipkart 與Google雲端平台的整合。

隨著電子商務在全球範圍內日益普及,合約物流的角色對於零售公司來說變得至關重要。隨著公司專注於整合線上和全通路策略,合約物流的重要性變得越來越明顯。合約物流統籌庫存管理、包裝、運輸、彙報、預測和倉儲,在幫助零售商更好地履行線上訂單方面發揮著至關重要的作用。

製造業和汽車業的成長推動合約物流市場

在「印度製造」計劃的推動下,合約物流市場正在強勁成長。製造商越來越注重核心競爭力,追求成本效率,並將先進技術融入其供應鏈活動。

同時,製造業正引領外包供應鏈管理的趨勢。這項轉變是由服務供應商發展成為關鍵合作夥伴推動的,他們提供全面的解決方案,包括文件、追蹤、倉儲和法規合規性。此外,汽車產業對多模態物流的需求正在增加。

同時,2023-24年,印度汽車零件進口額成長3%,達到209億美元,高於2022-23年的203億美元。來自亞洲的進口佔總量的66%,其次是歐洲(26%)和北美(8%)。值得注意的是,來自亞洲的進口成長了3%。主要進口產品為引擎零件、車身及底盤、懸吊及煞車、變速箱及轉向系統。因此,汽車進出口的增加預計將促進全國的合約物流服務。

印度合約物流業概況

印度的合約物流市場競爭激烈且分散,有許多國際參與者和小型國內參與者。

合約物流市場的主要企業正在採取行動,以最大限度地利用印度的機會。合約物流市場的主要企業包括德國郵政 DHL、DB Schenker、Kuehne+Nagel International AG 和 Allcargo。印度的合約物流業處於持續成長的曲線上。這種成長給產業帶來了新的挑戰,從運作更有效率的網路、擴大產品和服務組合到管理不可預測的成本。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場洞察

- 市場概況

- 洞察技術趨勢

- 政府法規與措施概述

- 價值鏈/供應鏈分析

- 洞察貨運成本/運費

- 洞察該地區的電子商務產業(國內和跨境)

- 售後服務/逆向物流背景下對合約物流的見解

- 消費稅實施對物流業影響的見解

- 合約物流參與企業提供的各種服務(一般倉儲/運輸、供應鏈服務和其他附加價值服務)概述

- 深入了解主要經濟特區 (SEZS) 和製造地

- 地緣政治與疫情如何影響市場

第5章市場動態

- 馬傑特 司機

- 電子商務的成長

- 政府措施提振市場

- 市場限制因素

- 缺乏技術純熟勞工

- 高資金投入

- 市場機會

- 技術創新

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第6章 市場細分

- 按類型

- 內部資源

- 外包

- 按最終用戶

- 製造/汽車

- 消費品/零售

- 高科技

- 醫療和製藥

- 其他最終用戶(能源、建築、航太等)

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- 參與企業海外市場

- Kuehne+Nagel Private Limited

- Hellmann Worldwide Logistics India Private Limited

- Agility Logistics

- CH Robinson Worldwide Freight India Private Limited

- DSV Panalpina

- Nippon Express (India) Private Limited

- FedEx Corporation

- Expeditors International (India) Private Limited*

- 參與企業國內市場

- All Cargo Logistics Limited

- VRL Logistics Ltd

- Adani Logistics Company

- Aegis Logistics Ltd

- Transport Corporation of India

- Gati Litmited

- Delhivery Private Limited

- Future Supply Chain Solutions Ltd

- TVS Supply Chain Solutions*

- 參與企業海外市場

- 其他公司(Mahindra Logistics、Safexpress Pvt Ltd、Snowman Logistics、GS Logistics、Nitco Logistics、Gateway Distriparks Limited*)

第8章 市場未來展望

第9章 附錄

- GDP 分佈(依活動、地區)

- 資本流向洞察(按行業分類的投資金額)

- 深入了解主要出口目的地

- 主要進口原產國洞察

The India Contract Logistics Market size is estimated at USD 160.88 billion in 2025, and is expected to reach USD 244.26 billion by 2030, at a CAGR of greater than 8.71% during the forecast period (2025-2030).

Key Highlights

- As the Indian economy continues its upward trajectory, the demand for contract logistics is witnessing a notable surge. E-commerce is reshaping the landscape, and as customers prioritize their core competencies, there's an increasing demand for tailored solutions and cost efficiency. This evolving landscape is pushing players to adapt beyond their traditional boundaries. Over the past decade, the Indian contract logistics scene has undergone significant transformations, primarily fueled by the nation's economic ascent. The allure of this burgeoning market has even drawn the attention of foreign players.

- For instance, in August 2023, CMA CGM's subsidiary, CEVA Logistics, made headlines by acquiring a 96 percent stake in Mumbai's Stellar Value Chain Solutions. This strategic move underscores the growing prominence of contract logistics, especially with omnichannel fulfillment services spanning diverse sectors such as e-commerce, automotive, food products, consumer goods, fashion, retail, healthcare, and pharmaceuticals. Stellar, now a pivotal player, boasts an expansive footprint with 7.7 million square feet of space distributed across over 70 facilities in 21 cities throughout India.

- Urbanization, economic development, and a burgeoning middle class have fueled domestic consumption in India. This surge spans everyday fast-moving consumer goods, personal automobiles, household essentials, and even luxury items, all propelling the growth of contract logistics within the retail sector.

- Moreover, e-commerce stands as a cornerstone in bolstering the country's contract logistics sector. Trends like the rise of mobile commerce, innovative payment methods, e-commerce's reach into rural territories, and the adoption of artificial intelligence and automation are reshaping online sales dynamics. These shifts not only bolster online sales but also amplify the growth of the contract logistics sector. Furthermore, cutting-edge interventions such as big data analytics, intelligent material handling equipment, and advanced tracking mobile apps are revolutionizing India's contract logistics landscape.

India Contract Logistics Market Trends

India's Insourced Logistics: Riding the Wave of E-Commerce and Digital Transformation

Driven by the surging demand for supply chain agility, digital innovation, and the e-commerce boom, India's insourced logistics sector is on the brink of significant expansion. While predominantly dominated by large corporations, mid-sized enterprises are making their foray into the sector, due to technology reducing traditional entry barriers. The e-commerce surge has prompted numerous businesses to cultivate in-house logistics capabilities, ensuring quicker deliveries and enhanced control over customer experiences. As the logistics sector evolves, it's responding to the burgeoning demand for services, largely spurred by the rapid advancements in e-commerce. Key drivers for India's e-commerce logistics market include increased internet penetration, the rise of last-mile delivery, a growing preference for online shopping-amplified by attractive discounts-and the broadening scope of online grocery logistics.

Forecasts suggest the Indian e-commerce industry will soar to USD 325 billion by 2030. In 2024, third-party logistics providers are set to handle around 17 billion shipments over the next seven years. With approximately 936.16 million internet subscribers in India, about 350 million are seasoned online users actively participating in transactions. In December 2023, Indian e-commerce titan Flipkart is gearing up to secure USD 1 billion in a fresh funding round, with its parent entity, Walmart, expected to infuse USD 600 million. Further bolstering this round, in May 2024, Google LLC is channeling USD 350 million into Flipkart. This funding, predominantly led by Walmart Inc.-Flipkart's majority stakeholder-aims to amplify Flipkart's operations and modernize its digital framework for a broader Indian customer base. Additionally, both entities are strategizing to enhance Flipkart's integration with Google's cloud platform.

As e-commerce garners global momentum, the role of contract logistics has become paramount for retailers. The emphasis on cohesive online and omnichannel strategies highlights the critical nature of contract logistics. By overseeing inventory management, packaging, transportation, reporting, forecasting, and warehousing, contract logistics plays a pivotal role in enhancing online order fulfillment for retailers.

Growth in the Manufacturing and Automotive Sector Driving the Contract Logistics Market

Fueled by the 'Make in India' initiative, the contract logistics market is witnessing robust growth, largely due to the rapid expansion of the manufacturing industry. Manufacturers are increasingly emphasizing core competencies, seeking cost efficiencies, and integrating advanced technologies into their supply chain activities.

Simultaneously, the manufacturing sector has pioneered the trend of outsourcing supply chain management. This shift is bolstered by the evolution of service providers into pivotal partners, delivering comprehensive solutions that encompass documentation, tracking, warehousing, and legal compliance. Furthermore, the automobile sector is amplifying the demand for multi-modal logistics.

On the other hand, In 2023-24, India saw a 3 percent rise in auto component imports, totaling USD 20.9 billion, up from USD 20.3 billion in 2022-23. Asia dominated the import landscape, contributing 66 percent, trailed by Europe at 26 percent and North America at 8 percent. Notably, imports from Asia experienced a 3 percent uptick. Major import categories encompassed engine components, body & chassis, suspension & braking, and drive transmission & steering. Thus, the growing automobile export imports are expected to drive contract logistics services across the country.

India Contract Logistics Industry Overview

The Contract Logistics market in India is fiercely competitive, fragmented in nature with the presence of many international and too many small domestic companies.

Key players in the contract logistics market are taking initiatives to gain maximum benefit from the opportunities in India. Some of the major players in the contract logistics market include Deutsche Post DHL, DB Schenker, Kuehne + Nagel International AG, Allcargo, among others. The contract logistics sector in India is on a constant growth curve. This growth has brought with it a new set of industry challenges, from running more efficient networks and expanding product and service portfolios to gaining control over unpredictable costs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Insights in Technological Trends

- 4.3 Brief on Government Regulations and Initiatives

- 4.4 Value Chain/Supply Chain Analysis

- 4.5 Insights on Freight Transportation Costs /Freight Rates

- 4.6 Insights on E-Commerce Industry in the Region (Domestic and Cross-Border)

- 4.7 Insights on Contract Logistics in the Context of After-Sales/Reverse Logistics

- 4.8 Insights on the impact of Implementation of GST in the Logistics Sector

- 4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing & Transportation, Supply Chain Services, and Other Value-Added Services)

- 4.10 Insights into Key Special Economic Zones (SEZS) and Manufacturing Hubs

- 4.11 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Marjet Drivers

- 5.1.1 Growth in Ecommerce

- 5.1.2 Government intiatives are boosting the market

- 5.2 Market Restriants

- 5.2.1 Skilled Labor Shortages

- 5.2.2 High Intiatial Investments

- 5.3 Market Oppurtunities

- 5.3.1 Technological Innovations

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Insourced

- 6.1.2 Outsourced

- 6.2 By End User

- 6.2.1 Manufacturing and Automotive

- 6.2.2 Consumer Goods & Retail

- 6.2.3 High - Tech

- 6.2.4 Healthcare and Pharmaceutical

- 6.2.5 Other End Users (Energy, Construction, Aerospace, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 International Players

- 7.2.1.1 Kuehne + Nagel Private Limited

- 7.2.1.2 Hellmann Worldwide Logistics India Private Limited

- 7.2.1.3 Agility Logistics

- 7.2.1.4 CH Robinson Worldwide Freight India Private Limited

- 7.2.1.5 DSV Panalpina

- 7.2.1.6 Nippon Express (India) Private Limited

- 7.2.1.7 FedEx Corporation

- 7.2.1.8 Expeditors International (India) Private Limited *

- 7.2.2 Domestic Players

- 7.2.2.1 All Cargo Logistics Limited

- 7.2.2.2 VRL Logistics Ltd

- 7.2.2.3 Adani Logistics Company

- 7.2.2.4 Aegis Logistics Ltd

- 7.2.2.5 Transport Corporation of India

- 7.2.2.6 Gati Litmited

- 7.2.2.7 Delhivery Private Limited

- 7.2.2.8 Future Supply Chain Solutions Ltd

- 7.2.2.9 TVS Supply Chain Solutions *

- 7.2.1 International Players

- 7.3 Other Companies (Mahindra Logistics, Safexpress Pvt Ltd, Snowman Logistics, GS Logistics, Nitco Logistics, Gateway Distriparks Limited*)

8 FUTURE OUTLOOK OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution, by Activity and Region

- 9.2 Insight into Capital Flows (investments by sector)

- 9.3 Insight into Key Export Destinations

- 9.4 Insight into Key Import Origin Countries