|

市場調查報告書

商品編碼

1642997

美國合約物流:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

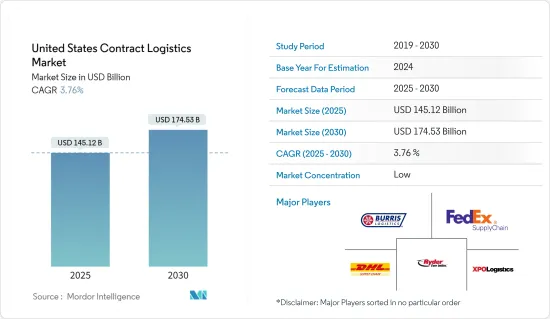

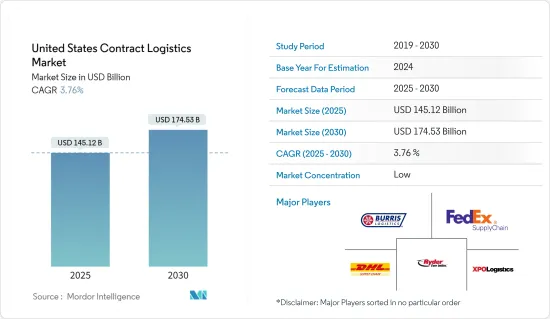

預計 2025 年美國合約物流市場規模為 1,451.2 億美元,到 2030 年將達到 1,745.3 億美元,預測期內(2025-2030 年)的複合年成長率為 3.76%。

主要亮點

- 美國合約物流行業已經做好轉型的準備,因為該行業在戰略上有望從蓬勃發展的電子商務和技術進步中獲益。這種演變很大程度上是由網路購物的爆炸式成長所推動的,網上購物正在重塑消費行為和物流要求。

- 為了滿足不斷成長的需求,物流公司正在大力投資擴大其倉庫網路。預測表明,美國將需要額外的 5 億平方英尺的倉庫空間來管理不斷成長的庫存並滿足當日送達的期望。領先的物流公司正在利用自動化和機器人等最尖端科技升級其基礎設施,以提高效率並加快產品流動速度。

- 截至 2024 年,美國合約物流市場專注於永續性數位化。公司正在採用節能的運輸方式和尖端的追蹤技術來增強業務能力,同時減少對環境的影響。此外,它已成為北美合約物流市場的主要貢獻者。

- 人工智慧和機器學習在供應鏈最佳化方面的整合成為推動這一市場擴張的關鍵因素。公司正在使用人工智慧來改善路線規劃、加強庫存管理並執行預測分析。例如,XPO 物流正在利用路線最佳化和即時追蹤技術來增強其服務產品並鞏固其作為合約物流主要企業的地位。

- 例如,C.H.Robinson 使用預測分析來監督其車隊的性能,確保及時維護並減少服務中斷。這些應用程式使公司能夠最大限度地減少效率低下並更準確地預測需求。

美國合約物流市場趨勢

電子商務銷售激增推動市場擴張

在美國,電子商務的興起極大地推動了合約物流的成長,刺激了對精簡倉儲、配送和最後一哩交付服務的需求增加。隨著網路購物的激增,物流供應商不斷擴大其基礎設施並採用最尖端科技來滿足履約需求。

2023年美國交付指標明顯改善。根據Statista的報告,簽發率年減3.6%至6.4%,準時送達率維持穩定在98%,一次送達功率與前一年同期比較與前一年同期比較12.2%至97%,國內平均在途時間與前一年同期比較減少24%至2.56天。

預計這一趨勢將持續到 2024 年,平均運輸時間預計將進一步減少至 2.32 天。即使面臨經濟逆風,產業預測仍顯示,2024 年美國零售電子商務銷售額將較 2023 年成長 10.5%。

隨著電子商務的蓬勃發展,聯邦快遞、美國郵政服務和 UPS 等物流巨頭正在透過最佳化路線、加強基礎設施和實施先進的包裹追蹤來加快小包裹遞送速度。 2024年,聯邦快遞的平均運輸時間為2.08天,而UPS的平均運輸時間為2.22天。同時,儘管盡了最大努力,美國郵政服務的平均運輸時間仍然增加到 2.55 天。

總之,電子商務的持續成長正在大力推動美國合約物流市場的發展。隨著物流供應商和運輸商適應日益成長的需求,該行業的效率和交付績效將進一步提高。

汽車和製造業推動的合約物流市場

隨著製造商不斷提高其核心競爭力,越來越多的公司將其物流業務外包給第三方供應商。這種轉變在汽車產業尤其明顯,該產業企業越來越依賴專業物流服務來駕馭複雜的供應鏈。例如,福特和通用汽車等主要汽車製造商已與 XPO 物流和 DHL Supply Chain 等物流供應商合作。該合作旨在簡化供應鏈、提高業務效率並降低成本。

包括聯邦快遞和 DHL 在內的大型物流公司將在 2024 年擴大其在美國戰略位置的倉庫容量。此次擴張是為了直接回應汽車製造商不斷成長的需求。物流基礎設施,尤其是倉庫和配送中心,正在進行大量投資,以滿足製造業和汽車產業不斷變化的需求。

全球物流領導者 DHL 在美國開設了最新的電動車(EV)卓越中心(CoE)。該中心致力於指導汽車出行產業及其相關公司推進電氣化進程。新的美國中心是更廣泛的全球網路的一部分,該網路對位於墨西哥、印尼、中國、阿拉伯聯合大公國、義大利和英國等戰略定位的現有電動車卓越中心進行了補充。

總之,由於汽車和製造業對第三方物流供應商的依賴日益增加,合約物流市場正經歷顯著成長。隨著企業最佳化供應鏈並採用新技術,預計這一趨勢將會持續下去。

美國合約物流行業概況

市場較分散,主要企業包括 XPO Logistics、Ryder System Inc.、FedEx Supply Chain、Burris Logistics、UPS Supply Chain Solutions 和 KUEHNE+NAGEL。物流自動化、物聯網、應用感測器和無人機偵測卡車人為損壞等技術進步,以及人工智慧在配送和物流中的作用,徹底改變了這個產業。市場仍然分散,國內外參與者多元。

為了提高效率,各公司正聯合起來。例如,國內領先的海運短程運輸供應商IMC 物流已與長期客戶Kuehne+Nagel建立了策略夥伴關係。根據美通社報道,Kuehne+Nagel 將收購 IMC Logistics 51% 的股份。此次合作旨在滿足日益成長的綜合貨運服務需求,促進美國各地海港、鐵路樞紐、客戶設施和內陸地區之間的旅行。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態與洞察

- 當前市場狀況

- 市場動態

- 市場促進因素

- 電子商務的成長

- 技術進步

- 市場限制

- 勞動力短缺

- 燃料和運輸成本上漲

- 市場機會

- 致力於永續性

- 客製化和量身定做的解決方案

- 市場促進因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈/供應鏈分析

- 產業監管和政策見解

- 技術整合洞察

- 區域電子商務產業洞察(國內和跨境)

- 了解合約物流參與者提供的各種服務(綜合倉儲和運輸、供應鏈服務和其他附加價值服務)

- 精選 - 運費/運費費率

- 地緣政治與疫情將如何影響市場

第5章 市場區隔

- 按類型

- 內部採購

- 外包

- 按最終用戶

- 製造/汽車

- 消費品和零售

- 高科技

- 醫療保健和醫藥

- 其他最終用戶(能源、建築、航太等)

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- XPO Logistics

- Ryder Supply Chain Solutions

- DHL Supply Chain North America

- FedEx Logistics

- Burris Logistics

- Kuehne+Nagel

- GXO Logistics

- UPS

- GAC United States

- GEODIS

- Hellmann Worldwide Logistics

- DB Schenker

- Hub Group*

- 其他公司

第7章:未來市場展望

第 8 章 附錄

- 宏觀經濟指標(GDP分佈,依活動分類)

- 經濟統計 - 交通運輸及倉儲業的經濟貢獻

- 對外貿易統計 - 按商品、目的地和原產國分類的進出口數據

The United States Contract Logistics Market size is estimated at USD 145.12 billion in 2025, and is expected to reach USD 174.53 billion by 2030, at a CAGR of 3.76% during the forecast period (2025-2030).

Key Highlights

- Strategically poised to benefit from the burgeoning e-commerce landscape and technological advancements, the United States contract logistics sector is witnessing a transformation. This evolution is largely fueled by a surge in online shopping, reshaping both consumer behavior and logistics requirements.

- In response to surging demand, logistics firms are significantly investing in expanding their warehousing networks. Projections indicate that the U.S. will need an additional 500 million square feet of warehouse space to manage growing inventories and meet same-day delivery expectations. Leading logistics companies are upgrading their infrastructure with cutting-edge technologies like automation and robotics to boost efficiency and accelerate product flow.

- As of 2024, the U.S. contract logistics market is placing a heightened focus on sustainability and digitalization. Firms are embracing energy-efficient transportation methods and state-of-the-art tracking technologies, aiming to bolster operational capabilities while reducing environmental impact. Furthermore, the nation emerges as the leading contributor to North America's contract logistics market.

- AI and ML integration for supply chain optimization stands out as a pivotal driver of this market's expansion. Businesses are leveraging AI to enhance route planning, strengthen inventory management, and perform predictive analyses. For instance, XPO Logistics utilizes technology for route optimization and real-time tracking, enhancing its service offerings and solidifying its position as a key player in the contract logistics landscape.

- For instance, C.H. Robinson employs predictive analytics to oversee its fleet's performance, guaranteeing timely maintenance and reducing service disruptions. These applications empower companies to minimize inefficiencies and forecast demands with greater precision

United States Contract Logistics Market Trends

Surge in E-Commerce Sales Fuels Market Expansion

In the U.S., the rise of E-Commerce has significantly propelled the growth of contract logistics, spurring heightened demand for streamlined warehousing, distribution, and last-mile delivery services. As online shopping surged, logistics providers expanded their infrastructures and adopted cutting-edge technologies to meet fulfillment demands.

Delivery metrics in the U.S. showed marked improvements in 2023: the issue ratio dipped 3.6% year-over-year (YoY) to 6.4%, the on-time delivery ratio held steady at 98%, the first-attempt delivery success rate jumped 12.2% YoY to 97%, and average domestic transit times shortened by 24% YoY to 2.56 days, as reported by Statista.

This momentum carried into 2024, with average transit times further refining to 2.32 days. Even amidst economic headwinds, U.S. retail e-commerce sales in 2024 are set to rise by 10.5% from 2023, as per industry forecasts.

In tandem with the E-Commerce surge, major logistics players like FedEx, USPS, and UPS have bolstered parcel delivery speeds via route optimization, infrastructure enhancements, and state-of-the-art package tracking. In 2024, FedEx and UPS achieved average transit times of 2.08 days and 2.22 days respectively. Conversely, USPS, despite their concerted efforts, saw an uptick in average transit time to 2.55 days.

In conclusion, the continuous growth of E-Commerce is driving significant advancements in the U.S. contract logistics market. As logistics providers and carriers adapt to increasing demands, the sector is poised for further improvements in efficiency and delivery performance.

Contract Logistics Market Propelled by the Automotive and Manufacturing Sectors

As manufacturers hone in on their core competencies, a growing number are turning to third-party providers for logistics operations. This shift is especially evident in the automotive sector, where firms increasingly rely on specialized logistics services to navigate their intricate supply chains. For example, leading automotive giants Ford and General Motors have teamed up with logistics providers like XPO Logistics and DHL Supply Chain. This collaboration aims to streamline their supply chains, boosting operational efficiency and driving down costs.

Major logistics companies, including FedEx and DHL, are expanding their warehouse capacities at strategic U.S. locations in 2024. This expansion is a direct response to the surging demands from automotive manufacturers. Significant investments are being made in logistics infrastructure, particularly in warehouses and distribution centers, to meet the evolving needs of the manufacturing and automotive sectors.

DHL, a prominent player in the global logistics arena, has inaugurated its latest Electric Vehicle (EV) Center of Excellence (CoE) in the U.S. This center is poised to guide the auto-mobility sector and its affiliates on their electrification journey. The newly established U.S. center is part of a broader global network, complementing existing EV Centers of Excellence in strategic locations such as Mexico, Indonesia, China, the UAE, Italy, and the UK.

In conclusion, the contract logistics market is experiencing significant growth, driven by the increasing reliance of the automotive and manufacturing sectors on third-party logistics providers. This trend is expected to continue as companies seek to optimize their supply chains and embrace new technologies.

United States Contract Logistics Industry Overview

The market is fragmented, with XPO Logistics, Ryder System Inc., FedEx Supply Chain, Burris Logistics, UPS Supply Chain Solutions, KUEHNE+NAGEL, etc as its major players. Technological advancements, such as logistic automation, IoT, and the application of sensors and UAVs for detecting human-made damages on tracks, alongside AI's role in delivery and logistics, have revolutionized the industry. The market remains fragmented, featuring a diverse mix of local and international players.

In a bid to boost effectiveness, companies are joining hands. For instance, IMC Logistics, the nation's leading marine drayage provider, has entered into a strategic partnership with its long-standing client, Kuehne+Nagel. As reported by PR Newswire, Kuehne+Nagel is set to acquire a 51% stake in IMC Logistics. This collaboration aims to meet the surging demand for comprehensive cargo transportation services, facilitating movement to and from seaports, rail hubs, customer facilities, and inland locations across the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 E Commerce Growth

- 4.2.1.2 Technological Advancements

- 4.2.2 Market Restraints

- 4.2.2.1 Labor Shortage

- 4.2.2.2 Rising Fuel and Transportation costs

- 4.2.3 Market Opportunities

- 4.2.3.1 Sustainability Initiatives

- 4.2.3.2 Customization and Tailored Solutions

- 4.2.1 Market Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Insights on Industry Policies and Regulations

- 4.6 Insights on Technological Integration

- 4.7 Insights on E-commerce Industry in the Region (Domestic and Cross-border)

- 4.8 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing and Transportation, Supply Chain Services, and Other Value-Added Services)

- 4.9 Spotlight - Freight Transportation Costs/Freight Rates

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End-User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Consumer Goods and Retail

- 5.2.3 High-tech

- 5.2.4 Healthcare and Pharmaceuticals

- 5.2.5 Other End-Users(Energy, Construction, Aerospace, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 XPO Logistics

- 6.2.2 Ryder Supply Chain Solutions

- 6.2.3 DHL Supply Chain North America

- 6.2.4 FedEx Logistics

- 6.2.5 Burris Logistics

- 6.2.6 Kuehne + Nagel

- 6.2.7 GXO Logistics

- 6.2.8 UPS

- 6.2.9 GAC United States

- 6.2.10 GEODIS

- 6.2.11 Hellmann Worldwide Logistics

- 6.2.12 DB Schenker

- 6.2.13 Hub Group*

- 6.3 Other Companies

7 FUTURE OUTLOOK OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin