|

市場調查報告書

商品編碼

1687871

歐洲合約物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Europe Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

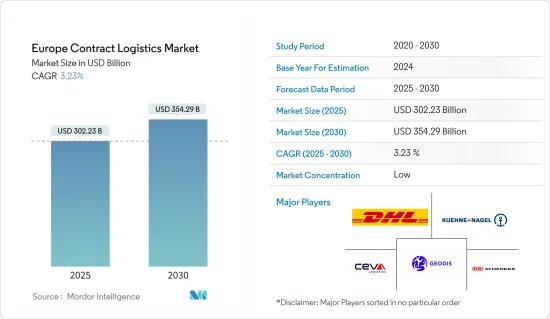

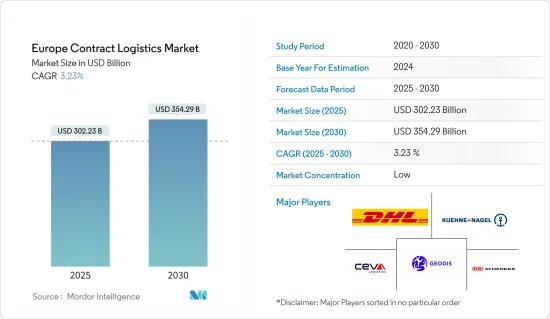

2025 年歐洲合約物流市場規模估計為 3,022.3 億美元,預計到 2030 年將達到 3,542.9 億美元,預測期內(2025-2030 年)的複合年成長率為 3.23%。

主要亮點

- 2024年歐洲的前景是逐步復甦。隨著價格下降和薪資上漲,歐洲消費者開始恢復購買力,這應該會提振國內需求。各國復甦力道各有不同。製造業和能源密集型經濟體的復甦速度可能比其他國家更慢。在歐洲已開發地區,預計今年經濟成長將放緩至 0.7%,然後在 2024 年和 2025 年略有回升。在新興歐洲(不包括俄羅斯、烏克蘭、土耳其和白俄羅斯),預計經濟成長將從 2021 年的 4.5% 下降,在 2025 年回升至 -1.1% 的降幅,然後在 2024 年回升至 2.9%。

- 由於能源價格下降和供應鏈限制的緩解,預計通膨率將下降。預計今年歐洲已開發經濟體的通膨率平均為5.8%,到2025年將降至11.9%。到2025年,大多數國家的通貨膨脹率可能都會低於其目標。歐洲的物流成本佔歐洲經濟GDP的11-12%。

- 德國位於歐洲中心的位置及其高度專業的物流服務為國際托運人在歐洲市場取得成功提供了理想的條件。德國可以輕鬆接觸歐盟5億消費者。德國的技術熟練的勞動力對於希望在德國物流業投資或設立當地分店的國際公司具有吸引力。德國約70%的對外貿易及相關商品及貨物運輸在歐洲境內進行。歐洲主要貿易夥伴包括法國(進出口額 1,700 億歐元(1,859 億美元))和荷蘭(出口額 1,670 億美元(1,826.2 億美元))。歐洲以外最大的物流目的地是亞洲,其次是美國。許多公司在德國開設倉庫以擴大業務。

- 例如,2023 年 6 月,GXO 宣布計劃「深化」在德國的業務。作為第一步,GXO 將在多爾馬根地區開設一個新 587,000 平方英尺的倉庫,展示其尖端的倉儲解決方案。 GXO 在德國只有 6 個倉庫,而在歐洲和英國有 700 個倉庫,在北美有 300 個倉庫。

- 例如,2023年7月,Geopost與京東物流宣佈建立策略夥伴關係,以增強全球物流能力。透過結合JDL強大的倉儲網路與Geopost的物流配送能力,此次合作將拓展從中國至歐洲的國際快遞服務,為消費者和企業提供高品質的快遞物流解決方案。 JDL 和 Geoopost 將創建從中國到歐洲的無縫雙向 C2C(直接面對消費者)和 B2C(企業對消費者)運輸解決方案。新的夥伴關係關係提供全面的端到端貨運追蹤和遞送,提供便利的「一站式」快遞服務,包括送貨上門和專門的客戶支持,以及整個物流過程中最先進的數位追蹤。

歐洲合約物流市場趨勢

合約物流外包市場將創下大幅成長

合約物流佔有率較低,成長潛力明顯。從全球來看,合約物流僅佔整個市場的10-15%。在歐洲,這一數字估計在20%左右。各國的外包程度有很大差異。通常情況下,運輸和儲存服務會大量外包。

預計電子商務將成為外包成長的主要動力。隨著電子商務市場的快速成長,消費者對更快、更可靠的配送的期望也越來越高。因此,倉儲和訂單履行的外包預計將會增加。合約物流為各種規模的電子商務公司提供了以下好處:業務控制、先進的技術解決方案、風險緩解和擴充性。

合約物流公司為線上企業提供服務,幫助他們利用全球網路進入新市場。我們也透過提供多種運送方式以及處理增值稅和增值稅服務來幫助您更貼近客戶。

合約物流公司專門為生產消費性電子產品、通訊設備、電腦設備和其他高科技產品的公司提供服務。它幫助這些公司減少庫存、降低分銷成本並推出新產品。

英國在該地區佔據主導地位

英國是繼中國和美國之後全球第三大電子商務市場。

隨著網路購物和付款的激增,英國正在向數位經濟轉型。英國電子商務市場是歐洲最大且成長最快的市場之一。到2023年,英國家庭預計將在電子商務上花費約1,200億英鎊(1,525.4億美元),年增率為8.8%。

零售電子商務是全球成長最快的零售趨勢之一。在過去的十幾年裡,網路購物已經成為英國最受歡迎的零售通路。電子商務網站已經存在幾十年了,但直到最近才變得流行。英國網路購物的成長令人矚目,與全球趨勢一致。因此,對合約物流服務的需求龐大。

2023 年 11 月 EV Cargo 投資了一條技術支援型供應鏈,以創建一個擁有世界領先的控制塔系統之一的物流網路。全球貨運代理公司和全球供應鏈服務提供商 EV Cargo 已贏得三份新的英國客戶契約,涉及公路貨運、倉儲業和契約物流。為了應對過去三年來影響英國物流業的更廣泛的市場狀況,EV Cargo 已完成對其英國持有的戰略資源審查。該公司採用技術來提高效率和增強靈活性。

歐洲合約物流行業概況

市場的主要參與者包括德國郵政敦豪集團、全球國際貨運代理公司 (DB Schenker)、Seba 物流、DSV AS 和 SNCF 物流/Geodis。這些總部位於歐洲的公司在全球佔有重要地位。儘管這些大公司在該地區擁有強大的影響力並佔據了相當大的市場佔有率,但市場仍然有些分散,許多公司提供不同層次的合約物流服務。

公司需要不斷發展才能跟上行業趨勢。這有望幫助您獲得新客戶並站穩腳跟。

大多數大公司都位於西歐。在中東歐地區,本地合約物流供應商的數量相對較少。這對中東歐地區現有的本地物流供應商來說是一個進入合約物流市場並佔據相當市場佔有率的機會。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

- 分析方法

- 研究階段

第3章執行摘要

第4章 市場動態與洞察

- 當前市場狀況

- 市場動態

- 驅動程式

- 外包服務的興起

- 義大利、法國和波蘭對合約物流的需求不斷增加

- 限制因素

- 歐洲合約物流市場競爭日益激烈

- 監理合規性

- 機會

- 池式倉庫

- 驅動程式

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 價值鏈/供應鏈分析

- 政府法規和舉措

- 科技趨勢

- 區域電子商務產業洞察(國內和跨境)

- 深入了解售後服務/逆向物流中的合約物流

- 合約物流參與者提供的各種服務概述(綜合倉儲和運輸、供應鏈服務和其他附加價值服務)

- 運費/費率考慮

- 深入了解英國脫歐對歐洲物流業的影響

- COVID-19 對市場的影響

第5章 市場區隔

- 按最終用戶

- 工業機械和汽車

- 飲食

- 建造

- 化學品

- 其他消費品

- 其他最終用戶

- 按國家

- 德國

- 英國

- 荷蘭

- 法國

- 義大利

- 西班牙

- 波蘭

- 比利時

- 瑞典

- 其他歐洲國家

第6章 競爭格局

- 公司簡介(包括併購、合資、聯盟和協議)

- Deutsche Post DHL Group

- XPO Logistics

- Schenker AG(DB Schenker)

- CEVA Logistics

- SNCF Logistics/Geodis

- DSV AS

- Neovia Logistics Services

- GEFCO SA

- United Parcel Service Inc.(UPS Supply Chain Solutions)

- Rhenus SE & Co. KG

- Bertelsmann SE & Co. KGaA(Arvato)

- FIEGE Logistik Stiftung & Co. KG*

- 其他公司(關鍵資訊/概況)

- Expeditors International, United Parcel Service Inc., Bollore Logistics, Hellmann Worldwide Logistics GmbH & Co. KG, Agility Logistics Pvt. Ltd, H. Essers NV, Wincanton PLC*

第7章 市場機會與未來趨勢

第 8 章 附錄

- 主要國家按活動分類的 GDP 分佈

- 資本流動洞察

- 對外貿易統計 - 進出口(依產品分類)

- 洞察歐洲主要出口目的地

- 了解歐洲主要進口來源地

The Europe Contract Logistics Market size is estimated at USD 302.23 billion in 2025, and is expected to reach USD 354.29 billion by 2030, at a CAGR of 3.23% during the forecast period (2025-2030).

Key Highlights

- Europe's outlook for 2024 is of gradual recovery. As prices fall and wages rise, European consumers are beginning to regain purchasing power, which will boost domestic demand. The strength of this recovery will vary across countries. Manufacturing and energy-intensive economies will recover more slowly than others. In advanced European economies, growth is projected to decline to 0.7% this year before some pickup in 2024 and 2025. In emerging European economies (except Russia, Ukraine, and Turkey, and Belarus), it is expected to recover from a decline of 4.5% in 2021 to 1.1% in 2025 and to recover to 2.9% in 2024.

- Inflation is projected to fall, driven by lower energy prices and loosening supply chain constraints. It is projected to average 5.8% in advanced European economies this year and to fall to 11.9% by 2025. Most countries will fall short of their inflation targets by 2025. The cost of logistics in Europe accounts for 11 to 12% of the European economy's GDP.

- Germany's central location in the middle of Europe and highly skilled logistics services provide ideal conditions for international shippers to succeed in European markets. Germany provides easy access to the EU's 500 million consumers. Germany's skilled workforce is attractive for international companies wanting to invest in the German logistics sector or consider setting up a local branch. About 70% of Germany's foreign trade and related goods and freight traffic takes place within Europe. The major European trading partners include France (with imports and exports of €170 billion (USD 185.90 bn) and the Netherlands (with exports of USD 167 billion (USD 182.62 billion)). The biggest destination for logistics outside Europe is Asia, followed by America. Many companies are opening warehouses to expand their business in Germany.

- For instance, in June 2023, GXO announced its plans to "deepen" its presence in Germany. As a first step, GXO will construct a new 587,000-square-foot warehouse in the Dormagen area to showcase its cutting-edge warehousing solutions. GXO has only six warehouses in Germany, compared with 700 in Europe and the United Kingdom and 300 in North America.

- For instance, In July 2023, Geopost and JD Logistics announced a strategic partnership to strengthen global logistics capabilities. By combining JDL's strong warehousing network with Geopost's logistics delivery capabilities, this partnership will expand international express services from China to Europe, providing consumers and businesses with high-quality express logistics solutions. JDL and Geoopost will create seamless C2C (direct-to-consumer) and B2C (business-to-consumer) shipping solutions from China to Europe in both directions. This new partnership will provide comprehensive end-to-end shipment tracking and delivery, with a convenient 'one-stop' express delivery service that includes doorstep delivery and dedicated customer support, as well as state-of-the-art digital tracking throughout the logistics process.

Europe Contract Logistics Market Trends

Outsourced Contract Logistics Market to Register Significant Growth

The outsourcing share of contract logistics is low, showing clear growth potential. Globally, the share of contract logistics in the total market is only 10-15%. In Europe, this proportion is estimated at around 20%. The extent of outsourcing varies greatly from country to country. Transportation and storage services are generally outsourced to a large extent.

E-commerce is expected to be a major driver of outsourcing growth. As the e-commerce market grows rapidly, so do consumer expectations for faster and more reliable delivery. As a result, outsourcing of warehousing and order processing is expected to increase. Contract logistics offers e-commerce companies of all sizes the following benefits: Business manageability, advanced technology solutions, risk mitigation, and scalability.

Contract logistics companies provide services to online businesses and help enter new markets by making good use of global networks. They also help move closer to customers by offering a choice of delivery options, taking care of customs and value-added tax (VAT) services, and more.

Contract logistics companies offer specialized services for businesses that manufacture consumer electronics, telecommunications devices, computer equipment, or other high-tech products. They help these businesses reduce inventory, lower distribution costs, and launch new products.

United Kingdom is dominating the region

The United Kingdom is the third biggest e-commerce market globally after China and the United States.

The United Kingdom is on track to become a digital economy as online shopping and online payments soar. The UK E-commerce market is one of Europe's largest and fastest-growing. In 2023, UK households are expected to spend approximately GBP 120 billion (USD 152.54 billion) on e-commerce, growing at an annual rate of 8.8%.

Retail e-commerce is one of the fastest-growing retail trends in the world. Over the past decade, online shopping has become the UK's most popular retail channel. While e-commerce sites have existed for decades, they've only recently started to gain traction. The growth of online shopping in the UK has been staggering to keep up with global trends. As a result, there's a huge demand for contract logistics services.

In November 2023, EV Cargo invested in technology-driven supply chains and built a distribution network with a world-leading control tower system. EV Cargo, a global freight forwarding company and global supply chain services provider, has won new UK contracts for three new customers in road freight and warehousing, as well as contract logistics. EV Cargo has completed a strategic resource review of its UK fleet in response to wider market conditions that have affected the UK logistics industry over the past three years. The company has incorporated technology to drive efficiencies and improve agility.

Europe Contract Logistics Industry Overview

The prominent players in the market include Deutsche Post DHL Group, Schenker AG (DB Schenker), Ceva Logistics, DSV AS, and SNCF Logistics/Geodis. These players based in Europe have a significant presence across the world. Even though these major players have a strong footprint across the region and account for significant market share, the market is still fragmented to some extent, with many players providing contract logistics services at different levels.

It is necessary for companies to make sure they are constantly evolving to match the industry trends. This is likely to help them gain a stronger foothold by attracting new customers.

Most major companies are based out of the Western European region. The number of local contract logistics providers in the CEE region is comparatively lower. This is an opportunity for the existing local logistics players in the CEE region to enter the contract logistics market and gain significant market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increased Outsourcing of Services

- 4.2.1.2 Increasing Demand For Contract Logistics In Italy, France, And Poland

- 4.2.2 Restraints

- 4.2.2.1 Increasing Competition In The European Contract Logistics Market

- 4.2.2.2 Regulatory Compliance

- 4.2.3 Opportunities

- 4.2.3.1 Pooled Warehousing

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Technological Trends

- 4.7 Insights into the E-commerce Industry in the Region (Domestic and Cross-border)

- 4.8 Insights into Contract Logistics in the Context of After-sales/Reverse Logistics

- 4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing and Transportation, Supply Chain Services, and Other Value-added Services)

- 4.10 Spotlight on Freight Transportation Costs/Freight Rates

- 4.11 Insights into Effects of Brexit on the European Logistics Industry

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Industrial Machinery and Automotive

- 5.1.2 Food and Beverage

- 5.1.3 Construction

- 5.1.4 Chemicals

- 5.1.5 Other Consumer Goods

- 5.1.6 Other End Users

- 5.2 By Country

- 5.2.1 Germany

- 5.2.2 United Kingdom

- 5.2.3 Netherlands

- 5.2.4 France

- 5.2.5 Italy

- 5.2.6 Spain

- 5.2.7 Poland

- 5.2.8 Belgium

- 5.2.9 Sweden

- 5.2.10 Rest of the Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles (including Merger and Acquisition, Joint Ventures, Collaborations, and Agreements)

- 6.2.1 Deutsche Post DHL Group

- 6.2.2 XPO Logistics

- 6.2.3 Schenker AG (DB Schenker)

- 6.2.4 CEVA Logistics

- 6.2.5 SNCF Logistics/Geodis

- 6.2.6 DSV AS

- 6.2.7 Neovia Logistics Services

- 6.2.8 GEFCO SA

- 6.2.9 United Parcel Service Inc. (UPS Supply Chain Solutions)

- 6.2.10 Rhenus SE & Co. KG

- 6.2.11 Bertelsmann SE & Co. KGaA (Arvato)

- 6.2.12 FIEGE Logistik Stiftung & Co. KG*

- 6.3 Other Companies (Key Information/Overview)

- 6.3.1 Expeditors International, United Parcel Service Inc., Bollore Logistics, Hellmann Worldwide Logistics GmbH & Co. KG, Agility Logistics Pvt. Ltd, H. Essers NV, Wincanton PLC*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution by Activity for Key Countries

- 8.2 Insights into Capital Flows

- 8.3 External Trade Statistics - Export and Import by Product

- 8.4 Insights into Key Export Destinations of Europe

- 8.5 Insights into Key Import Origins of Europe