|

市場調查報告書

商品編碼

1636232

電動摩托車電池:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Electric Two-wheeler Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

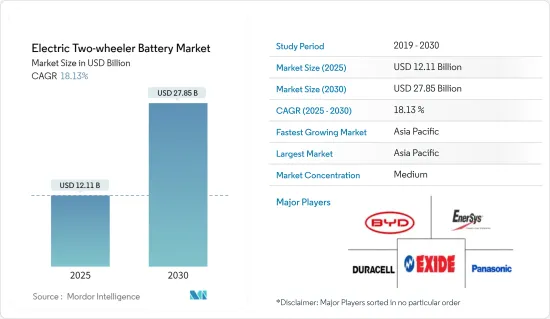

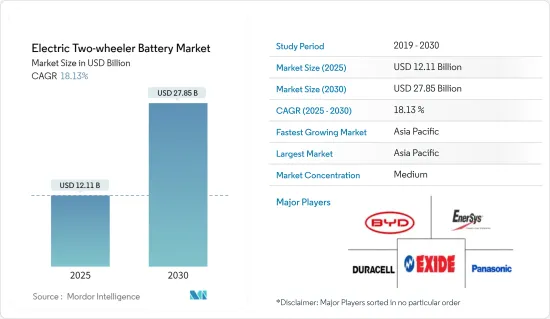

電動二輪車電池市場規模預計到2025年為121.1億美元,預計到2030年將達到278.5億美元,預測期內(2025-2030年)複合年成長率為18.13%。

主要亮點

- 從中期來看,電動車(EV)普及率的提高和鋰離子電池價格的下降預計將在預測期內推動電動二輪車電池的需求。

- 另一方面,原料供應鏈的限制可能會顯著抑制電動摩托車電池市場的成長。

- 電池材料的技術進步,如提高能量密度、縮短充電時間、提高安全性和延長使用壽命,預計將在不久的將來為市場相關人員提供重大機會。

- 由於兩輪電動車的採用不斷增加,亞太地區預計將在預測期內成為全球電動二輪車電池市場成長最快的地區。

電動摩托車電池市場趨勢

鋰離子電池類型主導市場

- 鋰離子電池因其能量密度高、壽命長和快速充電能力而成為電動二輪車電池市場的主導能源儲存解決方案。這些特性使它們非常適合用於需要輕質高效電源的電動摩托車和Scooter。

- 鋰離子電池的價格通常高於其他電池。然而,市場競爭日益加劇,導致鋰離子電池的價格下降。

- 由於電動車(EV)和電池能源儲存系統(BESS)的平均電池組價格上漲,電池價格將在 2023 年降至 139 美元/kWh,降幅超過 13%。隨著技術創新和製造水準的提高,電池組價格預計將進一步下降,2025年達到113美元/kWh,2030年達到80美元/kWh。

- 此外,由於對環境問題的日益關注,世界各國政府都在大力推廣電動車。政府重點關注淨零碳排放目標。鋰是為電動車提供儲存容量的電池中的重要元素。全球主要企業都在籌集資金,以增加摩托車電池的產量,滿足對鋰離子電池不斷成長的需求。

- 例如,2023 年 10 月,Ola Electric 宣布已從淡馬錫主導的投資者和印度國家銀行獲得 320 億印度盧比(3.836 億美元)的資金。該投資將用於透過在泰米爾納德邦建立印度第一家鋰離子電池製造工廠來擴大 Ola 的二輪車業務。

- 此外,世界各國政府也採取了各種措施和激勵措施來推廣電動二輪車。這些措施對鋰離子電池的需求產生了正面影響。政府宣布了多項在全部區域推廣電動車的舉措。

- 在歐洲,各國正在實施稅收措施,以促進電動車(EV)的引入,包括電動摩托車和Scooter等二輪車輛。例如,從2023年開始,德國將提供各種補貼,包括對購買電動摩托車和安裝充電基礎設施的財政誘因。同樣,義大利對購買電動二輪車提供激勵,並透過各種稅收優惠促進充電基礎設施的發展。

- 因此,此類措施和計劃可能會在未來幾年加速全國兩輪電動車的生產和需求,並在預測期內增加對鋰離子電池的需求。

亞太地區實現顯著成長

- 亞太地區是電動二輪車電池的重要且快速成長的市場。這一成長是由於都市化、環境問題和政府支持措施等多種因素導致對電動Scooter、電動摩托車和電動自行車的需求增加所推動的。

- 該全部區域對電動Scooter、二輪車和自行車的需求顯著增加。例如,根據Statista Market Insights的資料,2023年摩托車銷量為4,585萬輛,較2022年成長2.8%。該集團也預計2029年銷量將達到5,163萬輛。該資料表明,未來幾年二輪車銷量將大幅成長,這可能會增加預測期內對電動二輪車電池的需求。

- 亞太地區許多國家都採取了措施和獎勵來鼓勵使用電動車,包括二輪車。其中包括補貼、稅收優惠和更嚴格的排放法規,以鼓勵向電動車過渡。

- 例如,從2023年開始,中國政府將對包括摩托車在內的電動車的購買提供大量補貼。這些補助金可以覆蓋購買成本的很大一部分。同樣,印度政府宣布了混合動力汽車和電動車快速採用和製造(FAME)計劃,為購買電動二輪車提供財政獎勵。政府也將電動車的商品及服務稅從 12% 降至 5%,使電動車更便宜。預計此類措施將在未來幾年加速全國兩輪電動車的生產和需求,導致預測期內對二輪車電池的需求增加。

- 此外,大城市的快速都市化和日益嚴重的交通堵塞正在增加對電動二輪車等高效、環保的交通解決方案的需求。每家公司都在全球範圍內顯著擴展了摩托車業務,在每個地區推出了先進的摩托車。

- 例如,TVS Motor公司於2023年10月宣布將與新加坡科技新興企業ION Mobility合作,進軍印尼的運動Scooter領域。進入該市場的計劃是“Project Dynamo”,這是 ION Mobility 對 TVS Motor 的高階旗艦跨界電動二輪車“TVS X”的概念化。 TVS Motor 在 ION Mobility 的 A 輪資金籌措中發揮了關鍵作用,作為策略投資者提供了 1870 萬美元。在預測期內,此類措施和資金籌措可能會增加全部區域二輪車生產和電動二輪車電池的需求。

- 此類計劃的開發證明了兩輪電動車電池能源儲存系統的兩輪電池解決方案的可行性和重要性。這些計劃可能會在未來幾年推動全部區域對電動二輪車電池的需求。

電動摩托車電池產業概況

電動摩托車電池市場已被削減一半。該市場的主要企業包括(排名不分先後)比亞迪有限公司、金霸王公司、Exide Industries Ltd.、EnerSys 和松下控股公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車 (EV) 產量增加

- 鋰離子電池價格下降

- 抑制因素

- 原物料供應鏈約束

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他電池類型

- 車型

- 電動摩托車

- 電動Scooter

- 2029 年之前的市場規模和需求預測(按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 卡達

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略及SWOT分析

- 公司簡介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Holdings Corporation

- Gogoro Inc.

- Exide Industries Ltd

- Immotor Inc.

- MO Batteries Singapore Pte Ltd

- Kwang Yang Motor Co. Ltd(KYMCO)

- NIO Technologies

- 其他知名公司名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 電池材料技術進步

簡介目錄

Product Code: 50003500

The Electric Two-wheeler Battery Market size is estimated at USD 12.11 billion in 2025, and is expected to reach USD 27.85 billion by 2030, at a CAGR of 18.13% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising adoption of electric vehicles (EV) and declining lithium-ion battery prices are expected to drive the demand for electric two-wheeler batteries during the forecast period.

- On the other hand, the supply chain constraints of raw materials can significantly restrain the growth of the electric two-wheeler battery market.

- Nevertheless, technological advancements in battery materials like higher energy density, faster charging times, improved safety, and longer lifespan are expected to create significant opportunities for the market players in the near future.

- Asia-Pacific is expected to be the fastest-growing region in the global electric two-wheeler battery market during the forecast period due to the rising adoption of two-wheeler electric vehicles.

Electric Two-wheeler Battery Market Trends

Lithium-ion Battery Type to Dominate the Market

- Lithium-ion (Li-ion) batteries are the predominant energy storage solution in the electric two-wheeler battery market due to their high energy density, long lifespan, and fast charging capabilities. These attributes make them ideal for use in electric motorcycles and scooters, which require lightweight and efficient power sources.

- The price of lithium-ion batteries is usually higher than that of other batteries. However, major players across the market have been investing to gain economies of scale and R&D activities to enhance their performance by increasing the competition and, in turn, resulting in declining prices of lithium-ion batteries.

- Owing to the increasing average battery pack prices of electric vehicles (EV) and battery energy storage systems (BESS), the battery prices declined in 2023 to USD 139 /kWh, a decrease of over 13%. The trajectory of technological innovation and manufacturing enhancements is anticipated to decrease the battery pack prices further, projecting the cost to reach USD 113/kWh in 2025 and USD 80/kWh in 2030.

- Furthermore, governments worldwide are significantly promoting electric vehicles due to rising environmental concerns. The government is significantly focused on net zero carbon emission targets. Lithium is a vital element in batteries that provides the storage capacity for EVs. The leading companies around the globe are raising funds to increase two-wheeler battery production and fulfill the rising demand for lithium-ion batteries.

- For instance, in October 2023, Ola Electric announced that it secured funding of INR 3,200 crore (USD 383.6 million) from Temasek-led investors and the State Bank of India. The investment is likely to be used to set up India's first lithium-ion cell manufacturing facility in Tamil Nadu and expand Ola's two-wheeler business.

- Additionally, governments worldwide have implemented various policies and incentives to promote two-wheeler electric vehicles. These policies have positively impacted the demand for lithium-ion batteries. The government announced numerous initiatives to promote EVs across the region.

- In Europe, various countries have implemented tax policies to promote the adoption of electric vehicles (EVs), including two-wheelers like electric motorcycles and scooters. For instance, since 2023, Germany has offered a range of subsidies for electric two-wheelers, including financial incentives for the purchase and installation of charging infrastructure. Similarly, Italy offers purchase incentives for electric two-wheelers and promotes the development of charging infrastructure through various tax benefits.

- Hence, such initiatives and projects are likely to accelerate the production and demand for two-wheeler EVs across the country in the coming years and raise the demand for lithium-ion batteries during the forecast period.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific is a significant and rapidly growing market for electric two-wheeler batteries. This growth is driven by increasing demand for electric scooters, motorcycles, and bicycles due to various factors, including urbanization, environmental concerns, and supportive government policies.

- The demand for electric scooters, motorcycles, and bicycles is rising significantly across the region. For instance, according to Statista Market Insights data, in 2023, the sales of motorcycles were recorded at 45.85 million units, which increased by 2.8% compared to 2022. The group also estimated that the sales in 2029 are expected to be 51.63 million units. The data indicates an exponential increase in the sales of two-wheelers in the coming years, which may raise the demand for electric two-wheeler batteries during the forecast period.

- Many countries in Asia-Pacific have implemented policies and incentives to promote the adoption of electric vehicles, including two-wheelers. These include subsidies, tax incentives, and stringent emission norms that encourage the shift to electric mobility.

- For instance, since 2023, the Chinese government has provided substantial subsidies for the purchase of electric vehicles, including two-wheelers. These subsidies can cover a significant portion of the purchase cost. Similarly, the Indian government announced the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, which provides financial incentives for the purchase of electric two-wheelers. The government also reduced the GST on electric vehicles from 12% to 5%, making them more affordable. Such initiatives are likely to accelerate the production and demand for two-wheeler EVs across the country in the coming years and raise the demand for two-wheeler batteries during the forecast period.

- Furthermore, rapid urbanization and growing traffic congestion in major cities have led to an increased demand for efficient and eco-friendly transportation solutions, such as electric two-wheelers. The companies are significantly expanding their two-wheeler business worldwide and launching advanced two-wheelers across the regions.

- For instance, in October 2023, TVS Motor Company announced its collaboration with ION Mobility, a Singapore-based tech startup, to venture into the sports scooter segment in Indonesia. The entry into the market is to be made under "Project Dynamo," which is ION Mobility's conceptual adaptation of TVS Motor's premium flagship crossover electric two-wheeler, the TVS X. TVS Motor played a crucial role in ION Mobility's Series A funding, providing USD 18.7 million as a strategic investor. Such initiatives and funding are likely to raise the production of two-wheelers across the region and the demand for electric two-wheeler batteries during the forecast period.

- Such project developments showcase the feasibility and importance of two-wheeler battery solutions for battery energy storage systems in two-wheeler EVs. They are likely to raise the demand for electric two-wheeler batteries across the region in the coming years.

Electric Two-wheeler Battery Industry Overview

The electric two-wheeler battery market is semi-fragmented. Some key players in the market (not in particular order) are BYD Company Ltd, Duracell Inc., Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Electric Motorcycle

- 5.2.2 Electric Scooter

- 5.3 Geography [Market Size and Demand Forecast till 2029 (For Regions Only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 Duracell Inc.

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Gogoro Inc.

- 6.3.6 Exide Industries Ltd

- 6.3.7 Immotor Inc.

- 6.3.8 MO Batteries Singapore Pte Ltd

- 6.3.9 Kwang Yang Motor Co. Ltd (KYMCO)

- 6.3.10 NIO Technologies

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

02-2729-4219

+886-2-2729-4219