|

市場調查報告書

商品編碼

1636236

SLI用鉛酸電池-市場佔有率分析、產業趨勢、成長預測(2025-2030)Lead Acid Battery For SLI Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

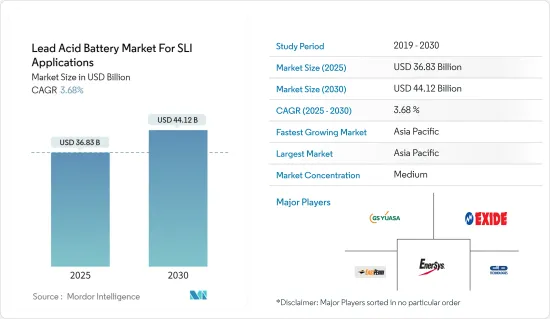

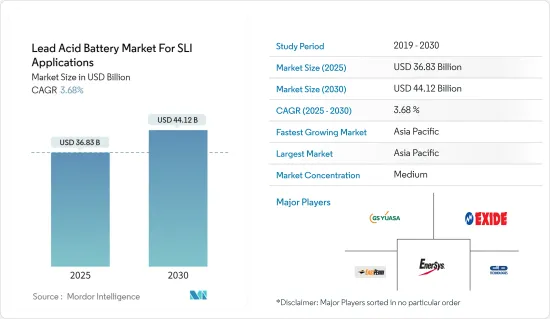

SLI鉛酸電池市場預計將從2025年的368.3億美元成長到2030年的441.2億美元,預測期間(2025-2030年)複合年成長率為3.68%。

主要亮點

- 從中期來看,汽車產業需求增加和鉛酸電池回收設施數量增加等因素預計將在預測期內推動市場發展。

- 另一方面,來自替代技術的競爭預計將阻礙預測期內的市場成長。

- 技術進步預計將在未來幾年為市場帶來重大商機。

- 由於電動車在該地區各國的滲透率不斷提高,預計亞太地區將主導市場。

鉛酸蓄電池市場趨勢

汽車產業需求不斷成長

- 汽車工業是各地區的主要產業之一,主要是北美、歐洲和亞太地區。這些地區高度都市化,推動了汽車需求,使其成為全球最大的 SLI 電池市場之一。

- 鉛酸電池是全球汽車和卡車等傳統內燃機車輛中所有 SLI 電池應用的首選技術。鉛酸電池是傳統車輛 SLI 應用中最經濟可行的大規模生產技術。 90%以上的汽車SLI電池基於鉛酸電池,90%以上的工業固定和發電廠應用(基於儲存容量)基於鉛酸電池。

- 到2023年,中國將成為全球乘用車產量的領導者,產量約2,610萬輛。日本排名第二,產量約 780 萬台。這些國家也是世界上一些最大的汽車製造商的所在地,其中包括 GS Yuasa Corporation 和 Camel Group,它們是 SLI 電池的主要消費者。

- 隨著世界各地(尤其是開發中地區)持有的擴張,為傳統內燃機 (ICE) 車輛提供動力的 SLI 電池的需求也在不斷成長。

- 雖然傳統內燃機汽車的市場預計將在未來 20 至 25 年內萎縮,但替代汽車技術正在使用 SLI 型鉛為車內的各種電子設備和安全功能提供動力,預計電池將繼續使用。先進的鉛基電池(吸收式玻璃墊或增強型富液式電池)具有啟動停止功能,可提高領先微混合動力汽車的燃油效率。借助怠速熄火系統,內燃機(ICE)在煞車或休息時自動停止,可降低油耗高達5-10%。

- 根據OICA(國際汽車製造商組織)預測,2023年全球乘用車銷售量將達6,527萬輛。 2023年商用車銷售量將達2,745萬輛。這表明對汽車零件的強勁需求,包括用於 SLI(啟動、照明和點火)應用的鉛酸電池。

- 持續的高銷量正在推動對鉛酸電池的需求,因為這些車輛依靠 SLI 電池來實現啟動引擎和為車載電子設備供電等關鍵功能。汽車產量和銷售量的激增預計將維持並在某些情況下推動全球 SLI 鉛酸電池市場。

中國預計將主導市場

- 中國的鉛酸電池市場預計將顯著成長,特別是在啟動、照明和點火(SLI)應用領域。這一市場擴張主要得益於疫情後的復甦和強勁的汽車產業的持續擴張。

- 鉛酸電池適合 SLI 應用,因為汽車產業需要可靠且經濟高效的電池。這些電池對於為汽車的啟動馬達、車燈和點火系統提供動力至關重要,可確保高性能和長壽命。

- 根據OICA(國際汽車製造商組織)預測,2023年中國乘用車銷售量將達2,606萬輛。 2023年商用車銷量達403萬輛。這創造了對汽車零件的需求,包括用於 SLI 應用的鉛酸電池。

- 鉛酸電池技術的創新,包括改進的回收流程和提高的電池性能,正在加劇鉛酸電池的競爭。儘管鋰離子電池越來越受歡迎,但鉛酸電池由於其成熟的供應鏈和成本效益仍然具有重要意義。

- 汽車電池售後市場正在擴大,消費者擴大更換或升級現有電池。這一趨勢對於維持 SLI 類別的需求並確保市場的永續成長至關重要。 Johnson Controls International PLC、Exide Technologies Inc. 和 Amara Raja Batteries Ltd. 等公司是市場的主要領導者,並專注於策略擴張和技術創新以保持競爭力。

- 總體而言,中國鉛酸蓄電池市場預計將保持成長軌跡。汽車行業的持續進步和穩定的需求、電動車的日益普及以及對先進能源儲存解決方案的需求不斷增加預計將推動這一成長。

SLI 鉛酸電池產業概覽

SLI鉛酸電池市場是細分的。主要參與企業包括(排名不分先後)GS Yuasa Corporation、C&D Technologies Inc.、East Penn Manufacturing Co. Inc.、EnerSys 和 Exide Technologies。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 汽車產業需求擴大

- 增加鉛酸電池的回收

- 抑制因素

- 來自替代技術的競爭

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 依技術

- 浸沒式

- VRLA(閥控鉛酸蓄電池)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 奈及利亞

- 卡達

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Johnson Controls International PLC

- Exide Technologies

- EnerSys

- East Penn Manufacturing Co. Inc.

- GS Yuasa Corporation

- Leoch International Technology Limited

- C&D Technologies Inc.

- NorthStar Battery Company LLC

- Camel Group Co. Ltd

- FIAMM Energy Technology SpA

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 技術進步

簡介目錄

Product Code: 50003504

The Lead Acid Battery Market For SLI Applications Industry is expected to grow from USD 36.83 billion in 2025 to USD 44.12 billion by 2030, at a CAGR of 3.68% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing demand from the automotive industry and rising lead-acid battery recycling facilities are expected to drive the market during the forecast period.

- On the other hand, competition from alternative technologies is likely to hinder market growth during the forecast period.

- Nevertheless, technological advancements are expected to provide significant opportunities for the market in the coming years.

- Asia-Pacific is estimated to dominate the market due to the increasing adoption rate of electric vehicles across various countries in the region.

Lead Acid Battery Market Trends

Growing Demand in the Automotive Industry

- Automotive is one of the major industries in various regions, particularly in North America, Europe, and Asia-Pacific. Growing urbanization in these regions is driving the demand for automobiles, thus making it one of the largest markets for SLI batteries globally.

- A lead-acid battery is the technology of choice for all SLI battery applications in conventional combustion engine vehicles, such as cars and trucks, worldwide. Lead-acid batteries are the most economically viable mass-market technology for SLI applications in traditional vehicles. Over 90% of automotive SLI batteries are lead-acid based, and over 90% (by storage capacity) of industrial stationary and motive applications.

- In 2023, China led the world in passenger car production, with approximately 26.1 million units manufactured. Japan, the second-highest producer, produced around 7.8 million units. These countries are also home to some of the world's largest automobile manufacturers, such as GS Yuasa Corporation and Camel Group Co. Ltd, the major SLI battery consumers.

- With expanding vehicle ownership worldwide, especially in developing regions, there is a parallel rise in the need for SLI batteries to power traditional internal combustion engine (ICE) vehicles.

- Although the market for conventional internal combustion engine vehicles is expected to decline over the next 20 to 25 years, replacement car technologies are expected to continue using SLI-type lead-acid batteries to power various electronics and safety features within the vehicle. Advanced lead-based batteries (absorbent glass mat or enhanced flooded batteries) provide start-stop functionality to improve fuel efficiency in major micro-hybrid vehicles. In start-stop systems, the internal combustion engine (ICE) automatically shuts down under braking and rest, reducing fuel consumption by up to 5-10%.

- According to the OICA (Organisation Internationale des Constructeurs d'Automobiles), the global vehicle sales for passenger cars reached 65.27 million in 2023. The vehicle sales for commercial vehicles reached 27.45 million in 2023. This indicates a robust demand for automotive components, including lead-acid batteries for SLI (starting, lighting, and ignition) applications.

- As these vehicles rely on SLI batteries for essential functions like starting the engine and powering onboard electronics, the continued high sales volumes drive the demand for lead-acid batteries. This vehicle production and sales surge is expected to sustain and possibly boost the global lead-acid battery market for SLI applications.

China is Expected to Dominate the Market

- The lead-acid battery market in China, especially for starting, lighting, and ignition (SLI) applications, is set to witness significant growth. This expansion is primarily driven by the robust automotive industry, which continues to recover and expand post-pandemic.

- The automotive industry's demand for reliable, cost-effective batteries makes lead-acid batteries a preferred choice for SLI applications. These batteries are integral to powering start motors, lights, and ignition systems in vehicles, ensuring high performance and longevity.

- According to OICA (Organisation Internationale des Constructeurs d'Automobiles), China's vehicle sales for passenger cars reached 26.06 million in 2023. The sales for commercial vehicles reached 4.03 million in 2023. This created a demand for automotive components, including lead-acid batteries for SLI applications.

- Innovations in lead-acid battery technology, such as improved recycling processes and enhanced battery performance, have made these batteries more competitive. Despite the growing popularity of lithium-ion batteries, lead-acid batteries remain relevant due to their established supply chain and cost-effectiveness.

- The aftermarket for automotive batteries is growing, with consumers increasingly replacing and upgrading their existing batteries. This trend is critical for maintaining demand in the SLI category and ensuring sustained market growth. Companies like Johnson Controls International PLC, Exide Technologies Inc., and Amara Raja Batteries Ltd are leading the market, focusing on strategic expansions and technological innovations to retain their competitive edge.

- Overall, the lead-acid battery market in China is expected to maintain its growth trajectory. Continuous advancements and steady demand from the automotive industry, along with the increasing adoption of electric vehicles and the need for advanced energy storage solutions, are expected to drive this growth.

Lead Acid Battery Industry Overview

The lead acid battery market for SLI applications is fragmented. Some of the major players include (not in particular order) GS Yuasa Corporation, C&D Technologies Inc., East Penn Manufacturing Co. Inc., EnerSys, and Exide Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumption

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand in the Automotive Industry

- 4.5.1.2 Increasing Lead-acid Battery Recycling

- 4.5.2 Restraints

- 4.5.2.1 Competition from Alternative Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Flooded

- 5.1.2 VRLA (Valve Regulated Lead-acid)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 Spain

- 5.2.2.4 NORDIC

- 5.2.2.5 Turkey

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Egypt

- 5.2.5.5 Nigeria

- 5.2.5.6 Qatar

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Johnson Controls International PLC

- 6.3.2 Exide Technologies

- 6.3.3 EnerSys

- 6.3.4 East Penn Manufacturing Co. Inc.

- 6.3.5 GS Yuasa Corporation

- 6.3.6 Leoch International Technology Limited

- 6.3.7 C&D Technologies Inc.

- 6.3.8 NorthStar Battery Company LLC

- 6.3.9 Camel Group Co. Ltd

- 6.3.10 FIAMM Energy Technology SpA

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements

02-2729-4219

+886-2-2729-4219