|

市場調查報告書

商品編碼

1683537

北美鉛酸電池:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Lead Acid Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

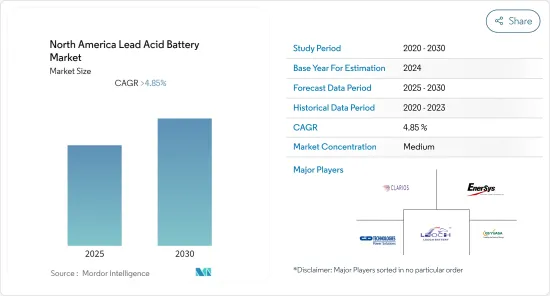

預測期內,北美鉛酸電池市場預計將以超過 4.85% 的複合年成長率成長

主要亮點

- 預計預測期內,SLI 電池領域將成為北美電池市場成長最快的領域。由於全國持有車輛數量眾多,SLI(啟動、照明和點火)意味著鉛酸電池銷售量龐大。

- 鉛酸電池技術的進步有望為市場參與者創造巨大的商機,因為與最先進的電池技術相比,鉛酸電池技術的進步可以提高儲存密度、延長使用壽命、改善寒冷天氣性能,而且成本相對較低。

- 由於強大的工業基礎設施、基於電池的儲能計劃的能源儲存以及不斷擴大的再生能源基礎設施,美國是全球工業電池的主要熱點之一。此外,美國對可再生能源和住宅分散式能源系統部署的優惠政策可能會在未來幾年推動電池市場的發展。

北美鉛酸電池市場趨勢

汽車電池(SLI 電池)領域將佔據市場主導地位

- 過去幾年來,幾乎所有汽車都安裝了啟動、照明和點火 (SLI) 電池。一般來說,SLI 電池用於短時間供電,例如運行輕電負載或啟動汽車引擎。此外,當車輛的電氣負載超過充電系統的供應量時,這些電池還會提供額外的電力,並充當電壓安定器,平衡電氣系統中的電壓尖峰,從而防止電氣系統中其他組件的損壞。

- SLI 電池市場成長的主要驅動力是對這些電池的需求不斷成長,以使用高性能、長壽命和具有成本效益的鉛酸電池為馬達、燈和其他內燃機提供動力。

- 鉛酸電池是北美等世界各地傳統內燃機車輛(例如汽車和卡車)中所有 SLI 電池應用的首選技術。鉛酸電池由於其出色的冷啟動性能、可靠性和低成本,成為經典汽車 SLI 應用(包括啟動停止和基本微混合系統)最經濟可行的量產技術。超過 90% 的汽車 SLI 電池都是鉛酸電池,超過 90%(基於儲存容量)的工業固定和馬達應用都是鉛酸電池。

- 北美是世界上最大的汽車市場之一。這使得該地區成為汽車生產的全球領導者,並成為全球最大的 SLI 電池市場之一。

- 截至 2021 年,美國是世界第二大汽車生產國,約佔該地區汽車總產量的 69%。中國也是福特、通用汽車和特斯拉等一些全球最大汽車製造商的所在地,因此中國是 SLI 電池的主要消費國。

- 鑑於上述情況,預計汽車電池(SLI 電池)領域將在預測期內見證顯著的市場成長。

美國:預計市場將大幅成長

- 美國是世界上最大的汽車市場之一。它也是領先的機動車製造商之一,包括輕型商用車。近年來,該國汽車產業經歷了顯著成長,但 2020 年因新冠疫情爆發而出現下滑跡象。

- 由於該國汽車市場的規模,也佔據了鉛酸電池市場的很大佔有率。鉛酸電池由於在SLI的應用,在汽車領域仍佔有很大的佔有率。

- 此外,鉛酸電池可能在鋰離子電池目前占主導地位的電動車市場提供巨大的機會。鉛酸電池的回收率極高,約96%,這是經過數十年的研究和開發才實現的。這使得它們比鋰離子電池更具優勢,因為鋰離子電池的回收過程非常複雜且昂貴,而且成功率極低。

- 美國是全球工業電池主要熱點地區之一,得益於其強大的能源儲存計劃、基於電池的儲能項目的激增以及不斷成長的再生能源基礎設施。此外,美國對採用可再生能源和住宅分散式能源系統的優惠政策可能會在未來幾年推動電池市場的發展。

- 此外,美國政府宣布2021年預算將大幅增加軍事開支。根據預算,美國政府將在2022財政年度撥款7,700億美元用於軍事開支,而美國參議院已決議2021財政年度撥款7,050億美元用於軍事開支。

- 預計國家軍事投資的增加將支持軍隊中電池供電的通訊和其他電子設備的日益廣泛使用,這反過來有望在預測期內推動對鉛酸電池的需求。

- 因此,鑑於上述情況,預計美國電池市場在預測期內將出現顯著的成長。

北美鉛酸電池產業概況。

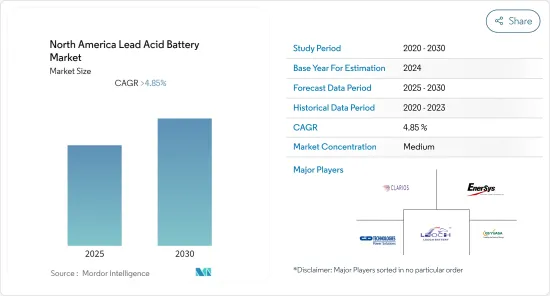

北美鉛酸電池市場中等分散。該市場的主要企業包括 Clarios(Brookfield Business Partners 的子公司)、EnerSys、C&D Technologies Inc、Leoch International Technology Limited 和 GS Yuasa Corporation。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模與需求預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 應用

- SLI(啟動、照明和點火)電池

- 固定電池(電訊、UPS、能源儲存系統(ESS)等)

- 可攜式電池(用於家用電器等)

- 其他用途

- 原產地

- 美國

- 加拿大

- 北美其他地區

第6章 競爭格局

- 合併、收購、合作及合資

- 主要企業策略

- 公司簡介

- Clarios(a subsidiary of Brookfield Business Partners)

- EnerSys

- C&D Technologies Inc.

- Leoch International Technology Limited

- GS Yuasa Corporation

- East Penn Manufacturing Company

- Exide Technologies

- Power-Sonic Corporation

- Johnson Controls International PLC

- Panasonic Holdings Corp

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 92071

The North America Lead Acid Battery Market is expected to register a CAGR of greater than 4.85% during the forecast period.

Key Highlights

- SLI Battery segment is the fastest growing segment in the North American battery market during the forecast period. SLI (Starting, Lighting, and Ignition), owing to the large vehicle fleet of the country translates into large volumes of lead-acid battery sales.

- Advances in lead-acid battery technology to increase storage density, extend usable service life, and improve cold-weather performance at a comparatively lower cost than modern battery technologies are expected to provide a significant opportunity to the market players.

- The United States is one of the major hotspots for industrial batteries across the world on account of robust industrial infrastructure, surging deployment of battery-based energy storage projects, and expansion in renewable power infrastructure. Moreover, the favorable policy toward the deployment of renewable energy and residential distributed energy systems in the United States is likely to drive the battery market in the coming years.

North America Lead acid battery Market Trends

Automotive Batteries (SLI Batteries) Segment to Dominate the Market

- Starting, lighting, and ignition (SLI) batteries have been in almost every car for the past several years. Generally, SLI batteries are used for short power bursts, such as running light electrical loads or starting a car engine. Moreover, these batteries supply extra power when the vehicle's electrical load exceeds the supply from the charging system & act as a voltage stabilizer in the electrical even out voltage spikes, thereby preventing them from damaging other components in the electrical system.

- The primary factor attributing to the growth of the SLI battery market is the increasing demand for these batteries to power motors, lights, or other internal combustion engines with high performance, long life, and cost-efficient lead-acid.

- The lead-acid battery is the technology of choice for all SLI battery applications in conventional combustion engine vehicles, such as cars and trucks across the globe, including North America. Lead-acid batteries are the most economically viable mass-market technology for SLI applications in classic cars, including those with start-stop and basic micro-hybrid systems, owing to their excellent cold cranking performance, reliability, and low cost. More than 90% of automotive SLI batteries are lead-acid based, and over 90% (by storage capacity) of industrial stationary and motive applications.

- North America is one of the biggest markets for automobiles globally. Due to this, the region is also a global leader in the production of automobiles, making it one of the largest markets for SLI batteries globally.

- As of 2021, the United States is the 2nd-largest producer of motor vehicles globally, accounting for approximately 69% of the region's total automobiles 2021. The country is also home to some of the world's largest automobile manufacturers, such as Ford, General Motors and Tesla, which are the primary consumers of SLI batteries.

- Hence, owing to the above points, the Automotive Batteries (SLI Batteries) segment will likely see significant market growth during the forecast period.

United States Expected to see Significant the Market Growth

- The United States is one of the largest automobile markets in the world. The country is also one of the major manufacturers of automobiles, including light and commercial vehicles. In recent years the automobile sector in the country has witnessed significant growth, only showing signs of decline in 2020 due to the outbreak of COVID-19.

- Due to the large size of the country's automobile market, the country holds a major share in the region's lead-acid battery market. Lead-acid battery still holds the major share in the automobile sector due to their SLI applications.

- Additionally, lead-acid batteries might also provide a significant opportunity in the electric vehicle market, where currently lithium-ion batteries hold the major share. Lead-acid batteries have a very high rate of recyclability of around 96%, which has been possible due to decades of research and development; this provides them an upper hand against lithium-ion batteries, which have a very complex and expensive process of recyclability with very low success rate.

- The United States is one of the major hotspots for industrial batteries across the world on account of robust industrial infrastructure, surging deployment of battery-based energy storage projects, and expansion in renewable power infrastructure. Moreover, the favorable policy toward the deployment of renewable energy and residential distributed energy systems in the United States is likely to drive the battery market in the coming years.

- Additionally, the United States government announced a substantial increase in military spending in its 2021 Budget. According to the budget, the US government allocated USD 770 billion in FY 2022 to the military and the US Senate voted to give the military USD 705 billion for FY 2021.

- The increasing investment in the country's military is expected to support the growing usage of battery-powered communication and other electronic equipment used in the army, in turn, driving the demand for lead-acid batteries during the forecast period.

- Hence, owing to the above points, the United States is expected to see significant market growth in Battery market during the forecast period.

North America Lead acid battery Industry Overview

The North American lead acid battery market is moderately fragmented. Some of the key players in this market are Clarios (a subsidiary of Brookfield BusinessPartners) , EnerSys, C&D Technologies Inc, Leoch International Technology Limited, and GS Yuasa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 SLI (Starting, Lighting, and Ignition) Batteries

- 5.1.2 Stationary Batteries (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.1.3 Portable Batteries (Consumer Electronics, etc.)

- 5.1.4 Other Applications

- 5.2 Countries

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Clarios (a subsidiary of Brookfield Business Partners)

- 6.3.2 EnerSys

- 6.3.3 C&D Technologies Inc.

- 6.3.4 Leoch International Technology Limited

- 6.3.5 GS Yuasa Corporation

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 Exide Technologies

- 6.3.8 Power-Sonic Corporation

- 6.3.9 Johnson Controls International PLC

- 6.3.10 Panasonic Holdings Corp

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219