|

市場調查報告書

商品編碼

1636252

起重與運輸:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Heavy Lifting & Haulage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

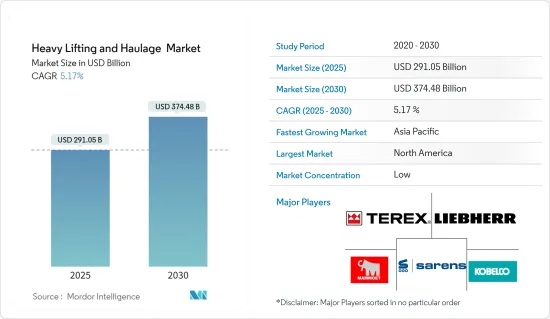

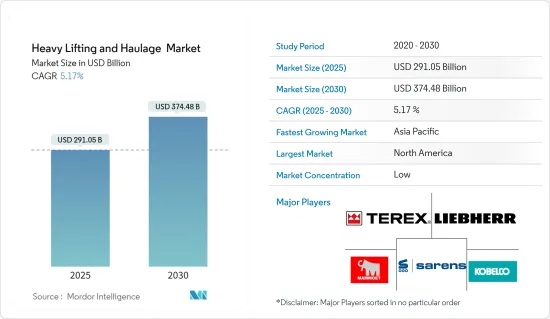

起重和牽引市場規模預計到 2025 年將達到 2,910.5 億美元,預計到 2030 年將達到 3,744.8 億美元,預測期內(2025-2030 年)複合年成長率為 5.17%。

主要亮點

- 在全球基礎設施計劃快速增加的推動下,起重和運輸市場預計將大幅擴張。隨著都市化和工業化的深入,對重型機械設備的運輸需求不斷增加。技術進步正在提高起重和運輸作業的效率和安全性,該領域的新進入者正在增加。此外,模組化建築技術的日益採用增加了對專業起重和運輸服務的需求。因此,市場將在未來幾年快速成長,為主要企業提供利潤豐厚的機會。

- 有幾個因素推動起重和牽引市場的成長。首先,該地區建築和基礎設施計劃的增加需要高效的重型設備移動,從而增加了對起重和運輸服務的需求。其次,起重設備自動化和物聯網整合等技術進步正在提高安全標準和工作效率,進一步推動市場成長。此外,擴大採用模組化施工方法正在推動對專業起重解決方案的需求。此外,隨著公司面臨更嚴格的職場安全法規,對先進起重和物料搬運設備的投資已成為強制性的,這為市場的持續擴張奠定了基礎。

重型起重和運輸市場趨勢

能源和電力領域的需求增加

- 可再生能源建設計劃,包括風電場、太陽能發電場、水力發電設施和生質能發電廠,將大幅增加對重型起重和運輸服務的需求。由於它們通常位於偏遠或困難的地點,例如離岸風力發電或山區水力發電廠,因此專業的運輸服務至關重要。這些服務不僅能穿越困難的地形,還能將關鍵零件及時運送到計劃現場。

- 2024年6月,以傳統產品綜合物流聞名的馬士基擴大了服務範圍。該公司隸屬於馬士基專案物流 (MPL) 部門,目前負責軌道外和特殊貨物運輸。馬士基最近與丹麥著名可再生能源公司維斯塔斯的合作證明了該公司在重型貨物運輸方面的實力。全球知名的可再生能源解決方案公司維斯塔斯委託馬士基承擔運輸其創紀錄風力發電機V236 重型動力傳動系統總成的關鍵任務。

- 動力傳動系統是重達 260 噸、令人印象深刻的 15MW 渦輪機的核心零件,來自維斯塔斯位於丹麥的 Lind 工廠。馬士基的航行從比利時洛默爾的組裝地點開始,然後經過安特衛普到達林德港。動力傳動系統是機艙的關鍵部分,導致 V236 的重量超過 630 噸。

- 在更廣泛的範圍內,包括中國在內的一些國家製定了雄心勃勃的目標來加強其可再生能源能力。尤其是中國,已成為可再生能源領域的全球領跑者,並在這一領域進行了大量投資。中國和美國在可再生能源消費量已經處於世界領先地位,但其使用量仍在穩步成長,為全球市場創造了機會。

亞太地區有望獲得巨大動力。

- 亞太起重和運輸服務市場正在經歷顯著成長。中國、印度和東南亞國家等國家正在經歷快速的都市化和工業化,增加了對這些服務的需求。需求激增主要是由高速公路、橋樑、鐵路和港口等基礎設施計劃的運輸需求所推動的。

- 在住宅、商業和工業計劃激增的推動下,亞太地區的建築業正走上積極的軌道。這種激增產生了對重型設備、建材和預製件的專業運輸的需求。產業專家表示,隨著亞太地區與西方新興經濟體的接軌,經濟成長將會加速。據預測,到2026年,該地區的建築和重型機械市場規模可能達到約650億美元。

- 此外,該地區對可再生能源的投資不斷增加,特別是風能、太陽能和發電工程,增加了對起重和運輸服務的需求。這些服務對於大型渦輪機、太陽能板和水力發電設備的運輸和安裝至關重要。

- 鑑於持續的基礎設施發展、都市化和工業擴張,亞太起重和運輸服務市場預計將持續成長。此外,該地區對可再生能源和永續實踐的重視預計將進一步增加對專業運輸服務的需求。

起重運輸業概況

起重和運輸市場高度分散,許多全球和參與企業參與企業正在應對不斷成長的需求。特雷克斯公司、利勃海爾、Sarens 是市場上的一些主要企業。

在起重和運輸作業中採用 GPS 追蹤、遠端資訊處理和自動化等先進技術可以為您帶來效率、安全性和成本效益的競爭優勢。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究場所

- 市場定義

- 調查範圍

第 2 章執行摘要

第3章調查方法

第4章市場動態與洞察

- 市場概況

- 市場動態

- 促進因素

- 基礎設施的成長推動了起重和運輸服務的需求

- 工業成長刺激了起重和運輸服務的需求

- 抑制因素

- 高成本

- 缺乏技術純熟勞工

- 機會

- 可再生能源計劃的成長

- 官民合作關係

- 技術整合

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 地緣政治與疫情如何影響市場

第5章市場區隔

- 按最終用戶

- 石油和天然氣

- 採礦和採石

- 能源/電力

- 建造

- 製造業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 新加坡

- 其他亞太地區

- 南美洲

- 巴西

- 墨西哥

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- Market Concentration

- 公司簡介

- Terex Corporation

- Liebherr

- Kobelco Construction

- Sarens

- Mammoet

- Global Rigging & Transport

- HSC Cranes

- Volvo Constructioon

- XCMG Construction

- KATO

- Konecranes*

- 其他公司

第7章 市場的未來

第8章附錄

- 以主要國家活動分類的 GDP 分佈

- 資本流動洞察 - 主要國家

- 經濟統計-運輸和倉儲業及其對經濟的貢獻(主要國家)

- 全球重大計劃清單(石油和天然氣、建築、基礎設施開發等)

- 貨運統計(運送方式、產品類型等)

The Heavy Lifting & Haulage Market size is estimated at USD 291.05 billion in 2025, and is expected to reach USD 374.48 billion by 2030, at a CAGR of 5.17% during the forecast period (2025-2030).

Key Highlights

- The heavy lifting and haulage market is set for significant expansion, fueled by a surge in infrastructure projects worldwide. As urbanization and industrialization intensify, the demand for transporting heavy machinery and equipment escalates. Technological advancements have enhanced the efficiency and safety of heavy-lifting operations and enticed new entrants to the sector. Additionally, the rising adoption of modular construction techniques is amplifying the need for specialized lifting and hauling services. Consequently, the market is poised for rapid growth in the coming years, offering lucrative opportunities for key players.

- Several factors are propelling the growth of the heavy-lifting and haulage market. Firstly, the uptick in regional construction and infrastructure projects necessitates efficient heavy equipment movement, driving the demand for lifting and haulage services. Secondly, technological advancements, including automation and Internet of Things integration in lifting equipment, are bolstering safety standards and operational efficiency, further fueling market growth. Moreover, the increasing adoption of modular construction methods is boosting the demand for specialized lifting solutions. Additionally, as businesses face stricter workplace safety regulations, investments in advanced lifting and hauling machinery are becoming imperative, setting the stage for continued market expansion.

Heavy Lifting & Haulage Market Trends

Increased Demand From Energy and Power Segment

- Renewable energy construction projects, encompassing wind farms, solar installations, hydropower facilities, and biomass plants, drive a surge in demand for heavy lifting and haulage services. Specialized haulage services are essential given their often remote or challenging locations-think offshore wind farms or mountainous hydropower sites. These services not only navigate tough terrains but also ensure the timely delivery of crucial components to the project sites.

- In June 2024, Maersk, known for its integrated logistics for conventional products, expanded its offerings. Under its Maersk Project Logistics (MPL) arm, it now caters to out-of-gauge and special cargo shipments. Maersk's recent collaboration with Vestas, a prominent Danish renewable energy firm, is a testament to its prowess in heavy lifting. Vestas, renowned for its global renewable energy solutions, entrusted Maersk with a pivotal task: transporting the hefty powertrains for its record-breaking V236 wind turbine.

- Weighing a staggering 260 tons, this powertrain, a centerpiece of the 15 MW turbine, is being ferried from Vestas' Lindo factory in Denmark. Maersk's journey starts from the assembly site in Lommel, Belgium, traversing through Antwerp and culminating at Lindo's port. The powertrain, a significant part of the nacelle, contributes to the V236's hefty weight, exceeding 630 tons.

- On a broader scale, several nations, including China, are setting ambitious targets to bolster their renewable energy capacities. China, in particular, has emerged as a global frontrunner in renewable energy, channeling substantial investments into the sector. China and the United States, already leading the global renewable energy consumption charts, continue to witness a steady uptick in their usage, creating opportunities in the global markets.

Asia-Pacific is Poised to Gain Significant Momentum

- The heavy lifting and haulage services market in Asia-Pacific is experiencing notable growth. Countries such as China, India, and various Southeast Asian nations are witnessing rapid urbanization and industrialization, increasing demand for these services. This surge in demand is primarily attributed to the transportation needs of infrastructure projects spanning highways, bridges, railways, and ports.

- The Asia-Pacific construction industry is on a robust trajectory, propelled by a surge in residential, commercial, and industrial projects. This surge necessitates specialized transportation for heavy machinery, building materials, and prefabricated components. Industry experts note that as Asia-Pacific aligns itself with the developed economies of the West, its economic growth accelerates. Projections indicate that by 2026, the market for construction and heavy equipment in the region could reach approximately USD 65 billion.

- Furthermore, the region's increasing investments in renewable energy, particularly in wind, solar, and hydropower projects, are bolstering the demand for heavy lifting services. These services are crucial for transporting and installing large turbines, solar panels, and hydroelectric equipment.

- Given the ongoing infrastructure development, urbanization, and industrial expansion, the Asia-Pacific heavy lifting and haulage services market is set for sustained growth. Moreover, the region's emphasis on renewable energy and sustainable practices is expected to boost the demand for specialized transport services further.

Heavy Lifting & Haulage Industry Overview

The heavy lifting and haulage market is highly fragmented, with many global and local players catering to the growing demand. Terex Corporation, Liebherr, and Sarens are some of the major players in the market.

Adopting advanced technologies such as GPS tracking, telematics, and automatons in heavy lifting and haulage operations gives a competitive edge in terms of efficiency, safety, and cost-effectiveness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption

- 1.2 Market Definition

- 1.3 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Infrastructure growth drives demand for heavy lift and haulage services

- 4.2.1.2 Industrial Growth Spurs Demand for Heavy Lift and Haulage Services

- 4.2.2 Restraints

- 4.2.2.1 High Costs

- 4.2.2.2 Skilled Labor Shortage

- 4.2.3 Opportunities

- 4.2.3.1 Growth in the Renewable Energy Projects

- 4.2.3.2 Public-Private partnerships

- 4.2.3.3 Technology Integration

- 4.2.1 Drivers

- 4.3 Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes Products and Services

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Oil and Gas

- 5.1.2 Mining and Quarrying

- 5.1.3 Energy and Power

- 5.1.4 Construction

- 5.1.5 Manufacturing

- 5.1.6 Other End Users

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Spain

- 5.2.2.5 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Singapore

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Egypt

- 5.2.5.5 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Company profiles

- 6.2.1 Terex Corporation

- 6.2.2 Liebherr

- 6.2.3 Kobelco Construction

- 6.2.4 Sarens

- 6.2.5 Mammoet

- 6.2.6 Global Rigging & Transport

- 6.2.7 HSC Cranes

- 6.2.8 Volvo Constructioon

- 6.2.9 XCMG Construction

- 6.2.10 KATO

- 6.2.11 Konecranes*

- 6.3 Other companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity - Key Countries

- 8.2 Insights into Capital Flows - Key Countries

- 8.3 Economic Statistics - Transport and Storage Sector, and Contribution to Economy (Key Countries)

- 8.4 List of Major Global Projects (Oil and Gas, Construction, Infrastructure Development, Etc.)

- 8.5 Freight Statistics (Mode, Product Category, Etc.)