|

市場調查報告書

商品編碼

1644653

美國工程服務:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)United States Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

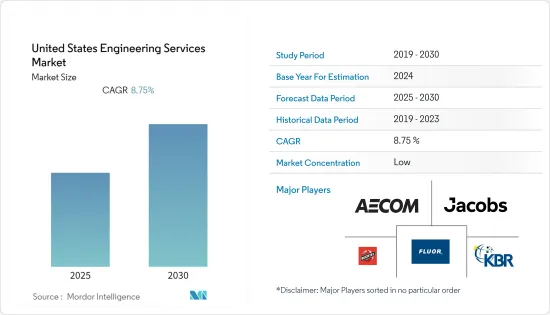

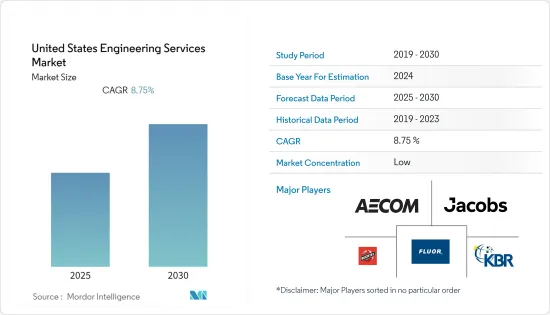

預計預測期內美國工程服務市場複合年成長率將達到 8.75%

關鍵亮點

- 數位化是市場的主要驅動力之一,它推動企業尋求現代 IT 解決方案,例如工程分析、物聯網 (IoT) 和人工智慧 (AI),以獲得競爭優勢並保持發展勢頭。其背景是工業IoT在各行各業的應用日益廣泛,推動了對管理複雜互聯基礎設施的工程服務的需求激增。

- 例如,2022 年 5 月,Aecom 表示其數位 Aecom PlanEngage 平台已在 Microsoft Azure 市場上線,這是一個用於購買和銷售經認證可在 Azure 上運行的雲端產品的線上市場。數位化 AECOM 整合了 Aecom 全球數位化重點諮詢服務、託管服務產品以加速客戶的數位化歷程並改善計劃成果,以及數位技術以改善核心工程和設計服務的交付。

- 此外,在預測期內,政府措施和大規模投資將推動工程服務市場的需求。例如,2021年11月,美國政府通過了一項兩黨基礎設施法案《基礎設施投資與就業法案》,這是對國家基礎設施和競爭力的重要投資。這項兩黨共同支持的基礎設施法案將修復美國的道路、橋樑和鐵路,改善安全飲用水的獲取,確保所有美國人都能使用高速網際網路,應對氣候危機,推進環境保護,並投資於那些經常被拋在後面的人們。

- 為了清理維護和維修積壓,減少港口和機場的擁擠和排放,並促進電氣化和其他低碳技術,該法案將向港口基礎設施和水道投資 170 億美元,向機場投資 250 億美元。

- 在新冠疫情為眾多產業帶來重創的當下,美國公共建築業是少數能夠維持相對穩定的產業之一。雖然短期內建築活動可能會繼續,但在過去,由於供應鏈中斷、分包商或材料短缺以及為控制成本而終止合約等各種因素,建築施工很快就被迫停止。

美國工程服務市場的趨勢

土木工程服務預計將大幅成長

- 公共和私營部門對住宅、商業、醫療保健和教育基礎設施建設計劃的支出增加,以及政府恢復劣化基礎設施的舉措,推動了土木工程行業的強勁成長。

- 美國土木工程師學會表示,如果美國致力於確保其基礎設施系統的未來發展,就必須從真正的、長期的、定期的投資開始。為了彌補2.59兆美元的投資缺口,滿足未來需求,重新獲得國際競爭力,到2025年,公共和私營部門的基礎設施投資必須從GDP的2.5%增加到3.5%。

- 近年來,各聯邦機構都透過投資重視橋樑維護。自 2010 年以來,已有 37 個州提高或改變了汽油稅,以資助其中的許多工作。儘管國家增加了資金投入,美國在橋樑建設上的整體支出仍然不足。

- 根據聯邦公路管理局最新的《現況與績效報告》,現有橋樑修復積壓費用估計為1,250億美元,為改善此一狀況,橋樑修復支出需要增加58%,從每年144億美元增至227億美元。經過分析,這些因素對預測期內的市場成長率做出了重大貢獻。

預測期內建築業預計將出現更高成長

- 公共工程建設是指公共和私人對電力、排水和水利基礎建設的投資總合。這些發展需要先進的工程服務來確保安全有效的運作。預計預測期內公共產業建設價值將會擴大,這對該行業來說是一個積極的機會。

- 根據美國人口普查局預測,2022年4月建築支出預計為1.7448兆美元,較3月修訂後的1.7406兆美元增加0.2%。 2022 年 4 月的數值為 15,535 億美元,比 2021 年 4 月的估計值高出 12.3%。 2022年1-4月建築支出為5,208億美元,較2021年同期的4,633億美元成長12.4%。

- 因此,政府投資支持正在推動國內建築業投資增加,預計將顯著促進市場成長。

- 2022 年 4 月,德克薩斯州運輸部(TxDOT) 選擇 AECOM 作為東南連接器計劃的領導工程公司,該專案旨在提高沃斯堡地區通勤者的流動性、安全性和可及性。

- 2022 年 5 月,奧斯汀交通局 (ATD) 選擇 AECOM 作為工程顧問,以補充 ATD 現有的勞動力。 AECOM 將根據 ATD 的目標,即開發一個可滿足該地區多樣化需求的便利、可靠的交通網路,與奧斯汀交通官員提供全面的工程設計、評估和協調。

美國工程服務業概況

由於 AECOM、Bechtel Corporation 和 Flour Corporation 等多家全球性公司的存在,美國工程服務市場競爭激烈。過去十年,全球各工程公司為了在市場上站穩腳步,紛紛進行合併與聯盟。

- 2022 年 6 月-德克薩斯州將位於德克薩斯州奧斯汀的 35 號州際公路 (I-35) 首都快線南段計劃的建設合約授予福陸公司 (TxDOT)。 2022年第二季度,福陸公司的合約價值約為5.48億美元。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 私人對大型計劃的投資不斷增加以及天然氣和石油價格的回升可能會推動工業客戶的需求。

- 技術進步意味著更短的前置作業時間和減少的資源開銷

- 市場限制

- 市場對宏觀環境和監管格局變化的敏感性

- 內部和外包工程服務業的比較分析

- 了解供應商產品(產品工程、程式工程、自動化、資產管理的趨勢與發展)

第6章 市場細分

- 按工程領域

- 土木工程

- 機器

- 電

- 環境

- 按最終用戶產業

- 建造

- 石油和天然氣

- 製造業

- 公共產業

- 運輸

- 其他

- 地區

- 西方

- 中西部

- 東北

- 南部

第7章 競爭格局

- 公司簡介

- AECOM

- Jacobs Engineering Group

- Bechtel Corporation

- Fluor Corporation

- KBR Inc.

- HDR Inc.

- Terracon

- Black & Veatch Holding Company

- Jensen Hughes

- ECS Group of Companies

第8章投資分析

第 9 章:未來趨勢

簡介目錄

Product Code: 91029

The United States Engineering Services Market is expected to register a CAGR of 8.75% during the forecast period.

Key Highlights

- One of the key driving factors of the market is digitalization, which has prompted businesses to demand modern IT solutions such as engineering analytics, the internet of things (IoT), and artificial intelligence (AI) to acquire a competitive advantage and sustain the company's momentum. This is due to the growing use of industrial IoT in various industry verticals, which has resulted in a surge in demand for engineering services to manage the complex connected infrastructure.

- For instance, in May 2022, Aecom stated that its Digital AECOM's PlanEngage platform is available on the Microsoft Azure Marketplace, an online marketplace for buying and selling cloud products certified to run on Azure. Digital AECOM brings together AECOM's global digital-focused consulting services, hosted services products to help customers accelerate their digital journeys and improve project outcomes, and digital technologies to improve its core engineering and design services delivery.

- Further, the government initiatives and significant investments are analyzed to bolster the demand for the engineering services market during the forecast period. For instance, in November 2021, The United States government passed the Bipartisan Infrastructure Act (Infrastructure Investment and Jobs Act), a significant investment in the country's infrastructure and competitiveness. This bipartisan infrastructure bill will repair America's roads, bridges, and rails, increase access to safe drinking water, ensure that every American has high-speed internet, address the climate crisis, advance environmental protection, and invest in populations that have been left behind, too often.

- To solve maintenance and repair backlogs, reduce congestion and emissions at ports and airports, and promote electrification and other low-carbon technologies, the Act invests USD 17 billion in port infrastructure and waterways and USD 25 billion in airports.

- During this time when the COVID-19 pandemic is various crippling industries, in the United States, public construction has been one of the few industries that have been maintained to some extent. Although activity will likely continue in the short-term, in the past, the work halted soon given various factors, including supply chains disruption, shortage of subcontractors and materials, and the termination of contracts to control expenses.

US Engineering Services Market Trends

Civil Engineering Services is Expected to Register a Significant Growth

- Increasing public and private sector expenditures in residential, commercial, healthcare, and educational infrastructure construction projects, alongside government measures to rehabilitate the country's depleted infrastructure, are causing the civil engineering sector to rise substantially.

- According to the American Society of Civil Engineers, if the United States is committed to building a future-proof infrastructure system, it must begin with substantial, long-term, regular investment. To close the USD 2.59 trillion investment gap, meet future needs, and regain global competitive advantage, the country must boost infrastructure investment from 2.5% to 3.5% of GDP in all government and private sectors by 2025.

- In recent years, all federal agencies have emphasized bridge maintenance through investments. Since 2010, 37 states have increased or altered their gas taxes to fund many of these initiatives. Despite rising state funding, overall spending on bridges in the United States remains insufficient.

- According to the Federal Highway Administration's most recent Conditions and Performance Report, the backlog for existing bridge repairs is estimated to be USD 125 billion, and spending on bridge rehabilitation needs to be increased by 58%, from USD 14.4 billion to USD 22.7 billion annually to improve the situation. These factors are analyzed to significantly contribute to the market growth rate during the forecast period.

Construction is Anticipated to Grow at Higher Rate During the Forecast Period

- The total public and private investment in the construction of power, sewage, or water supply infrastructure is represented by the value of utility construction. These developments will necessitate a high level of engineering services to ensure safe and effective operation. During the forecast period, the value of utility construction is expected to expand, creating an opportunity for the industry.

- As stated by the US Census Bureau, construction spending has been estimated at USD 1,744.8 billion in April 2022, up 0.2% from the revised March estimate of USD 1,740.6 billion. The April 2022 value is USD 1,553.5 billion, which is 12.3% higher than the April 2021 estimate. Construction spending was USD 520.8 billion in the first four months of 2022, up 12.4% from USD 463.3 billion in the same time in 2021.

- Therefore the growing investments in the construction sector in the country with the aid by investments through government are analyzed to bolster the market growth rate significantly.

- In April 2022, The Texas Department of Transportation (TxDOT) selected AECOM as the lead engineering firm for the Southeast Connector project, which aims to improve mobility, safety, and transportation options for commuters in the Fort Worth area.

- In May 2022, The City of Austin's Transportation Department (ATD) chose AECOM to continue acting as an engineering consultant, supplementing ATD's existing workforce. AECOM will offer thorough engineering design, evaluation, and coordination with City of Austin transportation officials, led by ATD's objectives to develop an accessible and dependable transportation network that serves the various demands of the community.

US Engineering Services Industry Overview

The United States engineering services market is very competitive because of the presence of many global players such as AECOM, Bechtel Corporation, Flour Corporation, and many others. A significant trend of mergers and alliances of various global engineering firms has been seen over the past decade to increase the market's foothold.

- June 2022 - The Texas Department of Transportation has granted Fluor Corporation a construction contract for the Interstate 35 (I-35) Capital Express South project in Austin, Texas (TxDOT). In the second quarter of 2022, Fluor recorded almost USD 548 million contract value.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand due to a growing private investment in large-scale projects and recovery in natural gas and oil prices likely to propel demand from industrial customers

- 5.1.2 Technological advancements have aided in reducing lead time and resource overheads

- 5.2 Market Restraints

- 5.2.1 Market susceptibility to changes in macro-environment as well as regulatory landscape

- 5.3 Comparative Analysis of In-house & Outsourced Engineering Services Industry

- 5.4 Insights on Services offered by Vendors (Trends and developments Product Engineering, Process Engineering, Automation, Asset Management)

6 MARKET SEGMENTATION

- 6.1 By Engineering Disciplines

- 6.1.1 Civil

- 6.1.2 Mechanical

- 6.1.3 Electrical

- 6.1.4 Environmental

- 6.2 By End-user Industry

- 6.2.1 Construction

- 6.2.2 Oil & Gas

- 6.2.3 Manufacturing

- 6.2.4 Utilities

- 6.2.5 Transportation

- 6.2.6 Other End-user Industries

- 6.3 Region

- 6.3.1 West

- 6.3.2 Mid West

- 6.3.3 North East

- 6.3.4 South

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AECOM

- 7.1.2 Jacobs Engineering Group

- 7.1.3 Bechtel Corporation

- 7.1.4 Fluor Corporation

- 7.1.5 KBR Inc.

- 7.1.6 HDR Inc.

- 7.1.7 Terracon

- 7.1.8 Black & Veatch Holding Company

- 7.1.9 Jensen Hughes

- 7.1.10 ECS Group of Companies

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219