|

市場調查報告書

商品編碼

1636423

車輛道路救援系統:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Vehicle Roadside Assistance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

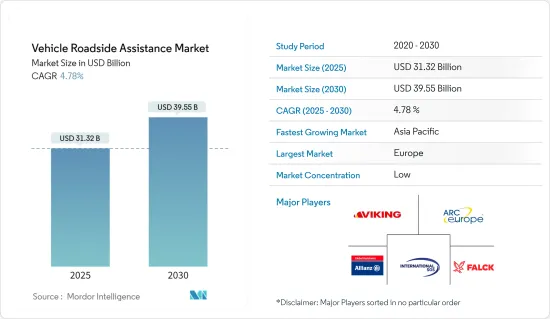

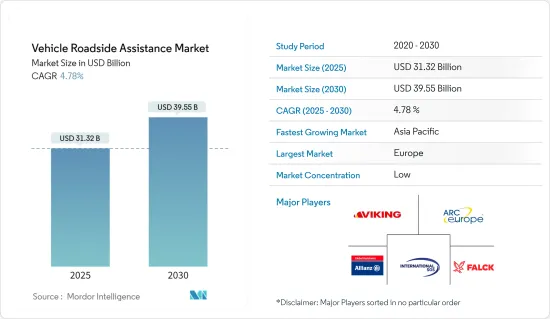

車輛道路救援系統市場規模預計到 2025 年將達到 313.2 億美元,到 2030 年將達到 395.5 億美元,預測期內(2025-2030 年)複合年成長率為 4.78%。

車輛道路救援系統市場迎合面臨故障和緊急情況的駕駛人。其服務旨在提供即時援助、找回您的車輛並確保您抵達安全地點。這些服務通常由專業承包商提供或與保險、保固和汽車俱樂部會員資格捆綁在一起,涵蓋輪胎漏氣、電池耗盡、引擎故障、事故、停工和其他可能妨礙駕駛員行動的情況,解決諸如此類的常見問題。該市場包括許多服務,如救援車、燃油輸送、緊急啟動、鎖匠服務等,為陷入困境的駕駛員提供全面的支援。

由於汽車持有的增加、對可靠援助的需求不斷成長以及汽車保有量的老化,該市場正在不斷擴大。汽車銷量的成長以及對安全性和便利性的日益關注進一步推動了這一成長。現代車輛日益複雜,需要專業知識和維修工具,這推動了對道路救援系統服務的需求。挑戰包括縮短回應時間、提高服務品質和改變客戶偏好。然而,市場上也存在著機會,例如人工智慧叫車系統、電動車支援和連網汽車技術。

車輛道路救援系統市場趨勢

商用車是市場上成長最快的細分市場

商用車道路救援系統市場預計將顯著成長。此類別包括主要用於商業目的的各種車輛,例如巴士、貨車和卡車。這一市場擴張是由多種因素造成的,包括物流、運輸業的激增以及電子商務行業的崛起,導致商用車持有的增加。

企業擴大投資於道路救援系統服務,以快速解決問題。服務提供者目前正在客製化其服務,以滿足商用車營運商的多樣化需求,從牽引大型車輛到與貨物裝卸相關的特殊援助。

此外,技術進步在該領域的成長中發揮著重要作用。將遠端資訊處理與 GPS 追蹤系統整合可實現即時監控,從而加快速度並提高道路救援系統服務的效率。此外,電動商用車的日益普及需要專門的道路救援系統服務,包括電池充電和管理解決方案。

此外,改善道路安全和減少車輛停機時間的法律規範和政府措施也在擴大市場。這些法規通常要求商用車輛使用道路救援系統服務,從而推動需求。

歐洲主導車輛道路救援系統市場

歐洲汽車工業正在迅速擴張,使該地區成為全球車輛道路救援系統市場的最大收益來源。快速成長的汽車銷售和歐洲道路上的人員密度是這一成長的主要驅動力。人均收入增加、消費者對奢侈品的偏好以及普遍較高的生活水準等其他因素也推動了該地區道路救援系統服務的需求。此外,遠距旅行的增加和對道路救援服務好處的認知的提高也促進了這一上升趨勢。

由於汽車行業的快速擴張、汽車銷售的快速成長以及豪華、高階汽車的顯著親和性,歐洲市場不僅佔據主導地位,而且佔據了最大的市場佔有率。強大的工業單位、豐富的原料資源、熟練的勞動力和其他因素進一步加強了歐洲在車輛道路救援系統市場的地位。德國在歐洲國家中處於領先地位,鞏固了歐洲在該領域的主導地位。德國雄厚的汽車製造基礎,加上先進的技術力,使其成為市場上的重要參與者。

車輛道路救援系統產業概況

車輛道路救援系統市場分散,參與者多。車輛道路救援系統公司正在積極採取策略來擴大其市場佔有率並滿足不斷變化的客戶需求。我們的關鍵策略之一是擴大我們的服務範圍,包括更廣泛的援助選項,例如電池跳躍啟動、輪胎更換、燃油輸送和拖車服務。主要參與者包括 Viking Assistance Group AS、ARC Europe SA、SOS International A/S、Allianz Global Assistance 和 Falck A/S。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 汽車持有的增加推動了道路救援服務的需求

- 消費者對安全和便利的期望不斷提高

- 市場限制因素

- 服務供應商數量有限可能會限制市場成長

- 車輛複雜性增加且缺乏技術專業知識

- 市場機會

- 數位化驅動的聯網汽車和自動駕駛汽車的採用推動了市場需求

- 按需和基於行動應用程式的服務

- 價值鏈分析

- 產業吸引力波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 洞察產業技術進步

- COVID-19 對市場的影響

第5章市場區隔

- 按車型分類

- 客車

- 商用車

- 按服務

- 拖曳

- 輪胎更換

- 燃油輸送

- 其他服務

- 按提供者

- 汽車製造商

- 汽車保險

- 獨立擔保

- 汽車俱樂部

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

第6章 競爭狀況

- 市場集中度概況

- 公司簡介

- Viking Assistance Group AS

- ARC Europe SA

- SOS International A/S

- Allianz Global Assistance

- Falck A/S

- Agero, Inc.

- Allstate Insurance Company

- AAA Roadside Assistance

- AutoVantage

- Best Roadside Service

第7章 市場趨勢

第 8 章 免責聲明與出版商訊息

The Vehicle Roadside Assistance Market size is estimated at USD 31.32 billion in 2025, and is expected to reach USD 39.55 billion by 2030, at a CAGR of 4.78% during the forecast period (2025-2030).

The vehicle roadside assistance market caters to drivers facing breakdowns or emergencies. Its services aim to provide immediate aid, restore vehicles, or ensure they reach a secure location. Typically offered by specialized firms or bundled with insurance, warranties, or automotive club memberships, these services address common issues such as flat tires, dead batteries, engine failures, accidents, lockouts, and other situations that could impede drivers' journeys. The market encompasses many services, including towing, fuel delivery, jump-starts, and locksmith services, ensuring comprehensive support for distressed drivers.

The market is expanding due to rising vehicle ownership, a growing need for reliable assistance, and an aging vehicle population. Increased vehicle sales and a heightened focus on safety and convenience further fuel this growth. The rising complexity of modern vehicles, demanding specialized knowledge and repair tools, fuels the demand for roadside assistance services. The challenges include improving response times, service quality, and changing customer preferences. However, the market also presents opportunities like AI dispatch systems, electric vehicle support, and connected vehicle technologies.

Vehicle Roadside Assistance Market Trends

Commercial Vehicle is the Fastest-growing Segment in the Market

The commercial vehicle roadside assistance market segment is poised for significant growth. This category encompasses various vehicles primarily utilized for commercial purposes, such as buses, vans, and trucks. Its expansion is attributed to multiple factors, including the upsurge in logistics, the transportation sector, and the flourishing e-commerce industry, which has led to an increase in the fleet size of commercial vehicles.

Companies are investing more in roadside assistance services to ensure swift issue resolution. Service providers are now tailoring their offerings to cater to the diverse needs of commercial vehicle operators, ranging from heavy-duty towing to specialized assistance related to cargo handling.

Additionally, technological advancements play a vital role in the growth of this segment. Integrating telematics with GPS tracking systems enables real-time monitoring, leading to swifter responses and heightened efficiency in roadside assistance services. Moreover, the increasing adoption of electric commercial vehicles necessitates specialized roadside assistance services, including battery charging and management solutions.

Furthermore, regulatory frameworks and government initiatives to improve road safety and reduce vehicle downtime also expand the market. These regulations often mandate the availability of roadside assistance services for commercial vehicles, thereby driving demand.

Europe Dominates the Vehicle Roadside Assistance Market

The European automotive industry is rapidly expanding, solidifying the region as the top revenue generator in the global vehicle roadside assistance market. Surging vehicle sales and the dense population on European roads primarily drive this growth. Other factors, including increasing per capita income, a penchant for luxury among consumers, and a generally high standard of living, are boosting the demand for roadside assistance services in the region. Additionally, the rise in long-distance travel and the growing awareness of the benefits of roadside assistance services contribute to this upward trend.

With its rapid automobile sector expansion, escalating vehicle sales, and a notable affinity for luxury and high-end vehicles, the European market not only dominates but also commands the largest market share. The presence of robust industrial units, ample raw resources, a skilled labor force, and other contributing factors further bolster Europe's position in the automobile roadside assistance market. Germany is the frontrunner among European nations, solidifying Europe's leading stance in this sector. Germany's solid automotive manufacturing base, coupled with its advanced technological capabilities, positions it as a critical player in the market.

Vehicle Roadside Assistance Industry Overview

The vehicle roadside assistance market is fragmented, with many players. Vehicle roadside assistance companies are actively adopting strategies to boost their market presence and cater to evolving customer demands. One key strategy is expanding service offerings to include a wider range of assistance options, such as battery jump-starts, tire changes, fuel delivery, and towing services. The key players include Viking Assistance Group AS, ARC Europe SA, SOS International A/S, Allianz Global Assistance, and Falck A/S.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Vehicle Owership to Propel the Demand for Roadside Assistance Service

- 4.2.2 Rising Consumer Expectations for Safety and Convenience

- 4.3 Market Restraints

- 4.3.1 Limited Availability of Service Providers may Restrain the Market Growth

- 4.3.2 Increasing Vechicle Complexity and Limited Technical Expertise

- 4.4 Market Opportunities

- 4.4.1 Adoption of Connected and Autonomous Vehicles Along with Digitalization to spur the Market Demand

- 4.4.2 On Demand and Mobile App Based Services

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By VehicleType

- 5.1.1 Passanger

- 5.1.2 Commercial

- 5.2 By Service

- 5.2.1 Towing

- 5.2.2 Tire Replacement

- 5.2.3 Fuel Delivery

- 5.2.4 Other Services

- 5.3 By Provider

- 5.3.1 Auto Manufacturers

- 5.3.2 Motor Insurance

- 5.3.3 Independent Warrenty

- 5.3.4 Automotive clubs

- 5.4 By Geography

- 5.5 North America

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

- 5.6 Europe

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Russia

- 5.6.5 Italy

- 5.6.6 Spain

- 5.6.7 Rest of Europe

- 5.7 Asia-Pacific

- 5.7.1 India

- 5.7.2 China

- 5.7.3 Japan

- 5.7.4 Australia

- 5.7.5 Rest of Asia-Pacific

- 5.8 South America

- 5.8.1 Brazil

- 5.8.2 Argentina

- 5.8.3 Rest of South America

- 5.9 Middle East and Africa

- 5.9.1 United Arab Emirates

- 5.9.2 South Africa

- 5.9.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 Viking Assistance Group AS

- 6.4 ARC Europe SA

- 6.5 SOS International A/S

- 6.6 Allianz Global Assistance

- 6.7 Falck A/S

- 6.8 Agero, Inc.

- 6.9 Allstate Insurance Company

- 6.10 AAA Roadside Assistance

- 6.11 AutoVantage

- 6.12 Best Roadside Service