|

市場調查報告書

商品編碼

1636458

中東和非洲電動車電池製造設備:市場佔有率分析、產業趨勢和成長預測(2025-2030)Middle East And Africa Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

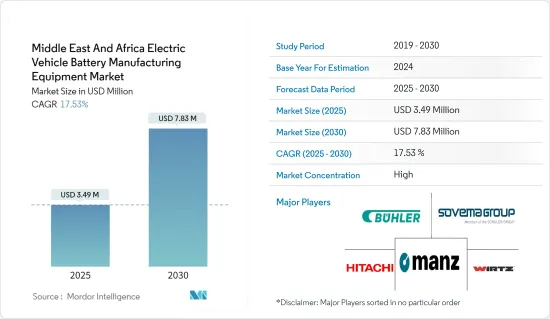

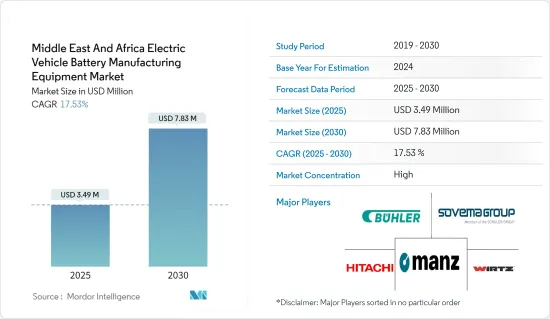

中東和非洲電動車電池製造設備市場規模預計到2025年為349萬美元,預計2030年將達到783萬美元,預測期內(2025-2030年)複合年成長率為17.53%。

主要亮點

- 從中期來看,政府對電池製造的政策和投資的增加以及電池原料成本的降低預計將在預測期內推動對電動車電池製造設備的需求。

- 另一方面,新興經濟體缺乏技術訣竅可能會嚴重限制電動車電池製造設備市場的成長。

- 然而,電動車的長期目標,如擴大產能、增強技術進步和降低成本,預計將在不久的將來為電動車電池製造設備市場的參與者創造重大機會。

- 隨著電動車在整個地區變得越來越受歡迎,預計阿拉伯聯合大公國(UAE)的中東和非洲電動車電池製造設備市場將顯著成長。

中東和非洲電動車電池製造設備市場趨勢

鋰離子電池領域佔主要佔有率

- 在中東和非洲等地區,原料成本的降低正在改變電動車(EV)電池的製造環境。鋰、鈷、鎳、石墨等關鍵材料價格下跌。價格下降不僅降低了整體生產成本,還使電動車電池變得更便宜,並推動了電動車市場的擴張。

- 鋰離子 (Li-ion) 電池對於重塑電動車 (EV) 格局至關重要,並正在推動電池生產的進步。近年來,全球鋰離子電池價格大幅下跌,而這一趨勢預計將持續下去。價格下降有助於讓更多消費者負擔得起電動車。

- 例如,彭博新能源財經注意到鋰離子電池價格顯著下降。 2023年,價格降至139美元/kWh,降幅13%。這種下降趨勢預計將持續下去,到 2025 年降至 113 美元/千瓦時,到 2030 年降至 80 美元/千瓦時。

- 在中東和非洲,我們正在加強鋰離子電池生產的供應鏈,從原料採購、加工到製造設備。透過在當地設立生產設施,公司可以受益於較低的生產成本,同時滿足該地區不斷成長的需求。

- 例如,2023年12月,聯邦電力部、中國生態環境部和奈及利亞聯邦電力部簽署了一項協議。該協議詳細介紹了由一家中國公司主導、耗資 1.5 億美元在奈及利亞建立鋰離子電池製造工廠的細節。預計此類措施將在預測期內推動該地區對電動車電池製造設備的需求。

- 此外,2024 年 2 月,Kezad 集團和阿拉伯聯合大公國 Titan Lithium 宣布計劃在阿布達比建造一座價值 14 億美元的鋰加工廠,以加強該地區新興的電動車 (EV) 產業。兩家公司簽署了為期50年的土地租約,投資額為50億迪拉姆(約1500億日圓)。

- 這些企業預計將在未來幾年擴大鋰離子電池產量並增加對電動車電池製造設備的需求。

阿拉伯聯合大公國(UAE)取得顯著成長

- 憑藉其戰略定位、強大的基礎設施和支持性的政府政策,阿拉伯聯合大公國 (UAE) 在電動車 (EV) 電池製造領域取得了重要的立足點。隨著原料成本下降以及阿拉伯聯合大公國加深對清潔能源和永續交通的承諾,電動車電池製造設備產業正在經歷顯著成長。

- 此外,阿拉伯聯合大公國電動車 (EV) 銷量的增加正在推動對電動車電池製造設備的需求。隨著電動車銷售的飆升,對電池的需求也將增加,需要先進的製造設備來實現高效、大規模的生產。近年來,阿拉伯聯合大公國的電動車銷量大幅成長。

- 例如,國際能源總署(IEA)報告稱,2023年電動車銷量將為28,900輛,比2022年成長52.9%。據預測,未來幾年電動車銷量將大幅成長,進一步增加該地區對電池製造設備的需求。

- 此外,阿拉伯聯合大公國政府也推出了多項促進電動車和永續能源的舉措,包括《2050 年杜拜清潔能源戰略》。政府旨在透過各種政策和獎勵吸引外資進入清潔能源和電動車領域。這些努力正在為該地區電動汽車電池製造設備行業的發展創造環境。

- 例如,2023 年 7 月,能源和基礎設施部 (MoEI) 宣布了到 2050 年該國道路上一半汽車為電動車的目標。這個目標補充了杜拜到 2030 年擁有 42,000 輛電動車的雄心。經濟部的聲明強調了杜拜致力於永續交通和減少碳排放,並與其氣候變遷和環境保護的更大策略保持一致。這些承諾預計將在短期內刺激電動車生產並增加對電動車電池製造設備的需求。

- 此外,電池技術的進步不僅增加了電動車 (EV) 的續航里程和性能,還增加了對消費者的吸引力。例如,2023 年,Ensurge Micropower 等公司開始將固體鋰微電池商業化。與傳統電池相比,這些先進電池具有更高的能量密度、更快的充電速度和更長的循環壽命。這些技術進步將提高電動車電池的產量,並增加未來幾年國家對電池製造設備的需求。

- 因此,這些舉措和進步預計將在不久的將來推動整個阿拉伯聯合大公國對電動車電池製造設備的需求。

中東和非洲電動汽車電池製造設備產業概況

中東和非洲的電動車電池製造設備適度整合。主要企業(排名不分先後)包括 Manz AG、Wirtz Manufacturing、Buhler AG、Sovema Group SpA 和 Hitachi。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電池製造的政府政策和投資

- 電池原物料成本下降

- 抑制因素

- 新興經濟體缺乏技術訣竅

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 按流程

- 混合物

- 塗層

- 日曆

- 狹縫/電極加工

- 其他工藝

- 透過電池

- 鋰離子

- 鉛酸

- 鎳氫電池

- 其他電池

- 按地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 奈及利亞

- 卡達

- 南非

- 其他中東和非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Manz AG

- Hitachi Ltd.

- Sovema Group SpA

- Wirtz Manufacturing

- Buhler AG

- SunPower Corporation(MEA)

- First National Battery

- Microvast Power Systems

- Metair Investments Ltd.

- Inobat

- 其他知名企業名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

簡介目錄

Product Code: 50003725

The Middle East And Africa Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 3.49 million in 2025, and is expected to reach USD 7.83 million by 2030, at a CAGR of 17.53% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising government policies and investments towards battery manufacturing and a decline in the cost of battery raw materials are expected to drive the demand for electric vehicle battery manufacturing equipment during the forecast period.

- On the other hand, the shortage of technological know-how in developing economies can significantly restrain the growth of the electric vehicle battery manufacturing equipment market.

- Nevertheless, the long-term ambitious targets for electric vehicles like scaling up production capacity, enhancing technological advancements, and reducing costs are expected to create significant opportunities for electric vehicle battery manufacturing equipment market players in the near future.

- United Arab Emirates (UAE) is anticipated to witness significant growth in the Middle East and Africa electric vehicle battery manufacturing equipment market due to the rising adoption of EVs across the region.

Middle East And Africa Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery Segment to Hold Significant Share

- Regions like the Middle East and Africa are experiencing a transformation in their electric vehicle (EV) battery manufacturing landscape, driven by falling raw material costs. Key materials, including lithium, cobalt, nickel, and graphite, have seen price reductions. This decline is not only lowering overall production costs but also making EV batteries more affordable, thus fueling the expansion of the EV market.

- Lithium-ion (Li-ion) batteries have been pivotal in reshaping the electric vehicle (EV) landscape, spurring advancements in battery production. In recent years, global prices for lithium-ion batteries have dropped significantly, a trend set to persist. This price dip has been instrumental in enhancing the affordability and accessibility of electric vehicles for a wider consumer base.

- For instance, Bloomberg NEF highlighted a notable decrease in lithium-ion battery prices. In 2023, prices fell to USD 139/kWh, marking a 13% reduction. Forecasts indicate this downward trend will continue, with prices projected at USD 113/kWh by 2025 and a further drop to USD 80/kWh by 2030, driven by ongoing technological and manufacturing advancements.

- The Middle East and Africa are bolstering their supply chains for lithium-ion battery production, covering everything from sourcing and processing raw materials to manufacturing equipment. By setting up local production facilities, companies can benefit from lower production costs while catering to the region's growing demand.

- For instance, in December 2023, an agreement was inked involving the Federal Ministry of Power, the China Ministry of Ecology and Environment, and Nigeria's Federal Ministry of Power. This pact details the creation of a USD 150 million lithium-ion battery manufacturing facility in Nigeria, led by a Chinese firm. Such initiatives are poised to boost the demand for electric vehicle battery manufacturing equipment in the region during the forecast period.

- Moreover, in February 2024, Kezad Group and Titan Lithium, a UAE-based company, unveiled plans for a USD 1.4 billion lithium processing facility in Abu Dhabi, aiming to bolster the region's emerging electric vehicle (EV) sector. The duo has inked a 50-year land lease for the AED5 billion plant.

- These ventures are set to amplify lithium-ion battery production, subsequently driving up the demand for EV battery manufacturing equipment in the coming years.

United Arab Emirates (UAE) to Witness Significant Growth

- With its strategic location, robust infrastructure, and supportive government policies, the United Arab Emirates (UAE) is establishing a significant foothold in the electric vehicle (EV) battery manufacturing sector. As raw material costs decrease and the UAE deepens its commitment to clean energy and sustainable transportation, the industry for EV battery manufacturing equipment is experiencing notable growth.

- Additionally, rising electric vehicle (EV) sales in the UAE are driving up the demand for EV battery manufacturing equipment. As EV sales surge, so does the need for batteries, which in turn requires sophisticated manufacturing equipment for efficient and large-scale production. In recent years, the sale of EVs in the UAE has seen a pronounced uptick.

- For example, in 2023, the International Energy Agency (IEA) reported that 28,900 electric vehicles were sold, marking a 52.9% increase from 2022. Projections indicate a substantial rise in EV sales in the coming years, further amplifying the demand for battery manufacturing equipment in the region.

- Furthermore, the UAE government has introduced several initiatives, such as the Dubai Clean Energy Strategy 2050, to promote electric vehicles and sustainable energy. Through diverse policies and incentives, the government seeks to attract foreign investments into the clean energy and EV sectors. These efforts have fostered a flourishing environment for the growth of the EV battery manufacturing equipment industry in the region.

- For instance, in July 2023, the Ministry of Energy and Infrastructure (MoEI) announced a target for 2050: half of all vehicles on the nation's roads will be electric. This goal complements Dubai's ambition of having 42,000 electric vehicles on its roads by 2030. The MoEI's declaration highlights the nation's dedication to sustainable transportation and carbon emission reduction, fitting into a larger strategy against climate change and for environmental preservation. Such commitments are anticipated to boost EV production and elevate the demand for EV battery manufacturing equipment in the foreseeable future.

- Moreover, advancements in battery technology are not only enhancing the range and performance of electric vehicles (EVs) but also increasing their attractiveness to consumers. For instance, in 2023, Ensurge Micropower and other firms began commercializing solid-state lithium micro-batteries. These advanced batteries, when compared to traditional ones, offer superior energy density, faster charging, and a longer cycle life. Such technological strides are set to escalate EV battery production and heighten the nationwide demand for battery manufacturing equipment in the upcoming years.

- Consequently, these initiatives and advancements are poised to bolster the demand for EV battery manufacturing equipment across the UAE in the near future.

Middle East And Africa Electric Vehicle Battery Manufacturing Equipment Industry Overview

The Middle East and Africa electric vehicle battery manufacturing equipment is moderately consolidated. Some key players (not in particular order) are Manz AG, Wirtz Manufacturing, Buhler AG, Sovema Group S.p.A, Hitachi Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 Dearth of technological know-how in developing economies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 Egypt

- 5.3.4 Nigeria

- 5.3.5 Qatar

- 5.3.6 South Africa

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Manz AG

- 6.3.2 Hitachi Ltd.

- 6.3.3 Sovema Group S.p.A

- 6.3.4 Wirtz Manufacturing

- 6.3.5 Buhler AG

- 6.3.6 SunPower Corporation (MEA)

- 6.3.7 First National Battery

- 6.3.8 Microvast Power Systems

- 6.3.9 Metair Investments Ltd.

- 6.3.10 Inobat

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219