|

市場調查報告書

商品編碼

1636481

中國電動汽車電池製造設備:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

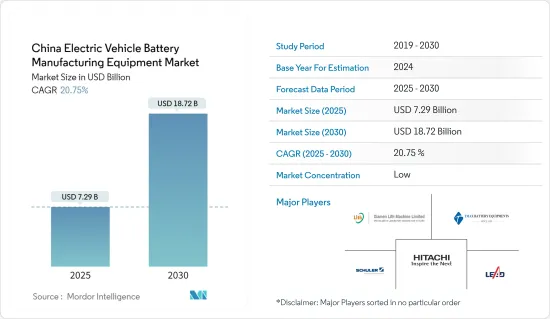

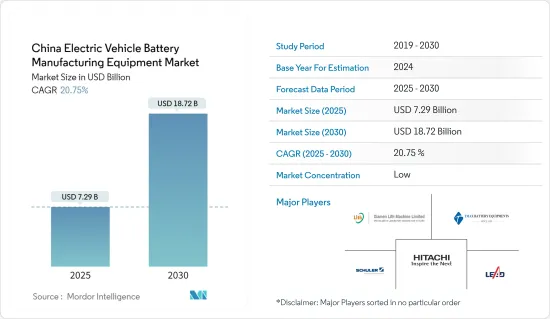

預計2025年中國電動車電池製造設備市場規模為72.9億美元,2030年將達187.2億美元,預測期內(2025-2030年)複合年成長率為20.75%。

主要亮點

- 從中期來看,政府對電池製造的政策和投資以及電池原料(特別是鋰離子)成本的下降預計將在預測期內推動市場發展。

- 另一方面,其他尋求建立製造設施的國家預計將阻礙市場的發展。

- 儘管如此,中國電動車的長期雄心勃勃的目標預計將在預測期內創造重大機會。

中國電動汽車電池製造設備市場趨勢

鋰離子電池預計將佔較大佔有率

- 鋰離子電池製造設備包括專門製造鋰離子電池的專用機械和工具。中國是鋰離子電池製造領域的世界領導者,擁有大量為各行業製造專用設備的公司。在堅實的基礎設施、政府支持和廣泛的專業知識的支持下,中國正在鞏固其作為鋰離子電池生產中心的地位。

- 此外,技術進步和規模經濟使得鋰離子電池組在中國變得更便宜,導致對電動車(EV)的需求增加。隨著電動車變得越來越普遍,對鋰離子電池製造設備的需求也隨之激增。

- 2023年,鋰離子電池組價格將比前一年下降14%,穩定在139美元/kWh。除了這些市場動態之外,正在進行的研究和開發旨在開發更高效的電動車鋰電池材料,進一步增加對電池製造設備的需求。

- 此外,隨著技術的進步,電動車電池製造商正在生產優質的鋰離子電池,增加了對先進電動車電池製造設備的需求。

- 例如,2024年4月,中國著名電動車電池製造商CATL推出了其尖端的磷酸鋰鐵鋰電池,單次充電續航里程超過1000公里,令人印象深刻。此類突破性技術預計將提振對鋰離子電池製造設備的需求。

- 此外,2024年5月,CATL與其他六家公司合作開發全固態電池(ASSB),這是傳統鋰離子電池的下一代發展,為未來的電動車動力來源,並宣布巨額投資約8.45億美元。

- 鑑於電動車鋰離子電池價格的下降和持續的技術創新,預計該行業將在未來幾年佔據很大佔有率。

政府對電池製造的政策和投資預計將推動市場

- 中國電動車電池製造設備市場得到政府支持政策和對電池製造的大量投資的支持。政府提供直接財政支持、稅收減免和補貼,有效降低製造商成本,並鼓勵對尖端設備的投資。

- 「中國製造2025」和新能源汽車指令等國家舉措正在支持包括電池技術在內的高科技產業的成長,並推動對專業製造工具的需求。此外,中國正在投資先進的電動車電池技術。

- 例如,2024年5月,中國宣布計畫投資8.45億美元用於下一代電動車電池技術。值得注意的是,包括寧德時代在內的六家公司以及主要汽車製造商比亞迪和吉利汽車將受益於政府對開發固態固態電池的支持。

- 此外,電動車銷量的快速成長促使電池製造商加大投資,進一步刺激了對電動車電池製造工具的需求。根據國際能源總署的報告,2023年中國電動車銷量將達810萬輛,較2022年的590萬輛大幅成長。隨著國家加速電動車生產和加大電池製造投資,相關設備的需求也預計會增加。

- 中國在全球電動車市場佔據壓倒性地位,佔 2023 年 12 月新電動車銷量的 69%,並繼續呈現樂觀的成長軌跡。去年銷量成長37%,達到近900萬台,市場佔有率為34%。該國還修改了電動車普及率目標,目標是到 2027 年市場佔有率達到 45%,高於之前的 2030 年 40% 的目標。

- 總之,在政府的大力支持和對電池生產的戰略投資下,市場可望持續成長。

中國電動汽車動力電池製造裝備產業概況

中國電動車電池製造設備市場呈現半分散狀態。市場主要企業包括(排名不分先後)廈門石梯機械有限公司、無錫先導智慧裝備有限公司、舒勒股份公司、日立有限公司、廈門天邁電池設備有限公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電池製造的政府政策和投資

- 降低電池原物料成本

- 抑制因素

- 其他尋求建立製造設施的國家

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 按流程

- 混合物

- 塗層

- 日曆

- 狹縫/電極加工

- 其他工藝

- 透過電池

- 鋰離子

- 鉛酸電池

- 鎳氫電池

- 其他電池

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Xiamen Lith Machine Limited

- Wuxi Lead Intelligent Equipment Co Ltd

- Schuler AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- Durr AG

- Xiamen ACEY New Energy Technology

- Xiamen TOB New Energy Technology Co., Ltd

- List of Other Prominent Companies

- 市場排名分析

第7章 市場機會及未來趨勢

- 電動車的長期目標

簡介目錄

Product Code: 50003749

The China Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 7.29 billion in 2025, and is expected to reach USD 18.72 billion by 2030, at a CAGR of 20.75% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, government policies and investments towards battery manufacturing, and a decline in the cost of battery raw materials, especially lithium-ion, are expected to drive the market in the forecast period.

- On the other hand, other countries striving to establish manufacturing facilities are expected to hamper the market in the future.

- Nevertheless, long-term ambitious targets for electric vehicles in China are expected to create a significant opportunity in the forecast period.

China Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery is Expected to have a Major Share

- Lithium-ion battery manufacturing equipment includes specialized machines and tools tailored for producing lithium-ion batteries. China stands as a global frontrunner in lithium-ion battery production, hosting a multitude of companies that manufacture a diverse array of industry-specific equipment. Bolstered by robust infrastructure, governmental backing, and a wealth of expertise, China has solidified its status as a central hub for lithium-ion battery production.

- Moreover, due to technological advancements and economies of scale, lithium-ion battery packs are becoming more affordable in China, leading to a rise in electric vehicle (EV) demand. As EVs become more accessible, the parallel surge in demand for lithium-ion battery manufacturing equipment becomes evident.

- In 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD 139/kWh. Beyond these market dynamics, ongoing research and development efforts aim to create more efficient lithium battery materials for EVs, further amplifying the demand for battery manufacturing equipment.

- Moreover, as technology advances, EV battery manufacturers are crafting superior lithium-ion batteries, intensifying the need for advanced EV battery manufacturing equipment.

- For example, in April 2024, CATL, a prominent Chinese EV battery manufacturer, introduced its cutting-edge lithium iron phosphate battery, achieving a remarkable driving range exceeding 1,000 kilometers on a single charge. Such breakthroughs are poised to bolster the demand for lithium-ion battery manufacturing equipment.

- Additionally, in May 2024, CATL, in collaboration with six other firms, announced a substantial investment of nearly USD 845 million aimed at developing all-solid-state batteries (ASSBs), a next-gen evolution of conventional lithium-ion batteries, set to power future EVs.

- Given the declining prices and continuous innovations in EV lithium-ion batteries, this segment is projected to command a significant share in the coming years.

Government Policies and Investments Towards Battery Manufacturing is Expected to Drive the Market

- China's EV battery manufacturing equipment market is propelled by supportive government policies and substantial investments in battery production. The government provides direct financial support, tax incentives, and subsidies, effectively lowering costs for manufacturers and promoting investments in cutting-edge equipment.

- National initiatives, such as "Made in China 2025" and the New Energy Vehicle mandate, champion the growth of high-tech sectors, notably battery technology, thus fueling the demand for specialized manufacturing tools. Moreover, the nation is channeling investments into pioneering battery technologies for electric vehicles.

- For example, in May 2024, China unveiled plans to invest USD 845 million into next-gen battery tech for EVs. Notably, six firms, including CATL, alongside major automakers BYD and Geely, are poised to benefit from government support in developing all-solid-state batteries.

- Additionally, surging EV sales are prompting battery manufacturers to ramp up investments, further driving the demand for EV battery manufacturing tools. The International Energy Agency reported that in 2023, China's EV car sales reached 8.1 million, a jump from 5.9 million in 2022. As the nation accelerates its EV production and bolsters investments in battery manufacturing, the demand for related equipment is projected to rise.

- China holds a commanding position in the global EV landscape, representing 69% of new EV sales in December 2023, with an optimistic growth trajectory ahead. The previous year witnessed a 37% surge in sales, totaling around 9 million new EVs and capturing a 34% market share. Furthermore, the nation has revised its EV penetration ambitions, targeting a 45% market share by 2027, up from the earlier goal of 40% by 2030.

- In conclusion, with robust government backing and strategic investments in battery production, the market is poised for continued growth.

China Electric Vehicle Battery Manufacturing Equipment Industry Overview

The china electric vehicle battery manufacturing equipment market is semi-fragmented. Some of the major players in the market (in no particular order) include Xiamen Lith Machine Limited, Wuxi Lead Intelligent Equipment Co Ltd, Schuler AG, Hitachi Ltd, and Xiamen Tmax Battery Equipments Limited., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments Towards Battery Manufacturing

- 4.5.1.2 Decline in Cost of Battery Raw Materials

- 4.5.2 Restraints

- 4.5.2.1 Other Countries Striving Towards Establishing Manufacturing Facilities

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendering

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Xiamen Lith Machine Limited

- 6.3.2 Wuxi Lead Intelligent Equipment Co Ltd

- 6.3.3 Schuler AG

- 6.3.4 Hitachi Ltd

- 6.3.5 Xiamen Tmax Battery Equipments Limited

- 6.3.6 Durr AG

- 6.3.7 Xiamen ACEY New Energy Technology

- 6.3.8 Xiamen TOB New Energy Technology Co., Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Long-term ambitious targets for electric vehicles

02-2729-4219

+886-2-2729-4219