|

市場調查報告書

商品編碼

1636487

中東和非洲電動汽車電池電解市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Middle East And Africa Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

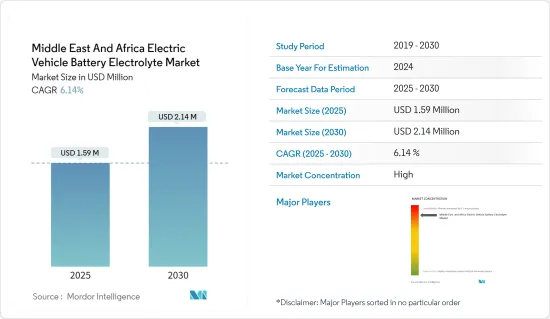

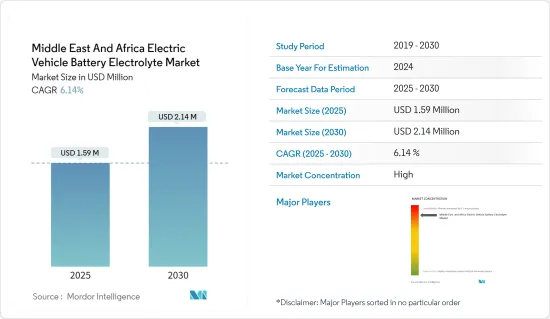

中東和非洲電動車電池電解市場規模預計到2025年為159萬美元,預計到2030年將達到214萬美元,預測期內(2025-2030年)複合年成長率為6.14%。

主要亮點

- 從中期來看,由於政府措施和相關投資,電動車在中東變得越來越受歡迎,預計將推動市場發展。

- 另一方面,電動車電池和原料對進口的高度依賴可能會阻礙市場成長。

- 隔板材料的持續研發預計將為市場提供未來的成長機會。

- 研究期間,南非預計將成為中東和非洲電動車電池電解的最大市場。

中東和非洲電動車電池電解市場趨勢

鋰離子電池領域佔主要佔有率

- 鋰在電動車 (EV) 電池的生產中發揮關鍵作用。作為可充電鋰離子電池的主要成分,鋰的高能量密度有利於延長行駛里程。最近,中東和非洲的鋰離子電池製造和研究迅速成長,人們對電解等電池組件的興趣不斷增加。

- 例如,2023 年 7 月,卡達大學先進材料中心 (CAM) 與全球知名機構合作,徹底改變了從海水中提取鋰的方法。這項突破性技術有望滿足對清潔能源日益成長的需求並促進永續性。

- 2024 年 7 月,埃及 Raya Auto 與專門從事電池生產和汽車電氣化的新興企業Shift EV 建立了策略合作夥伴關係。根據合作夥伴關係,Shift EV 將供應本地製造的鋰離子電池,為 Raya Auto 的輕型電動車系列提供動力。這些措施旨在加強電解市場,以適應整個中東地區鋰電池需求的預期成長。

- 同樣,隨著中東和非洲鋰離子探勘計劃的擴大,電池生產對電解的需求也會增加。 2024 年 6 月,EV Metals Group plc 結束了沙烏地阿拉伯 Barsagah 鋰計劃的探勘。該計劃位於阿拉伯地盾東南部吉達以東 450 公里處,橫跨 13 個特許權區,面積達 1,200 平方公里。這可能會增強沙烏地阿拉伯鋰電池製造的前景,增加電解需求並影響預測期內的市場成長。

- 從歷史上看,鋰離子電池價格暴跌,刺激了對電解等相關組件的需求。根據彭博社NEF報道,2023年鋰離子電池的平均價格為139美元/kWh,比2014年下降了五倍。因此,如果鋰離子電池的採用隨著價格下降而迅速增加,電解市場將從中受益。

- 考慮到上述鋰離子電池和電解生產趨勢,中東和非洲的電動車電池電解市場預計將會成長。

南非可能主導市場

- 2023 年 12 月,南非政府宣布該國汽車產業計劃在 2026 年推出電動車 (EV)。對交通電氣化的關注是南非正義能源轉型 (JET) 策略的核心,該策略旨在培育低碳和氣候適應經濟。 JET框架需要在2023年至2027年期間進行約68.4億美元的重大投資。

- 2024年2月,南非政府推出稅收優惠措施以提高國內電動車產量。該激勵措施為製造業提供 150% 的稅額扣抵。此類激勵措施對福特汽車公司和大眾汽車等熱衷於擴大電動車產量的工業巨頭尤其有利。因此,南非電動車的產量不斷增加,對電動車電池和相關零件(特別是電解)的需求也增加。

- 2024年7月,中國著名電動車製造商比亞迪在南非獲得了第一筆電動公車訂單,符合世界公共交通電氣化的願景。擁有 163 年歷史的南非巴士營運商金箭 (Golden Arrow) 與新能源汽車 (NEV) 製造商合作訂購了 120 輛電動巴士。隨著南非採用電動公車,這種勢頭預計將在市場預測期內增加對電池製造至關重要的電解產量。

- 此外,近年來南非電動車的採用率顯著增加。國際能源總署的資料顯示,2023年印度電動車銷量將達1,080輛,與前一年同期比較大幅成長74%。以此軌跡來看,南非電動車需求呈現復甦趨勢,可望進一步振興電解市場。

- 鑑於這些趨勢,電動車及其電池的採用將會增加,電解的製造也將得到加強。因此,中東和非洲的電動車電池電解市場預計在未來幾年將大幅成長。

中東和非洲電動汽車電池電解產業概況

中東和非洲電動車電池電解市場集中,參與企業較少。主要參與企業(排名不分先後)包括 Dubi Chem、Oasis Chemical Materials Trading Co、Targray Technology International, Inc、Andrea FZCO 和 Rekoser。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 政府支持電動車引進的措施

- 鋰離子電池價格下降

- 抑制因素

- 電池及原料進口依賴度高

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 電池類型

- 鉛酸電池

- 鋰離子電池

- 其他

- 電解質類型

- 液體電解質

- 凝膠電解質

- 固體電解質

- 地區

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 埃及

- 卡達

- 奈及利亞

- 其他中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Dubi Chem

- Oasis Chemical Materials Trading Co

- Targray Technology International, Inc.

- Andrea FZCO

- Rekoser

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電解質材料的研發

The Middle East And Africa Electric Vehicle Battery Electrolyte Market size is estimated at USD 1.59 million in 2025, and is expected to reach USD 2.14 million by 2030, at a CAGR of 6.14% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles in the Middle East region due to government policies and associated investments in them is likely to drive the market.

- On the other hand, high dependency on imported electric vehicle batteries and raw materials are likely to hinder the market growth.

- Continuous research and development in separator material is expected to provide future growth opportunities for the market.

- The South Africa is expected to be the largest market for the Middle East and Africa Electric Vehicle Battery Electrolyte during the study period.

Middle East And Africa Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery Segment to Hold Significant Share

- Lithium plays a crucial role in manufacturing batteries for electric vehicles (EVs). As the key ingredient in rechargeable lithium-ion batteries, lithium's high energy density facilitates extended driving ranges. Recently, the Middle East and Africa have seen a surge in lithium-ion manufacturing and research, heightening interest in battery components like electrolytes.

- For example, in July 2023, Qatar University's Center for Advanced Materials (CAM) collaborated with renowned global institutions to revolutionize lithium extraction from seawater. This breakthrough promises to address the escalating demand for clean energy and promote sustainability.

- In July 2024, Raya Auto in Egypt entered a strategic partnership with Shift EV, a startup focused on battery production and fleet electrification. Under this alliance, Shift EV will supply locally made lithium-ion batteries to power Raya Auto's light e-mobility range. Such initiatives are poised to bolster the electrolyte market, aligning with the anticipated rise in lithium battery demand across the Middle East.

- Similarly, as lithium-ion exploration projects expand in the Middle East and Africa, the demand for electrolytes in battery production is set to grow. In June 2024, EV Metals Group plc wrapped up its exploration at the Balthaga Lithium Project in Saudi Arabia. Located 450km east of Jeddah, within the Arabian Shield's southeastern area, the project spans 13 tenements over 1,200 square kilometers. This bolsters Saudi Arabia's lithium battery manufacturing prospects, likely driving up electrolyte demand and influencing market growth during the forecast period.

- Historically, lithium-ion battery prices have plummeted, spurring demand for related components like electrolytes. Bloomberg NEF reported that in 2023, the average price of lithium-ion batteries was USD 139 USD/kWh, marking a fivefold drop since 2014. Thus, as lithium-ion battery adoption surges with falling prices, the electrolyte market stands to gain.

- Given the aforementioned trends in lithium-ion batteries and electrolyte production, the electric vehicle battery electrolyte market in the Middle East and Africa is poised for growth.

South Africa is Likely to Dominate the Market

- In December 2023, South Africa's government announced plans for the nation's automotive sector to debut its electric vehicles (EVs) by 2026. Central to South Africa's Just Energy Transition (JET) strategy, which aims to cultivate a low-carbon and climate-resilient economy, is the emphasis on transport electrification. The JET framework highlights a significant investment requirement of approximately USD 6.84 billion, slated for the period from 2023 to 2027.

- In February 2024, the South African government rolled out a tax incentive to bolster domestic EV production. This initiative offers manufacturing companies a generous 150% tax deduction. Such incentives particularly benefit industry titans like Ford Motor Company and Volkswagen AG, both eager to amplify their EV output. Consequently, this uptick in EV production is set to escalate the demand for EV batteries and associated components, notably electrolytes, within the South African landscape.

- In July 2024, BYD Company, a prominent Chinese electric vehicle manufacturer, secured its inaugural order for electric buses in South Africa, aligning with its global vision to electrify public transport. Golden Arrow, a 163-year-old South African bus operator, has collaborated with the new energy vehicle (NEV) maker, placing an order for 120 electric buses. As South Africa embraces electric buses, this momentum is expected to amplify the production of electrolytes vital for battery manufacturing during the market's forecast period.

- Furthermore, South Africa has seen a notable uptick in electric vehicle adoption in recent years. Data from the International Energy Agency reveals that electric car sales in India reached 1,080 units in 2023, marking a staggering 74% surge from the prior year. Given this trajectory, South Africa's demand for electric vehicles is poised for a rebound, further energizing the electrolyte market.

- Given these trends, the rising adoption of electric vehicles and their batteries is set to bolster electrolyte manufacturing. Thus, the electric vehicle battery electrolyte market in the Middle East and Africa is poised for significant growth in the coming years.

Middle East And Africa Electric Vehicle Battery Electrolyte Industry Overview

The Middle East and Africa Electric Vehicle battery Elecrolytr market is concentrated, with few players. Some of the major players (not in particular order) include Dubi Chem, Oasis Chemical Materials Trading Co, Targray Technology International, Inc., Andrea FZCO, and Rekoser.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government policies supporting adoption of electric vehicles

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 High dependecy on imported batteries and raw materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid Batteries

- 5.1.2 Lithium-ion Batteries

- 5.1.3 Other Battery Types

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 South Africa

- 5.3.3 United Arab Emirates

- 5.3.4 Egypt

- 5.3.5 Qatar

- 5.3.6 Nigeria

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Dubi Chem

- 6.3.2 Oasis Chemical Materials Trading Co

- 6.3.3 Targray Technology International, Inc.

- 6.3.4 Andrea FZCO

- 6.3.5 Rekoser

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research & Development in Electrolyte material