|

市場調查報告書

商品編碼

1687445

電池電解:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

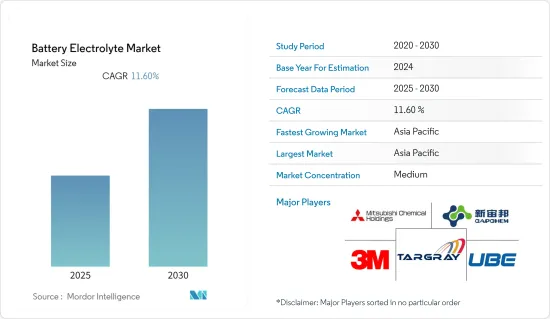

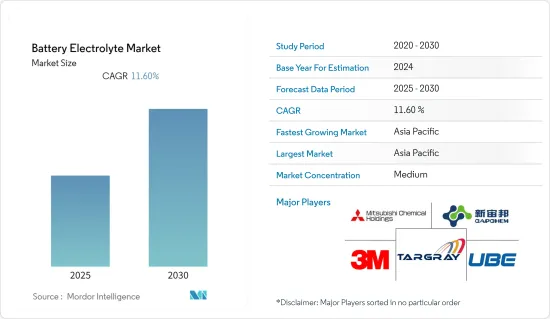

預測期內,電池電解市場預計將以 11.6% 的複合年成長率成長。

2020年市場受到了新冠疫情的負面影響。目前市場已經恢復到疫情前的水準。

主要亮點

- 從長遠來看,電動車需求的成長和電解技術的市場發展是市場的主要推動要素。

- 然而,缺乏高效率的電池回收技術,以及人們對電池對人體有害影響日益成長的擔憂,都是市場發展的障礙。

- 光伏(PV)模組和相關系統成本的下降,以及支持全球消除碳排放和推廣再生能源的技術創新,為電池電解市場參與者提供了充足的機會。

- 預計亞太地區將成為最大且成長最快的市場,需求來自中國、印度和日本等國家。

電池電解市場趨勢

鋰離子電池可望佔據市場主導地位

- 鋰離子電池最初是為家用電子電器領域開發的,因為它們可以承受多次充電循環,具有高容量重量比和高能量密度。

- 全球都市化和不斷成長的消費者支出預計將推動對技術先進設備的需求,這反過來又會導致對鋰離子電池的需求增加。

- 鋰離子電池比其他類型的電池更受歡迎,主要是因為它們具有良好的容量重量比。其他採用促進因素包括性能的提高、能量密度的增加和價格的下降。

- 鋰離子電池通常比其他類型的電池更貴。然而,市場領導者正在進行投資以獲得規模經濟,並進行研發活動以提高性能和價格。

- 此外,電動車和能源儲存系統(ESS) 等新興市場的出現也推動了商業和住宅應用對鋰離子電池的需求。當 ESS 與風能、太陽能和水力發電等再生能源相結合時,其在技術和商業性都是可行的,可以顯著提高電網的穩定性。截至年終,全球共有近 1,130 萬輛純電動車 (BEV) 在運作。此外,全球新增電動車數量超過 400 萬輛,自 2016 年以來一直保持穩定成長。

- 此外,近年來,技術進步和成本下降導致資料中心產業對鋰離子電池的需求不斷成長。預計在預測期內,資料中心建設投資的增加(尤其是亞洲開發中國家)將進一步支撐鋰離子電池的需求。

- LIB製造廠主要位於亞太地區、北美和歐洲。此外,Panasonic Corporation於 2022 年 2 月宣布,其能源公司將在日本西部的和歌山工廠建立一個生產設施,用於生產用於電動車(EV)的新型大型 4680(寬 46 毫米,高 80 毫米)圓柱形鋰離子電池。

- 因此,鑑於上述情況,預計鋰離子電池將在預測期內佔據電池電解市場主導地位。

亞太地區可望主導市場

- 由於汽車、太陽能、電器產品和資料中心等各個領域的電池使用量不斷增加,亞太地區在市場中佔據主導地位。在亞太地區,中國預計將成為佔據電子產品銷售額最大佔有率的國家。此外,該國在太陽能發電工程(包括屋頂和地面安裝)和汽車銷售方面也處於市場領先地位。

- 由於電動車和太陽能發電工程中電池儲存系統的採用越來越多,預計預測期內鋰離子電池的使用量將會增加。因此,這種情況可能會推動該地區的電池電解市場的發展。

- 近年來,印度的太陽能和風能裝置量強勁成長。 2010年至2021年間,該國風電裝置容量將增加2.5倍以上,而同期太陽能發電裝置容量將增加400倍以上。

- 該國電網基礎設施品質仍較差,使得電網公司難以吸收可再生能源發電。儘管面臨這些挑戰,該國仍主要依靠替代方案,例如替代電源(發電機、儲能系統、電池等)來滿足尖峰需求。

- 此外,中國電動車的日益普及以及政府的優惠政策預計將增加鋰離子電池的使用,這將對預測期內的市場成長產生積極影響。通訊服務的不斷滲透將為中國電池電解市場提供成長機會。

- 此外,2022 年 8 月,中國製造商 Bslbatt Battery 宣布推出其住宅鋰離子電池的升級版。該裝置的儲存容量為 5.12 至 12.8 kWh,可可靠運作長達 6,000 次充電循環。

- 鑑於上述情況,預計亞太地區將在預測期內佔據主導地位並快速成長。

電池電解產業概況

電池電解市場中等程度分散。市場的主要企業(不分先後順序)包括三菱化學控股株式會社、宇部興產株式會社、深圳新宙邦科技、3M 公司、特銳工業公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 調查前提條件

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2027 年市場規模與需求預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 電池類型和電解類型

- 鉛酸

- 液態電解

- 凝膠電解

- 鋰離子

- 固體電解

- 凝膠電解

- 液態電解

- 液流電池

- 釩

- 溴化鋅

- 其他電池和電解類型

- 鉛酸

- 最終用戶

- 電動車

- 能源儲存

- 家電

- 其他最終用戶

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 南美洲

- 中東和非洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- 3M Co.

- NEI Corporation

- Guangzhou Tinci Materials Technology Co. Ltd

- Mitsubishi Chemical Holdings Corporation

- Mitsui Chemicals Inc.

- NOHMs Technologies Inc.

- Shenzhen Capchem Technology Co. Ltd

- Targray Industries Inc.

- UBE Industries Ltd

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 63512

The Battery Electrolyte Market is expected to register a CAGR of 11.6% during the forecast period.

The market was negatively impacted by the COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, the major driving factors of the market are its rising demand from electric vehicles and ongoing developments in electrolyte technology.

- On the flip side, lack of efficient recycling technologies for batteries and rising concerns over the harmful effects of batteries on human health pose a barrier for the market.

- With the decreasing cost of solar photovoltaic (PV) modules and associated systems, supportive global initiatives to eliminate the carbon emission and promote renewables along with technological innovations provide ample opportunities for the battery electrolyte market players.

- Asia-Pacific is expected to be the largest and fastest-growing market, with majority of the demand coming from countries like China, India, and Japan, etc.

Battery Electrolytes Market Trends

Lithium-ion Battery Expected to Dominate the Market

- The lithium-ion batteries were initially developed to serve the consumer electronics sector as these batteries last for a large number of charging cycles and have a high capacity-to-weight ratio and high energy density, which make them ideal for consumer electronics applications.

- The rise in urbanization and consumer spending across the world is expected to drive the demand for technically advanced devices, in turn, leading to an increase in demand for lithium-ion batteries.

- Li-ion batteries are gaining more popularity than other battery types, majorly due to their favorable capacity-to-weight ratio. Other factors contributing to its adoption include better performance, higher energy density, and decreasing price.

- The price of lithium-ion batteries is usually higher than other batteries. However, leading players in the market have been investing to gain economies of scale and R&D activities to improve their performance and prices.

- Furthermore, the emergence of new and exciting markets via electric vehicle and energy storage systems (ESS) has been boosting the demand for Li-ion batteries for both commercial and residential applications. ESS, coupled with renewables, such as wind, solar, or hydro, are technically and commercially viable for significantly increasing grid stability. At the end of 2021, nearly 11.3 million battery electric vehicles (BEVs) were in use globally. Also, more than four million new battery electric vehicles were added to the worldwide fleet, steadily growing since 2016.

- Additionally, in recent years, the demand for Li-ion batteries from the data center industry has grown due to technological advancements and declining costs. Increasing investments in data center construction, particularly in the developing countries in Asia, are expected to further support the lithium-ion battery's demand during the forecast period.

- LIB manufacturing facilities are majorly located in Asia-Pacific, North America, and Europe. Also, in February 2022, Panasonic Corporation announced that its Energy Company will establish a production facility at its Wakayama Factory in western Japan to manufacture new, large 4680 (46 millimeters wide and 80 millimeters tall) cylindrical lithium-ion batteries for electric vehicles (EVs).

- Therefore, owing to the above points, lithium-ion battery is expected to dominate the battery electrolyte market during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- The Asia-Pacific region is dominating the market with the increase in the use of batteries in different sectors such as automobiles, solar PV, electronic appliances, and data centers. Among all countries in the Asia-Pacific region, China is expected to be the leading country, with the majority of electronic appliance sales. Moreover, the country is a market leader in solar PV projects (including rooftop and ground-mounted) and automobile sales.

- With the increasing adoption of electric vehicles and battery energy storage systems in solar PV projects, the usage of lithium-ion batteries is expected to increase during the forecast period. Thus, such a situation may drive the battery electrolyte market in the region.

- India has seen significant growth in the installation of solar and wind power in recent years. During 2010 to 2021, the country's wind power generation capacity increased by over 2.5 times, while the solar power generation capacity during the same period increased by over 400 times.

- The country's grid infrastructure quality remains poor, making it difficult for grid companies to assimilate renewable power generation. Despite these problems, the country has mostly been dependent on alternative methods such as alternative power generation sources (generators, ESS, batteries, etc.) to meet the peak demand.

- Further, with the increasing adoption of EVs and the favorable government policies in China, the use of lithium-ion batteries is expected to increase, which is expected to have a positive impact on the market growth during the forecast period. The increasing penetration of telecommunication services provides an opportunity for the growth of the battery electrolyte market in China.

- Moreover, in August 2022, Chinese manufacturer Bslbatt Battery has unveiled an upgraded version of its residential lithium-ion battery. The device has a storage capacity ranging from 5.12 to 12.8 kWh and it is able to provide steady operation for up to 6,000 charge cycles.

- Therefore, owing to the above points, Asia-Pacific is expected to dominate and be the fastest-growing region during the forecast period.

Battery Electrolytes Industry Overview

The battery electrolyte market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Mitsubishi Chemical Holdings Corporation, Ube Industries Ltd, Shenzhen Capchem Technology Co. Ltd, 3M Co., and Targray Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type and Electrolyte Type

- 5.1.1 Lead Acid

- 5.1.1.1 Liquid Electrolyte

- 5.1.1.2 Gel Electrolyte

- 5.1.2 Lithium-ion

- 5.1.2.1 Solid Electrolyte

- 5.1.2.2 Gel Electrolyte

- 5.1.2.3 Liquid Electrolyte

- 5.1.3 Flow Battery

- 5.1.3.1 Vanadium

- 5.1.3.2 Zinc Bromide

- 5.1.4 Other Battery Types and Electrolyte Types

- 5.1.1 Lead Acid

- 5.2 End User

- 5.2.1 Electric Vehicle

- 5.2.2 Energy Storage

- 5.2.3 Consumer Electronics

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 3M Co.

- 6.3.2 NEI Corporation

- 6.3.3 Guangzhou Tinci Materials Technology Co. Ltd

- 6.3.4 Mitsubishi Chemical Holdings Corporation

- 6.3.5 Mitsui Chemicals Inc.

- 6.3.6 NOHMs Technologies Inc.

- 6.3.7 Shenzhen Capchem Technology Co. Ltd

- 6.3.8 Targray Industries Inc.

- 6.3.9 UBE Industries Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219