|

市場調查報告書

商品編碼

1636491

德國電動車電池電解:市場佔有率分析、產業趨勢、成長預測(2025-2030)Germany Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

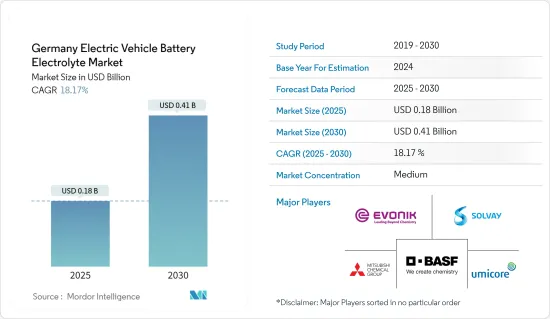

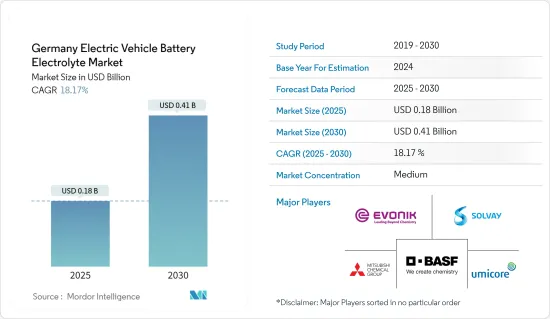

德國電動車電池電解市場規模預計2025年為1.8億美元,2030年將達4.1億美元,預測期間(2025-2030年)複合年成長率為18.17%。

主要亮點

- 從中期來看,預計全部區域電動車普及率的提高以及政府對電池製造的支持措施和投資將推動預測期內對德國電動車電池電解市場的需求。

- 另一方面,電解生產所用關鍵原料對其他國家的依賴預計將抑制德國電動車電池電解市場的成長。

- 電解配方的創新可提高電池性能、安全性和壽命,特別是高性能或遠距電動車,將在不久的將來為德國電動車電池電解市場創造重大成長機會。

德國電動車電池電解市場趨勢

鋰離子電池預計將佔較大佔有率

- 德國是歐洲領先的電動車 (EV) 市場。該國對電動車的承諾是由政府舉措推動的,包括補貼、稅收優惠和嚴格的法規(例如減排目標)。隨著持有中電動車數量的增加,對鋰離子電池和對其功能至關重要的電解的需求也在增加。

- 此外,隨著鋰離子電池材料價格的下降,製造商正在增加對電動車電池生產的投資。產量的增加自然會增加對包括電解在內的基本電池組件的需求。

- 例如,2023年鋰離子電池組的成本將比前一年下降14%,穩定在139美元/kWh。電池價格的下降將導致電動車價格更加實惠,從而刺激電動車的採用並增加電動車的市場佔有率。這種不斷成長的需求不僅是由電池組件(特別是電解質)消耗的增加所推動的,也是由旨在提高電池性能的技術進步所推動的。

- 此外,德國正積極努力縮小供應鏈缺口,旨在減少對鋰離子電池進口材料(包括正極、負極和電解液)的依賴。隨著電動車電池製造和鋰生產方面雄心勃勃的投資計畫正在進行,預計對鋰離子電池組件(特別是電解)的需求將很大。

- 例如,2024年5月,Rock Tech Lithium Inc.獲得批准在德國古本建立鋰精製。該精製預計產能約為 24,000 噸氫氧化鋰,這是電動車電池和能源儲存系統的重要組成部分。

- 另一項舉措是,2024 年 2 月,汽車電池公司 (ACC) 籌集了 47 億美元資金,在法國、德國和義大利建立三個鋰離子電池超級工廠。 ACC預測,到2030年,鋰離子電池產量將超過200萬顆。此類戰略投資預計將增加未來幾年對鋰離子電池電解的需求。

- 鑑於這些動態,鋰離子電池電解細分市場預計在預測期內將大幅成長。

電池製造投資預計將推動市場

- 德國是大眾、寶馬和戴姆勒(梅賽德斯-奔馳)等汽車巨頭的所在地,在電動車(EV)開發方面正在取得長足進步。這些製造商計劃持有大部分車隊提供電氣化,因此對電動車電池及其基本電解的需求迅速增加。

- 為了加強對電動車領域的投資,德國政府正在推出一系列獎勵和補貼。隨著電動車銷量持續上升,預計政府將宣布更多措施,進一步加強國內電池製造。國際能源總署的資料凸顯了這個趨勢。 2023年德國純電動車(BEV)銷量達到52萬輛,較2022年的47萬輛大幅成長。

- 同時,多家電池製造商正在德國夥伴關係生產不僅效率更高、整體性能也提高的電動車電池。這些進步的核心是先進的電池電解配方。這些尖端配方不僅可以延長電池壽命和安全性,還可以提高能量密度,在產業未來創新中發揮關鍵作用。

- 2024 年 5 月,著名電池製造商 VARTA主導了一個由 15 家公司和大學組成的聯盟。此次合作以 ENTISE計劃為中心,致力於利用鈉離子技術的潛力,生產用於工業應用的高性能、環保電池。該聯盟獲得德國聯邦研究和教育部約 750 萬歐元的津貼,並計劃在 2027 年中期完成計劃的最後階段。

- 隨著產業轉向提供更高能量密度和安全性的固態電池,電解要求預計會發生變化。近年來,企業之間達成了多項協議,凸顯了業界為滿足汽車領域固態電池快速成長的需求所做的努力。

- 例如,2024年7月,大眾集團電池部門Powerco與QuantumScape簽署協議,將QuantumScape開創性的固體鋰金屬電池技術推向業界尖端。這些合作關係不僅顯示對固態電池的需求不斷成長,也凸顯了電動車電池生產中對電解穩定供應的需求。

- 考慮到此類新興市場的發展和資本的湧入,旨在提高電動車電池產能的預期投資預計將重振市場。

德國電動汽車電池電解液產業概況

德國電動車電池電解市場溫和。市場的主要企業包括(排名不分先後)贏創工業公司、BASF公司、索爾維公司、優美科公司和三菱化學集團公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車的擴張

- 政府對電池製造的支持措施和投資

- 抑制因素

- 電解生產中使用的關鍵原料對其他國家的依賴

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子

- 鉛酸

- 其他電池類型

- 電解質類型

- 液體電解質

- 凝膠電解質

- 固體電解質

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Evonik Industries AG

- BASF SE

- Solvay SA

- Mitsubishi Chemical Group.

- Umicore SA

- Targray Industries Inc.

- 3M Company

- NEI Corporation

- Cabot Corporation

- Samsung SDI

- 其他知名公司名單

- 市場排名分析

第7章 市場機會及未來趨勢

- 電解液配方的創新

簡介目錄

Product Code: 50003760

The Germany Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.18 billion in 2025, and is expected to reach USD 0.41 billion by 2030, at a CAGR of 18.17% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles and supportive government policies and investments towards battery manufacturing across the region are expected to drive the demand for the Germany electric vehicle battery electrolyte market during the forecast period.

- On the other hand, the dependence on other countries for key raw materials used in the production of electrolytes is expected to restrain the growth of the Germany electric vehicle battery electrolyte market.

- Nevertheless, the innovation in electrolyte formulations that improve battery performance, safety, and lifespan, particularly for high-performance or long-range EVs, creates significant growth opportunities in the Germany electric vehicle battery electrolyte market in the near future.

Germany Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery is Expected to Have a Major Share

- Germany stands as one of Europe's foremost markets for electric vehicles (EVs). The nation's push towards electric mobility is bolstered by government initiatives, including subsidies, tax incentives, and stringent regulations like emission reduction targets. As the fleet of EVs expands, so does the demand for lithium-ion batteries, and by extension, the electrolytes integral to their function.

- Moreover, as the prices of materials for lithium-ion batteries decline, manufacturers are ramping up investments in EV battery production. This uptick in production naturally amplifies the demand for essential battery components, notably electrolytes.

- For example, in 2023, the cost of lithium-ion battery packs saw a 14% drop from the previous year, settling at USD 139/kWh. This decline in battery prices translates to more affordable EVs, spurring adoption and expanding the market share for electric vehicles. Such heightened demand not only signals increased consumption of battery components, especially electrolytes but also propels technological advancements aimed at enhancing battery performance.

- Additionally, Germany is actively working to bridge supply chain gaps, aiming to lessen its dependence on imported materials for lithium-ion batteries, including cathodes, anodes, and electrolytes. With ambitious investment plans on the horizon for both EV battery manufacturing and lithium production, a pronounced demand for lithium-ion battery components, particularly electrolytes, is anticipated.

- For instance, in May 2024, Rock Tech Lithium Inc. secured approval to set up a lithium refinery in Guben, Germany. This refinery is projected to boast a capacity of approximately 24,000 tonnes of lithium-hydroxide, a crucial ingredient for electric car batteries and energy storage systems.

- In another move, February 2024 saw Automotive Cells Company (ACC) amass USD 4.7 billion in funding to establish three lithium-ion battery gigafactories spread across France, Germany, and Italy. ACC projects that by 2030, its production will exceed 2 million lithium-ion batteries. Such strategic investments are poised to amplify the demand for lithium-ion battery electrolytes in the coming years.

- Given these dynamics, the lithium-ion battery electrolyte segment is set for a significant upswing in the forecast period.

Investments Towards Battery Manufacturing is Expected to Drive the Market

- Germany, home to automotive titans like Volkswagen, BMW, and Daimler (Mercedes-Benz), is witnessing these giants make substantial strides in electric vehicle (EV) development. With plans to electrify a significant portion of their fleets, these manufacturers are fueling a burgeoning demand for EV batteries and their essential electrolytes.

- To bolster investments in the EV sector, the German government has rolled out a suite of incentives and subsidies. As electric vehicle sales continue to rise, it's anticipated that the government will unveil additional policies to further bolster domestic battery manufacturing. Data from the International Energy Agency highlights this trend: in 2023, Germany's battery electric vehicle (BEV) sales reached 0.52 million units, a notable increase from 0.47 million in 2022.

- In tandem, several battery manufacturers are forging partnerships in Germany, aiming to produce EV batteries that are not only more efficient but also enhance overall performance. At the heart of these advancements are advanced battery electrolyte formulations. These cutting-edge formulations not only extend battery life and safety but also elevate energy density, marking them as key players in the industry's future innovations.

- Highlighting the collaborative spirit, in May 2024, VARTA, a prominent battery manufacturer, spearheaded a consortium of 15 companies and universities. This alliance, centered around the project ENTISE, is dedicated to crafting high-performance, eco-friendly cells for industrial applications, harnessing the potential of sodium-ion technology. With a financial backing of approximately EUR 7.5 million in grants from Germany's Federal Ministry of Research and Education, the consortium aims to wrap up the project's final phase by mid-2027.

- As the industry pivots towards solid-state batteries, heralded for their superior energy density and safety, there's an anticipation of a shift in electrolyte requirements. Recent years have seen a flurry of agreements among companies, underscoring the industry's commitment to meeting the surging demand for solid-state batteries in the automotive realm.

- For instance, in July 2024, Volkswagen Group's battery arm, Powerco, inked a deal with QuantumScape to bring QuantumScape's pioneering solid-state lithium-metal battery technology to the industrial forefront. Such collaborations not only signal a rising demand for solid-state batteries but also underscore the need for a consistent supply of electrolytes in EV battery production.

- Given these developments and the influx of funding, the anticipated investments aimed at bolstering EV battery production capacity are set to invigorate the market.

Germany Electric Vehicle Battery Electrolyte Industry Overview

The Germany electric vehicle battery electrolyte market is moderate. Some of the major players in the market (in no particular order) include Evonik Industries AG, BASF SE, Solvay SA, Umicore SA, and Mitsubishi Chemical Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Growing Adoption of Electric Vehicles

- 4.5.1.2 Supportive Government Policies and Investments Towards Battery Manufacturing

- 4.5.2 Restraints

- 4.5.2.1 The Dependence on Other Countries for Key Raw Materials Used in the Production of Electrolytes

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Evonik Industries AG

- 6.3.2 BASF SE

- 6.3.3 Solvay SA

- 6.3.4 Mitsubishi Chemical Group.

- 6.3.5 Umicore SA

- 6.3.6 Targray Industries Inc.

- 6.3.7 3M Company

- 6.3.8 NEI Corporation

- 6.3.9 Cabot Corporation

- 6.3.10 Samsung SDI

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Innovation in Electrolyte Formulations

02-2729-4219

+886-2-2729-4219