|

市場調查報告書

商品編碼

1636509

義大利電動汽車電池電解:市場佔有率分析、產業趨勢與成長預測(2025-2030)Italy Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

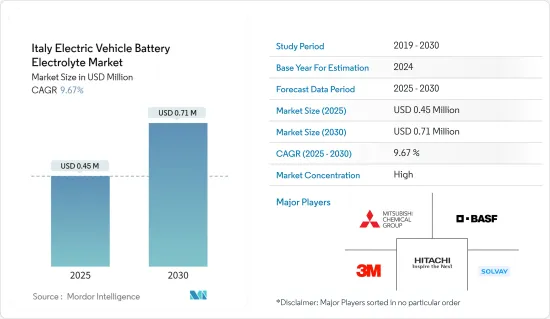

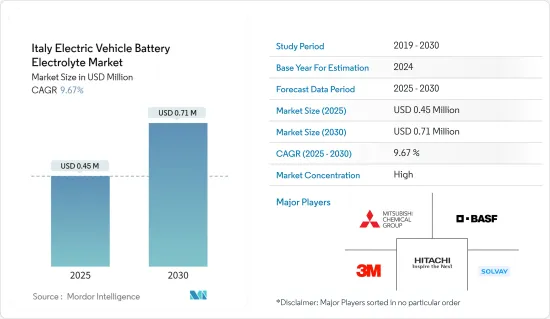

義大利電動車電池電解市場規模預計到2025年為45萬美元,預計2030年將達到71萬美元,預測期間(2025-2030年)複合年成長率為9.67%。

主要亮點

- 從中期來看,電動車(EV)需求不斷成長和政府支持措施等因素預計將在預測期內推動市場發展。

- 另一方面,供應鏈問題預計將阻礙預測期內的市場成長。

- 電解質材料的技術創新預計將在未來幾年為市場帶來重大機會。

義大利電動汽車電池電解液市場趨勢

電動車 (EV) 需求不斷成長推動市場發展

- 義大利電動車(EV)市場蓬勃發展,推動了對電池電解的需求。近年來電動車註冊數量的大幅增加也支持了這一趨勢。註冊的純電動車 (BEV) 數量正迅速從 2017 年的 2,000 輛增加到 2023 年的 66,000 輛。同樣,插電式混合動力汽車(PHEV) 的需求已從 2017 年的 29,000 輛猛增至 2023 年的 70,000 輛,這證實了義大利消費者對電動車的接受度不斷提高。

- 2024年6月,義大利電動車註冊量顯著激增,主要得益於新Ecobonus激勵措施的推出,有效激發了消費者的興趣。光是 6 月份,就有 13,285 輛新純電動車註冊,比 2023 年同月激增 115.8%。這一成長將電動車的市場佔有率推升至 8.3%,較一年前的 4.4% 大幅躍升。 2024年上半年電動車登記數量為34,709輛,較2023年同期成長6.2%,市場佔有率維持在3.9%。

- 義大利政府透過各種措施明確承諾推廣電動車。例如,2024年1月,政府累計9.3億歐元用於促進國產電動車(EV)的銷售。該舉措的主要目標是增加低收入家庭對電動車的可用性。透過鼓勵購買國產電動車,我們預計會增加電動車的銷售量,特別是低收入家庭的銷售量。銷量的成長預計將增加對電池組件(包括電解質)的需求。

- 除了財政激勵措施外,義大利還雄心勃勃地計劃在 2030 年之前安裝 110,000 個公共電動車充電站。截至2023年8月,已有45,210個充電站投入運作,其中近75%為快速充電樁,主要分佈在都市區和購物中心。

- 儘管包括德國和法國在內的許多主要歐洲市場正在經歷電動車市場的低迷,但義大利的上升趨勢標誌著向電動車的重大轉變。隨著電動車銷量持續成長,這一趨勢對電池電解市場來說也是個好兆頭。

- 總而言之,政府的獎勵、快速增加的註冊數量以及不斷擴大的充電基礎設施相結合,為義大利電動車電池電解液市場的成長創造了良好的環境。

鋰離子電池領域佔市場主導地位

- 在電動車(EV)的日益普及、政府推動永續交通以及電池開發技術進步的推動下,鋰離子電池領域已佔據舉足輕重的地位。電動車選擇鋰離子電池是因為其能量密度高、重量輕、循環壽命長。隨著電動車市場的擴大,對提高電池效率、安全性和壽命的高性能電解的需求不斷增加。

- 義大利強勁的汽車產業目前正在轉向電動車,並正在加強其鋰離子電池產業。隨著主要汽車製造商加大對電動車生產的投資,鋰離子電池的產量正在顯著增加。為了證明這一勢頭,Statevolt 於 2023 年 1 月宣布計劃在義大利建立一座專門用於電動車的 45GWh 鋰離子電池工廠。這個汽車產業的轉變與義大利致力於遏制碳排放和支持清潔能源的承諾完美契合,並呼應了歐盟更廣泛的雄心。

- 電動車電池電解市場受鋰離子電池價格大幅下滑影響較大。 2023年,鋰離子電池的平均價格將降至每千瓦時(kWh)約139美元,較2013年大幅下降82%以上。預測表明,到 2025 年,該價格可能進一步降至 113 美元/千瓦時以下,並目標在 2030 年降至 80 美元/千瓦時。

- 隨著電池成本的下降,電動車的整體價格也會隨之下降,從而提高消費者的承受能力和可用性。由於價格下降,電動車的需求預計將增加,因此對頂級電池電解的需求正在成長。

- 此外,隨著價格下降,製造商擴大投資於先進的電解配方,以提高電池的性能和安全性。體現這一趨勢的是,史丹佛大學專門研究先進電池電解液的分支機構Feon Energy 於2024 年6 月為其創新電解液獲得了610 萬美元的種子資金,這將有助於鋰金屬電池獲得UN38. 3 認證。這些進步將推動電解質領域的創新,為提高電池效率、減輕重量和提高能量密度的產品鋪平道路。

- 鑑於這些動態,在技術創新和電池價格下降的推動下,義大利鋰離子電池領域,特別是電動車電池電解領域,呈上升趨勢,從而推動了電動車的普及。

義大利電動汽車電池電解液產業概況

義大利電動車電池電解市場正變得半固體。主要參與企業包括(排名不分先後)三菱化學集團公司、3M、日立、Solvay SA 和BASF SE。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 電動車 (EV) 需求不斷成長

- 政府支持措施

- 抑制因素

- 供應鏈挑戰

- 促進因素

- 供應鏈分析

- PESTLE分析

- 投資分析

第5章市場區隔

- 電池類型

- 鋰離子電池

- 鉛酸電池

- 其他

- 電解質類型

- 液體電解質

- 凝膠電解質

- 固體電解質

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Mitsubishi Chemical Group

- 3M

- Arkema

- Daikin Industries

- Dow Chemical Company

- BASF SE

- Solvay SA

- Asahi Kasei Corporation

- Hitachi, Ltd.

- Cabot Corporation

- 市場排名/佔有率分析

- 其他知名公司名單

第7章 市場機會及未來趨勢

- 電解質材料的創新

簡介目錄

Product Code: 50003839

The Italy Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.45 million in 2025, and is expected to reach USD 0.71 million by 2030, at a CAGR of 9.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the growing demand for electric vehicle (EVs) and suppotive government initiatives are expected to drive the market during the forecast period.

- On the other hand, supply chain challanges are likely to hinder the market growth during the forecast period.

- Nevertheless, innovations in electrolyte materials are expected to provide significant opportunities for the market in the coming years.

Italy Electric Vehicle Battery Electrolyte Market Trends

Growing Demand for Electric Vehicles (EVs) to Drive the Market

- Italy's electric vehicle (EV) market is booming, driving up the demand for battery electrolytes. This trend is underscored by a significant uptick in EV registrations over recent years. Registrations for Battery Electric Vehicles (BEVs) surged from a mere 2,000 units in 2017 to an impressive 66,000 units in 2023. Likewise, Plug-in Hybrid Electric Vehicles (PHEVs) saw their demand leap from 29,000 units in 2017 to 70,000 units in 2023, underscoring the growing acceptance of EVs among Italian consumers.

- In June 2024, Italy experienced a notable spike in EV registrations, primarily due to the rollout of the new Ecobonus incentive, which has effectively piqued consumer interest. June alone witnessed the registration of 13,285 new fully electric vehicles, marking a staggering 115.8% jump from the same month in 2023. This upswing elevated the market share of electric vehicles to 8.3%, a significant leap from the previous year's 4.4%. In the first half of 2024, electric vehicle registrations totaled 34,709, reflecting a 6.2% growth from the same timeframe in 2023, and sustaining a market share of 3.9%.

- The Italian government's dedication to promoting EV adoption is evident through various initiatives. For example, in January 2024, the government earmarked 930 million euros to bolster the sales of locally produced electric vehicles (EVs). A primary objective of this initiative is to champion electromobility among lower-income households. By incentivizing the purchase of domestically produced EVs, especially for these families, the government anticipates a boost in overall EV sales. Such an uptick in sales is poised to drive up the demand for battery components, notably electrolytes.

- Beyond financial incentives, Italy is ambitiously aiming to set up 110,000 public electric vehicle charging points by 2030. As of August 2023, 45,210 charging points were already operational, with nearly 75% being fast chargers, predominantly situated in urban locales and shopping centers.

- While many major European markets, including Germany and France, saw stagnation in their EV markets, Italy's upward trajectory signals a pronounced shift towards electric mobility. This trend bodes well for the battery electrolyte market as EV sales continue their ascent.

- In summary, the confluence of government incentives, surging registrations, and an expanding charging infrastructure is cultivating a robust environment for the growth of Italy's EV battery electrolyte market, all fueled by the nation's escalating appetite for electric vehicles.

Lithium-Ion Batteries Segment to Dominate the Market

- Driven by the rising adoption of electric vehicles (EVs), government pushes for sustainable transportation, and technological strides in battery development, the lithium-ion battery segment is pivotal. Valued for their high energy density, lightweight nature, and extended cycle life, lithium-ion batteries are the preferred choice for EVs. As the EV market expands, there's a growing demand for high-performance electrolytes that boost battery efficiency, safety, and lifespan.

- Italy's robust automotive sector, now pivoting towards electric mobility, bolsters the lithium-ion battery segment. With major automakers pouring investments into EV production, lithium-ion battery manufacturing is witnessing a notable uptick. A testament to this momentum, Statevolt announced in January 2023 its plans to set up a 45 GWh lithium-ion battery facility in Italy, specifically for EVs. This automotive shift aligns seamlessly with Italy's dedication to curbing carbon emissions and championing clean energy, echoing the broader ambitions of the European Union.

- The electric vehicle battery electrolyte market is significantly swayed by the plummeting prices of lithium-ion batteries. In 2023, the average price of lithium-ion batteries dipped to approximately USD 139 per kilowatt-hour (kWh), showcasing a remarkable decline of over 82% since 2013. Forecasts suggest a further drop to below USD 113/kWh by 2025, with a potential target of USD 80/kWh by 2030.

- As battery costs decrease, the overall price of electric vehicles follows suit, enhancing their affordability and accessibility for consumers. This anticipated rise in EV demand, spurred by lower prices, underscores the growing need for top-tier battery electrolytes.

- Furthermore, as prices decline, manufacturers are more inclined to invest in cutting-edge electrolyte formulations that bolster battery performance and safety. Highlighting this trend, Feon Energy, a Stanford University offshoot specializing in advanced battery electrolytes, clinched USD 6.1 million in seed funding in June 2024 for its innovative electrolytes and achieved UN 38.3 certification for its lithium-metal batteries. Such advancements catalyze innovation in the electrolyte domain, paving the way for products that amplify battery efficiency, lighten weight, and boost energy density.

- Given these dynamics, Italy's lithium-ion battery segment, especially in the realm of electric vehicle battery electrolytes, is on an upward trajectory, buoyed by technological innovations and falling battery prices that facilitate the broader embrace of electric vehicles.

Italy Electric Vehicle Battery Electrolyte Industry Overview

The Italy electric vehicle battery electrolyte market is semi-consolidated. Some of the major players include (not in particular order) Mitsubishi Chemical Group, 3M, Hitachi Ltd., Solvay SA, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Demand for Electric Vehicles (EVs)

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Challanges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group

- 6.3.2 3M

- 6.3.3 Arkema

- 6.3.4 Daikin Industries

- 6.3.5 Dow Chemical Company

- 6.3.6 BASF SE

- 6.3.7 Solvay SA

- 6.3.8 Asahi Kasei Corporation

- 6.3.9 Hitachi, Ltd.

- 6.3.10 Cabot Corporation

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Electrolyte Materials

02-2729-4219

+886-2-2729-4219