|

市場調查報告書

商品編碼

1636517

北美混合電動汽車電池:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

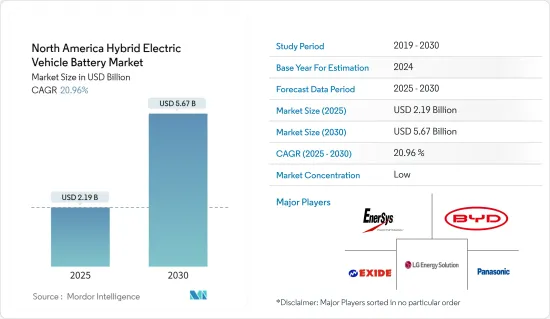

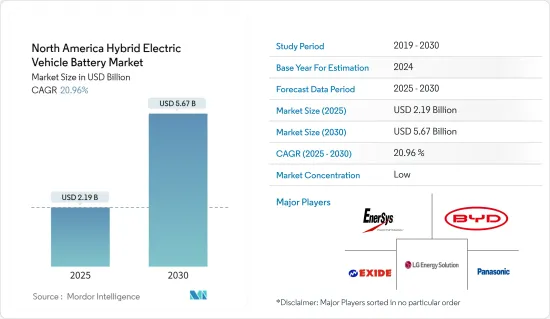

預計2025年北美混合動力汽車電池市場規模為21.9億美元,2030年達56.7億美元,預測期間(2025-2030年)複合年成長率為20.96%。

主要亮點

- 未來幾年,政府推廣電動車(EV)的政策將增加對混合動力汽車電池的需求。

- 然而,有限的原料蘊藏量對混合動力汽車電池市場的成長構成了重大挑戰。

- 另一方面,電池技術的進步,例如更高的能量密度、更快的充電、更高的安全性和更長的使用壽命,正在為混合動力電動車電池市場的參與者創造利潤豐厚的機會。

- 電動車的快速普及使美國成為全球混合動力電動車電池市場成長最快的地區。

北美混合動力汽車電池市場趨勢

鋰離子電池類型主導市場

- 北美鋰離子電動車電池市場是一個充滿活力、機會與挑戰並存的市場。鋰離子二次電池比其他電池技術更受歡迎,這主要是由於其良好的容量重量比。鋰離子二次電池因其優越的性能特點,如壽命長、維護成本低、使用壽命長、價格大幅下降等而變得越來越受歡迎。

- 鋰離子電池傳統上比同類電池更昂貴,但產業主要企業已進行投資以實現規模經濟並加大研發力度。這些趨勢不僅提高了電池性能,而且加劇了市場競爭,導致鋰離子電池價格下降趨勢。

- 2023年,受電動車(EV)電池組和電池能源儲存系統(BESS)平均價格上漲的推動,鋰離子電池價格將顯著下降,跌幅超過13%至139美元/kWh 。隨著技術創新和製造流程的持續改進,預計這一下降將繼續下去,我們的雄心勃勃的目標是到 2025 年達到 113 美元/千瓦時,到 2030 年達到 80 美元/千瓦時。

- 為了因應日益成長的環境問題,北美各國政府都是電動車的熱情支持者。主要重點是實現淨零碳排放目標。鋰是電池的基本元素,支援電動車必需的能量儲存能力。為了滿足快速成長的鋰離子電池需求,世界領先的公司正在加大鋰礦開採力度。

- 例如,2023年11月,埃克森美孚宣布計劃在鋰礦床豐富的阿肯色州西南部開始北美首個鋰生產。由於設定了 2027 年的生產目標,隨著整個預測期內鋰離子電池需求的增加,此類措施可望提高鋰產量。

- 此外,北美政府政策對於塑造鋰離子和混合動力電動車 (HEV) 電池的採用軌跡至關重要。多項政府政策正在幫助加強該地區對鋰離子電池的需求並推廣電動車。

- 例如,2023年,加拿大政府對新購買配備鋰離子電池的電動和混合動力汽車實施回扣。具體來說,聯邦政府將為純電動車提供高達 5,000 美元的回扣,為混合動力汽車提供高達 2,500 美元的回扣。這些積極措施不僅將提高加拿大的電動車產量,還將增加未來幾年對鋰離子電池的需求。

- 這些發展表明,在市場動態和政府舉措的推動下,北美鋰離子電池市場即將發生重大發展。

美國正在經歷顯著的成長

- 各種政府政策、產業發展和市場動態正在塑造美國混合動力電動車 (HEV) 電池格局。旨在減少溫室氣體排放的聯邦和州法規促進混合動力汽車成為減少交通部門排放的一種手段。

- 美國是該地區最大的生產國,對混合動力汽車的需求正在迅速成長。例如,國際能源總署(IEA)報告稱,2023年電動車銷量將達到139萬輛,比2022年成長40.4%。隨著眾多電動車生產工廠的出現以及對混合動力汽車電池的需求不斷增加,銷售量預計將進一步增加。

- 消費者偏好的變化刺激了美國對混合動力汽車的需求增加。高通膨和有限的電動車充電基礎設施等因素正在促使買家轉向混合動力汽車。這一發展正值許多製造商對電動車提供大幅折扣以及拜登政府提供稅額扣抵之際。除了擴大混合動力汽車產品線外,各公司還應對該地區快速成長的電動車需求。

- 2024 年 4 月,福特宣布致力於電動車計畫並擴大其混合動力產品線。該公司計劃在北美的整個福特 Blue 系列中整合混合動力傳動系統,並計劃於 2026 年推出下一代電動卡車。由於這些努力,預計未來幾年對下一代混合動力電動車甚至混合動力汽車電池的需求將會增加。

- 由於技術進步、政府支持性政策以及消費者日益轉向永續交通,美國混合動力汽車電池的前景一片光明。政府正在積極推廣混合動力汽車,以應對當地溫室氣體排放。

- 2024年3月,拜登政府將推出全國最具野心的氣候法規,目標是到2032年銷售的大部分新車和輕型卡車為全電動或混合動力汽車。這些努力將加強電動車的生產和需求,並增加對混合動力汽車電池的需求。

- 這些發展凸顯了混合動力汽車電池解決方案在電動能源儲存中的重要性,並表明美國對混合動力汽車電池的需求在不久的將來將會強勁。

北美混合動力汽車電池產業概況

北美混合動力汽車電池市場已縮減一半。主要企業(排名不分先後)包括比亞迪有限公司、LG Energy Solution、Exide Industries Ltd、EnerSys 和松下控股公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車 (EV) 產量增加

- 政府扶持政策

- 抑制因素

- 原料蘊藏量不足

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品/服務的威脅

- 競爭公司之間的敵對關係

- 投資分析

第5章市場區隔

- 依電池類型

- 鋰離子電池

- 鉛酸電池

- 鈉離子電池

- 其他

- 按車型分類

- 客車

- 商用車

- 按地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- BYD Company Ltd

- LG Energy Solution

- EnerSys

- Panasonic Holdings Corporation

- Energizer Holdings Inc.

- Exide Industries Ltd

- Saft Groupe SA

- AMTE Power

- Clarios LLC

- Gotion High tech Co Ltd

- 其他知名企業名單

- 市場排名/佔有率分析

第7章 市場機會及未來趨勢

- 電池材料技術進步

簡介目錄

Product Code: 50003884

The North America Hybrid Electric Vehicle Battery Market size is estimated at USD 2.19 billion in 2025, and is expected to reach USD 5.67 billion by 2030, at a CAGR of 20.96% during the forecast period (2025-2030).

Key Highlights

- In the coming years, government policies promoting electric vehicles (EVs) are set to boost the demand for hybrid electric vehicle batteries.

- However, a limited availability of raw material reserves poses a significant challenge to the growth of the hybrid electric vehicle battery market.

- On a positive note, advancements in battery technology-such as enhanced energy density, quicker charging, heightened safety, and extended lifespan-present lucrative opportunities for players in the hybrid electric vehicle battery market.

- Due to a surge in electric vehicle adoption, the United States is emerging as the fastest-growing region in the global hybrid electric vehicle battery market.

North America Hybrid Electric Vehicle Battery Market Trends

Lithium-Ion Battery Type Dominate the Market

- The North American lithium-ion electric vehicle battery market is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion rechargeable batteries are outpacing other battery technologies in popularity, primarily due to their advantageous capacity-to-weight ratio. Their adoption is further fueled by superior performance attributes, such as longevity, low maintenance, an extended shelf life, and a notable decrease in price.

- While lithium-ion batteries traditionally commanded a higher price point than their counterparts, key industry players have been channeling investments into achieving economies of scale and bolstering R&D efforts. These endeavors not only enhance battery performance but also intensify market competition, leading to a downward trend in lithium-ion battery prices.

- In 2023, driven by rising average battery pack prices for electric vehicles (EVs) and battery energy storage systems (BESS), lithium-ion battery prices saw a notable dip, settling at USD 139/kWh-a reduction exceeding 13%. With ongoing technological innovations and manufacturing refinements, projections suggest a continued decline, targeting USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030.

- Amidst escalating environmental concerns, North American governments are fervently championing electric vehicles. A primary focus is on achieving net-zero carbon emission targets. Lithium, a cornerstone element in batteries, underpins the storage capacity essential for EVs. In response to the surging demand for lithium-ion batteries, global frontrunners are ramping up lithium extraction efforts.

- For example, in November 2023, Exxon Mobil Corporation unveiled plans to kickstart North America's inaugural lithium production phase in southwest Arkansas, a region rich in lithium deposits. With a production target set for 2027, such initiatives are poised to bolster lithium production, aligning with the escalating demand for lithium-ion batteries throughout the forecast period.

- Moreover, North American governmental policies are pivotal in shaping the trajectory of lithium-ion and hybrid electric vehicle (HEV) battery adoption. A slew of government policies has been instrumental in bolstering lithium-ion battery demand and promoting EVs in the region.

- As a case in point, in 2023, the Canadian government rolled out rebates for new electric and hybrid vehicle purchases, encompassing those equipped with lithium-ion batteries. Specifically, the federal government offers rebates up to USD 5,000 for fully electric vehicles and USD 2,500 for hybrids. Such proactive measures are set to not only boost EV production in Canada but also amplify the demand for lithium-ion batteries in the ensuing years.

- Given these developments, it's evident that North America's lithium-ion battery landscape is on the brink of significant evolution, driven by both market dynamics and governmental initiatives.

United States to Witness Significant Growth

- Various government policies, industry developments, and market dynamics shape the landscape of hybrid electric vehicle (HEV) batteries in the United States. Federal and state regulations, targeting a reduction in greenhouse gas emissions, promote HEVs as a means to lessen emissions from the transportation sector.

- Demand for HEVs is surging in the United States, the region's top producer of these vehicles. For example, the International Energy Agency (IEA) reported that in 2023, sales of electric vehicles reached 1.39 million units, marking a 40.4% increase from 2022. With numerous EV production plants emerging and a growing demand for HEV batteries, sales are poised to climb further.

- Changing consumer preferences are fueling the rising demand for hybrid cars in the United States. Factors like high inflation and limited EV charging infrastructure are nudging buyers towards hybrids. This trend unfolds amidst significant discounts on EVs from many manufacturers and tax credits from the Biden administration. Companies are not only expanding their hybrid offerings but also addressing the surging demand for EVs in the region.

- In April 2024, Ford unveiled its commitment to EV programs and an expanded hybrid lineup. The automaker plans to integrate hybrid powertrains across its entire Ford Blue lineup in North America and is gearing up to launch its next-generation electric truck in 2026. Such initiatives are set to boost the demand for next-gen hybrid EVs and, consequently, HEV batteries in the coming years.

- With technological advancements, supportive government policies, and a growing consumer shift towards sustainable transportation, the future of HEV batteries in the United States appears bright. The government is actively promoting hybrid vehicles to address regional greenhouse emissions.

- In March 2024, the Biden administration rolled out the country's most ambitious climate regulations, aiming for a majority of new passenger cars and light trucks sold by 2032 to be all-electric or hybrids. These initiatives are set to bolster EV production and demand, subsequently driving up the need for HEV batteries.

- These developments underscore the significance of HEV battery solutions in EV energy storage, suggesting a robust demand for HEV batteries in the United States in the near future.

North America Hybrid Electric Vehicle Battery Industry Overview

The North America hybrid electric vehicle battery market is semi-fragmented. Some key players (not in particular order) are BYD Company Ltd, LG Energy Solution, Exide Industries Ltd, EnerSys, and Panasonic Holdings Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Supporting Government Policies

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 LG Energy Solution

- 6.3.3 EnerSys

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 Energizer Holdings Inc.

- 6.3.6 Exide Industries Ltd

- 6.3.7 Saft Groupe SA

- 6.3.8 AMTE Power

- 6.3.9 Clarios LLC

- 6.3.10 Gotion High tech Co Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

02-2729-4219

+886-2-2729-4219