|

市場調查報告書

商品編碼

1637712

衛生黏合劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Hygiene Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

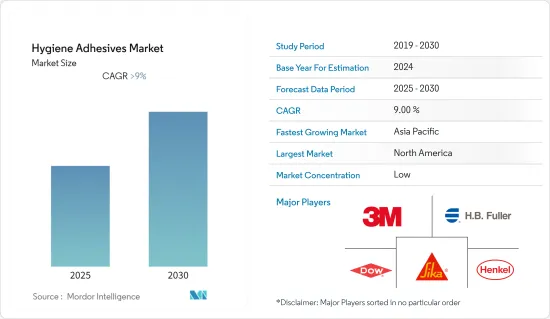

預測期內,衛生黏合劑市場預計將以超過 9% 的複合年成長率成長。

受新冠疫情影響,2020年各國實施了某些規則和規定,導致各行業的市場需求放緩。不過,2021年產業已經開始復甦,市場需求有所回升。

主要亮點

- 預計在預測期內推動市場發展的關鍵因素包括亞太地區對一次性衛生用品的需求不斷增加以及女性用衛生用品的採用率不斷提高。

- 然而,另一方面,有關黏合劑滲出的問題日益增多可能會阻礙市場的成長。

- 不斷增加的產品創新以提供更好的衛生性能預計將為市場帶來機會。

- 由於成年人口和嬰兒人口的快速成長,亞太地區預計將成為成長最快的市場。

衛生用品用膠黏劑的市場趨勢

嬰兒護理應用需求增加

- 衛生黏合劑可用於製造吸水、衛生的嬰兒尿布。北美和歐洲佔據了嬰兒尿布市場的一半以上。

- 不過,由於新興市場的出生率上升至16.6%左右,而已開發市場的平均出生率為11.2%,因此亞太地區的嬰兒紙尿褲市場預計將以更快的速度成長。

- 嬰兒護理產業的成長得益於多種因素,例如兒童衛生意識的增強、在職父母數量的增加以及個人消費能力的提高。

- 嬰兒護理產品成長的主要動力是父母對兒童衛生的日益關注。

- 近年來,每年的出生人數一直在減少,但隨著人們對嬰兒衛生意識的增強,高階、高品質產品的銷售量也在增加。 2021年全球整體為135,132,602人。

- 新生兒在出生後的第一年每天大約會使用 8-9 片尿布,每年總計約 3,100 片尿布。使用的床單數量隨著年齡的成長而減少:1至2歲的兒童每天使用5至6張床單,2至3歲的兒童每天使用3至4張床單。

- 在一次性紙尿褲市場,寶潔衛生保健旗下的幫寶適佔據了較大的市場佔有率,其次是Unicharm Corp旗下的媽咪寶和金佰利旗下的好奇,兩者的競爭還在繼續。

- 預計在預測期內,所有上述因素都將推動嬰兒護理領域的衛生黏合劑市場的發展。

亞太地區是一個快速成長的市場

- 預計預測期內亞太地區將呈現良好的成長。由於出生率上升,亞太地區是嬰兒護理產品成長最快的市場之一。品牌滲透率的提高和分銷網路的廣泛是推動該地區嬰兒護理產品市場發展的一些因素。

- 根據《金融時報》報道,中國人口老化加劇和出生率下降意味著到2025年成人紙尿褲的銷售量可能會超過嬰兒紙尿褲。到2050年,預計中國65歲以上老人將達3.3億。

- 由於人口結構的變化,一些尿佈公司已經開始調整行銷手段以吸引老年消費者。Unicharm Corp)是中國最受歡迎的一次性尿布品牌之一,似乎就是其中之一。此外,隨著國內年輕女性意識的增強,國內女性衛生市場也不斷擴大。

- 隨著老年人口的增加,失禁產品的產量也增加。根據日本衛生材料工業協會(JHPIA)的數據,2021年成人一次性紙尿褲(包括褲型、平板型和墊片型紙尿褲)的產量將達到約89億片。日本生產一次性尿布的主要公司有Unicharm Corp、花王和大王。

- 預計到 2050 年印度將成為世界上人口最多的國家。根據美國統計,預計2022年印度的生育率將達到每名婦女生育2.1個孩子,導致該國嬰兒人口數量上升。

- 消費者意識的增強和強生、聯合利華等主要企業的投資增加也預計將推動市場的發展。

- 這一成長是由於印度和中國等國家女性用衛生用品的普及率不斷提高。

- 這些因素正在推動亞太地區衛生黏合劑市場的發展。

衛生膠黏劑產業概況

衛生膠合劑市場部分分散,許多參與者在市場上佔據同等地位。衛生黏合劑市場的主要企業包括 3M、陶氏、漢高股份公司、HB Fuller Company、SIKA AG 等。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 一次性衛生用品需求不斷增加

- 亞太地區女性用衛生用品使用率上升

- 限制因素

- 黏合劑滲出問題增多

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 依樹脂類型

- 乙烯醋酸乙烯酯 (EVA)

- 苯乙烯-乙烯-丁二烯-苯乙烯 (SEBS)

- 苯乙烯-異戊二烯-苯乙烯 (SIS)

- 聚丁二烯(SBS)

- 其他樹脂類型

- 依產品類型

- 機織布料

- 不織布

- 按應用

- 嬰兒護理

- 成人護理

- 女性護理

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- 3M

- Abifor AG

- ADTEK Malaysia Sdn Bhd

- ALFA Klebstoffe AG

- Arkema Group(Bostik SA)

- Avery Dennison Corp.

- Beardow and Adams(Adhesives)Ltd

- Dow

- Evonik Industries AG

- Exxon Mobil Corporation

- HB Fuller Company

- Henkel AG & Co. KGaA

- Hexion

- Huntsman Corp.

- Ichemco srl

- Jowat AG

- Lohmann GmbH & Co. KG

- OMNOVA Solutions Inc.

- PPG Industries

- Sika AG

- The Reynolds Co.

第7章 市場機會與未來趨勢

- 擴大產品創新,提供更好的衛生性能

- 其他機會

The Hygiene Adhesives Market is expected to register a CAGR of greater than 9% during the forecast period.

Due to COVID-19, there was a slowdown in the market demand from various sectors in 2020 owing to specific rules and regulations imposed by countries. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- The significant factors that are likely to drive the market studied in the forecast period include the increasing demand for disposable hygiene products and the growing adoption of female hygiene products in the Asia-Pacific region.

- However, on the flip side, increasing adhesive bleed challenges are likely to hinder the market's growth.

- Growing product innovations for providing better hygienic properties are expected to act as an opportunity for the market.

- The Asia-Pacific region is expected to be fastest growing market owing to its quickly growing adult and infant poulation.

Hygiene Adhesives Market Trends

Increasing Demand from Baby Care Applications

- Hygiene adhesives can be used in absorbent sanitary baby diapers. More than half of the baby diapers market is dominated by the North American and European regions.

- However, with the rise in the average birth rate of approximately 16.6% in developing markets, compared to 11.2% in developed markets, the baby diapers market in the Asia-Pacific region is expected to grow at a faster pace.

- There are various factors responsible for the enhancement of the baby care industry, including increased awareness about child hygiene, a growing number of working parents, and the spending power of individuals.

- The primary factor for the growth of baby care products is the rising parental concern about the child's hygiene.

- Although in recent years, the number of births per year has been decreasing, with increased awareness about baby hygiene, the sales of premium and good quality products are growing simultaneously. Globally, the number of newborn babies was 135,132,602 in the 2021.

- A newborn uses approximately 8 to 9 diapers per day for its first year, which turns out to be around 3100 pieces in a year. The number of diapers being used decreases with the age of the kids to 5-6 diapers a day for kids aged 1 to 2 years and 3-4 diapers for kids aged 2 to 3 years.

- The major share of the diapers market is taken up by Pampers, a product of Procter & Gamble Hygiene & Health Care Ltd, followed by Mamypoko by Uni-Charm Corp., and Huggies, a product of Kimberly-Clark Lever Ltd.

- All these aforementioned factors are likely to drive the hygiene adhesives market in the baby care segment during the forecast period.

The Asia-Pacific Region is the Fastest Growing Market

- The Asia-Pacific region is expected to show a good increase during the forecast period. The Asia-Pacific is one of the fastest-growing markets for baby care products due to the rise in the birth rate. An increase in brand penetration and a wide distribution network are the few factors driving the baby care products market in the region.

- According to the Financial Times, by 2025, adult diaper sales in China could surpass infant diaper sales due to the country's rapidly aging population and dropping birth rate. It is expected that 330 million Chinese will be over the age of 65 by 2050.

- As a result of the demographic transition, some diaper companies are already adjusting their marketing efforts to appeal to older clients. Unicharm, one of China's most popular diaper brands, appears to be one of them. Furthermore, the female hygiene market in the country is also increasing with the increase in awareness among young women in the country.

- With the increase in aging people, the production volume of incontinent products is increasing. According to the Japan Hygiene Products Industry Association (JHPIA), in 2021, the production volume of disposable adult diapers, including pants, flat, and pad type diapers, amounted to around 8.9 billion. The major companies manufacturing diapers in the country are Unicharm, Kao, and Daio.

- India is expected to be the most populous nation in the world by 2050 owing to the increasing number of infants born in the country. According to the United States stats, India's fertility rate hit 2.1 births per woman in 2022, which will lead to an increasing population of infants in the country.

- The rise in consumer awareness and an increase in investments by key players, such as Johnson & Johnson, and Unilever, among others, are also expected to drive the market.

- This growth is due to the rising adoption of female hygiene products in countries like India, China, etc.

- Such factors are driving the market for hygiene adhesives in the Asia-Pacific region.

Hygiene Adhesives Industry Overview

The hygiene adhesives market is partially fragmented, with many players holding an equivalent position in the market. The key players in the hygiene adhesives market include 3M, Dow, Henkel AG & Co. KGaA, H. B. Fuller Company, and SIKA AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Disposable Hygiene Products

- 4.1.2 Growing Adoption of Female Hygiene Products in the Asia-Pacific region

- 4.2 Restraints

- 4.2.1 Increasing Adhesive Bleed Challenges

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Ethylene-vinyl acetate (EVA)

- 5.1.2 Styrene-ethylene-butadiene-styrene (SEBS)

- 5.1.3 Styrene-isoprene-styrene (SIS)

- 5.1.4 Styrene-butadiene-styrene (SBS)

- 5.1.5 Other Resin Types

- 5.2 Product Type

- 5.2.1 Woven

- 5.2.2 Non-woven

- 5.3 Application

- 5.3.1 Baby Care

- 5.3.2 Adult Care

- 5.3.3 Feminine Care

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia & New Zealand

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Egypt

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Abifor AG

- 6.4.3 ADTEK Malaysia Sdn Bhd

- 6.4.4 ALFA Klebstoffe AG

- 6.4.5 Arkema Group (Bostik SA)

- 6.4.6 Avery Dennison Corp.

- 6.4.7 Beardow and Adams (Adhesives) Ltd

- 6.4.8 Dow

- 6.4.9 Evonik Industries AG

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 H. B. Fuller Company

- 6.4.12 Henkel AG & Co. KGaA

- 6.4.13 Hexion

- 6.4.14 Huntsman Corp.

- 6.4.15 Ichemco srl

- 6.4.16 Jowat AG

- 6.4.17 Lohmann GmbH & Co. KG

- 6.4.18 OMNOVA Solutions Inc.

- 6.4.19 PPG Industries

- 6.4.20 Sika AG

- 6.4.21 The Reynolds Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Product Innovations to Provide Better Hygienic Properties

- 7.2 Other Opportunities

![床墊膠合劑市場評估,依類型 [水基、溶劑型、熱熔型]、依應用 [記憶泡棉床墊、乳膠泡棉床墊、凝膠泡棉床墊]、依地區、機會和預測,2018-2032年](/sample/img/cover/42/default_cover_2.png)