|

市場調查報告書

商品編碼

1637723

亞太地區 WiGig -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Asia Pacific WiGig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

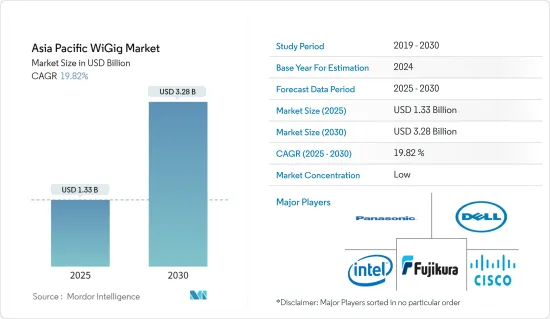

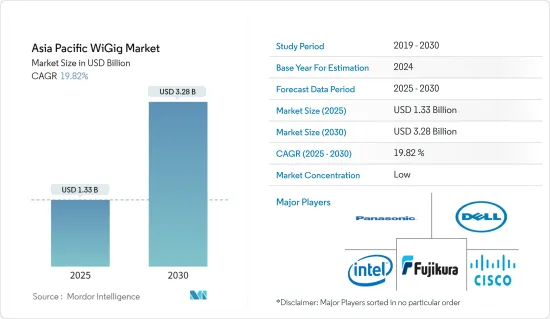

亞太地區 WiGig 市場規模預計 2025 年為 13.3 億美元,預計到 2030 年將達到 32.8 億美元,預測期內(2025-2030 年)複合年成長率為 19.82%。

主要亮點

- 近年來,高速網路和5G網路越來越受到關注。中國、日本、台灣、印度和澳洲等新興經濟體是該地區的主要驅動力。中國擁有完善的5G生態系統,預計在預測期內將進一步成長。然而,5G技術有望成為與目前行動寬頻共存的熱點技術。預計該國將出現溫和成長。

- 隨著物聯網 (IoT) 和機器類型通訊(MTC) 的出現,預計無線流量在不久的將來將呈指數級成長。這意味著假設頻率效率相同,當前頻寬會增加。例如,5.4GHz 工業、科學和醫療 (ISM) RF頻寬約為 500MHz,主要用於無線保真 WiFi。此頻寬已經達到飽和,這是 WiGig 背後的驅動力之一。

- WiGig 預計將成為無需實體有線連線即可快速輕鬆地進行資料分發的領先選擇之一。 WiGig不穿牆,通訊很短,因此對於近距離通訊有效,無意取代或直接取代WiFi或蜂窩網路。許多家用電子電器可能支援多模式 WiFi 和 WiGig。

- 由於 WiGig 的高速連接、卓越的可靠性和減少的延遲等功能,醫療保健系統受益於改進的回應時間、患者監控、資料收集和分析、遠端協作、資源分配等。它還為該地區領先的數位化、資料驅動和雲端基礎的創新公共緊急應變平台樹立了典範。

- 印度電訊監管局 (TRAI) 指出,可用於 WiFi 的免執照頻段非常擁擠。根據 DigiAnalysis 的分析,截至 2022 年,印度約有 50 萬個可用的公共熱點,預計到 2030 年將達到約 5,000 萬個。同時,全球有超過 4500 萬個可用熱點。因此,該委員會表示需要將這項基礎設施擴展至每 150 人至少一個熱點,從而產生額外 800 萬個熱點的需求。

亞太地區 WiGig 市場趨勢

顯示設備推動市場成長

- 無線Gigabit(WiGig) 技術的運作頻率為 60GHz。這使得每秒可無線傳輸5 Gigabit的音訊和視訊資料,是目前最大無線傳輸速度的 10 倍,成本僅為十分之一,通常在 10 公尺的範圍內。由於其易於操作和高速,WiGig 技術市場越來越受歡迎,尤其是在遊戲領域。根據 StatCounter 統計,截至 2024 年 1 月,行動裝置(不包括平板電腦)在全球網頁瀏覽量中佔據主導地位,佔據近 60% 的市場佔有率。

- WiGig技術也用於體育場館的廣播視訊訊號傳輸和毫米波視訊訊號傳輸。該技術還可用於即時傳輸全高清視訊。該技術可用於以無線方式虛擬連接筆記型電腦和其他具有擴充座所需的所有擴充功能的電腦,包括二次性顯示器和儲存電腦。

- 此外,家用電子電器領域正在推動 WiGig 市場的發展。行動電話、平板電腦或電腦可以將內容無線傳輸到同一房間內的高畫質電視或顯示器。例如,華碩的 ROG Phone 使用帶有顯示底座的 WiGig 將任何行動電話無線連接到大螢幕電視。 TwinView 底座配備 6.59 吋、120Hz 觸控螢幕、第二個 5,000mAh 大電池和內建風扇。

- 在預測期內,市場的顯示設備部分將享受充足的成長機會,特別是隨著虛擬實境(VR)/擴增實境(AR)技術的出現。韓國政府宣布,未來三年將投資約190億韓元開發擴增實境平台。作為促進 AR/VR 平台開發和吸引觀眾觀看 AR/VR 內容的努力的一部分,文化部計劃利用雲端運算創建一個大型虛擬文化場館,以提供廣泛的內容服務。

韓國佔有較大市場佔有率

- 據科學資訊通訊部稱,SK Telecom、KT 和 LG Uplus 等電信業者已領先世界其他地區在韓國推出 5G。截至 2023 年 4 月,SK Telecom 擁有最多的 5G 用戶數量,為 1,435 萬,其次是 KT,為 900 萬,LG Uplus 為 643 萬。

- 此外,根據IEEE通訊協會的數據,截至2023年3月,韓國5G用戶數將超過2,960萬,且迄今每月用戶數已增加至約50萬。

- 韓國科學部、ICP 和未來規劃 (MSIP) 表示,韓國半導體公司可以透過快速進入 60GHz WiGig 市場來獲得資料通訊市場的競爭優勢。

- 虛擬實境市場是WiGig晶片組的重要應用。由於政府對市場的投資增加以及該國最終用戶產業擴大採用 AR/VR 技術,該國也已成為 AR/VR 技術的新興市場之一。

- 國內硬體公司也不斷推出支援WiGig晶片組的產品。例如,三星發布了通訊,通訊以 60GHz 頻率運行的最新 802.11ad Wi-Fi 標準中所示。

亞太 WiGig 產業概覽

亞太地區 WiGig 市場呈現出顯著的細分趨勢,各產業參與企業都在積極爭取技術進步,以克服可能阻礙當前成長軌跡的市場挑戰。這些主要企業積極參與策略性舉措,例如建立夥伴關係、進行合併和收購。市場開發的顯著進展包括:

2022 年 6 月,中國著名網路設備製造商 H3C 發布了首款 Wi-Fi 7 路由器。 H3C Magic BE18,000 路由器擁有令人印象深刻的 18.443Gbps 峰值吞吐量,與 Wi-Fi 6 和 6E 硬體相比,吞吐量顯著增強。這項創新凸顯了業界為突破無線技術界限而不斷做出的努力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 通訊產業不斷進步的技術

- 高畫質影片的採用增加

- 市場限制因素

- WiGig 產品的工作範圍短

第 6 章 技術概覽

第7章 市場區隔

- 依產品

- 顯示裝置

- 網路基礎設施設備

- 按用途

- 遊戲和多媒體

- 聯網

- 其他

- 按地區

- 中國

- 日本

- 印度

- 韓國

第8章 競爭格局

- 公司簡介

- Panasonic Corporation

- Dell Technologies Inc.

- Cisco Systems Inc.

- Intel Corporation

- Fujikura Ltd

- Lenovo Group Limited

- Broadcom Inc.

- Qualcomm Technologies Inc.

- NEC Corporation

- Marvell Semiconductor, Inc.

第9章投資分析

第10章市場的未來

The Asia Pacific WiGig Market size is estimated at USD 1.33 billion in 2025, and is expected to reach USD 3.28 billion by 2030, at a CAGR of 19.82% during the forecast period (2025-2030).

Key Highlights

- In recent years, there has been an increased emphasis on high-speed internet and 5G networks. Emerging countries, including China, Japan, Taiwan, India, and Australia, are the major driving countries in the region. China has an established ecosystem for 5G and is expected to grow further in the forecast period. However, the 5G technology is expected to serve as a hotspot technology in existence with the current mobile broadband. The growth is expected to be gradual in the country.

- Due to the advent of the Internet of Things (IoT) and machine-type communication (MTC), exponential wireless traffic growth is expected in the near future. This would mean an increase in current bandwidth, assuming the same spectrum efficiency. For instance, the industrial, scientific, and medical (ISM) RF band in the 5.4 GHz region is approximately 500 MHz, mainly used by wireless fidelity WiFi. This bandwidth is already getting saturated, which is one of the driving forces of WiGig.

- WiGig is expected to be one of the main options for quick and easy data delivery without a physical wired connection. As it does not pass through walls and has a very short range, it is more useful for transfers within a short range and won't replace or directly supersede WiFi or cellular. Many consumer electronic devices will be multi-mode WiFi and WiGig capable.

- As a result of WiGig features, such as elevated speed connection, extraordinary reliability, and decreased latency, the healthcare system has benefited from improved response times, patient monitoring, data collection and analytics, remote collaboration, and resource allocation. It also sets an example for digitalized, data-driven, and Cloud-based innovative major public emergency response platforms in the region.

- The Telecom Regulatory Authority of India (TRAI) has mentioned that the delicensed bands available for WiFi are congested. According to the analysis of DigiAnalysis, in India, there are around 0.5 million public hotspots available as of 2022, which is expected to reach around 50 million by 2030. In contrast, there are over 45 million hotspots available worldwide. Hence, the board has shown a need to expand this infrastructure to at least one hotspot for 150 persons, creating a demand for another 8 million hotspots.

Asia Pacific WiGig Market Trends

Display Devices to Drive the Market Growth

- Wireless Gigabit (WiGig) technology operates at 60GHz. It allows wireless transfer of audio and video data up to 5 gigabits per second, ten times the current maximum wireless transfer rate, at one-tenth of the cost, usually within a range of 10 meters. Due to the ease of operation and high speed, the WiGig technology market is gaining traction, especially in the gaming sector. According to StatCounter, as of January 2024, mobile devices, excluding tablets, dominated global web page views, capturing close to 60% of the market share.

- WiGig technology is also being used in broadcasting video signal transmission systems in sports stadiums and mm-wave video video signal transmission systems. The technology could also be used for beaming full HD video in real time. It could be used by notebooks and other computers to wirelessly connect virtually, all the expansion needed for a docking station, including a secondary display and storage computer.

- Further, the consumer electronics sector is boosting the WiGig market. A phone, tablet, or computer could wirelessly stream content to a high-resolution TV or another monitor in the same room. For instance, Asus's ROG Phone can use WiGig along with its display dock to wirelessly connect any phone to a big-screen TV. The TwinView dock has its 6.59-inch, 120Hz touchscreen, a second massive 5,000mAh battery, and a built-in fan.

- The display devices segment of the market is presented with ample growth opportunities, especially with the advent of virtual reality (VR)/augmented reality (AR) technologies, in the forecast period. The South Korean government has announced to invest nearly KRW 19 billion in developing augmented reality platforms over the next three years. As part of efforts to boost AR/VR platform development and engage viewers in AR/VR content, the culture ministry will create a large-scale virtual cultural venue using cloud computing and provide a wide range of content services.

South Korea to Hold Significant Market Share

- The telecommunication companies, like SK Telecom, KT, and LG Uplus, were the first to launch 5G in the world in South Korea, according to the ministry of Science and ICT. SK Telecom, had the most 5G users at 14.35 million as of April 2023, followed by KT at 9 million and LG Uplus at 6.43 million.

- Moreover, according to the IEEE Communications Society, South Korean 5G users account for over the 29.6 million users as of this March 2023 and given that number of subscribers has increased to around 500,000 per month up to now, Such high penetration and quick adoption of technology indicate the demand for high-speed data transfer, which may drive WiGig chips' demand in the country.

- Ministry of Science, ICP, and Future Planning (MSIP) in South Korea has stated that the country's semiconductor companies have made an early move by entering the 60GHz WiGig market, enabling them to gain a competitive edge in the data communication market.

- The Virtual Reality market has a significant application of WiGig chipsets. The country is also emerging as one of the emerging markets for AR/VR technologies, owing to growing government investment in the market coupled with the growing adoption of AR/VR technologies among the country's end-user industries.

- The hardware companies in the country are also making continuous product launches that support WiGig chipsets. For instance, Samsung introduced its 5G New Radio (NR) Access Unit (AU), which can be used for high-speed wireless communications with high-speed wireless communications, as seen with the latest 802.11ad Wi-Fi standard operating at 60 GHz frequency.

Asia Pacific WiGig Industry Overview

The Asia Pacific WiGig market exhibits a notable degree of fragmentation, with various industry players vigorously striving to advance the technology in order to overcome market challenges that could impede its current growth trajectory. These key players are actively engaging in strategic initiatives such as forging partnerships, executing mergers, and pursuing acquisitions. Some noteworthy developments within the market include:

In June 2022, H3C, a prominent Chinese network equipment manufacturer, introduced what it purports to be the inaugural Wi-Fi 7 router. The H3C Magic BE18000 router boasts a remarkable peak throughput capacity of 18.443 Gbps, offering a tantalizing glimpse of significantly enhanced throughput compared to Wi-Fi 6 or 6E hardware. This innovation underscores the ongoing efforts within the industry to push the boundaries of wireless technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancement in Communication Industry

- 5.1.2 Rising Adoption of High-resolution Videos

- 5.2 Market Restraints

- 5.2.1 Shorter Operating Range of WiGig Products

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Product

- 7.1.1 Display Devices

- 7.1.2 Network Infrastructure Devices

- 7.2 By Application

- 7.2.1 Gaming and Multimedia

- 7.2.2 Networking

- 7.2.3 Other Applications

- 7.3 By Geography

- 7.3.1 China

- 7.3.2 Japan

- 7.3.3 India

- 7.3.4 South Korea

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Panasonic Corporation

- 8.1.2 Dell Technologies Inc.

- 8.1.3 Cisco Systems Inc.

- 8.1.4 Intel Corporation

- 8.1.5 Fujikura Ltd

- 8.1.6 Lenovo Group Limited

- 8.1.7 Broadcom Inc.

- 8.1.8 Qualcomm Technologies Inc.

- 8.1.9 NEC Corporation

- 8.1.10 Marvell Semiconductor, Inc.