|

市場調查報告書

商品編碼

1637839

WiGig:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)WiGig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

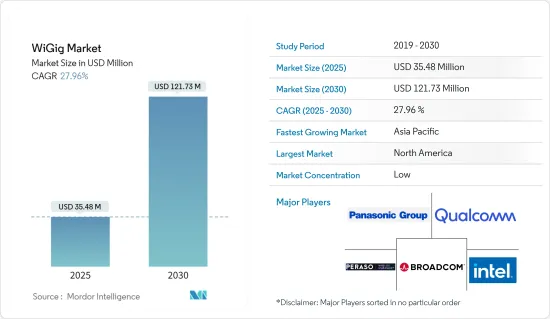

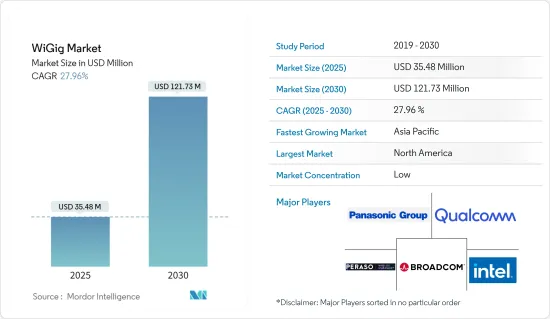

預計2025年WiGig市場規模為3,548萬美元,預估至2030年將達1.2173億美元,預測期內(2025-2030年)複合年成長率為27.96%。

主要亮點

- 技術進步是市場成長的關鍵因素。此外,對有助於高速資料傳輸的高頻頻譜的需求不斷成長也是對市場產生積極影響的因素。 WiGig 也稱為「IEEE 802.11ad 標準」。推動無線Gigabit市場成長的因素包括不斷成長的頻寬需求、智慧型手機的飽和以及多種設備的使用,最終有助於產業的整體發展。

- 公共 Wi-Fi 可實現各種智慧城市目標,包括彌合數位落差、透過物聯網 (IoT) 提供城市服務以及為學生、居民和遊客提供便利設施。除此之外,許多公司都在使用 WiGig 設備,讓員工能夠透過多種設備完成工作,而無需有線連接的麻煩。它還用於辦公室中的高效網路、無縫運行頻寬應用程式、傳輸大型文件和音訊以及將超低延遲圖形投影到會議室的大螢幕上。

- 通訊業不斷進步的技術也在推動市場發展。在物聯網服務方面,WiGig 可實現物聯網裝置之間的高速區域連接,從而實現快速且有效率的資料共用。這對於智慧家庭等多個物聯網設備需要即時通訊的應用尤其有利。根據思科年度網路報告,到 2023 年,除了影響力之外,還將有約 300 億台連網設備,高於 2018 年的 184 億台。

- 高清視訊的普及正在推動 WiGig 市場的發展。高清影片(包括 4K 和 8K影片)的激增正在推動對高速無線連接的需求,這種連接可以在沒有緩衝或延遲的情況下串流傳輸這些影片。此外,全球數位化的推動和 5G 網路的引入也促進了 WiGig 的成長。據 5G Americas 稱,截至 2023 年,全球將有約 19 億份第五代(5G)合約。預計到 2024 年,這一數字將增至 28 億,2027 年將增至 59 億。

- 然而,WiGig 產品的工作範圍較短(通常約 10 公尺或更小)阻礙了市場成長。由於通訊距離短,WiGig的應用可能受到限制,特別是當使用者需要移動性或需要覆蓋大面積時。

- COVID-19 大流行為 WiGig 技術支援遠距工作和數位協作創造了機會。然而,也存在來自 Wi-Fi 等現有無線技術的競爭。各行業的組織正在加速數位轉型,以擁抱遠距業務並滿足疫情後不斷變化的消費者需求。

WiGig市場趨勢

顯示設備領域預計將佔據主要市場佔有率

- 顯示裝置受到各種應用中無線連接和顯示無縫整合不斷成長的需求的推動,這些應用包括頭戴式顯示器 (HMD) (AR)、智慧型手機、 VR頭戴裝置以及 PC 和筆記型電腦等顯示整合裝置。列出了各種解決方案來滿足您的需求。

- 支援 WiGig 的智慧型手機的激增推動了對支援無線連接的顯示設備的需求,使用戶能夠充分利用行動裝置的潛力來提高工作效率、娛樂、遊戲和協作。根據 GSMA 的數據,截至 2023 年,北美地區的智慧型手機普及率最高,佔所有行動連線的 84%。到 2030 年,北美智慧型手機普及率預計將成長至 89%,歐亞大陸和亞太地區等地區預計也將強勁成長。

- WiGig技術工作在60GHz,可以以每秒5Gigabit的速度無線傳輸音訊和視訊格式的訊息,是目前最大無線傳輸容量的10倍,而成本卻只有十分之一。通常支援10米範圍內的資料傳輸。由於其易於操作和高速,它在市場上處於領先地位,尤其是在遊戲領域。

- WiGig技術也應用於體育場館的視訊訊號傳輸和毫米波視訊訊號廣播系統。該技術還可用於即時傳輸全高清品質的視訊。它還可用於與筆記型電腦和其他電腦進行無線連接,以及擴充座的所有必要開發,例如二次性顯示器或儲存電腦。

- 預計市場上的近距離應用在預測期內仍將具有吸引力。螢幕共用和虛擬實境 (VR) 耳機是 WiGig 廣泛實施的例子。 Peraso、Nitero、Qualcomm、Blu Wireless、Tensorcom 和 Intel 等公司專門生產支援 WiGig 的半導體。戴爾在部分筆記型電腦和無線塢站中配備了 WiGig。它可以為同一房間內的高解析度虛擬實境耳機無線供電。 WiGig 技術可以足夠快地傳輸資料,將 VR 影像從 PC 發送到VR頭戴裝置的顯示器。

預計北美將佔據較大市場佔有率

- 該地區以美國和加拿大為首的高網路普及率以及大量智慧型手機用戶預計將推動對使用 WiGig 的千兆位元組高速 Wi-Fi 的需求。北美正在迅速過渡到主要使用光纖的多Gigabit住宅網路存取。使用 DOCSIS 3.1 從現有網路中提取更多頻寬的經濟可行性是無線和速度的真正機會和趨勢,這正在增加該地區對 WiGig 的需求。

- 2023 年 7 月,FCC 通過新法規,鼓勵開發不需要許可證的創意設備。此規則適用於使用 60GHz 頻段(57 至 71GHz 之間)的未經許可的雷達和其他感測器設備。其目標是讓設備製造商在設計和操作方面擁有更大的自由度,並實現新的應用,例如檢測留在高溫汽車中的嬰兒的技術。重要的是,這些規則確保該頻寬可以與其他未經許可的技術共用,例如支援 VR 和 XR 應用的 WiGig。

- 加拿大的電玩產業正在蓬勃發展。加拿大娛樂軟體協會報告稱,63% 的加拿大人(即超過 2,400 萬人)是遊戲玩家。這一趨勢在年輕人中尤其明顯,與成年人(18-64 歲)相比,近十分之九(89%)的幼兒和青少年(6-17 歲)玩電子遊戲。這項研究不包括 65 歲及以上加拿大人的資料。該地區電動遊戲的日益普及帶來了市場成長的機會。

- 2024 年 3 月,Miliwave 宣布推出使用 Peraso X720 晶片組的全新固定無線產品。 Miliwave 也在北美開設了辦事處,以服務不斷成長的 WISP 市場。 Milliwave 的airPATH 60 產品利用免授權的60GHz 頻段,為需要可靠的多Gigabit資料連線的應用提供解決方案。

- 此外,2023 年 8 月,開放網路解決方案先驅供應商之一 STORDIS 宣布與 60GHz 無線網路技術產業領導者 Tachyon Networks 建立合作夥伴關係。此次合作將使 STORDIS 能夠在整個歐洲分銷 Tachyon Networks 的創新產品,提高網路效率和靈活性,並促進更快、更輕鬆和更具成本效益的安裝,從而為客戶帶來顯著的好處。

WiGig 產業概覽

由於全球參與企業和中小企業的存在,WiGig 市場被細分。該市場的主要參與企業包括松下公司、高通技術公司、英特爾公司、博通公司和佩拉索技術公司。市場參與企業正在採取聯盟、創新和收購等策略來加強其產品供應並獲得永續的競爭優勢。例如

- 2024 年 4 月,松下系統網路研發實驗室選擇 Peraso 的 X710 晶片組用於其新的 60GHz WLAN 解決方案。 PSNRD 的新型 60GHz WLAN 解決方案採用 Peraso 的相位陣列天線技術,可在數百公尺的距離內提供堪比有線 LAN 的無線高速、低延遲通訊。這種新解決方案易於安裝和操作,不受 60GHz 頻段的干擾,並可實現窄波束定向天線控制。

- 2023 年 9 月,以 60GHz 免授權和 5G 授權網路的毫米波技術而聞名的 Peraso 宣布發布 PERSPECTUS 系列中的 PRM2144X,主打遠距戶外應用。 PRM2144X 採用 Peraso X720 60GHz 晶片組,專為密集都市區設計。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 通訊產業不斷進步的技術

- 高畫質影片的採用率增加

- 市場限制因素

- WiGig 產品的工作範圍短

第 6 章 技術概覽

第7章 市場區隔

- 依產品

- 顯示裝置

- 網路基礎設施設備

- 按用途

- 遊戲和多媒體

- 聯網

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Panasonic Corporation

- Qualcomm Technologies Inc.

- Intel Corporation

- Broadcom Inc.

- Peraso Technologies Inc.

- Blu Wireless Technology Limited

- Tensorcom Inc.

- Fujikura Ltd

- Sivers Ima Holding AB

- Cisco Systems Inc.

- Dell Technologies Inc.

- Lenovo Group Limited

- HP Development Company LP

第9章投資分析

第10章市場的未來

The WiGig Market size is estimated at USD 35.48 million in 2025, and is expected to reach USD 121.73 million by 2030, at a CAGR of 27.96% during the forecast period (2025-2030).

Key Highlights

- Technological advancement is the primary factor contributing to the market's growth. In addition, the rising need for the high-frequency spectrum, which contributes to high-speed data transfer, is another factor influencing the market positively. WiGig is also termed the "IEEE 802.11ad standard." The factors that propel the wireless gigabit market's growth include increased bandwidth demand, smartphone saturation, and the use of several devices that eventually contribute to the overall industry development.

- Public Wi-Fi enables achieving various smart city goals, which include bridging the digital divide, enabling the Internet of Things (IoT) based municipality services, and providing amenities for students, residents, visitors, and tourists. Apart from this, WiGig devices are utilized in different businesses to enable employees to complete work from many devices without the hassle of a wired connection. They are also used for efficient in-office networking, running bandwidth-heavy applications seamlessly, transferring large files and audio, and projecting graphics to a large screen in a conference room with very low latency.

- Increasing technological advancements in the communications industry are also driving the market. Regarding IoT services, WiGig enables high-speed local area connections between IoT devices, allowing them to share data quickly and efficiently. This can be especially beneficial for applications such as smart homes, where multiple IoT devices need to communicate with each other in real-time. According to Cisco's Annual Internet Report, by 2023, there will be approximately 30 billion network-connected devices in addition to influences, growing from 18.4 billion in 2018.

- The rising adoption of high-resolution videos is driving the WiGig market. With the growing popularity of high-resolution videos, including 4K and 8K videos, there is an increasing demand for high-speed wireless connectivity to enable streaming these videos without buffering or lagging. In addition, the global development push toward digitization and the implementation of 5G networks has also contributed to the growth of WiGig. According to 5G Americas, as of 2023, fifth-generation (5G) subscriptions are approximately 1.9 billion globally. This number is forecast to increase to 2.8 billion in 2024 and 5.9 billion by 2027.

- However, the shorter operating range of WiGig products (typically around 10 meters or less) hampers the market's growth. The short range can restrict WiGig's applications, particularly when users require mobility or coverage over large areas.

- The COVID-19 pandemic created opportunities for WiGig technology to support remote work and digital collaboration. However, it has also introduced competition from existing wireless technologies like Wi-Fi. Organizations in various industries are accelerating their digital transformation efforts to adopt remote operations and meet changing consumer demands after the pandemic.

WiGig Market Trends

Display Devices Segment is Expected to Hold Significant Market Share

- Display devices offer various solutions to meet the growing demand for wireless connectivity and seamless integration of displays in various applications, such as head-mounted displays (HMD)(AR), smartphones, VR headsets, and devices with integrated displays, such as PCs and Laptops.

- The proliferation of WiGig-enabled smartphones drives demand for display devices that support wireless connectivity, enabling users to leverage the full potential of their mobile devices for productivity, entertainment, gaming, and collaborative applications. According to GSMA, as of 2023, North America has the maximum smartphone adoption rate, with 84% of total mobile connections. North America is anticipated to see its smartphone adoption rate grow to 89% by 2030, with regions like Eurasia and Asia-Pacific looking forward to significant growth.

- WiGig technology functions at 60 GHz and permits the wireless transfer of information in audio and video format at a speed of up to 5 gigabits per second, which is ten times the present maximum wireless transfer capacity, and that too at one-tenth of the cost. Typically, it supports data transfer within a range of 10 meters. The market is gaining traction due to the ease of operation and high speeds, particularly in the gaming sector.

- WiGig technology is also used to broadcast video signal transmission systems in sports stadiums and mm-wave video signal broadcast systems. The technology could also be used to beam full HD-quality video in real time. It can also be used by notebooks and other computers to wirelessly connect, along with all the development needed for a docking station, including a secondary display and storage computer.

- During the forecast period, short-range applications in the market are expected to be attractive. Screen sharing and virtual Reality (VR) headsets are instances where WiGig is being implemented widely. Companies such as Peraso, Nitero, Qualcomm, Blu Wireless, Tensorcom, and Intel specialize in WiGig-supporting semiconductors. Dell is integrating WiGig in carefully chosen laptops and wireless docking stations. It can wirelessly power a high-resolution virtual reality headset in the same room. The WiGig technology can transfer data at fast enough rates to feed VR imagery from a PC to a VR headset display.

North America is Expected to Hold Significant Market Share

- The high internet penetration and large smartphone users in the region driven by the United States and Canada are expected to drive the demand for high-speed Wi-Fi in gigabytes using WiGig. North America is quickly migrating toward multi-gigabit, residential internet access, primarily using fiber. The economic feasibility of extracting more bandwidth from existing networks using DOCSIS 3.1 is trending with the real opportunity of wireless and speed, by which the demand for WiGig is increasing in this region.

- In July 2023, the FCC adopted new regulations to encourage the development of creative devices that do not require a license. These rules apply to unlicensed radar and other sensor devices that use the 60 GHz band (between 57-71 GHz). The goal is to give device makers more freedom in their designs and how they operate while also enabling new applications like technology to detect children left in hot cars. Importantly, these rules ensure that this band can still be shared with other unlicensed technologies, like WiGig, which supports VR and XR applications.

- The video game industry in Canada is booming. The Entertainment Software Association of Canada reported that 63% of Canadians, over 24 million people, are gamers. This trend is particularly strong among younger demographics, with nearly 9 out of 10 (89%) kids and teens (aged 6-17) playing video games, compared to 61% of adults (aged 18-64). The survey did not include data for Canadians over 65. The increasing popularity of video games in the region provides opportunities for the market to grow.

- In March 2024, Miliwave Co. Ltd announced new Fixed-Wireless products using Peraso's X720 chipset. In addition, Miliwave opened an office in North America to service the growing WISP market. Utilizing the license-free 60 GHz band, Miliwave's airPATH 60 products provide solutions for applications demanding reliable, multi-gigabit data connectivity.

- Moreover, in August 2023, STORDIS, one of the pioneering providers of open networking solutions, announced a partnership with Tachyon Networks, an industry leader in 60 GHz wireless networking technology. This collaboration would enable STORDIS to distribute Tachyon Networks' innovative products across Europe and deliver substantial benefits for customers, enhancing network efficiency and flexibility and facilitating faster, easier, and more cost-effective installations.

WiGig Industry Overview

The WiGig market is fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Panasonic Corporation, Qualcomm Technologies Inc., Intel Corporation, Broadcom Inc., and Peraso Technologies Inc. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage. For instance,

- In April 2024, Panasonic System Networks R&D Lab. Co. Ltd adopted Peraso's X710 chipset for its new 60 GHz WLAN solution. Incorporating Peraso's phased array antenna technology, PSNRD's newly introduced 60 GHz WLAN solution achieves wireless high-speed, low-latency communication equivalent to wired LAN over distances of hundreds of meters. The new solution is easy to install and operate, has interference-free use of the 60 GHz band, and has narrow beam directional antenna control.

- In September 2023, Peraso, one of the prominent players in mmWave technology for 60 GHz license-free and 5G licensed networks, announced the release of the PRM2144X in the PERSPECTUS series featuring long-range, outdoor applications. Utilizing the Peraso X720 60 GHz chipset, the PRM2144X is designed for dense urban areas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancements in the Communications Industry

- 5.1.2 Rising Adoption of High-resolution Videos

- 5.2 Market Restraints

- 5.2.1 Shorter Operating Range of WiGig Products

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Product

- 7.1.1 Display Devices

- 7.1.2 Network Infrastructure Devices

- 7.2 By Application

- 7.2.1 Gaming and Multimedia

- 7.2.2 Networking

- 7.2.3 Other Applications

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Panasonic Corporation

- 8.1.2 Qualcomm Technologies Inc.

- 8.1.3 Intel Corporation

- 8.1.4 Broadcom Inc.

- 8.1.5 Peraso Technologies Inc.

- 8.1.6 Blu Wireless Technology Limited

- 8.1.7 Tensorcom Inc.

- 8.1.8 Fujikura Ltd

- 8.1.9 Sivers Ima Holding AB

- 8.1.10 Cisco Systems Inc.

- 8.1.11 Dell Technologies Inc.

- 8.1.12 Lenovo Group Limited

- 8.1.13 HP Development Company LP