|

市場調查報告書

商品編碼

1640408

北美 WiGig:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America WiGig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

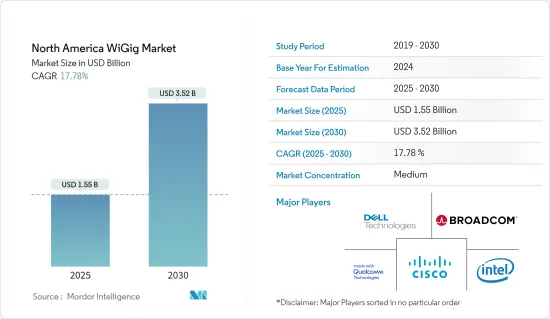

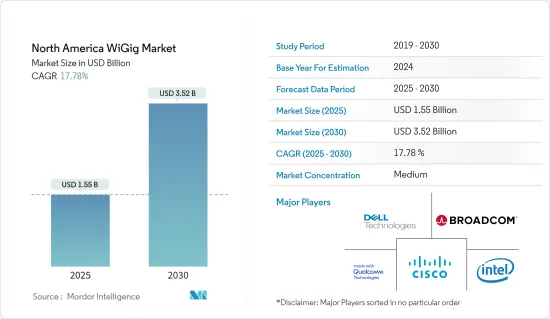

北美WiGig市場規模預計到2025年為15.5億美元,預計2030年將達到35.2億美元,預測期內(2025-2030年)複合年成長率為17.78%。

主要亮點

- WiGig 市場主要由虛擬實境、多媒體串流、遊戲、無線對接和企業應用等各種應用(主要在北美地區)對高速和資料密集型連接的需求不斷成長所推動。

- 高網路普及率以及該地區以美國和加拿大為首的大量智慧型手機用戶預計將推動對使用 WiGig 的千兆位元組高速 Wi-Fi 的需求。北美正在迅速過渡到多Gigabit住宅網際網路接入,主要是透過光纖到戶。使用 DOCSIS 3.1 從現有網路中獲取更多頻寬的經濟可行性正在隨著真正的無線電和速度機會而發展,這將增加該地區對 WiGig 的需求。

- 由於技術進步,消費者體驗的品質也得到了改善。隨著對超高清視訊、電影和隨選視訊服務的需求增加,WiGig 市場預計將進一步成長。遊戲中的虛擬實境和擴增實境也有望推動該市場的成長。

- 近年來,隨著物聯網 (IoT) 和機器通訊MTC 的出現,行動流量急劇增加。

- Wi-Fi 的缺點是與目前使用的 Wi-Fi 相比,該技術的範圍有限。 WiGig使用60GHz頻段的無線電波,因此在小區域或目標區域有效,但無法到達牆壁。為了彌補人口稠密地區WiGig連線覆蓋不足的問題,需要使用多個存取點,每個存取點獨立運行,這在防止網路流量方面也意味著。

北美WiGig市場趨勢

網路佔有很大佔有率

- WiGig 技術支援直接模式,家庭、企業和服務供應商正在轉向該網路以進行電纜更換和基礎設施聯網。這將是一個關鍵點,因為 2.4GHz 和 5Ghz 頻段的 802.11n 和 ac WiGig 將能夠動態地從傳統 WiFI 轉移到三頻連接網路。這是一個很棒的功能,因為當 WiG 進入您的家中時,覆蓋範圍可能會出現差距。

- 此外,由於物聯網設備的增加,WiGig 市場可能提供成長機會。然而,WiGig2D 網路在 DND2D 鄰居發現期間使用直接波束成形訓練,這會產生大量開銷、高能耗和低吞吐量。

- 北美正在對 5G 基礎設施進行重大投資,以覆蓋大多數偏遠地區。 60GHz 頻段的使用對於擴展 5G 網路至關重要,可以透過添加小型基地台無線電回程傳輸來提高網路密度。與光纖連接相比,WiGig 透過使用無線小型基地台回程傳輸來實現成本效益。

- WiGig 晶片組的開發是英特爾和 SK Telecom 之間的合作。兩家公司聯手推進 Anchorbooster Cell 技術的工作,該技術是 5G 的關鍵技術之一,結合 LTE 和 WiGig 網路,實現大量資料的無縫傳輸。兩家公司還表示,將行動邊緣運算技術應用於 Anchor Booster Cells 將進一步提高體驗質量,並為企業和關鍵產業開發新的經營模式。

顯然,鑑於先前高流量區域的連網設備和電腦數量大幅下降,COVID-19 爆發對通訊服務和流量的影響將值得注意。在家工作和遠距工作的普及導致連接的行動裝置和電腦減少,同時美國消費者對家庭 Wi-Fi 網路的使用增加。

美國佔最高市場佔有率

- 為了涵蓋大部分偏遠地區,該地區正在大力投資 5G 基礎設施。 60GHz 頻段在 5G 網路部署中發揮著至關重要的作用,並且還可以透過添加小型基地台無線電回程傳輸來提高密度。與光纖連接相比,WiGig 的成本效益來自於無線小型基地台回程傳輸的使用。

- 此外,家用電子電器產業推動了向室內高畫質電視和其他顯示器無線傳輸內容的市場,因為行動電話、平板電腦和電腦都可以與 WiGig 連接。例如,如果您的華碩 ROG行動電話配備可無線連接到大螢幕電視的顯示底座,則可以使用 WiGig。 TwinView 底座配備 6.59 吋 TFT 觸控螢幕、120Hz 觸控螢幕、第二個大容量 5,000mAh 電池和空調。

- 高網路普及率以及該地區以美國為首的大量智慧型手機用戶預計將推動對使用 WiGig 的千兆位元組高速 Wi-Fi 的需求。北美正在迅速過渡到多Gigabit住宅網際網路接入,主要是透過光纖到戶。使用 DOCSIS 3.1 從現有網路中提取更多頻寬的經濟可行性對於無線和速度來說是一個真正的機會和趨勢,這將增加該地區對 WiGig 的需求。

- 此外,FCC表示,要建置5G網路,全國至少需要安裝80萬根射頻天線。這表明在預測期內,全部區域可能有機會安裝 WiGig 晶片以擴展 5G 網路。

北美 WiGig 產業概況

北美 WiGig 市場目前已成為半固體市場,擁有多家佔據重要市場佔有率的主要供應商。該市場的主要企業包括Google、Facebook、英特爾、英飛凌、高通等。

2023 年 9 月,Peraso Inc. 宣布發布 PRM2144X,這是該公司 PERSPECTUS 系列中最新的毫米波模組。該模組專為遠距戶外應用而設計,並結合了 Peraso 的智慧媒體存取控制功能。 PRM2144X 使無線網際網路服務供應商(WISP) 能夠在密集的用戶環境中部署遠距點網路,而無需擔心干擾。

2022 年 9 月,英特爾公司和博通聯合宣布推出業界首個跨供應商 Wi-Fi 7 展示。該演示展示了無線通訊速度超過每秒 5Gigabit。 Wi-Fi 7具有免許可6GHz頻段的320MHz寬頻頻道、高階4K QAM資料調變、多頻寬同時連接的多鏈路操作以及多資源單元打孔以提高通道利用效率,利用創新功能。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

第5章市場動態

- 市場促進因素

- 通訊產業不斷進步的技術

- 高畫質影片的採用增加

- 市場限制因素

- WiGig 產品的工作範圍短

第6章 市場細分

- 產品

- 顯示裝置

- 網路基礎設施設備

- 應用

- 遊戲和多媒體

- 聯網

- 其他

- 國家名稱

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Qualcomm Technologies Inc.

- Intel Corporation

- Broadcom Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Lenovo Group Limited

- HP Development Company LP

- Tensorcom Inc.

第8章投資分析

第9章市場的未來

The North America WiGig Market size is estimated at USD 1.55 billion in 2025, and is expected to reach USD 3.52 billion by 2030, at a CAGR of 17.78% during the forecast period (2025-2030).

Key Highlights

- The WiGig market is primarily driven by the increasing demand for high-speed, data-intensive connections in various applications such as virtual reality, multimedia streaming, gaming, wireless docking, and enterprise applications in the North American region.

- The high internet penetration, along with large smartphone users in the region driven by the United States and Canada, is expected to drive the demand for Wi-Fi with high speed in gigabytes using WiGig. North America is quickly migrating toward multi-gigabit, residential internet access, primarily using fiber to the home. The economic feasibility of extracting more bandwidth from existing networks using DOCSIS 3.1 is trending with the real opportunity of wireless and speed, by which the demand for WiGig is increasing in this region.

- The quality of consumers' experience is also improving as a result of technological progress. The WiGig market is expected to grow further as demand for ultrahigh definition videos, films, and video-on-demand services increases. Virtual Reality and Augmented Reality in gaming are also expected to boost the growth of this market.

- The advent of the Internet of Things, i.e., IoT and machine communication MTC, has led to exponentially growing mobile traffic in recent years.

- The disadvantage associated with Wi-Fi is that this technology has a limited range compared with the current use of Wi-Fi. The use of the 60GHz spectrum for WiGig means that a signal cannot be transmitted to walls, although it is effective in small and targeted areas. It is necessary to use multiple access points in order to remedy the lack of range available for WiGig connections in densely populated areas, but this also means that each Access Point should function on an individual basis with a view to preventing network traffic.

North America WiGig Market Trends

Networking to Hold a major share of the Market

- The WiGig technology supports direct mode, which means the home, enterprises, and service providers are switching to a network for the replacement of cables as well as infrastructure networking. This is a critical point when WiGig in the 2.4 GHz and 5Ghz bands 802.11n and ac would be able to move around dynamically from conventional WiFIs into or across the triband connectivity network. That's a big feature because there are likely to be gaps in coverage of WiG when it comes out into the house.

- Moreover, The WiGig market could offer opportunities for growth due to the increasing number of Internet of Things devices. However, it leads to significant overhead costs, high energy consumptions, and low throughput of WiGig2D networks in the use of direct beamforming training during DND2D neighbor discovery.

- North America has been extensively investing in its 5G infrastructure in order to cover most remote places. The use of a 60GHz band has a vital importance in 5G network scaling and can be densified through the addition of small-cell wireless backhaul. In comparison with a fiber connection, WiGig has a cost-effective advantage by using wireless small-cell backhaul.

- The development of WiGig chipsets was a collaboration between Intel and SK Telecom. Both companies have joined forces to advance their efforts with the Anchorbooster Cell technology, which they state as one of the key technologies for 5G that allows seamless transmission of large amounts of data through a combination of LTE and WiGig networks. The two companies have also mentioned that they would apply Mobile Edge Computing technology on the anchor-booster cell to enhance the quality of experience further and to enable the development of new business models for enterprises and critical verticals.

Given the significant decrease in the count of connected devices and personal computers observed in previously high-traffic areas, it is evident that the impact of the COVID-19 pandemic on telecommunications services and traffic is noteworthy. As a result of people staying at home and the surge in remote work, there has been a reduction in the number of connected mobile devices and PCs, with a simultaneous increase in the utilization of home Wi-Fi networks by American consumers.

United States to Hold the Highest Market Share

- In order to cover the majority of these isolated areas, the region is investing heavily in its 5G infrastructure. The 60 GHz band has a pivotal role to play in the deployment of 5G networks and can also be made densable by adding small cell wireless backhaul. Compared to the fiber connections, WiGig's cost-effectiveness is due to its use of Wireless Small Cell backhaul.

- Furthermore, the market for wireless streaming of content to high-resolution televisions or other monitors in a room is being stimulated by the consumer electronics sector as mobile phones, tablets, and computers could connect with WiGig. For instance, if you have an Asus ROG phone with a display dock that's capable of wireless connectivity to large-screen TVs, WiGig can be used. The TwinView dock is equipped with a 6.59-inch TFT touchscreen, 120Hz touchscreen, a 2nd massive 5,000 mAh battery, and an air conditioning unit.

- The high internet penetration, along with large smartphone users in the region driven by the United States, is expected to drive the demand for Wi-Fi with high speed in gigabytes using WiGig. North America is quickly migrating toward multi-gigabit, residential internet access, primarily using fiber to the home. The economic feasibility of extracting more bandwidth from existing networks using DOCSIS 3.1 is trending with the real opportunity of wireless and speed, by which the demand for WiGig is increasing in this region.

- In addition, the FCC stated that in order to create a 5G network, there must be at least 800,000 RF antennas set up throughout the country, three times as large as what is currently available. This indicates that in the forecast period, there may be an opportunity to install WiGig chips for 5G network expansion across the region.

North America WiGig Industry Overview

The North American WiGig market is semi-consolidate due to the presence of several major vendors that currently hold significant market share. Key players in this market include Google, Facebook, Intel, Infineon, Qualcomm, and others.

In September 2023, Peraso Inc. announced the release of the PRM2144X, the latest mmWave module in the company's PERSPECTUS series. This module is designed for long-range outdoor applications and incorporates Peraso's intelligent Media Access Control features. The PRM2144X empowers wireless Internet service providers (WISPs) to deploy long-range, multi-point networks in dense user environments without concerns about interference.

In September 2022, Intel Corporation and Broadcom Inc. jointly announced the industry's first cross-vendor Wi-Fi 7 demonstration. This demonstration showcased over-the-air speeds exceeding 5 gigabits per second. Wi-Fi 7 leverages innovative features, such as wider 320 MHz channels in the unlicensed 6GHz spectrum, higher order 4K QAM data modulation, simultaneous connections across multiple bands with multi-link operation, and improved channel utilization efficiency with multi-resource unit puncturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Technological Advancement in Communication Industry

- 5.1.2 Rising Adoption of High-resolution Videos

- 5.2 Market Restraints

- 5.2.1 Shorter Operating Range of WiGig Products

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Display Devices

- 6.1.2 Network Infrastructure Devices

- 6.2 Application

- 6.2.1 Gaming and Multimedia

- 6.2.2 Networking

- 6.2.3 Other Applications

- 6.3 Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies Inc.

- 7.1.2 Intel Corporation

- 7.1.3 Broadcom Inc.

- 7.1.4 Cisco Systems Inc.

- 7.1.5 Dell Technologies Inc.

- 7.1.6 Lenovo Group Limited

- 7.1.7 HP Development Company LP

- 7.1.8 Tensorcom Inc.