|

市場調查報告書

商品編碼

1637762

亞太地區數位鑑識 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030 年)Asia Pacific Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

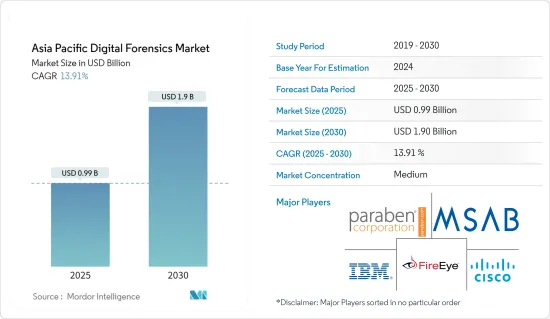

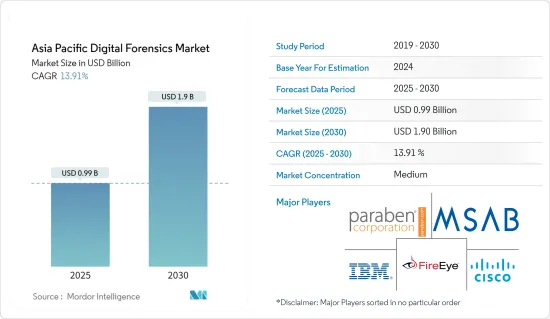

亞太地區數位鑑識市場規模預計到 2025 年為 9.9 億美元,預計到 2030 年將達到 19 億美元,預測期內(2025-2030 年)複合年成長率為 13.91%。

亞太地區的銀行計劃增加雲端支出,該地區 93% 的銀行預測,到 2023 年,它們將利用混合雲端或多重雲端基礎設施達到曲折點。隨著這些 BFSI 採用雲端解決方案,對網路安全措施的需求將會增加,對數位鑑識的投資也會增加。

主要亮點

- 許多網路風險正在迅速針對泰國企業。根據高科技犯罪趨勢共用的報告,泰國在亞太地區排名第五,有 27 個受害者組織的資料在專門的勒索軟體洩漏網站上遭到洩露。 Group-IB 在泰國設立的數位犯罪預防中心是為了回應日益成長的網路攻擊。 Group-IB 先進的數位鑑識和事件回應專家幫助泰國一家醫療機構破解了其網路。

- 自 COVID-19 爆發以來,網路犯罪攻擊顯著增加。美國聯邦調查局 (FBI) 記錄稱,疫情期間網路犯罪增加了 400%。隨著數位活動的增加,雲端環境中的網路犯罪不斷增加,人們採用數位取證來偵測這些詐欺。

亞太地區數位鑑識市場趨勢

各行業網路犯罪和安全問題的增加推動了市場

- 隨著時間的推移,網路犯罪事件的數量正在迅速增加。根據網路安全公司 CloudSEK 的數據,亞太地區是網路犯罪的首要目標之一,2022 年攻擊數量將增加 26.4%。由於新勒索軟體營運商的出現,2022 年勒索攻擊有所增加。

- IBM發布的報告顯示,48%的案例來自製造業,而金融和保險業的佔有率為18%。攻擊者附著目標並進行魚叉式網路釣魚,觀察到的此類案例中有近 40%。由於製造業對停機的容忍度較低,因此很容易成為攻擊者的目標。

- IT 公司正在增加工具和基礎設施來管理這些網路安全問題。 2022 年 5 月,思科為亞太地區的中小企業 (SMB) 推出了網路安全評估工具,以識別和分析其整體安全狀況。這個新工具提供對使用者和身份驗證、設備、網路、工作負載(應用程式)、資料和安全操作的存取。這將有助於中小型企業將其業務從傳統基礎設施轉變為數位平台。

- 中國公共安全機構利用 DNA 分析、熱成像、數位取證和網路安全等美國技術來監控國內團體並審查資料。這項技術可用於建立人口資料庫和進行大規模監測。

- 金融犯罪在馬來西亞一直是一個令人擔憂的問題,導致法律取證的需求很高。馬來西亞網路安全局已收到超過 7,000 份有關馬來西亞網路安全事件的報告。為了控制網路攻擊,政府打算成立馬來西亞網路安全委員會,以加強該國的網路安全。

行動取證領域證實了市場的高成長

- 行動訂閱的加速成長正在創造對電子商務、銀行、零售和其他各個領域的服務的需求。透過行動電話交易產生的資料對網路安全構成威脅。 2023 年 1 月,駭客入侵了亞洲的兩個大型資料中心,竊取了財富 500 強組織和關鍵 IT 公司的 3,000 多個登入憑證。總部位於上海的萬國資料控股有限公司和總部位於新加坡的 ST Telemedia 全球資料中心 (STT GDC) 經營受感染的資料中心。結果,客戶被迫更改他們的登入憑證。

- 在一次網路釣魚攻擊中,香格里拉的一組飯店遭受了資料外洩。包括新加坡和香港在內的亞洲六家分店受到此攻擊的影響。駭客竊取了住宿的姓名、電子郵件地址和電話號碼。聘請網路取證團隊進行調查,發現該電子郵件被用來攻擊飯店的IT安全監控系統。

- 澳洲也是遭受這些網路攻擊的國家之一。 2022 年 10 月,醫療服務提供者 Medibank 遭遇資料洩露,影響了 970 萬人的記錄。在此次事件發生後,該醫療保健公司指示其會員不要從暗網上下載不必要的敏感個人資料,並避免與客戶直接接觸。

- 幾乎所有智慧型手機應用程式都會從客戶的裝置收集資料。如果這些伺服器被駭客攻擊或因技術錯誤而容易受到攻擊,資料都可能被竊取並被犯罪分子用來實施詐騙。因此,用戶應該設定安全控制來限制每個應用程式收集的資料,或在下載需要許多權限的新應用程式之前。

亞太地區數位鑑識產業概況

亞太地區數位取證市場的競爭適度。然而,隨著律師事務所採用基於人工智慧的解決方案來控制犯罪,預計在研究期間需求將會成長。該行業的供應商尋求聯盟並不斷推出新產品功能,以抵禦競爭並維護品牌聲譽。

- 2023 年 4 月 - 安全解決方案公司 Wavesys Global 宣布使用 Forsenic 服務進行影片內容分析。該工具使用元資料來建立外觀搜尋,並提供篩選器來修改搜尋條件。記錄元資料並使用現有現場攝影機的簡介,無需後處理,從而減少法醫證據搜尋時間。

- 2023 年 3 月 - 新加坡網路安全公司 Group-IB 與泰國網路安全供應商 nForce 簽署協議。 nForce 組建了第一支事件回應 (IR) 團隊,Group IB 已為他們提供培訓和專門支援。 Group-IB 的團隊採用由威脅情報驅動的尖端技術,並擁有成功調查和解決複雜網路犯罪案件的良好記錄。此次夥伴關係將使 nForce 能夠擴大其在泰國市場的覆蓋範圍,並協助當地企業應對不斷變化的網路威脅。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 物聯網設備的日益普及推動了對數位取證解決方案和服務的需求

- 各行業對網路犯罪和安全的擔憂日益加深

- 市場問題

- 組織內缺乏熟練的專業人員和預先規劃

第6章 市場細分

- 成分

- 硬體

- 軟體

- 服務

- 類型

- 行動取證

- 電腦取證

- 網路取證

- 其他

- 按行業分類

- 政府和執法部門

- BFSI

- 資訊科技和電訊

- 其他最終用戶產業

- 按國家/地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Cisco Systems Inc.

- SecureWorks, Inc.

- Guidance Software Inc.(Opentext)

- Network Intelligence, Inc.

- Paraben Corporation

- FireEye Inc.

- MSAB Inc.

- LogRhythm Inc.

- Oxygen Forensics Inc.

第8章 未來展望

第9章投資分析

The Asia Pacific Digital Forensics Market size is estimated at USD 0.99 billion in 2025, and is expected to reach USD 1.90 billion by 2030, at a CAGR of 13.91% during the forecast period (2025-2030).

Banks across the Asia-Pacific region plan to increase their cloud spending, and 93% of banks in the region anticipate reaching an inflection point and utilizing hybrid and multi-cloud infrastructures by 2023. Adopting cloud solutions by these BFSIs will create a demand for cyber security measures, which will increase investments in digital forensics.

Key Highlights

- Many cyber risks are rapidly targeting Thai businesses. According to a report shared by Hi-Tech Crime Trends, with 27 victim organizations whose data was exposed on ransomware-specialized leak sites, Thailand ranked fifth in the Asia Pacific region. Group-IB's Digital Crime Resistance Centre in Thailand was established to counter this increasing number of cyber attacks. Group-IB's highly skilled digital forensics and incident response experts helped decrypt a medical organization's network in Thailand.

- Since the Covid-19 outbreak, there has been a significant increase in cyber crime attacks. Federal Bureau of Investigation (FBI) recorded a 400% increase in cyber crimes during the pandemic. With increasing digital activities, cybercrimes in the cloud environment are growing, and to detect these frauds, digital forensics was adopted.

APAC Digital Forensics Market Trends

Growing Cybercrimes and Security Concerns Across Industries to Drive the Market

- The instances of cyber crimes have increased drastically over time. According to cyber security firm CloudSEK, Asia Pacific was one of the top targets of cyber crimes, and the number of attacks increased by 26.4% in 2022. Ransome attacks increased during 2022 with the emergence of new ransomware operators.

- A report released by IBM depicted 48% of the cases of attacks were from the manufacturing sector, while the finance and insurance sector share was 18%. Attackers used spear phishing by attaching to the target; nearly 40% of such cases were observed. Due to its low tolerance for downtime, the manufacturing sector was an easy target for attackers.

- IT companies are enhancing their tool and infrastructure to manage these cyber security issues. In May 2022, Cisco launched a cybersecurity assessment tool for small and medium-sized businesses (SMBs) in the Asia Pacific to identify and analyze their overall security posture. User and Identity, Device, Networks, Workload (applications), Data, and Security Operations will be accessed using this new tool. This will help SMBs looking to transform their business from traditional infrastructure to digital platforms.

- Public security entities in China use US technology like DNA analysis, thermal imaging, digital forensics, and cyber security to monitor groups and censor material in the country. This technology could help build population databases and carry out mass surveillance.

- Financial crime has always been a concern in Malaysia, which has resulted in high demand for legal forensics. CyberSecurity Malaysia received over 7,000 reports involving cyber security incidents in Malaysia. To control cyber attacks government intends to set up the Malaysian Cyber Security Commission to strengthen cyber security in the country.

Mobile Forensic Segment to Witness High Market Growth

- Accelerating mobile subscriptions creates a demand for e-commerce, banking, retail, and other services in every sector. As vast data is generated through mobile phone transactions, it threatens cyber security. In January 2023, hackers stole over 3,000 login credentials from Fortune 500 organizations and significant IT firms after infiltrating two sizable data centers in Asia. Shanghai-based GDS Holdings and Singapore-based ST Telemedia Global Data Centers (STT GDC) operated the breached data centers. Thus customers were forced to change their login credentials.

- In another phishing attack, a group of Shangri-La hotels was hit by a data breach. Including Singapore and Hong Kong, six other branches in the Asia region were affected by this attack. The hackers stole the guests' names, e-mail addresses, and phone numbers. A Cyber forensic team was hired, which investigated and revealed that the e-mail was used to attack the hotel's IT security monitoring systems.

- Australia was yet another country that became the prey of these cyber attacks. In Oct 2022, Medibank, the health service provider, suffered a data breach where records of 9.7 million citizens were affected. After this incident, the health company instructed its members not to download sensitive personal data from the dark web unnecessarily and to refrain from contacting customers directly.

- Nearly every smartphone app collects data from a customer's device. If those servers are hacked, or a technical error leaves them vulnerable, all that data can be stolen and used by criminals for fraud. Therefore users need to set security controls to limit the data collected by each app or before downloading any new app that requests a lot of permissions.

APAC Digital Forensics Industry Overview

There is moderate competition in the Asia Pacific Digital Forensics Market. Still, the demand will grow as law firms adopt AI-based solutions to control crime during the study period. The vendors involved in this business continuously introduce new product features, seeking collaborations to withstand competition and maintain their brand reputation.

- April 2023 - Wavesys Global, a security solution company, launched Video Content Analytics with Forsenic Service Feature. The tool uses object metadata to create an appearance search and also has filters to change the search criteria. It records metadata and uses snapshots from existing onsite cameras without post-processing, reducing the forensic evidence search time.

- March 2023 - Singapore based cybersecurity company Group-IB signed a deal with Thailand's cybersecurity provider nForce. nForce will form the first Incident Response (IR) team, where Group IB will provide training and dedicated support to them. The team at Group-IB employs cutting-edge technology driven by threat intelligence, and they have a track record of successfully researching and resolving complicated cybercrime cases. This partnership will thus help nForce to improve coverage of the Thai market and assist local companies in dealing with ever-evolving cyber threats.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT Devices Driving Demand for Digital Forensics Solutions and Services

- 5.1.2 Growing Cybercrimes and Security Concerns across Industries

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Professionals and Preplanning among Organizations

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 Type

- 6.2.1 Mobile Forensics

- 6.2.2 Computer Forensics

- 6.2.3 Network Forensics

- 6.2.4 Other Types

- 6.3 End-User Vertical

- 6.3.1 Government and Law Enforcement Agencies

- 6.3.2 BFSI

- 6.3.3 IT and Telecom

- 6.3.4 Other End-user Verticals

- 6.4 By Country

- 6.4.1 India

- 6.4.2 China

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc.

- 7.1.3 SecureWorks, Inc.

- 7.1.4 Guidance Software Inc. (Opentext)

- 7.1.5 Network Intelligence, Inc.

- 7.1.6 Paraben Corporation

- 7.1.7 FireEye Inc.

- 7.1.8 MSAB Inc.

- 7.1.9 LogRhythm Inc.

- 7.1.10 Oxygen Forensics Inc.