|

市場調查報告書

商品編碼

1640545

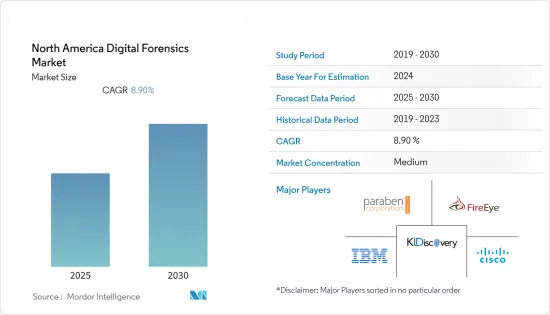

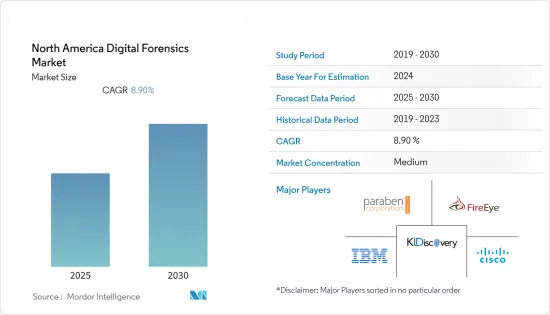

北美數位鑑識:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)North America Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預測期內,北美數位鑑識市場預計複合年成長率為 8.9%

關鍵亮點

- 在組織壓力和危機巨大的時期,新的詐欺和醜聞風險不斷出現,內部控制跟不上不斷變化的風險,法醫調查的需求日益增加。 COVID-19 疫情反映了遠距工作環境的新模式,需要符合法律和社會目標(例如社交距離和自我隔離)的調查技術。

- 數位取證允許透過分析和評估來自數位設備的資料來提取證據,並用於恢復和檢查資料,同時保留資料原始性。識別資料重複和時間欺騙是這項技術面臨的一些主要挑戰。

- 物聯網推動的運算技術的出現以及全部區域行動電話、電腦和其他電子設備的快速成長都促進了數位取證的需求。

- 技術進步和執法也是影響北美數位取證採用率的因素。相反,缺乏專業技能、使用專有作業系統以及新行動應用程式中的高加密等級等因素可能會阻礙市場成長。

- 此外,市場正在見證主要參與者進行各種併購活動,以加強產品系列擴大其影響力。例如,2020 年 8 月,網路安全公司 Palo Alto Networks 宣布已簽署最終協議,收購事件回應、風險管理和數位鑑識顧問公司 The Crypsis Group。

北美數位取證市場趨勢

網路取證預計將顯著成長

- 北美地區一直是網路取證解決方案採用的主要創新者、先驅者和最大的市場之一。此外,該地區擁有強大的骨幹力量和多家市場供應商。

- 網際網路和數位通訊系統(尤其是物聯網 (IoT))的使用日益增多,導致對網路取證領域功能的需求不斷增加。

- IoT 和 BYOD 趨勢的興起也導致網路犯罪的增加,迫使許多組織採用這些解決方案。該地區連網設備的增加也使企業網路變得更加複雜。不斷發展的網路環境也要求企業重新評估其網路安全基礎設施並採用強大的網路解決方案。

- 根據 Verizon 最近的一項研究,安全漏洞的首要原因是「身份驗證洩漏」。根據身分盜竊資源中心發布的研究資料,2020年僅美國就發生了1001起資料外洩事件,導致超過1.558億筆記錄暴露。

- 各行業資料外洩數量的大幅增加促使企業採用強大的取證解決方案。例如,根據白宮經濟顧問委員會的數據,美國經濟每年因危險的網路活動面臨約 570 億至 1,090 億美元的損失。

預計美國將佔據較大的市場佔有率

- 一段時間以來,美國金融體系一直是外國網路對手的攻擊目標。基於這一現象,美國政府最近向私營部門開放了專門的網路保護團隊(CPT),以便在發生網路攻擊時以高級分析、網路和端點取證的形式提供突波的能力。它。

- 此外,2018年11月,美國政府簽署立法,成立網路安全與基礎設施安全局(CISA),以加強國家對網路攻擊的防禦能力。該機構與聯邦政府合作,提供網路安全工具、事件回應服務和評估能力,以保護支援合作機構關鍵業務的政府網路。因此,它為新舊公司投資專門針對該行業設計的取證解決方案開闢了新的途徑。

- 花旗集團、美國銀行、摩根大通和富國銀行等美國銀行都曾遭遇各種網路攻擊,導致客戶資料外洩。聯邦當局建議銀行監控網路活動。此類政府授權正在推動該地區對數位取證解決方案的需求。

- 預計美國將佔據數位取證市場的大部分佔有率,政府和私人公民可以在刑事和民事案件中使用這項技術。聯邦調查局和州警等機構正在使用這項技術來抓捕參與網路非法活動的犯罪分子和恐怖分子。私人公司使用該系統進行類似的調查。

北美數位取證行業概況

北美數位取證市場競爭激烈,有多家公司參與企業。市場集中度適中,主要參與企業採用併購、產品創新等策略來提供更好的產品並擴大影響力。該市場的主要企業包括 IBM Corporation、KLDiscovery Inc.、Paraben Corporation 和 Cisco Systems Inc.

- 2022 年 1 月-STG(FireEye 從其出售了其名稱和產品業務)宣布推出Trellix,這是一家擴展的檢測和回應公司,結合了 FireEye 和 McAfee 的企業業務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 網路犯罪和先進竊盜手段增多

- 物聯網設備的日益普及推動了對數位取證解決方案的需求

- 市場限制

- 專業技能人才短缺

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 工業影響評估

第5章 市場區隔

- 按組件

- 硬體

- 軟體

- 服務

- 按類型

- 行動取證

- 電腦取證

- 網路取證

- 其他

- 按最終用戶產業

- 政府和執法部門

- BFSI

- 資訊科技和電訊

- 其他最終用戶產業

- 按國家

- 美國

- 加拿大

第6章 競爭格局

- 公司簡介

- IBM Corporation

- Binary Intelligence LLC

- Guidance Software Inc.(Opentext)

- AccessData Group LLC

- KLDiscovery Inc.

- Paraben Corporation

- FireEye Inc.

- LogRhythm Inc.

- Cisco Systems Inc.

- Oxygen Forensics Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The North America Digital Forensics Market is expected to register a CAGR of 8.9% during the forecast period.

Key Highlights

- During this period of significant organizational stress and crisis, newer frauds and misconduct risks have emerged, internal controls are lagging behind the evolving risks, and the need for forensic investigations have been witnessing an increase. The COVID-19 pandemic will require investigation techniques that reflect the new patterns of employee remote working environment and comply with the legal and societal goals such as social distancing and self-isolation.

- Digital forensic enables the extraction of evidence through analysis and evaluation of data from digital devices and is used to recover and inspect the data while maintaining the originality of the same. Identification of duplication of data and spoofing of timings are some of the major challenges for this technology.

- The emergence of computing shaped by the IoT and the rapid increase in the number of mobiles, computers, and other electronic devices across the region are contributing to the demand for digital forensics.

- Technological advancements and law enforcement are some of the other factors impacting the adoption rate of digital forensics in North America. In contrast, factors such as lack of specialized skills, usage of proprietary operating systems, and high level of encryption in new mobile applications may hinder the growth of the market.

- Moreover, the market has been witnessing various mergers and acquisition activities by big players in the market to enhance their product portfolio and expand their reach. For instance, in Aug 2020, Palo Alto Networks, a cybersecurity company, announced that it has entered into a definitive agreement to acquire The Crypsis Group, an incident response, risk management, and digital forensics consulting firm.

North America Digital Forensics Market Trends

Network Forensic is Expected to Witness Significant Growth

- The North American region is among the lead innovators and pioneers in terms of the adoption of network forensics solutions and is one of the largest markets. Moreover, the region also has a strong foothold of multiple vendors in the market.

- The increasing usage of the internet and digital communications systems, especially in the shape of the Internet of things (IoT), among others, is leading towards the increasing demand for competence in the network forensics field.

- The growing popularity of IoT and BYOD trends have also resulted in the growth of cyber-crimes, forcing multiple organizations to use these solutions. The rise in connected devices in the region has also made enterprise networks much more complex. The evolving network landscape has also generated the need among enterprises to reassess their network security infrastructure and adopt robust network solutions.

- A recent study by Verizon suggests that 'compromised identities' represent the top reason for security breaches. In the year 2020, the number of data breaches in the United States alone aggregated to 1,001, with more than 155.8 million records exposed, according to the survey data published by the Identity Theft Resource Center.

- The substantial increase in the number of data breaches across various industries boosts companies to adopt robust forensics solutions. For instance, according to the White House Council of Economic Advisers, the US economy faces losses of approximately USD 57 billion to USD 109 billion per annum due to dangerous cyber activities.

United states is Anticipated to Account for a Major Market Share

- The US financial system has always been a target for foreign cyber adversaries for a considerable period. Based on this phenomenon, the US government recently imposed laws for the private sector to have a dedicated cyber protection team (CPT) to provide surge capacity in the event of an ongoing cyberattack in the form of advanced analysis and network and endpoint forensics.

- Moreover, the United States government signed the law to establish Cybersecurity and Infrastructure Security Agency (CISA) in Nov 2018, in order to enhance national defense against cyber attacks. The agency works with the federal government to provide cybersecurity tools, incident response services, and assessment capabilities to safeguard the governmental networks that support essential operations of the partner departments and agencies. As a result, it will open new avenues for the new and existing companies to invest in forensics solutions primarily designed for this industry.

- The US banks, such as Citigroup, Bank of America, JPMorgan Chase, and Wells Fargo, have faced various cyberattacks that led to exposing the customer data. These banks were recommended, by the federal officials, to monitor network activities. Such government impositions are, therefore, driving the demand for digital forensics solutions in the region.

- The United States is expected to have a prominent share in the digital forensics market, where this technology can be used by governments and private citizens for criminal and civil cases. Agencies, like FBI and State Police departments, are using this technology to catch criminals and terrorists involved in illegal activities online. In the private sector, this system is used for similar investigations inside the companies.

North America Digital Forensics Industry Overview

The North America Digital Forensics Market is significantly competitive owing to the presence of multiple players. The market is moderately concentrated, with the major players adopting strategies such as mergers and acquisition product innovation to make their offerings better and expand their reach. Some of the major players operating in the market are IBM Corporation, KLDiscovery Inc., Paraben Corporation, Cisco Systems Inc., among others.

- January 2022 - STG, the company to which FireEye had sold its name and products business, announced the launch of Trellix, an extended detection and response company, which is a combination of FireEye and the McAfee enterprise business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Cyber Crimes and Advanced Theft Mechanisms

- 4.2.2 Growing Adoption of IoT Devices Driving the Demand for Digital Forensics Solutions

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Professionals

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type

- 5.2.1 Mobile Forensic

- 5.2.2 Computer Forensic

- 5.2.3 Network Forensic

- 5.2.4 Other Types

- 5.3 By End-user Industry

- 5.3.1 Government and Law Enforcement Agencies

- 5.3.2 BFSI

- 5.3.3 IT and Telecom

- 5.3.4 Other End-user Verticals

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Binary Intelligence LLC

- 6.1.3 Guidance Software Inc. (Opentext)

- 6.1.4 AccessData Group LLC

- 6.1.5 KLDiscovery Inc.

- 6.1.6 Paraben Corporation

- 6.1.7 FireEye Inc.

- 6.1.8 LogRhythm Inc.

- 6.1.9 Cisco Systems Inc.

- 6.1.10 Oxygen Forensics Inc.