|

市場調查報告書

商品編碼

1637823

歐洲油田設備租賃服務市場:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Europe Oilfield Equipment Rental Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

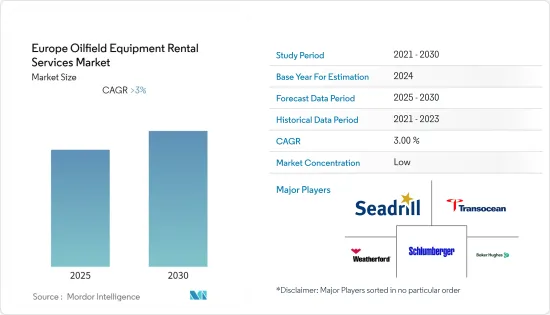

歐洲油田設備租賃服務市場預計在預測期內將維持3%以上的複合年成長率

主要亮點

- 從中期來看,由於原油和天然氣需求增加而導致的探勘和生產活動活性化等因素預計將在預測期內推動歐洲油田設備租賃服務市場的發展。

- 另一方面,石油和天然氣價格的波動為石油和天然氣營運商帶來了不確定性,這可能會限制未來幾年歐洲油田設備租賃服務市場的成長。

- 然而,挪威和英國等地區不斷成長的深水和超深水鑽探活動預計將在未來幾年為市場相關人員提供充足的機會。

- 由於挪威探勘活動增加以彌補其他地區油田的下降,預計挪威將主導市場。

歐洲油田設備租賃服務市場趨勢

鑽機佔據市場主導地位

- 2020年油價危機後,2020年至2022年期間,陸上和海上鑽機數量皆大幅減少。然而,預計從2022年初開始,該地區的鑽機市場將受到推動,屆時原油價格將相對穩定。

- 海上營運商已承諾大力投資油田開發。截至 2022 年,按計劃和在建計劃數量計算,歐洲將成為最大的海上鑽井市場之一。

- 隨著北海蘊藏量的減少,鑽探活動達到歷史最高水平,試圖在更深的水域發現更多的石油和天然氣。

- 荷蘭、挪威和英國等其他國家是該市場的主要驅動力,因為活性化鑽探活動以尋找更多的石油和天然氣。

- 隨著原油價格的上漲,油氣產業的投資將大幅增加,預計多個計劃將運作,這將帶動歐洲油氣設備租賃服務市場。

挪威主導市場

- 預計挪威在預測期內將保持在該地區的主導地位。石油和天然氣公司面臨越來越大的壓力,要求他們用更少的資源做更多的事情,並提高成本效益,這正在推動市場的發展。

- 近年來,挪威石油和天然氣產業的探勘、開發和生產領域發生了重大變化。

- 在該國議會最大政黨撤回對北極圈羅弗敦群島周圍探勘鑽探的支持後,探勘行業遭受重大挫折。據估計,島上地下約有1至30億桶石油。上游公司認為,羅弗敦群島的鑽探對於維持未來幾年的石油產量水準至關重要。

- 因此,該地區的探勘活動預計將轉向巴倫支海。據估計,挪威約三分之二的未發現資源(特別是天然氣)位於巴倫支海。

- 這些資源的開發預計將大幅增加挪威的天然氣產量,挪威天然氣產量已從2011年的97.2億立方英尺/日穩步增加到2021年的110.6億立方英尺/日,而且還在增加。

- 近年來,挪威發現了多項石油和天然氣,其中包括巨大的 Johan Sverdrup 油田。 2021年6月,挪威石油和能源部宣佈在邊境地區第25輪許可中獲獎,授予7家公司總合4個挪威梯田生產許可證的所有權。其中三個許可證安裝在巴倫支海新開放的區域,一個安裝在挪威海。

- 與前兩年相比,2021 年探勘活動大幅增加。在挪威大陸棚上鑽探了 40 口探勘並取得了 20 個發現。初步估計已發現石油總量為8,100萬立方公尺。這顯示過去三年每年庫存豐度都在增加。

- 挪威石油管理局估計,挪威梯田上未發現的可採石油資源量約為 40 億立方公尺。這約佔貨架上剩餘資源的 47%。

歐洲油田設備租賃服務業概況

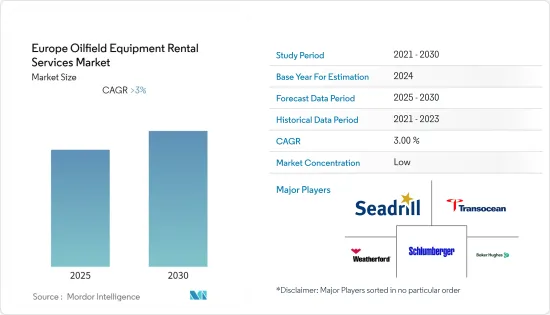

歐洲油田設備租賃服務市場部分細分,市場上有許多大大小小的參與企業。市場的主要企業包括(排名不分先後)Transocean LTD、Seadrill Ord Shs、Schlumberger NV、Baker Hughes Co 和 Weatherford International plc。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 裝置

- 鑽機

- 完井修井鑽機

- 鑽孔機

- 伐木設備

- 其他設備

- 地區

- 英國

- 挪威

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Transocean LTD

- Seadrill Ord Shs

- Valaris Ltd

- Noble Corporation PLC

- Weatherford International plc

- Superior Energy Services Inc.

- Schlumberger NV

- Baker Hughes Co

- Oil States International, Inc.

- Halliburton Company

- Parker Drilling Co

- TechnipFMC PLC

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 47463

The Europe Oilfield Equipment Rental Services Market is expected to register a CAGR of greater than 3% during the forecast period.

Key Highlights

- Over the medium term, Factors, such as increasing exploration and production activities due to increasing crude oil and natural gas demand, are likely to drive the European oilfield equipment rental services market during the forecast period.

- On the other hand, volatile oil and gas prices are leading to uncertainty among oil and gas operators, which is likely to restrain the growth of the Europe oilfield equipment rental services market in the coming years.

- However, advancements in deepwater and ultra-deepwater drilling activities in the region, like Norway and the United Kingdom, are expected to create ample opportunity for the market players in the coming years.

- Norway is expected to dominate the market, owing to the increased exploration activity in the country, to compensate for declining fields elsewhere.

Europe Oilfield Equipment Rental Services Market Trends

Drilling Rigs to Dominate the Market

- After the oil price crisis in 2020, during 2020-22, the rig count, both onshore and offshore, declined significantly. But the period after early 2022 with relatively stabilized crude oil prices is expected to drive the drilling rigs market in the region.

- The offshore operators have committed to significant investments in field developments. As of 2022, Europe was among the largest offshore drilling market in terms of a number of planned and under-pipeline projects.

- Amid the reduced reserves in the North Sea, drilling activity is ever-high, given the attempts to find more oil and gas in deeper waters.

- Other countries like the Netherlands, Norway and the United Kingdom are increasing their drilling activity every year in search of more oil and gas, thus acting as a major driver for this market.

- As crude oil prices increase, investment in the oil and gas industry is expected to grow significantly and bring several projects online, thereby driving the Europe Oilfield Equipment Rental Services Market.

Norway to Dominate the Market

- Norway is expected to maintain its dominance in the region in forecast period, the increased pressure on oil and gas companies to do more in limited money and become more cost-efficient has been driving the market.

- In recent years, the Norwegian oil and gas sector has witnessed major changes across the exploration, development, and production sector.

- The exploration sector is witnessing a major setback, after the biggest party in the country's parliament withdrew its support for exploration drilling around the Lofoten islands in the Arctic Circle. Around 1-3 billion barrel of crude oil is estimated to be present beneath the island. Upstream companies see drilling in the Lofoten islands as crucial for maintaining petroleum production levels, in the coming years.

- As a result, exploration activities in the region are expected to shift toward the Barents Sea. Around two-thirds of Norway's undiscovered resources, especially gas, are estimated to lie in the Barents Sea.

- Development of these resources is expected to significantly increase the natural gas production in the country which have already been steadily rising from 9.72 billion cubic feet per day in 2011 to 11.06 billion cubic feet per day in 2021.

- Norway has had several significant oil and gas discoveries in the past few years, including the giant Johan Sverdrup field. In June 2021, the Norwegian Ministry of Petroleum and Energy announced awards in the 25th licensing round in frontier areas, granting seven companies ownership interests in a total of four production licenses on the Norwegian Shelf. Three of the licenses are placed in the newly opened area in the Barents Sea, while one license is in the Norwegian Sea.

- In 2021, there were considerably higher exploration activities compared to the previous two years. Forty exploration wells were drilled, and 20 discoveries were made on the Norwegian continental shelf. The discoveries have a preliminary total estimate of 81 million standard cubic meters of recoverable oil equivalents. This gives an expected resource growth that is higher than in each of the previous three years.

- The Norwegian Petroleum Directorate has estimated that the undiscovered resources on the Norwegian shelf are at approximately 4 billion standard cubic meters of recoverable oil equivalents. This corresponds to around 47% of all the remaining resources on the shelf.

Europe Oilfield Equipment Rental Services Industry Overview

The European Oilfield Equipment Rental Services Market is partially fragmented, with a number of small and big players in the market. Some of the key players in this market include Transocean LTD, Seadrill Ord Shs, Schlumberger NV, Baker Hughes Co, and Weatherford International plc, among others (not in particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Equipment

- 5.1.1 Drilling Rigs

- 5.1.2 Completion and Workover Rigs

- 5.1.3 Drilling Equipment

- 5.1.4 Logging Equipment

- 5.1.5 Other Equipment

- 5.2 Geography

- 5.2.1 United Kingdom

- 5.2.2 Norway

- 5.2.3 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Transocean LTD

- 6.3.2 Seadrill Ord Shs

- 6.3.3 Valaris Ltd

- 6.3.4 Noble Corporation PLC

- 6.3.5 Weatherford International plc

- 6.3.6 Superior Energy Services Inc.

- 6.3.7 Schlumberger NV

- 6.3.8 Baker Hughes Co

- 6.3.9 Oil States International, Inc.

- 6.3.10 Halliburton Company

- 6.3.11 Parker Drilling Co

- 6.3.12 TechnipFMC PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219