|

市場調查報告書

商品編碼

1683539

海上油田服務-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Offshore Oilfield Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

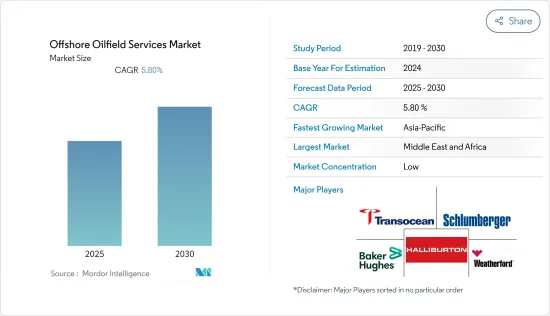

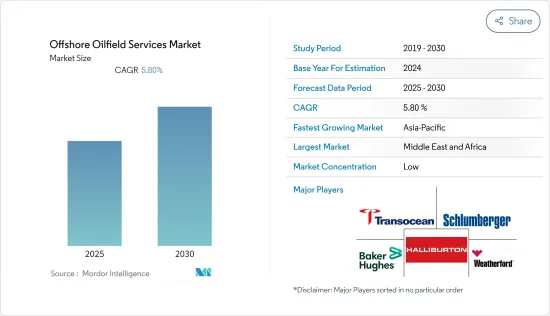

預計預測期內海上油田服務市場複合年成長率為 5.8%。

2020年,新冠肺炎疫情對市場產生了負面影響。目前市場已經恢復到疫情前的水準。

主要亮點

- 從中期來看,預計預測期內海上石油和天然氣探勘和生產活動增加等因素將推動市場發展。

- 然而,預測期內各地區和國家對多項海上活動的禁令預計將阻礙市場的成長。

- 然而,預計未來的多項技術進步和可用資源的最佳化將為海上油田服務市場創造大量機會。

- 由於最近的深水探勘和生產活動,預計亞太地區在預測期內將見證顯著的市場成長。

海上油田服務市場趨勢

鑽井服務可望主導市場

- 海上鑽井服務是指將鑽管插入海底表面形成油井的過程。泵浦與管道相連,將地面上的石油泵出。從海底開採石油和天然氣的常用方法包括旋轉鑽井、定向鑽井、控壓鑽井(MPD)和衝擊鑽井。

- 據貝克休斯稱,亞太地區持有世界上最多的海上石油和天然氣鑽井鑽機。截至 2022 年 10 月,該地區共有 86 個海上鑽機。

- 深水石油生產集中在四個國家:安哥拉、巴西、奈及利亞和美國。過去幾年,深水投資在海上投資中佔了很大佔有率,反映了墨西哥灣和拉丁美洲近海(巴西和圭亞那)的機會。

- 成熟的海上油田也為海上鑽井服務市場創造了機會。隨著石油公司將注意力轉向挪威大陸棚(NCS)更成熟的區域,挪威計劃將將近海的探勘鑽探量增加一倍。此外,在安哥拉,隨著淺水區的成熟,深海域產量將會增加。因此,預計在預測期內,成熟油田增產計畫將推動海上鑽井服務的需求。

- 2022年2月,阿布達比國家石油公司(ADNOC)啟動了巨型下札庫姆海上油田進一步開發的工程、採購、施工和安裝合約的競標程序。預計這一發展將在預測期內加強海上探勘活動並推動對鑽井服務的需求。

- 2022年,沙烏地阿拉伯和科威特同意開發位於兩國中立區之間的杜拉海上天然氣田。該海上油田預計每天生產10億立方英尺天然氣和84,000桶冷凝油。

- 因此,鑑於上述情況,預計鑽井服務將在預測期內佔據市場主導地位。

亞太地區:預計大幅成長

- 另一個大型海上油田服務市場在亞太地區,印度、中國和印尼等國家佔據了很大一部分市場佔有率。

- 中國是世界第五大原油生產國,2021年原油日產量為399.4萬桶。自2015-2016年油價暴跌以來,由於上游支出削減,原油產量一直呈下降趨勢。

- 然而,2019年,習近平主席推動加速國內探勘和生產活動(特別是天然氣)並提高國家安全,這可能導致一些公司,特別是中國海洋石油集團公司(中海油)、中國石油天然氣集團公司(中石油)和中國石油化工集團公司(中石化)增加其海上資本投資。

- 2021年11月,中國國營石油公司中海油宣布南海東部陸豐海上油田投產。主要生產設施包括兩座鑽井生產平台和一套水下生產系統。

- 中海油也宣布,計劃在未來幾年開發一批深水油田,目標是到2025年將探勘工作量和探明蘊藏量增加一倍。

- 2022年10月,中海油前三季成功完成14個發現,估算20個含油氣構造。第三季度,中海石油共獲得5個發現,預計建造4個油氣構造。已有6個新計畫投入生產,計劃7個項目計劃於2022年推進。中國近海流花28-2西部氣田的發現預計將帶動流花28-2構造帶中小型天然氣田的開發,鹽城13-10天然氣田的發現預計將帶動鹽城13-1氣田的接替。

- 此外,印度石油天然氣公司計劃於 2022 年 12 月在安得拉邦鑽探 53 口探勘井,其中在 KG 盆地的 Godavari 陸上 PML 區塊鑽探 50 口,在 Cuddepar 盆地的 CD-ON HP- 2020 /1(OALP-Vial)在 Cuddepar 盆地的 CD-ON HP- 2020 /1(OALP-Vial)在 Cuddepar 盆地的 CD-ON HP- 總合/1(OALP-Vial)在 Cuddepar 盆地的 CD-ON HP- 2020 /1(OALP-Vial)在印度鑽探63 口, 提案億盧比(65,500 億盧比)。

- 因此,預計亞太地區在預測期內將顯著成長。

海上油田服務業概況

海上油田服務市場中等分散。該市場的主要企業(不分先後順序)包括 Transocean、Schlumberger、Baker Hughes、Weatherford International 和 Halliburton。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 2028 年市場規模與需求預測

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 驅動程式

- 限制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 服務類型

- 鑽井服務

- 完工服務

- 固井服務

- 水力壓裂服務

- 其他完井服務

- 生產和干涉服務

- 測井服務

- 生產測試

- 油井服務

- 其他生產和干涉服務

- 其他服務(包括海上直升機服務、地震資料收集和處理、海上供應船、退役)

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 亞太地區

- 中國

- 印度

- 印尼

- 馬來西亞

- 其他亞太地區

- 歐洲

- 德國

- 英國

- 挪威

- 丹麥

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Schlumberger Limited

- Baker Hughes Company

- Weatherford International PLC

- Halliburton Company

- Transocean LTD.

- Valaris Plc

- China Oilfield Services Limited

- Nabors Industries Ltd.

- TechnipFMC PLC

- OiLSERV

- Expro Group Holdings NV

第7章 市場機會與未來趨勢

簡介目錄

Product Code: 92095

The Offshore Oilfield Services Market is expected to register a CAGR of 5.8% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as increasing offshore oil and gas exploration and production activities are expected to drive the market during the forecast period.

- On the other hand, a ban on several offshore activities in various regions and countries is expected to hinder market growth during the forecast period.

- Nevertheless, several technological advancements and the optimization of available resources are expected to create many opportunities for the offshore oilfield services market in the future.

- Asia-Pacific, due to its recent deep-water exploration and production activities, is expected to witness significant market growth during the forecast period.

Offshore Oilfield Services Market Trends

Drilling Services Expected to Dominate the Market

- Offshore drilling services refer to the process by which tubing is bored through the earth's surface beneath a sea and a well is established. A pump is connected to the tube, and the petroleum under the surface is forcibly removed from underground. The most common drilling methods used to extract oil and gas beneath the sea are rotary drilling, directional drilling, managed pressure drilling (MPD), percussion drilling, and others.

- According to Baker Hughes Company, the Asia-Pacific region hosts the most offshore oil and gas rigs worldwide. As of October 2022, there were 86 offshore rigs in that region.

- Deepwater oil production is concentrated in four countries: Angola, Brazil, Nigeria, and the United States. During the past years, deepwater investments have retained a significant share of offshore investments, reflecting opportunities in the Gulf of Mexico and offshore Latin America (Brazil and Guyana).

- Mature offshore fields are also creating opportunities for the drilling services market in the offshore segment. In Norway, oil companies plan to nearly double exploration drilling offshore Norway to focus on more mature areas of the Norwegian Continental Shelf (NCS). Moreover, Angola's deepwater production is also set to ramp up as its shallow-water sector matures. Therefore, owing to the plans to increase production from mature fields, the demand for drilling services in the offshore segment is expected to be driven during the forecast period.

- In February 2022, Abu Dhabi National Oil Company (ADNOC) kicked off a bid process for an engineering, procurement, construction, and installation contract for further development at its huge Lower Zakum offshore oilfield. The development is expected to bolster offshore exploration activities and drive demand for drilling services during the forecast period.

- In 2022, Saudi Arabia and Kuwait agreed to develop the Durra offshore gas field that lies between the neutral zones of both countries. The offshore oilfield is expected to produce 1 billion cubic feet per day and 84,000 barrels per day of condensate.

- Therefore, due to the above points, drilling services are expected to dominate the market during the forecast period.

Asia-Pacific Expected to Witness Significant Growth

- Another sizable offshore oilfield services market is in the Asia-Pacific region, where nations like India, China, Indonesia, etc. dominate the market in large part.

- China was the fifth-largest producer of crude oil globally, producing 3,994 thousand barrels per day in 2021. Since the 2015-2016 slump in oil prices, crude oil production was on the decline, owing to cuts in upstream spending.

- However, in 2019, as a result of President Xi Jinping's call to expedite domestic exploration and production activities (particularly for natural gas) and to improve national security, multiple companies, particularly CNOOC, CNPC, and Sinopec, were likely to increase their capital expenditures in the offshore regions.

- In November 2021, the Chinese national oil company CNOOC declared that it started production from Lufeng offshore oil fields in the eastern part of the South China Sea. The main production facilities include two drilling production platforms and one subsea production system.

- CNOOC also announced its plans to develop a deepwater oilfield complex in the next few years, and it aims to double its exploration workload and proven reserves by 2025.

- In October 2022, CNOOC successfully made 14 discoveries and estimated 20 oil and gas structures for the first three quarters. In the third quarter, CNOOC made five discoveries, and four oil and gas structures were estimated to be built. Six new projects were placed into production, and seven other projects were planned to progress in 2022. The development of the small and medium-sized gas fields in the Liuhua 28-2 Tectonic Belt is expected to be driven by the Liuhua 28-2 West discovery in offshore China, and the replacement of the Yancheng 13-1 gas field is anticipated to be contributed by the discovery of Yacheng 13-10.

- Further, in December 2022, the Oil and Natural Gas Corporation Ltd. proposed drilling 53 exploratory wells in Andhra Pradesh, fifty in the KG Basin's Godavari on-land PML Block, and three in the Cuddapah basin's CD-ON HP-2020/1 (OALP-Vi) Block, with an investment of INR 2,150 crore (USD 263056370.00).

- Therefore, owing to the above points, Asia-Pacific is expected to witness significant growth during the forecast period.

Offshore Oilfield Services Industry Overview

The offshore oilfield services market is moderately fragmented. Some of the major players in the market (in no particular order) include Transocean Ltd., Schlumberger Limited, Baker Hughes Company, Weatherford International PLC, and Halliburton Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, until 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products & Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.2.1 Cementing Services

- 5.1.2.2 Hydraulic Fracturing Services

- 5.1.2.3 Other Completion Services

- 5.1.3 Production and Intervention Services

- 5.1.3.1 Logging Services

- 5.1.3.2 Production Testing

- 5.1.3.3 Well Services

- 5.1.3.4 Other Production and Intervention Services

- 5.1.4 Other Services (includes Offshore Helicopter Services, Seismic Data Acquisition and Processing, Offshore Supply Vessels, and Decommissioning)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Asia-Pacific

- 5.2.2.1 China

- 5.2.2.2 India

- 5.2.2.3 Indonesia

- 5.2.2.4 Malaysia

- 5.2.2.5 Rest of Asia-Pacific

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Norway

- 5.2.3.4 Denmark

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Nigeria

- 5.2.5.4 Rest of Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger Limited

- 6.3.2 Baker Hughes Company

- 6.3.3 Weatherford International PLC

- 6.3.4 Halliburton Company

- 6.3.5 Transocean LTD.

- 6.3.6 Valaris Plc

- 6.3.7 China Oilfield Services Limited

- 6.3.8 Nabors Industries Ltd.

- 6.3.9 TechnipFMC PLC

- 6.3.10 OiLSERV

- 6.3.11 Expro Group Holdings NV

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219