|

市場調查報告書

商品編碼

1637873

北美化妝品包裝:市場佔有率分析、行業趨勢和成長預測(2025-2030)North America Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

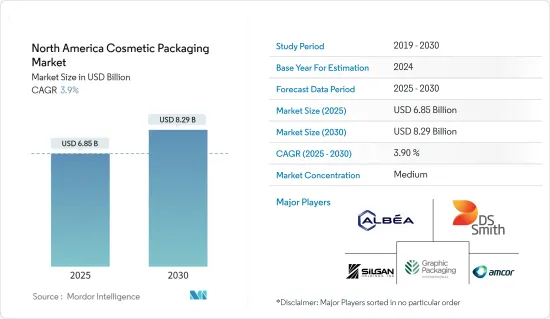

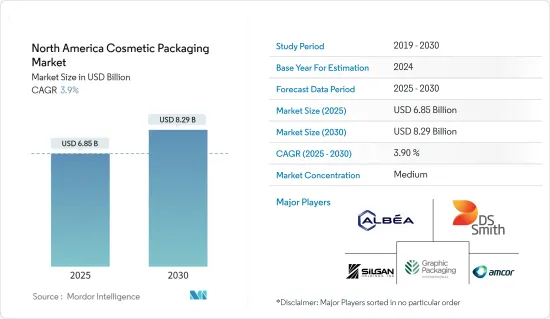

北美化妝品包裝市場規模預計到2025年為68.5億美元,預計2030年將達到82.9億美元,預測期內(2025-2030年)複合年成長率為3.9%。

化妝品包裝在各類化妝品中扮演至關重要的角色。各種化妝品包裝設計讓包裝看起來美觀大方、吸引人。消費者對化妝品以增強美麗外觀的需求不斷成長,預計將推動市場成長和對可重複使用包裝的需求。

主要亮點

- 在北美,市場正在經歷一場有利於清潔、營養品牌的重組。這導致了 RMS Beauty 和 Bite Beauty 等品牌的發展,這些品牌在口紅和多功能棒中使用食品級成分。支持該地區包裝產業發展的趨勢包括持續的健康和永續性趨勢,以及消費者對個人保健產品興趣的增加。預計這種趨勢將持續下去,並且對類似的新包裝的需求正在增加。

- 近年來,人們對個人形象意識的增強增加了對化妝品的需求,導致全部區域化妝品包裝市場的成長。

- 化妝品市場對奢侈品的需求不斷成長,導致對創新和優質包裝的需求不斷增加。對優質化妝品的需求不斷成長,推動了對獨特優質包裝的需求。這種優質化趨勢正在推動由玻璃和其他特殊材料製成的優質包裝的使用增加。然而,原物料價格的波動可能會阻礙市場成長。

- 化妝品行業對包裝的要求多種多樣。化妝品行業現在似乎正在聯合起來,透過創新的包裝策略和複雜的配方來減少塑膠包裝的使用。玻璃是最古老的包裝材料之一,無孔且不滲透。它不會劣化並具有化學惰性。玻璃賦予產品優雅的外觀,讓買家看到裡面的東西及其顏色,這樣他們就知道他們得到的東西。這是北美奢侈化妝品品牌高度採用玻璃包裝的主要原因之一。

- 由於人們越來越意識到合成美容產品的風險,天然和有機化妝品變得越來越受歡迎,合成美容產品富含可能導致皮膚癌、阿茲海默症、過敏、出生缺陷等的化學物質。

- 根據全球化妝品產業2023年12月發布的消息,彩妝已成為美國化妝品市場表現最好的品類。報告也表示,財務壓力降低了消費者的購買慾望,但鼓勵他們花錢購買那些讓他們感覺良好、力所能及的產品。

北美化妝品包裝市場趨勢

玻璃材質可望錄得大幅成長

- 玻璃是一種高度永續的產品,可以無限期回收而不會損失體積。這種類型的包裝可實現獨特的設計和創新,並為護膚和香水領域的品牌提供卓越的產品差異化。

- 該地區的化妝品行業已經成熟,正在齊心協力減少塑膠污染。市場參與企業正試圖利用新的包裝策略和複雜的配方來實現這一目標。 Verescent 推出了 Proenza Schouler 的首款香水 Arizona,採用了一種名為 SCULPT'in 技術的創新玻璃製造程序,打造出具有不對稱玻璃分佈的獨特玻璃瓶。這些技術進步正在幫助公司擴大產品陣容。

- 由於指甲護理產品市場的快速擴張,北美化妝品行業的玻璃瓶市場正在經歷顯著成長。這一成長是由凝膠和藝術指甲油的流行所推動的,而傳統液體指甲油的需求仍預計會增加。

- 化妝品行業正在經歷前所未有的成長並創造創紀錄的收益。男士美容和天然/有機化妝品等領域的佔有率正在迅速增加。此外,社群媒體、生態意識和事業驅動的消費主義正在對購買決策產生重大影響。化妝品產業是一個龐大、不斷變化的產業,已成為經濟不可或缺的一部分。這些也是未來市場進一步成長的一些關鍵因素。

- 根據Happi統計,2023年美國彩妝品銷售額為72億美元。臉部化妝品獲得了巨大的市場佔有率,銷售額達 23 億美元。美國對彩妝品的需求正在影響化妝品包裝的趨勢,推動材料、設計和功能的創新,以滿足不斷變化的消費者偏好和市場需求。

加拿大預計將出現顯著成長

- 從長遠來看,隨著人們對天然成分益處的認知不斷增強,天然化妝品的普及預計將加速。再加上多年來該國優質功能產品購買量的穩定成長,預計將有助於市場在預測期內復甦。

- 此外,對天然或有機、無殘忍和無農藥化妝品以及創新和環保包裝設計的需求不斷成長,預計將進一步加強該國市場。此外,社群媒體和電子商務管道也顯著提高了化妝品和護膚領域的受歡迎程度和可用性,推動了該行業的成長。由於人們傾向於在外表上花費更多,並且居住者的數量不斷增加,該國的家庭支出顯著增加。

- 製造商專注於其產品的創新包裝,因為男性和女性都被設計和奢華的產品包裝所吸引。此外,男性在日常生活中對化妝品的使用也正在增加。預計將進一步提振加拿大化妝品市場。

- 加拿大的經濟復甦使美國公司能夠進入不斷成長的市場。加拿大強勁而充滿活力的經濟為尋求進入和發展化妝品市場的美國化妝品公司提供了可靠的市場。該行業包括許多產品,包括但不限於肥皂、化妝品、化妝品、指甲膠、紋身墨水和染髮劑。

- 根據加拿大廣播公司2023年11月發布的消息,化妝品已成為藥局和藥局零售商可靠的業務驅動力。加拿大零售商 Loblaw 報告稱,其健康的收益並非得益於雜貨通膨,部分原因在於化妝品等高利潤領域的銷售成長。

- 新化妝品原料和生物活性劑的開發對加拿大化妝品製造業至關重要。該行業的成功主要取決於產品創新、有吸引力的銷售和行銷以及高效的營運。

- 根據加拿大統計局的數據,2023年第三季加拿大市場的化妝品和香水零售為13.8084億美元。加拿大化妝品和香水的穩定銷售正在推動北美化妝品包裝的創新,重點是永續性、便利性和美學吸引力,以滿足不斷變化的消費者偏好。由於需求激增,化妝品品牌正在投資環保材料、易於使用的設計和視覺吸引力的包裝,以贏得市場佔有率並提高整個北美的品牌認知度。

北美化妝品包裝產業概況

北美化妝品包裝市場是半固定的,Albea SA、AptarGroup Inc.和Graphic Packaging Holding Co.等大公司佔據了市場佔有率。市場上的供應商專注於可再生和氣候友善的包裝解決方案,並利用聯盟和收購作為競爭策略。例如

- 2023年11月,Quadpack與美國射出成型公司Colt's Plastics合作,開始在美國生產無氣產品。該公司向區域品牌提供最暢銷的 Regula 無氣補充裝系列,減少了前置作業時間和碳足跡。 Regula 無氣補充裝是首批推出的系列之一。這種高階解決方案將無氣技術的所有優點與生態設計相結合,包括奶粉保護、高復原率、精確劑量和 360 度使用。

- 2023年9月,Albea Tubes與法國化妝品品牌歐舒丹合作,更新Albea 30ml護手霜系列的包裝。新的包裝解決方案採用全塑膠層壓板,帶有多層高密度聚苯乙烯(HDPE)套管和塑膠回收再利用協會認證的綠葉管。這種新管可在法國、歐洲和美國現有的 PE 回收流程中回收。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 擴大化妝品消費

- 越來越注重創新和有吸引力的包裝

- 市場限制因素

- 對永續性的興趣日益濃厚

第6章 市場細分

- 依材料類型

- 塑膠

- 玻璃

- 金屬

- 紙

- 依產品類型

- 塑膠瓶/容器

- 玻璃瓶/容器

- 金屬容器

- 折疊式紙盒

- 瓦楞紙箱

- 管和棒

- 蓋子和封口

- 泵浦和分配器

- 滴管

- 安瓿

- 軟質塑膠包裝

- 依化妝品類型

- 頭髮護理

- 彩妝品

- 護膚

- 男士美容

- 除臭劑

- 其他化妝品

- 按國家/地區

- 美國

- 加拿大

第7章 競爭格局

- 公司簡介

- Albea SA

- HCP Packaging Co. Ltd

- Berry Global Group

- Silgan Holdings Inc.

- DS Smith PLC

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor PLC

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Corp.

- Gerresheimer AG

- Berlin Packaging LLC

第8章投資分析

第9章市場的未來

The North America Cosmetic Packaging Market size is estimated at USD 6.85 billion in 2025, and is expected to reach USD 8.29 billion by 2030, at a CAGR of 3.9% during the forecast period (2025-2030).

Cosmetic packaging plays an essential role in various kinds of cosmetic products. Various cosmetic packaging designs make the packaging look engaging and attractive. The increasing need for cosmetics to help consumers improve their beautiful appearance is anticipated to enhance the market's growth and demand for reusable packaging.

Key Highlights

- North America has experienced higher levels of market re-arrangement in favor of clean, nutrient-rich brands. This has led to the growth of brands like RMS Beauty or Bite Beauty, which uses food-grade ingredients for its lipsticks and multi-sticks. The trends supporting the development of the packaging industry in the region include ongoing wellness and sustainability trends that increase consumer interest in personal care products. This trend is projected to continue, increasing the need for new packaging on similar lines.

- In recent years, there has been an increase in consciousness regarding personal appearance among individuals, leading to an increased demand for cosmetic products and the growth of the cosmetic packaging market across the region.

- The cosmetics market is undergoing an increased need for premium products, resulting in a growing demand for innovative and premium packaging. A rising demand for high-end cosmetics products drives the need for creative and premium packaging. This trend toward premiumization is causing an increase in the use of upscale packaging made of glass and other specialty materials. However, raw material price fluctuations can hinder the market's growth.

- The cosmetic industry has varied packaging requirements. The cosmetics industry now seems united to reduce the usage of plastic packaging through innovative packaging strategies and refined formulations. Glass is one of the oldest packaging materials, which is nonporous and impermeable. It does not degrade, providing chemically inert properties. Glass adds to the premium appeal of the products and allows buyers to see the content and its color, thus giving them an idea of what they are getting. This is one of the main reasons for the high adoption rate of glass packaging among premium cosmetics brands across North America.

- There has been a significant growth in the popularity of natural and organic cosmetics due to the increased awareness of the risks of synthetic beauty products, which are laden with chemicals that can cause skin cancers, Alzheimer's, allergies, and congenital disabilities.

- As per news published by the global cosmetics industry in December 2023, makeup emerged as the strongest-performing category in the US cosmetics market. The report further stated that economic stress can make consumers purchase less overall, but it also encourages spending on feel-good products within their reach.

North America Cosmetic Packaging Market Trends

Glass Material is Expected to Register Significant Growth

- Glass is a highly sustainable product, which means it can be recycled indefinitely, and there is no loss in quantity. This type of packaging allows for unique design and innovation, offering exceptional product differentiation for brands in the skincare and fragrance segments.

- The cosmetics industry in the region has matured and is working together to reduce plastic pollution. The players in the market are using new packaging strategies and refined formulations to achieve this. Verescence, a company that launched Proenza Schouler's debut scent named 'Arizona,' used an innovative glass-making process called SCULPT'in technology to create a unique glass bottle with an asymmetric distribution of glass. These technological advancements have helped companies expand their offering.

- The glass bottle market is experiencing significant growth in the North American cosmetic industry due to the rapidly expanding nail care products market. This growth is fueled by the popularity of gel formulas and artistic manicures, while traditional liquid nail polishes are still expected to increase in demand.

- The cosmetics industry is growing unprecedentedly, with record revenues being generated. Sectors such as men's grooming and natural/organic cosmetics are gaining market share rapidly. Moreover, social media, eco-consciousness, and cause-based consumerism significantly influence purchasing decisions. The cosmetics industry is an ever-changing behemoth that has become an integral part of the economy. These are some of the critical factors that will also help the market grow further in the future.

- As per Happi Magazine, the color cosmetics sales in the United States in 2023 stood at USD 7.20 billion. Facial cosmetics acquired a significant market share, generating a revenue of USD 2.30 billion. The demand for color cosmetics in the United States influences cosmetic packaging trends, fostering innovations in materials, designs, and functionalities to meet evolving consumer preferences and market demands.

Canada Expected to Register Significant Growth

- Over the long term, with the rising awareness about the benefits of natural ingredients, the popularity of natural cosmetics is expected to accelerate. This, coupled with the steady rise in the purchase of premium functional products in the country over the years, is expected to aid the market's recovery over the forecast period.

- Moreover, the increasing demand for natural or organic, no animal tested, and cruelty-free cosmetic products and innovative and eco-friendly packaging designs is expected to enhance the market further in the country. In addition, social media and e-commerce channels have also significantly increased the popularity and availability of cosmetics and skincare segments, driving the industry's growth. The country witnessed a significant increase in household expenditure due to the inclination of people toward spending on appearance and an increasing settlement of the ex-pat population in the country.

- The manufacturers are focused more on innovative packaging of products as men and women are attracted to the design and exclusive product packaging. There has also been a rise in the utilization of cosmetics among men in their daily regimes. This is expected to boost Canada's cosmetics products market further.

- Canada's economic recovery allows US companies to become involved in a growing market. Canada's strong and vibrant economy provides a reliable market for American cosmetic companies seeking to enter and grow within the cosmetics market. The industry encompasses many products, including but not limited to soaps, makeup, makeup, nail adhesives, tattoo inks, and hair dyes.

- According to Canadian Broadcasting Corporation news published in November 2023, cosmetics became a reliable business driver for pharmacy and drugstore retailers. Loblaw, a retail Canadian company, reported that its healthy earnings are not because the grocer is taking advantage of food inflation but are partly due to sales growth in high-margin areas like cosmetics.

- Developing new cosmetic materials and bio-actives is integral to the Canadian cosmetics manufacturing industry. Success within the industry depends mainly on product innovation, compelling sales and marketing, and efficient operations.

- As per Statistics Canada, the Canadian market generated USD 1380.84 million in the third quarter of 2023 through its retail cosmetics and fragrances sales. The steady sales of cosmetics and fragrances in Canada are driving innovation in North American cosmetic packaging, focusing on sustainability, convenience, and aesthetic appeal to cater to evolving consumer preferences. The surge in demand is prompting cosmetic brands to invest in eco-friendly materials, user-friendly designs, and visually appealing packaging to capture market share and enhance brand perception across the continent.

North America Cosmetic Packaging Industry Overview

The North American cosmetic packaging market is semi consolidated with the presence of major players like Albea SA, AptarGroup Inc., and Graphic Packaging Holding Co. dominating market share. Vendors in the market are leveraging partnerships and acquisitions as a competitive strategy and are focusing on climate-friendly packaging solutions that are both renewable and recyclable. For instance,

- In November 2023, Quadpack began the production of its airless products in the United States by partnering with US injection molding company Colt's Plastics. The company offers its best-selling Regula Airless Refill range locally to regional brands, with quicker lead times and a reduced carbon footprint. Regula Airless Refill is one of the first ranges to be introduced. This high-end solution combines all the advantages of airless technology, including formula protection, a high restitution rate, precision dosage, and 360-degree usage, with an eco-design.

- In September 2023, Albea Tubes partnered with French cosmetics brand L'Occitane to redesign the packaging of Albea's 30 ml hand cream collection. The new packaging solution features an all-plastic laminate and an Association of Plastic Recyclers-certified Greenleaf tube with a multilayer sleeve in high-density polyethylene (HDPE). The new tube is recyclable in existing PE recycling streams in France, Europe, and the United States.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Cosmetic Products

- 5.1.2 Increasing Focus on Innovation and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 Growing Sustainability Concerns

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Product Type

- 6.2.1 Plastic Bottles & Containers

- 6.2.2 Glass Bottles & Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tubes & Sticks

- 6.2.7 Caps & Closures

- 6.2.8 Pump & Dispenser

- 6.2.9 Droppers

- 6.2.10 Ampoules

- 6.2.11 Flexible Plastic Packaging

- 6.3 By Cosmetic Type

- 6.3.1 Hair Care

- 6.3.2 Color Cosmetics

- 6.3.3 Skin Care

- 6.3.4 Men's Grooming

- 6.3.5 Deodorants

- 6.3.6 Other Cosmetic Types

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 Berry Global Group

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Libo Cosmetics Company Ltd

- 7.1.7 AptarGroup Inc.

- 7.1.8 Amcor PLC

- 7.1.9 Cosmopak Ltd

- 7.1.10 Quadpack Industries SA

- 7.1.11 Rieke Corp.

- 7.1.12 Gerresheimer AG

- 7.1.13 Berlin Packaging LLC