|

市場調查報告書

商品編碼

1637895

日本紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Japan Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

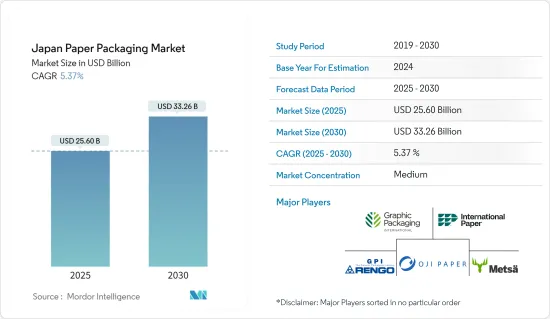

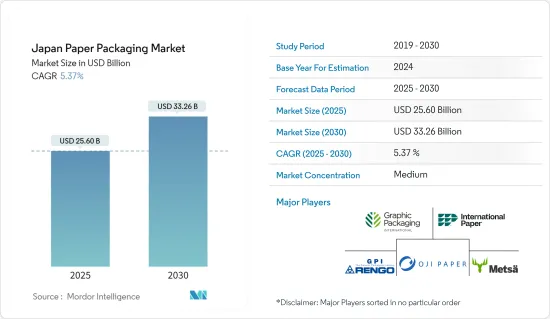

日本紙包裝市場規模預計在 2025 年將達到 256 億美元,預計到 2030 年將達到 332.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.37%。

主要亮點

- 日本是世界上人均塑膠廢棄物排放第二大的國家,僅次於美國。預計日本更嚴格的國際法規將促使製造商滿足各行各業對永續包裝材料(尤其是紙質包裝材料)日益成長的需求。

- 日本是紙製品的重要消費國,其消費領域涵蓋報紙紙張、包裝、印刷和通訊、衛生和其他用途等多個行業。該地區的食品製造商開始意識到塑膠包裝的缺點,並準備改用紙質包裝。

- 該地區的大型塑膠購物袋供應商,如工業,已經經歷了雜貨店對塑膠購物袋的需求下降。下降的原因是法律明確要求顧客為行李支付費用。該公司預計近期訂單將下降三分之一。工業宣布投資材料開發,以減少對環境的影響和生產成本。

- 日本製紙等日本主要造紙公司正打算利用塑膠需求下降的機會。日本製紙工業公司宣布擴大其紙基阻隔材料的應用,以保護產品免受空氣和水的侵害。據該公司介紹,作為塑膠替代品的紙和紙板包裝材料的需求逐年增加。紙質包裝材料佔日本製紙總銷售額的70%。

- 儘管人們越來越關注永續性和減少廢棄物,但紙包裝產業仍面臨挑戰。由於人們認為紙質包裝不如替代材料環保,因此對紙質包裝的需求可能會下降。它們還面臨塑膠、金屬和玻璃等具有耐用性和成本優勢的材料的競爭。此外,紙漿和紙張等原料價格的波動也會影響紙包裝製造商的盈利。

日本紙包裝市場的趨勢

紙板有望實現強勁成長

- 日本的紙和紙板包裝市場正在健康成長。食品飲料和加工食品的成長正在推動日本對瓦楞包裝的需求。日本加工食品產業的成長預計也將成為紙板包裝市場的主要驅動力之一。

- 為了減少塑膠的使用以及相應的策略開發,紙質包裝的採用大幅增加,從而推動了市場的發展。此外,該地區的主要紙張製造商正在擴大其市場佔有率,預計這將支持市場成長。

- 雀巢日本也推出了其著名套件巧克力棒的新微型包裝,並宣布計劃在 2025 年使用 100% 可回收包裝。新的紙質包裝也將獲得森林管理委員會的認證,並且完全可回收。

- 據有機貿易協會稱,2021 年日本有機包裝食品市場的零售額為 4.166 億美元。預計到 2025 年市場規模將達到 4.271 億美元。

- 有機食品通常需要符合其環保形象的包裝。此類產品通常使用可回收、生物分解性的紙板。隨著有機包裝食品市場的成長,預計將有更多公司使用紙板來滿足消費者對永續包裝的偏好。

零售業大幅成長

- 日本是全球成長最快的電子商務市場之一,發展穩定,擁有樂天、亞馬遜等全球大型公司的存在。伊藤洋華堂等超級市場電商平台也大力推廣使用紙質包裝。

- 電子商務的成長導致對包裝材料的需求大幅增加。許多電子商務企業更喜歡紙質包裝,因為它環保且具有成本效益。

- 紙包裝的回收成本通常比塑膠和玻璃等材料低。此外,再生紙市場規模龐大,包裝是廣泛使用再生紙產品的眾多產業之一。

- 再生紙的需求量很大,因此它比替代材料更便宜。紙質包裝的回收成本低,對於希望降低包裝成本同時支持永續實踐的電子商務和零售企業來說,這是一個有吸引力的選擇。

- 根據經濟產業省統計,2023年12月零售業銷售額為1,106.7億美元,較2023年4月的940.1億美元略有成長。銷售額的成長可能導致零售商擴大其產品供應,從而可能產生對更多樣化包裝解決方案的需求,包括專門的紙質包裝選擇,例如客製化設計的盒子和環保材料。

日本紙包裝產業概況

市場呈現半分散狀態,Graphic Packaging、International Paper Company 和 Rengo 等公司利用塑膠包裝需求下降和客戶對紙質包裝的偏好來推動需求成長,發揮重要作用。為了獲得市場佔有率,供應商正在加強其產品線,並透過合作和收購來制定經營模式策略,並專注於永續性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 食品和飲料行業的需求增加

- 對塑膠包裝產品的限制將促進需求增加

- 市場限制

- 原料成本上漲和外包

第6章 市場細分

- 按產品

- 紙板

- 箱板紙

- 紙板

- 其他產品

- 按最終用戶產業

- 飲食

- 個人護理

- 居家護理

- 衛生保健

- 零售

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Graphic Packaging International Corporation

- International Paper Company

- Rengo Co. Ltd

- Oji Paper Co. Ltd

- Metsa Group

- Amcor Group GmbH

- Daio Paper Corporation

- THE PACK CORPORATION

第8章 市場機會與未來趨勢

The Japan Paper Packaging Market size is estimated at USD 25.60 billion in 2025, and is expected to reach USD 33.26 billion by 2030, at a CAGR of 5.37% during the forecast period (2025-2030).

Key Highlights

- Japan ranks as the world's second-largest producer of plastic waste per capita, following the United States. Stringent international regulations in Japan are expected to drive manufacturers toward meeting the increasing demand for environmentally sustainable packaging materials, particularly paper packaging, across various industries.

- Japan is a significant consumer of paper-based products across multiple industries, including newsprint, packaging, printing and communication, sanitary, and other miscellaneous applications. Food manufacturers in the region have begun to recognize the disadvantages of plastic wrapping and are preparing to transition to paper packaging.

- Major plastic bag suppliers in the region, such as Fukusuke Kogyo, are experiencing decreased demand for plastic bags at grocery stores. This decline is attributed to customers being legally required to pay explicitly for bags. The company anticipates a one-third decrease in orders in the near future. Fukusuke Kogyo has announced investments in materials development to reduce environmental impacts and production costs.

- Leading paper manufacturing companies in Japan, such as Nippon Paper, are aiming to capitalize on the decreasing demand for plastic. Nippon Paper has announced the expansion of paper-based barrier materials that protect products from air and water. According to the company, the demand for paper and paperboard packaging materials has increased over the years as a replacement for plastics. Paper-based packaging materials account for 70% of Nippon Paper's total sales.

- While sustainability and waste reduction have gained prominence, the paper packaging industry faces challenges. There is a potential decline in demand due to perceptions of paper packaging being less environmentally friendly than alternative materials. The industry also faces competition from materials like plastic, metal, and glass, which offer advantages in durability and cost. Additionally, fluctuating prices of raw materials such as pulp and paper potentially impact the profitability of paper packaging producers.

Japan Paper Packaging Market Trends

Paperboard is Anticipated to Witness Significant Growth

- The paper and paperboard packaging market in Japan is experiencing healthy growth. Beverages and packaged food growth have fueled the demand for corrugated packaging in the country. Japan's growing processed food industry is also expected to act as one of the critical drivers for the paperboard packaging market.

- The market is led by the massively growing adoption of paper packaging in response to reduced plastic usage and the respective strategic developments. Furthermore, major paper manufacturing companies in the region aiming to capitalize on developments to cater to the market are expected to support market growth.

- Also, in line with the announcement of Nestle Japan's plan to use 100% recyclable packaging by 2025, Nestle Japan released new packaging for its famous miniature KitKat Chocolate bars featuring origami paper instead of plastic materials. Also, the new paper packaging is set to receive the Forest Stewardship Council certification and is fully recyclable.

- According to the Organic Trade Association, in 2021, the retail value of the organic packaged food market in Japan accounted for USD 416.6 million. The market size is expected to reach USD 427.1 million in 2025.

- Organic food products often require packaging that aligns with their eco-friendly image. Recyclable and biodegradable paperboard is a popular choice for such products. As the organic packaged food market grows, more companies are expected to use paperboard to meet consumer preferences for sustainable packaging.

Retail is Observing Notable Growth

- Japan boasts one of the world's fastest-growing e-commerce markets, with consistent development and the presence of global giants like Rakuten and Amazon. The country also hosts supermarket e-commerce platforms such as Ito-Yokado and Markets, which promote paper packaging use.

- The growth of e-commerce has significantly increased demand for packaging materials. Many e-commerce businesses prefer paper packaging due to its environmental friendliness and cost-effectiveness.

- Paper packaging typically has lower recycling costs than materials like plastics and glass. Additionally, there is a substantial market for recycled paper, with packaging being one of many industries extensively using recycled paper products.

- The high demand for recycled paper makes it less expensive than alternative materials. Paper packaging's lower recycling cost makes it an attractive option for e-commerce and retail businesses aiming to reduce packaging expenses while supporting sustainable practices.

- According to the Ministry of Economy, Trade and Industry, commercial sales in the retail industry accounted for USD 110.67 billion in December 2023, a slight increase from USD 94.01 billion in April 2023. This rise in sales may lead retailers to expand their product ranges, potentially increasing demand for diverse packaging solutions, including specialized paper packaging options such as custom-designed boxes and eco-friendly materials.

Japan Paper Packaging Industry Overview

The market is semi-fragmented, with the presence of players like Graphic Packaging, International Paper Company, and Rengo Co. Ltd, which play vital roles in upscaling the rise in the demand, leveraging the declining demand for plastic packaging and customers' preference for paper-based packaging. To capture the market share, vendors are strategizing their business models by enhancing their product lines and engaging in collaborations and acquisitions, with a core focus on sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand from the Food and Beverage Sector

- 5.1.2 Regulations on Plastic-based Packaging Products Contributes to Higher Demand

- 5.2 Market Restraints

- 5.2.1 Increasing Raw Material Costs and Outsourcing

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Paperboard

- 6.1.2 Container Board

- 6.1.3 Corrugated Board

- 6.1.4 Other Products

- 6.2 By End-user Industry

- 6.2.1 Food and Beverage

- 6.2.2 Personal Care

- 6.2.3 Home Care

- 6.2.4 Healthcare

- 6.2.5 Retail

- 6.2.6 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Graphic Packaging International Corporation

- 7.1.2 International Paper Company

- 7.1.3 Rengo Co. Ltd

- 7.1.4 Oji Paper Co. Ltd

- 7.1.5 Metsa Group

- 7.1.6 Amcor Group GmbH

- 7.1.7 Daio Paper Corporation

- 7.1.8 THE PACK CORPORATION