|

市場調查報告書

商品編碼

1637910

表面計算:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Surface Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

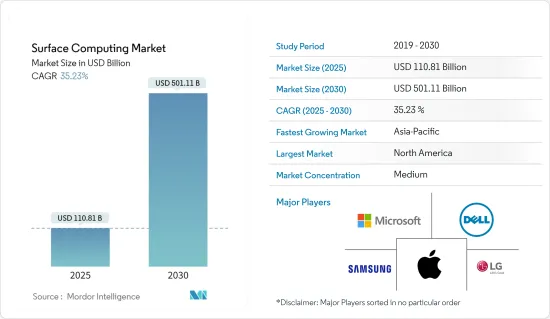

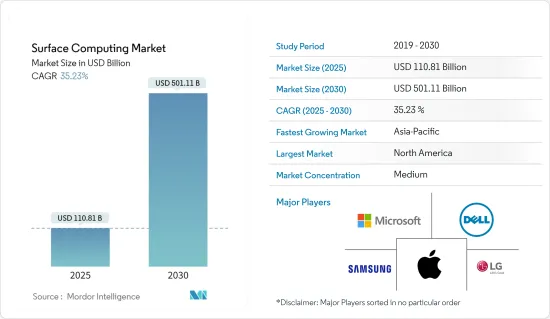

表面計算市場規模在2025年預估為1108.1億美元,預計到2030年將達到5011.1億美元,預測期間(2025-2030年)複合年成長率為35.23%。

主要亮點

- 表面計算是一種新的計算形式,可讓您使用桌面作為電腦介面。表面計算使用專用的電腦 GUI,因為傳統的 GUI 被直覺的物件所取代。表面運算開啟了可供使用者互動的全新產品類別。

- 微軟是第一家提出表面運算概念的公司。 Microsoft Surface 技術可讓您使用非數位物件作為輸入裝置。 Microsoft Surface 是微軟首款商用表面電腦,是一個革命性的表面運算平台,可回應自然手勢和現實世界物件在顯示器上的放置。

- Microsoft Surface 採用大型 360 度水平使用者介面,打造一個獨特的聚會場所,讓多個使用者可以同時協作處理資訊和內容。此外,使用者還可以透過觸摸和拖曳螢幕上的指尖或畫筆等物體,甚至放置和移動放置的物體來與機器互動。

- 此外,商業上可用的多點觸控技術(例如來自微軟和SMART Technologies 的技術)正在推動在非實驗室環境中(例如辦公室、零售店、酒店、學校、餐廳甚至醫院)進行表面運算的探索,預計這將預測期內成長 1.5%。

- 此外,Microsoft Surface 的獨特功能使企業能夠設計創新的宣傳活動來吸引和轉化新客戶、交叉銷售產品和服務、提高客戶忠誠度並提高業務效率。

- 介面設計的複雜性和多向媒體是市場的關鍵問題。由於功能有限且價格昂貴,Surface 電腦的普及預計會受到限制。由於行業競爭激烈,表面計算市場面臨巨大的障礙,導致參與者採用多用戶和表面電腦技術。

表面計算市場趨勢

零售業可望佔據主要市場佔有率

- 零售業對於表面計算市場的成長具有巨大的潛力。表面運算不僅讓交易變得更快捷、更簡便,也為企業主提供了個人化的運算環境。表面計算還可以減少紙張、墨水和其他辦公用品的浪費,從而促進公司的綠色計劃。

- 透過將實體店與數位體驗結合,零售商可以更好地服務客戶,並創建一個從銷售樓層、商店到高階主管的更互聯的組織。線下商家正在採用非接觸式購物和路邊取貨等新的經營模式。這是一個巨大的變化,它可以幫助消費者找到他們想要的東西,預測需求,並在競爭日益激烈的市場中為零售商創造新的機會。

- 此外,2023年5月,中國超級市場麥德龍推出了Telpo自助服務亭。 K7 Telpo 自助服務終端提供多種付款方式,包括電子轉帳、2D碼和臉部認證。熱敏印表機紙張寬度為80毫米,列印速度為每秒150毫米,並配有自動切紙器。

- 此外,零售業的數位化正在突飛猛進。表面運算技術可以多方面進一步支持零售業的轉型,包括高效的庫存管理、改善的用戶體驗、增強的盈利、擴大的廣告機會。

預計北美將佔據最大市場佔有率

- 北美是一個已開發地區,其購買力和可支配收入比發展中國家更高。在北美,表面計算廠商集中的美國佔據市場主導地位。

- 由於該地區對技術先進產品的需求,北美表面計算市場正在迅速發展。消費者的高認知度和產品的易得性增加了該行業的成長機會。美國擁有幾家重要的表面計算技術製造商,從而推動了其產品的知名度和需求的提高。

- 根據 SelectUSA 統計,美國媒體和娛樂業是世界上最大的。該產業的規模達7,170 億美元,佔全球媒體和娛樂業的三分之一,涵蓋電影、電視節目和商業廣告、串流內容、音樂和錄音、廣播、電台、圖書出版、電玩遊戲、輔助服務和產品。

- 這些產業的成長,以及各產業擴大採用創新技術解決方案,預計將在預測期內推動該地區表面運算市場的發展。

表面計算行業概覽

由於現有參與者的存在,表面計算市場的競爭較不激烈,例如:微軟、戴爾、蘋果和三星。

2023 年 4 月,Zalando 為數百萬顧客試辦虛擬試衣間。此次試驗首次向 Zalando 所有 25 個市場的顧客開放了虛擬試衣間。該公司已對 Zalando 和 Puma 自有品牌 Anna Field 的精選服飾進行了兩次成功的試點,超過 30,000 名客戶嘗試了這項創新技術。

2022 年 8 月,Hugo Boss 推出了虛擬實境試衣間,讓網路購物購物者可以使用個人化頭像試穿服裝。德國奢侈品牌 Hugo Boss 與虛擬試穿 (VTO) 供應商 Reactive Reality 合作,最初向英國、德國和法國的客戶提供該服務。客戶可以透過 Reactive Reality 的 PITCTOFiT 平台創建的個人化碰撞測試人偶上瀏覽數千種產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 更先進、更人性化的介面-自然使用者介面(NUI)

- 透過採用多用戶平板電腦增加業務收益

- 市場限制

- 僅提供有限的功能

- Surface 電腦的高成本

第6章 市場細分

- 按類型

- 平板顯示

- 曲面顯示螢幕

- 成分

- 螢幕

- 相機

- 感應器

- 處理器

- 軟體

- 投影儀

- 其他組件

- 透過觸摸

- 單點觸摸

- 多點觸控

- 多用戶

- 其他細節

- 按願景

- QR 圖

- 3D

- 按應用

- 娛樂

- 零售

- 飯店業

- 衛生保健

- 商業的

- 廣告

- 車

- 教育

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Microsoft Corporation

- 3M Co.

- Dell Inc.

- Samsung Electronic Co. Ltd

- Planar Systems Inc.

- Lenovo Group Ltd

- Apple Inc.

- Viewsonic Corporation

- Toshiba Corporation

- Hewlett-Packard Ltd

- Sony Corporation

- LG Electronics Inc.

- Fujitsu Ltd

- IBM Corporation

- Intel Corporation

- Panasonic Corporation

- Qualcomm Technologies Inc.

- Acer Inc.

第8章投資分析

第9章:市場的未來

The Surface Computing Market size is estimated at USD 110.81 billion in 2025, and is expected to reach USD 501.11 billion by 2030, at a CAGR of 35.23% during the forecast period (2025-2030).

Key Highlights

- Surface computing is a new form of computing that allows users to work on a tabletop surface as a computer interface. Surface computing uses a specialized computer GUI as the traditional GUI is replaced by intuitive objects. Surface computing opens up a whole new category of products for users to interact with.

- Microsoft was the first company to unveil the concept of surface computing. The technology of Microsoft Surface allows non-digital objects to be used as input devices. Microsoft Surface, the first commercially available surface computer from Microsoft, is a revolutionary surface computing platform that responds to natural hand gestures and the placement of real-world objects on display.

- Using its large, 360-degree, horizontal user interface, Microsoft Surface creates a unique gathering place where multiple users can collaboratively and simultaneously interact with information and content. Furthermore, users can also interact with the machine by touching or dragging their fingertips and objects, such as paintbrushes, across the screen or by placing and moving placed objects.

- Furthermore, commercially available multitouch technology (e.g., Microsoft and SMART Technologies) enables exploration of surface computing in settings outside of the lab, such as offices, retail stores, hotels, schools, restaurants, and even hospitals, which is expected to drive the market growth during the forecast period.

- In addition, Microsoft Surface, with its unique set of features, enables companies to design innovative campaigns to attract and convert new customers as well as cross-sell products and services, drive customer loyalty, and achieve operating efficiencies.

- Interface design complexity and Multi-directional media are significant market problems. The low availability of features and the high cost of surface computers are expected to limit their adoption rate. The surface computing market has encountered a significant barrier due to the intense competition in the industry, resulting in players adopting multi-user and surface computer technology.

Surface Computing Market Trends

The Retail Sector is Expected to Hold a Significant Market Share

- The retail segment possesses a huge potential for the growth of the Surface Computing Market. Surface computing not only makes transactions faster and easier but also provides a personalized computing environment to business owners. Surface computing also facilitates businesses in their green initiatives, allowing them to cut back on paper, ink, and other office supply wastes.

- Retailers connect their physical locations with digital experiences to better serve customers and build a more connected organization from the sales/shop floor to the C-suite. Offline merchants are embracing new business models, like contactless shopping and curbside pickup. It's an upheaval that brings new opportunities for retailers in an ever-competitive market, helping consumers find what they're looking for and anticipating demand.

- Further, in May 2023, Metro, a China-based supermarket, introduced Telpo self-service kiosks. The K7 Telpo kiosks feature multiple payment methods, including EFT, QR code, and facial recognition. The thermal printer features an 80-millimeter paper width, 150-millimeters per second printing speed, and an automated cutter.

- Furthermore, the digitization of the retail sector has increased manifold. Surface computing technology can further support the transformation of the retail sector in multiple ways, including efficient inventory management, better user experience, enhanced profitability, and better advertising opportunities.

North America is Expected to Hold the Largest Market Share

- North America is a developed region, and people have more purchasing power and disposable income than those in growing areas. In North America, this market is driven by the United States, owing to the concentration of surface computing manufacturers.

- The North America surface computing market is developing rapidly due to the region's demand for technically advanced products. High consumer awareness and easy product availability increase the industry's growth opportunities. The existence of several significant surface computing technology manufacturers in the U.S. creates heightened product awareness and demand.

- According to Select USA, the U.S. media and entertainment industry is the largest in the world. At USD 717 billion, it represents a third of the global media and entertainment industry, and it includes motion pictures, television programs and commercials, streaming content, music and audio recordings, broadcast, radio, book publishing, video games, and ancillary services and products.

- The growth of these sectors, along with the growing adoption of innovative technological solutions across various sectors, is expected to drive the development of the surface computing market in the region during the forecast period.

Surface Computing Industry Overview

The surface computing market is moderately competitive due to the presence of established players such as Microsoft, Dell, Apple Inc., and Samsung. However, competition among the players is expected to grow as the penetration of surface computers increases.

In April 2023, Zalando introduced a virtual fitting room pilot to millions of customers. This pilot brings the virtual fitting room to customers in all 25 Zalando markets for the first time. The company has already successfully run two pilots with selected clothing items from Zalando's and Puma private label Anna Field, where more than 30,000 customers have tried this innovative technology.

In August 2022, Hugo Boss ventured into a virtual reality dressing room, letting online shoppers try on apparel using personalized avatars. The exclusive German brand has partnered with virtual try-on (VTO) provider Reactive Reality for the ambition, initially available for UK, German, and France customers. Customers can check on thousands of products via personalized dummies created through Reactive Reality's PITCTOFiT platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 More Advanced and User-friendly Interface - Natural User Interface (NUI)

- 5.1.2 Increasing Business Revenue Due to Adoption of Multi-user Tabletops

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Features

- 5.2.2 High Cost of Surface Computers

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 Flat Display

- 6.1.2 Curved Display

- 6.1.3 Components

- 6.1.3.1 Screen

- 6.1.3.2 Camera

- 6.1.3.3 Sensor

- 6.1.3.4 Processor

- 6.1.3.5 Software

- 6.1.3.6 Projector

- 6.1.3.7 Other Components

- 6.2 Touch

- 6.2.1 Single Touch

- 6.2.2 Multi-touch

- 6.2.3 Multi-user

- 6.2.4 Other Touches

- 6.3 Vision

- 6.3.1 Two Dimensional

- 6.3.2 Three Dimensional

- 6.4 Application

- 6.4.1 Entertainment

- 6.4.2 Retail

- 6.4.3 Hospitality

- 6.4.4 Healthcare

- 6.4.5 Commercial

- 6.4.6 Advertisement

- 6.4.7 Automotive

- 6.4.8 Education

- 6.4.9 Other Applications

- 6.5 Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Australia and New Zealand

- 6.5.4 Latin America

- 6.5.4.1 Mexico

- 6.5.4.2 Brazil

- 6.5.4.3 Argentina

- 6.5.5 Middle East and Africa

- 6.5.5.1 Saudi Arabia

- 6.5.5.2 United Arab Emirates

- 6.5.5.3 South Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 3M Co.

- 7.1.3 Dell Inc.

- 7.1.4 Samsung Electronic Co. Ltd

- 7.1.5 Planar Systems Inc.

- 7.1.6 Lenovo Group Ltd

- 7.1.7 Apple Inc.

- 7.1.8 Viewsonic Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 Hewlett-Packard Ltd

- 7.1.11 Sony Corporation

- 7.1.12 LG Electronics Inc.

- 7.1.13 Fujitsu Ltd

- 7.1.14 IBM Corporation

- 7.1.15 Intel Corporation

- 7.1.16 Panasonic Corporation

- 7.1.17 Qualcomm Technologies Inc.

- 7.1.18 Acer Inc.