|

市場調查報告書

商品編碼

1639427

北美營運情報:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)North America Operational Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

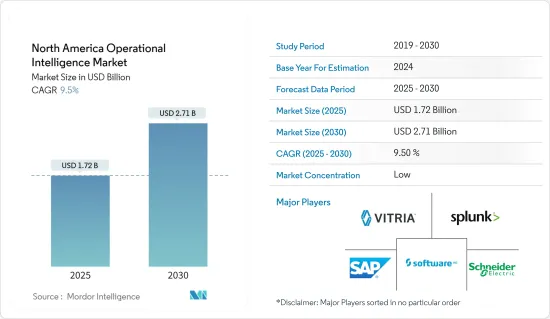

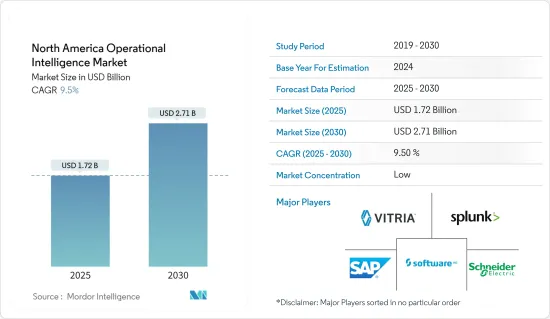

北美營運情報市場規模預計在 2025 年為 17.2 億美元,預計到 2030 年將達到 27.1 億美元,預測期內(2025-2030 年)的複合年成長率為 9.5%。

資料品管、發現和視覺化的需求正在推動企業採用營運智慧軟體。內部部署 ESB 和 BPM(業務流程管理)解決方案非常適合整合公司複雜的內部系統和架構,同時確保垂直擴充性。

主要亮點

- 營運智慧 (OI) 是一種動態、即時業務分析的形式,可提供對業務和 IT 營運的洞察。這些解決方案為企業提供了簡化資料收集和分析流程的機會。企業可以即時監控和排除故障,改善安全性和合規性實踐,並加快向客戶提供服務。

- 商業情報和資料倉儲工具等傳統分析工具不允許公司充分利用可用於決策的資料潛力。這些傳統的資訊管理系統受到資料量和種類的限制,難以以實用、可操作的方式分析資料。

- Cisco估計,所有生成資料中約有 42% 來自機器,包括感測器、網路、安全系統、伺服器、儲存和應用程式。即時資料分析可以利用物聯網和巨量資料功能來增強業務營運。

- 此外,不同裝置和平台之間的互通性挑戰使企業在連接動態應用程式、服務和資料時遇到的問題變得更加複雜。因此,轉向雲端解決方案可以幫助企業解決當前的整合挑戰,同時提供未來所需的可管理性、擴充性和可靠性。

北美營運智慧市場趨勢

雲端運算將佔據主要市場佔有率

- 由於降低成本、可訪問性、擴充性和服務集中化等附加優勢,雲端運算預計將佔據相當大的市場佔有率。此外,預計超過 83% 的企業工作負載將在雲端運行,其中 41% 的工作負載在公共雲端平台上運行。另外 20% 將基於私有雲端,22% 將依賴混合雲端的採用。

- Flexera 的研究表明,雲端策略越來越注重混合雲而不是公有雲或私有雲。混合雲是公司提供產品和服務的新常態。據 Flexera 稱,到 2023 年混合雲採用率將增加到 72%。

- 此外,成本效率在推動雲端運算實現營運智慧方面發揮關鍵作用。雲端供應商提供計量收費模式,無需在硬體和基礎設施上進行大量的前期投資。這使得企業能夠有效地分配資源並在必要時投資營運智慧工具。雲端的彈性使得公司只需為其消耗的資源付費,這對於希望在控制成本的同時最佳化營運智慧工作的企業來說是一個有吸引力的選擇。

- 此外,雲端基礎的營運智慧解決方案的速度和靈活性在當今快節奏的商業環境中非常寶貴。即時資料分析使企業能夠做出即時、明智的決策,快速回應不斷變化的市場條件,並掌握新興趨勢。雲端的分散式架構和先進的分析功能使企業能夠以創紀錄的時間從各種資料來源中獲得可操作的見解。

零售預計將佔據較大的市場佔有率

- 零售業採用人工智慧將透過減少人工工作、加快交付速度、改善客戶和訂單管理以及簡化營運來實現零售相關流程的自動化,最終降低所有成本。

- 此外,零售基礎設施複雜且分散,包括銷售點 (POS)、收銀終端、自助結帳、個人電腦和後勤部門伺服器。這導致批發商、經銷商、製造商和供應商對 IT 的依賴性不斷增強,需要整合的基礎設施來實現無縫的零售價值鏈。這與操作智慧的成長相對應。

- 根據牛津經濟研究院統計,83%的大型零售企業已將數位轉型作為核心業務目標。牛津經濟研究院也指出,中小型零售商(59%)正在推動數位轉型。隨著數位轉型變得更加普遍,零售業變得更加重視變革,市場預計將擴大。

- 此外,零售業也擴大採用雲端基礎的解決方案,透過整合庫存和訂單處理等多條業務線來提高補貨能力。

- 此外,雲端處理還允許零售商實現企業範圍的供應鏈可視性。最近,Gap Inc. 採用雲端技術來支援其 Intermix 品牌的全球營運。時尚零售商部署Oracle雲端服務來提供零售商品商品行銷、整合和庫存管理解決方案。

北美營運智慧產業概況

北美營運情報市場分散且競爭激烈,擁有許多大大小小的供應商,提供對業務的全面可視性和洞察力。這使企業能夠做出明智的、資料主導的決策。這個充滿活力的市場的其他主要企業包括 Vitoria Technology 和 Splunk。

2023年5月,SAP SE宣布與IBM建立策略夥伴關係。根據夥伴關係,SAP 將把 IBM Watson 技術整合到其解決方案中。此次整合將使 SAP SE 能夠提供先進的人工智慧洞察和自動化,加速創新並改善更廣泛解決方案組合中的使用者體驗。

2022 年 8 月,國家農村電信合作社 (NRTC) 宣布其營運智慧平台全面上市。該平台具有與供應商無關的分析功能,旨在最佳化寬頻供應商的業務。透過利用即時資料分析和機器學習,平台可以主動識別用戶問題和潛在的服務中斷,讓提供者能夠在問題影響客戶之前解決這些問題。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 對即時資料分析的需求日益增加

- 巨量資料分析和物聯網的採用日益廣泛

- 市場限制

- 合併來自多個資料來源的資料

第6章 市場細分

- 依部署類型

- 雲

- 本地

- 按最終用戶產業

- 零售

- 製造業

- BFSI

- 政府

- 資訊科技/通訊

- 軍事和國防

- 運輸和物流

- 衛生保健

- 能源和電力

第7章 競爭格局

- 公司簡介

- Vitria Technology Inc.

- Splunk Inc.

- SAP SE

- Inside Analysis(The Bloor Group)

- Software AG

- Schneider Electric SE

- Rolta India Limited

- SolutionsPT Ltd

- IBENOX Pty Ltd

- Turnberry Corporation

- HP Inc.

- OpenText Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The North America Operational Intelligence Market size is estimated at USD 1.72 billion in 2025, and is expected to reach USD 2.71 billion by 2030, at a CAGR of 9.5% during the forecast period (2025-2030).

The need for data quality management, discovery, and visualization compels businesses to adopt operational intelligence software. On-premise ESB and BPM (business process management) solutions are well suited for vertical scalability while integrating an enterprise's complex internal systems and architecture.

Key Highlights

- Operational intelligence (OI) is a form of dynamic, real-time business analytics that delivers insights into business and IT operations. These solutions provide enterprises with the opportunity to streamline the process of data collection and analysis. Enterprises can monitor and troubleshoot in real-time and improve their security and compliance methods, thereby speeding up the delivery of their services to customers.

- Enterprises cannot tap the full potential of the available data for making decisions using traditional analytical tools, such as business intelligence and data warehouse tools. These conventional information management systems cannot analyze the data in any practical and actionable way due to their high volume and diversity.

- Cisco Systems estimates that around 42% of all data generated will likely be from machines, including sensors, networks, security systems, servers, storage, and applications. Real-time data analytics can influence the IoT and Big Data capabilities to enhance business operations.

- Moreover, the challenge of interoperability between different devices and platforms has complicated issues for businesses, as it is challenging to connect dynamic applications, services, and data. Therefore, the shift to cloud solutions helps enterprises address their current integration challenges while giving them the manageability, scalability, and reliability they need for the future.

North America Operational Intelligence Market Trends

Cloud Accounts for Significant Market Share

- Cloud deployment is expected to hold a prominent market share owing to the added benefits, such as cost-saving, accessibility, scalability, and centralized service. It is also expected that more than 83% of the enterprise workload will be in the cloud, out of which 41% of the enterprise workload will be run on public cloud platforms. Another 20% will be private-cloud-based, while 22% will rely on hybrid-cloud adoption.

- According to the survey by Flexera, cloud strategy is increasingly focused on hybrid instead of public and private. A hybrid cloud is a new norm for businesses delivering products and services. According to Flexera, the hybrid cloud penetration rate increased to 72% in 2023.

- Moreover, cost-effectiveness plays a crucial role in driving cloud adoption for operational intelligence. Cloud providers offer a pay-as-you-go model, eliminating the need for substantial upfront investments in hardware and infrastructure. This allows businesses to allocate resources efficiently, investing in operational intelligence tools as necessary. The cloud's elasticity ensures that organizations only pay for the resources they consume, making it an attractive option for companies looking to optimize their operational intelligence efforts while managing costs.

- Furthermore, the speed and agility of cloud-based operational intelligence solutions are invaluable in today's fast-paced business landscape. Real-time data analysis enables organizations to make informed decisions on the fly, respond swiftly to changing market conditions, and identify emerging trends. The cloud's distributed architecture and advanced analytics capabilities empower businesses to derive actionable insights from diverse data sources in record time.

Retail is Expected to Account For Significant Market Share

- The adoption of AI in the retail industry automates retail-related processes with lesser manual work, faster delivery, better customer and order management, and streamlined operations, all of which eventually reduce costs.

- Moreover, retail infrastructure is complex and distributed and includes POS (point of sale), checkout terminals, self-checkout units, PCs, and back-office servers. Thus, the increasing dependency on IT, ranging from wholesalers and distributors to manufacturers and suppliers, demands an integrated infrastructure that enables a seamless retail value chain. This caters to the growth of operational intelligence.

- According to Oxford Economics, 83% of large retailers consider digital transformation a core business goal. Oxford also highlighted the traction from small and midsize retailers ((59%) and their belief in digital transformation. In the era where digital transformation is gaining traction, the market studied is expected to grow along with the retail sector's inclination to transform.

- Additionally, the retail sector is increasingly witnessing the adoption of cloud-based solutions, as they integrate several verticals, like inventory and order processing, thus improving the restocking capabilities.

- Furthermore, with cloud computing, retailers may have enterprise-wide supply chain visibility. Recently, Gap Inc. adopted cloud technology across its global operations for its Intermix brand. The fashion retailer has deployed cloud services provided by Oracle, with solutions comprising retail merchandising, integration, and inventory management.

North America Operational Intelligence Industry Overview

The North American operational intelligence market is marked by fragmentation and fierce competition, featuring a wide range of vendors, both large and small, that offer comprehensive visibility and insights into business operations. This enables companies to make informed, data-driven decisions. Notable key players in this dynamic market include Vitria Technology Inc. and Splunk Inc., among others.

In May 2023, SAP SE announced a strategic collaboration with IBM. Under this partnership, SAP will be integrating IBM Watson technology into its solutions. This integration is set to empower SAP SE in delivering advanced AI-driven insights and automation, accelerating innovation, and enhancing user experiences throughout its extensive solution portfolio.

In August 2022, the National Rural Telecommunications Cooperative (NRTC) unveiled the general availability of its operational intelligence platform. This platform is characterized by its vendor-agnostic analytics capabilities, designed to optimize the operations of broadband providers. Leveraging real-time data analysis and machine learning, this platform proactively identifies subscriber issues and potential service disruptions, enabling providers to address these concerns before they impact users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Real Time Data Analytics

- 5.1.2 Increasing Adoption of Big Data Analytics and the Internet-of-Things (IoT)

- 5.2 Market Restraints

- 5.2.1 Combining Data from Multiple Data Sources

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By End-user Vertical

- 6.2.1 Retail

- 6.2.2 Manufacturing

- 6.2.3 BFSI

- 6.2.4 Government

- 6.2.5 IT and Telecommunication

- 6.2.6 Military and Defense

- 6.2.7 Transportation and Logistics

- 6.2.8 Healthcare

- 6.2.9 Energy and Power

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vitria Technology Inc.

- 7.1.2 Splunk Inc.

- 7.1.3 SAP SE

- 7.1.4 Inside Analysis (The Bloor Group)

- 7.1.5 Software AG

- 7.1.6 Schneider Electric SE

- 7.1.7 Rolta India Limited

- 7.1.8 SolutionsPT Ltd

- 7.1.9 IBENOX Pty Ltd

- 7.1.10 Turnberry Corporation

- 7.1.11 HP Inc.

- 7.1.12 OpenText Corporation