|

市場調查報告書

商品編碼

1639515

潤滑油 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

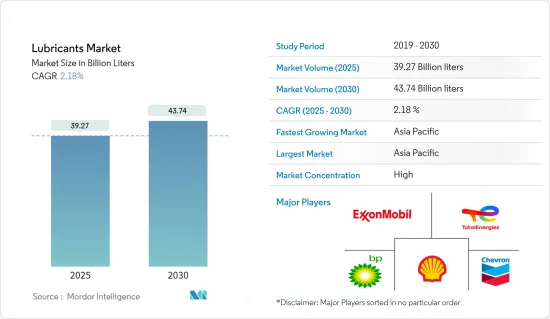

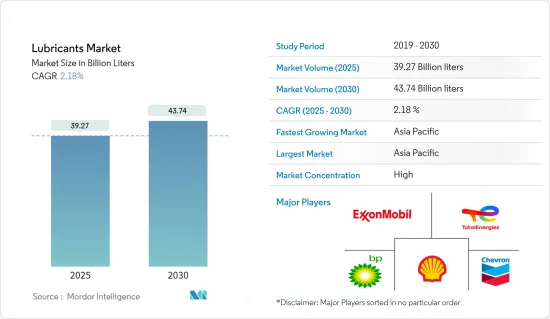

2025年潤滑油市場規模預估為392.7億公升,預估至2030年將達437.4億公升,預測期間(2025-2030年)複合年成長率為2.18%。

2020 年,由於 COVID-19 造成的全球供應鏈中斷,潤滑油市場面臨挫折。疫情導致許多為潤滑油產業提供基礎油和添加劑等重要原料的工廠關閉。在汽車行業積極前景以及石油和天然氣行業持續進步的推動下,潤滑油市場預計在未來幾年將出現溫和但積極的成長。

主要亮點

- 短期來看,汽車保有量的快速成長和發電產業投資的強勁成長是推動該市場需求的關鍵因素。

- 然而,由於環境問題日益嚴重,嚴格的法規預計將阻礙市場的成長。

- 生物潤滑劑的日益普及預計將在該市場創造新的商機。

- 預計亞太地區將主導全球市場,其中大部分需求來自中國和印度。

潤滑油市場趨勢

汽車和其他運輸領域主導市場

- 潤滑油市場主要由汽車業和其他運輸業(包括飛機和船舶)主導。

- 汽車產業是潤滑油的主要消費者之一,潤滑油對於確保車輛的平穩運作至關重要。潤滑劑還有助於清洗和冷卻引擎部件,防止生鏽和腐蝕積聚。

- 在汽車領域,商用車和二輪車使用機油、變速箱油、液壓油、潤滑脂等各種潤滑油,帶動了潤滑油產業的發展。

- 機油、齒輪油、變速箱油、潤滑脂和壓縮機油主要用於小型車輛,包括摩托車和乘用車。OEM和售後市場都非常喜歡這些潤滑劑。

- 新興市場對輕型高性能汽車的需求不斷增加、汽車輪轂數量不斷增加以及可支配收入不斷增加是潤滑油需求旺盛的關鍵原因。

- 國際汽車製造商組織(OICA)報告稱,2023年全球新車銷量穩定成長,達到9,270萬輛以上,較2022年成長11.9%。其中,乘用車新車銷量與前一年同期比較增11.3%至6,530萬輛,高於2022年的5,860萬輛。同時,2023年全球商用車新註冊量將達到2,750萬輛,比2022年的2,420萬輛成長13.3%。

- 2023年北美汽車銷量為1,919萬輛,比2022年的1,693萬輛成長13.4%。 1919萬輛汽車總銷量中,乘用車398萬輛,商用車1521萬輛,其餘為重卡、客車、客車的組合。

- 此外,根據歐洲汽車工業協會的資料,2023年歐洲新車註冊數量與前一年同期比較增加18.7%。 2023年,乘用車銷量將達到1500萬輛,商用車銷量將達到290萬輛,而2022年將分別達到1264萬輛和244萬輛。

- 鑑於這些動態,預計市場在預測期內將顯著成長。

亞太地區主導市場

- 亞太地區領先全球市場佔有率。隨著中國、印度和日本等國家加大力度發展風力發電並提高汽車產量,該地區對潤滑油的需求正在上升。

- 中國在潤滑油消費和生產方面均位居世界強國。塑造中國潤滑油格局的主要企業包括殼牌公司、中石化、埃克森美孚公司和英國石油公司。該行業的成長是由整個預測期內投資活性化和擴張所推動的。

- 2024 年 6 月,殼牌完成了曼谷油脂製造工廠的重大擴建,產能增加兩倍。此次擴建將使該工廠能夠滿足泰國一半的潤滑脂需求,將年產量從 5,000 噸增加到 15,000 噸。

- 2023 年 9 月,麥克唐奇石化有限公司宣布計劃在中國天津建造一座新的複合工廠。

- 在汽車數量迅速增加和技術進步的推動下,中國汽車產業已成為潤滑油的最大消費國。中國工業協會(CAAM)宣布,2023年,中國汽車產銷雙雙創歷史新高,達3,000萬輛,與前一年同期比較成長兩位數。

- 受可支配收入增加、新型運動型多用途車的繁榮和有吸引力的貸款利率的推動,到 2023 年,印度的乘用車銷量將首次突破 400 萬輛大關。印度汽車工業協會 (SIAM) 的數據顯示,印度國內市場轎車、轎車和多功能車銷量超過 410 萬輛,比一年前的 379 萬輛成長 8.2%。其中,多用途車佔總量的57.4%。

- 此外,隨著經濟體越來越傾向於風能等可再生能源,亞太地區的離岸風力發電裝置容量預計將大幅增加。世界風力發電理事會(GWEC)預測,到2029年,亞太地區離岸風力發電裝置量將比2022年成長225.4%。這種激增將在預測期內擴大風電產業的潤滑油需求。

- 考慮到這些動態,亞太地區的潤滑油消費量將增加,確保該地區的持續市場主導地位。

潤滑油產業概況

全球潤滑油市場本質上是一體化的。主要參與企業(排名不分先後)包括殼牌公司、埃克森美孚、BP公司(嘉實多)、TotalEnergies和雪佛龍公司。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車保有量快速成長帶動潤滑油需求

- 發電業投資強勁成長

- 其他司機

- 抑制因素

- 由於環境問題日益嚴重,監管更加嚴格

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 團體

- 第一組

- 第二組

- 第三組

- 第四組

- 第五組

- 基料

- 礦物油潤滑劑

- 合成潤滑油

- 半合成潤滑油

- 生物性潤滑劑

- 產品類型

- 機油

- 變速箱/液壓油

- 金屬加工油

- 一般工業油

- 齒輪油

- 潤滑脂

- 加工油

- 其他

- 最終用戶產業

- 發電

- 機動車輛及其他運輸

- 重型設備

- 飲食

- 冶金/金屬加工

- 化學製造

- 其他最終用戶產業(包裝、石油和天然氣)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- BP PLC

- Chevron Corporation

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation(Sinopec)

- ENEOS Corporation

- Exxon Mobil Corporation

- FUCHS

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co. Ltd

- Indian Oil Corporation Ltd

- LUKOIL

- MOTUL

- Petromin

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Shell PLC

- TotalEnergies

- Valvoline(Saudi Aramco)

第7章 市場機會及未來趨勢

- 擴大生物潤滑劑的採用

- 其他機會

The Lubricants Market size is estimated at 39.27 billion liters in 2025, and is expected to reach 43.74 billion liters by 2030, at a CAGR of 2.18% during the forecast period (2025-2030).

In 2020, the lubricants market faced setbacks due to global supply chain disruptions caused by COVID-19. The pandemic led to shutdowns of numerous factories supplying essential raw materials, such as base oil and additives, to the lubricants industry. Nevertheless, buoyed by a positive automotive industry outlook and consistent advancements in the oil and gas sector, the lubricants market is expected to experience modest yet positive growth in the coming years.

Key Highlights

- Over the short term, the surging vehicle population and robust growth of investments in the power generation sector are the major factors driving the demand for the market studied.

- However, stringent regulations amidst growing environmental concerns are expected to hinder the market's growth.

- Nevertheless, the growing adoption of bio-lubricants is expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Lubricants Market Trends

Automotive and Other Transportation Segment to Dominate the Market

- Automotive and other transportation sectors, including aircraft and marine, dominate the lubricant market.

- The automotive sector stands out as one of the primary consumers of lubricants, which are crucial for ensuring smooth vehicle operation. The lubricants also help clean and cool down the engine parts and prevent them from buildup of rust and corrosion.

- In the automotive sector, various lubricants such as engine oil, transmission oil, hydraulic oil, greases, and other lubricants are used in commercial vehicles and motorcycles, which will drive the lubricants industry.

- Light-duty vehicles, encompassing two-wheelers and passenger cars, predominantly use engine oils, gear oils, transmission oils, greases, and compressor oils. Both OEMs and the aftermarket show a strong preference for these lubricants.

- Growing demand for lightweight, high-performance cars in emerging markets, increasing automotive hubs, and rising disposable income are the major reasons for the high demand for lubricants.

- In 2023, global new vehicle sales saw a robust growth of 11.9% over 2022, totaling over 92.7 million units, as reported by the Organisation Internationale des Constructeurs d'Automobiles (OICA). Specifically, new passenger vehicle sales climbed by 11.3% year-over-year, hitting 65.3 million units, up from 58.6 million in 2022. Concurrently, new commercial vehicle registrations worldwide rose to 27.5 million units in 2023, marking a notable 13.3% increase from the 24.2 million units recorded in 2022.

- In North America, motor vehicle sales in 2023 accounted for 19.19 million units, an increase of 13.4% compared to 2022's sales, which was reported to be 16.93 million units, according to the OICA. Out of the total 19.19 million units, passenger cars accounted for 3.98 million units, commercial vehicles made up 15.21 million units, and the remaining units were a combination of heavy trucks, buses, and coaches.

- Furthermore, as per the data from the European Automobile Manufacturers Association, in Europe, the overall registration of new motor vehicles increased by 18.7% in 2023 compared to the previous year. In 2023, passenger car and commercial vehicle sales reached 15 million units and 2.90 million units, respectively, compared to 12.64 million units and 2.44 million units in 2022.

- Given these dynamics, the market is poised for significant growth during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region led the global market share. As countries like China, India, and Japan ramp up their wind power initiatives and bolster automotive production, the demand for lubricants in the region is on the rise.

- China stands out as a global powerhouse, both in lubricant consumption and production. Major players shaping China's lubricant landscape include Shell Plc, Sinopec, ExxonMobil Corporation, and BP Plc. The sector's growth was bolstered by heightened investments and expansions throughout the forecast period.

- In June 2024, Shell completed a significant expansion at its grease manufacturing plant in Bangkok, tripling its production capacity. This enhancement positions the plant to meet half of Thailand's grease demand, boosting its annual output from 5,000 to 15,000 metric tons.

- In September 2023, McDonch Petrochemical Co. unveiled plans for a new blending plant in Tianjin, China, targeting an annual production of 50,000 finished lubricant products.

- China's automotive sector, driven by a burgeoning vehicle fleet and tech advancements, emerges as the top lubricant consumer. 2023 saw both sales and production of automobiles in China hit a record 30 million units, marking a notable double-digit growth from the prior year, as highlighted by the China Association of Automobile Manufacturers (CAAM).

- In 2023, India's passenger vehicle sales surpassed the 4 million milestone for the first time, fueled by increasing disposable incomes, a boom in new sport-utility vehicles, and attractive loan rates. The domestic market recorded sales of over 4.1 million cars, sedans, and utility vehicles, marking an 8.2% rise from the previous year's 3.79 million, according to the Society of Indian Automobile Manufacturers (SIAM). Significantly, utility vehicles made up 57.4% of the overall sales.

- Moreover, with economies increasingly leaning towards renewable energies like wind, the Asia-Pacific's offshore wind installations are set for a significant uptick. The Global Wind Energy Council (GWEC) projects a 225.4% growth in the region's offshore wind installation volume by 2029, compared to 2022. This surge is poised to amplify the wind power industry's lubricant demand during the forecast period.

- Given these dynamics, lubricant consumption in the Asia-Pacific is set to rise, ensuring the region's continued market dominance.

Lubricants Industry Overview

The Global lubricants market is consolidated in nature. The major players (not in any particular order) include Shell PLC, Exxon Mobil Corporation, BP PLC (Castrol), TotalEnergies, and Chevron Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Vehicle Population to Drive the Demand for Lubricants

- 4.1.2 Robust Growth of Investments in the Power Generation Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Amidst Growing Environmental Concerns

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Group

- 5.1.1 Group I

- 5.1.2 Group II

- 5.1.3 Group III

- 5.1.4 Group IV

- 5.1.5 Group V

- 5.2 Base Stock

- 5.2.1 Mineral Oil Lubricant

- 5.2.2 Synthetic Lubricant

- 5.2.3 Semi-synthetic Lubricant

- 5.2.4 Bio-based Lubricant

- 5.3 Product Type

- 5.3.1 Engine Oil

- 5.3.2 Transmission and Hydraulic Fluid

- 5.3.3 Metalworking Fluid

- 5.3.4 General Industrial Oil

- 5.3.5 Gear Oil

- 5.3.6 Grease

- 5.3.7 Process Oil

- 5.3.8 Other Product Types

- 5.4 End-user Industry

- 5.4.1 Power Generation

- 5.4.2 Automotive and Other Transportation

- 5.4.3 Heavy Equipment

- 5.4.4 Food and Beverage

- 5.4.5 Metallurgy and Metalworking

- 5.4.6 Chemical Manufacturing

- 5.4.7 Other End-user Industries (Packaging, Oil and Gas)

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 NORDIC countries

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Qatar

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 South Africa

- 5.5.5.7 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BP PLC

- 6.4.2 Chevron Corporation

- 6.4.3 China National Petroleum Corporation (CNPC)

- 6.4.4 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.5 ENEOS Corporation

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Hindustan Petroleum Corporation Limited

- 6.4.9 Idemitsu Kosan Co. Ltd

- 6.4.10 Indian Oil Corporation Ltd

- 6.4.11 LUKOIL

- 6.4.12 MOTUL

- 6.4.13 Petromin

- 6.4.14 PETRONAS Lubricants International

- 6.4.15 Phillips 66 Company

- 6.4.16 PT Pertamina Lubricants

- 6.4.17 Repsol

- 6.4.18 Shell PLC

- 6.4.19 TotalEnergies

- 6.4.20 Valvoline (Saudi Aramco)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Adoption of Bio-lubricants

- 7.2 Other Opportunities