|

市場調查報告書

商品編碼

1640335

壁紙:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Wall Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

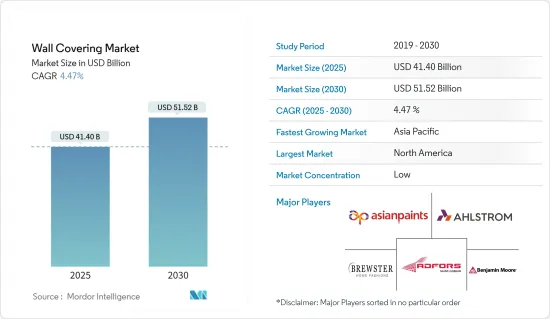

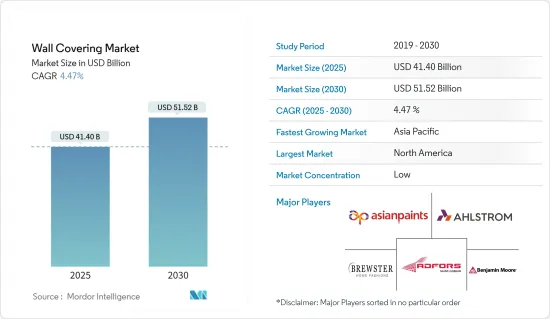

壁紙市場規模預計在 2025 年為 414 億美元,預計到 2030 年將達到 515.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.47%。

壁紙和其他牆面覆蓋物是用於裝飾建築物內牆的材料。受歡迎的選擇包括壁紙、大理石、陶瓷和微水泥,所有這些都是為了增強房間的美感。

主要亮點

- 牆面覆蓋物的需求不斷成長,是由於人們希望改善牆面的美觀度,並且個人收入不斷增加,從而能夠在牆面裝飾方面投入更多。製造商在設計、紋理、材料和價格分佈方面提供廣泛的選擇,以滿足不同消費者的偏好。

- 不斷發展的建設產業和住宅及商業空間房地產市場可能會推動全球對牆面覆蓋物的需求。根據美國非營利組織房地產圓桌會議的資料,過去40年來,美國商業建築數量增加了55%,推動了市場成長。

- 此外,印度品牌股權基金會 (IBEF) 的資料預測,資料中心房地產的需求將激增,到 2025 年將成長 1,500 萬至 1,800 萬平方英尺。該國的零售、酒店和商業房地產行業經歷了顯著成長,促進了市場擴張。

- 風格產品的可用性是壁紙市場的關鍵促進因素。消費者越來越尋求能夠反映個人風格並與空間整體美感相得益彰的牆面覆蓋物。室內設計趨勢和風格對於塑造壁紙的需求至關重要。隨著室內設計的發展,製造商也開始開發能夠反映最新趨勢的壁紙。

- 油漆業的激烈競爭可能對市場成長構成挑戰。油漆為牆面裝飾提供了多功能的選擇,使消費者可以輕鬆改變牆面的顏色和飾面。該塗料可塗在各種表面,包括牆壁、天花板和裝飾物,以提供整體的外觀。這種多功能性使得這種塗料受到許多消費者的歡迎,尤其是那些喜歡簡約或現代美學的消費者。

壁紙市場趨勢

牆板市場預計將佔據主要佔有率

- 牆板有望成為牆面覆蓋市場成長軌跡的驅動力。這些裝飾元素增強了美感並提供了功能優勢。牆板具有多種材料、設計和飾面,可滿足各種用途,凸顯了其多功能性和客製化選項。對具有視覺吸引力且經濟高效的牆體解決方案的需求激增,刺激了市場對牆板的需求。

- 與油漆和壁紙等傳統覆蓋物相比,牆板更耐用、更易於安裝且維護需求更少。此外,其出色的隔熱、隔音和防潮性能使其成為住宅和商業建築的熱門選擇,進一步推動了市場成長。

- 這些面板具有多種設計、紋理、顏色和圖案,可以逼真地模仿木材、石材、金屬和織物等材料。這種程度的客製化擴大了設計選擇範圍,吸引了更多尋求獨特家居裝飾解決方案的消費者。

- 建築業已成為推動牆面覆蓋市場發展的關鍵力量。隨著建設產業的擴張,特別是住宅和商業領域的擴張,對牆板的需求預計會增加。它省時且安裝方便,深受建築商和承包商的青睞。

- 尤其是美國人口普查局的資料凸顯了一個關鍵趨勢:到2024年,美國私人建築支出將飆升至公共建築支出的近四倍。預測進一步凸顯了這一勢頭,預計美國新建築價值將繼續上漲。截至 2024 年 4 月,私人計劃的建築支出估計為 1,6119 億美元,公共計劃的建築支出估計為 4,871 億美元。

預計北美將佔據很大市場佔有率

- 牆板是壁紙市場成長的主要驅動力。這些裝飾元素增強了美感並提供了功能優勢。牆板採用多種材料、設計和飾面,為各種應用提供了多功能性和可自訂性。對具有視覺吸引力且具有成本效益的牆面覆蓋物的需求不斷成長,刺激了牆板的興起,從而推動了市場的成長。

- 市場擴張主要歸因於建築業的強勁發展、改造和裝修活動的激增、都市化趨勢以及消費者對室內設計的偏好日益提升。由於都市化進程加快、新住宅和商業建築激增以及對創新和永續壁紙解決方案的需求不斷成長,預計這一勢頭將持續下去。

- 美國在住宅重建和維修的支出增加進一步促進了市場的發展。根據家居裝修研究機構的資料,過去幾年美國住宅維修支出持續成長。 2023年,35%的住宅將增加支出,預計這一趨勢將持續到2024年。

- 雖然美國佔據了市場佔有率的主導地位,但加拿大活性化的住宅和商業建設活動也在市場成長中發揮關鍵作用。根據加拿大統計局的最新資料,2024 年 5 月住宅建築投資較上季成長 0.9%。此外,非住宅建築同期成長了0.6%。

- 隨著可支配收入的增加、人們對奢侈品的偏好日益增加以及家居客製化的興起,生活水準不斷提高,壁紙市場正在不斷擴大。此外,自訂3D噴墨列印壁紙等高階產品的出現等市場創新正在刺激富人的購買慾望。

- 北美市場因注重牆面裝飾的設計和創新而脫穎而出。製造商和設計師不斷推出新的圖案、紋理、顏色和飾面,以滿足不斷變化的消費者偏好。數位印刷技術的出現進一步推動了該地區市場的發展,實現了從壁畫到逼真的設計和幾何圖案等高度精細和可客製化的牆面覆蓋物。

壁紙產業概況

壁紙市場高度分散,主要參與者包括 Brewster Home Fashion、Adfors(聖戈班)、Ahlstrom-Munksj Oyj、Asian Paints Ltd 和 Benjamin Moore & Co.。市場參與者正在採用合作、創新和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 9 月亞洲塗料旗下壁紙品牌 Nilaya 與印度設計公司 Tilla Studio 合作推出以大自然為靈感的系列。該系列展示了水彩、水粉和鉛筆的精美手繪插圖,為印度設計精神提供了全新的觀點。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場洞察

- 市場促進因素

- 不斷發展的建築和房地產行業

- 提供時尚產品

- 市場挑戰

- 油漆業競爭激烈

第6章 行業法規、政策與標準

第7章 市場區隔

- 依產品類型

- 牆板

- 壁紙

- 乙烯基壁紙

- 不織布壁紙

- 紙壁紙

- 布藝壁紙

- 其他壁紙

- 瓦

- 金屬壁紙

- 其他產品類型

- 按應用

- 商業的

- 住宅

- 按分銷管道

- 專賣店

- 家裝中心

- 建材店

- 家具店

- 量販店

- 電子商務

- 其他分銷管道

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 北美洲

第8章 競爭格局

- 公司簡介

- Brewster Home Fashion

- Adfors(Saint Gobain)

- Ahlstrom-Munksjo Oyj

- Asian Paints Ltd

- Benjamin Moore & Co.

- AS Creation Tapeten AG

- J. Josephson Inc.

- Walker Greenbank PLC

- Grandeco Wallfashion Group

- York Wallcoverings Inc.

第9章投資分析

第10章:市場的未來

The Wall Covering Market size is estimated at USD 41.40 billion in 2025, and is expected to reach USD 51.52 billion by 2030, at a CAGR of 4.47% during the forecast period (2025-2030).

Wallcoverings, such as wallpaper, are materials designed to adorn the interior walls of a building. Popular options include wallpaper, marble, ceramic, and micro-cement, all aiming to elevate a room's aesthetic.

Key Highlights

- The rising demand for wall coverings stems from a desire to enhance wall aesthetics and an uptick in personal incomes, allowing individuals to invest more in wall decor. Manufacturers offer a wide range of options in terms of design, texture, material, and price point, catering to diverse consumer preferences.

- The growing construction industry and the real estate market for residential and commercial spaces are likely to boost the demand for wall coverings globally. According to data from the Real Estate Roundtable, a non-profit organization based in the United States, the number of commercial buildings in the United States has increased by 55% in the last 40 years, which has enhanced the market's growth.

- Furthermore, data from the Indian Brand Equity Foundation (IBEF) projects a surge in demand for data center real estate, with an anticipated growth of 15-18 million sq. ft by 2025. The country's retail, hospitality, and commercial real estate sectors are experiencing notable growth, contributing to the expansion of the market.

- Styled products' availability is a significant driver for the wallcovering market. Consumers are increasingly seeking wallcoverings that reflect their style and complement the overall aesthetic of their spaces. Interior design trends and styles are crucial in shaping the demand for wallcoverings. As interior design evolves, manufacturers respond by developing wallcoverings that reflect the latest trends.

- High competition from the paints segment can be a challenge for the market's growth. Paints offer a versatile option for wall decoration, allowing consumers to change the color and finish of their walls easily. Paints can be applied to various surfaces, including walls, ceilings, and trim, providing a cohesive look. This versatility makes paints popular for many consumers, especially those who prefer a more minimalistic or contemporary aesthetic.

Wall Covering Market Trends

The Wall Panel Segment is Expected to Hold a Significant Share in the Market

- Wall panels are expected to be a driving force in the wall-covering market's growth trajectory. These decorative elements elevate aesthetics and offer functional benefits. With many materials, designs, and finishes, wall panels cater to diverse applications, emphasizing their versatility and customization options. The surge in demand for visually appealing yet cost-effective wall solutions is fueling the demand for wall panels in the market.

- Compared to traditional coverings like paint or wallpaper, wall panels have superior durability, ease of installation, and minimal maintenance requirements. Moreover, they excel in providing insulation, soundproofing, and moisture resistance, making them a sought-after choice in both residential and commercial settings, further bolstering the market's growth.

- These panels come in a rich array of designs, textures, colors, and patterns, with the ability to convincingly mimic materials such as wood, stone, metal, or fabric. This level of customization broadens design horizons, appealing to a wider consumer base seeking distinctive interior decor solutions.

- The construction sector emerges as a pivotal force propelling the wall covering market. As the construction industry, especially in residential and commercial segments, expands, the demand for wall panels is expected to increase. Their time-saving and convenient installation make them a favored choice for builders and contractors.

- Notably, data from the US Census Bureau highlights a significant trend, in 2024, private construction spending in the United States surged at a rate nearly four times that of public construction spending. Forecasts further underline this momentum, predicting a continued uptick in the value of new buildings in the United States. As of April 2024, the construction spending figures stood at USD 1,611.9 billion for private projects and USD 487.1 billion for public endeavors.

North America is Expected to Hold a Significant Share in the Market

- Wall panels are set to be a key driver in the growth of the wall-covering market. These decorative elements enhance aesthetics and offer functional benefits. With a range of materials, designs, and finishes, wall panels provide versatility and customization for various applications. The increasing demand for visually appealing and cost-efficient wall coverings is fueling the rise of wall panels, thereby bolstering the market's growth.

- The market's expansion is largely attributed to a robust construction sector, a surge in renovation and remodeling activities, urbanization trends, and a growing consumer penchant for interior design. This momentum is expected to persist, driven by ongoing urbanization, a surge in new residential and commercial constructions, and a heightened demand for innovative, sustainable wall-covering solutions.

- The rising home renovation and improvement spending among Americans is further boosting the market. Data from the Home Improvement Research Institute reveals a consistent increase in US home improvement expenditures over the past couple of years. In 2023, 35% of homeowners increased their spending, a trend projected to continue through 2024.

- While the United States dominates the market share, Canada's escalating residential and commercial construction activities are also playing a pivotal role in the market's growth. Recent data from Statistics Canada indicates a 0.9% rise in residential construction investments in May 2024 compared to the previous month. Additionally, non-residential construction saw a 0.6% increase during the same period.

- The wall coverings market is expanding, buoyed by higher living standards, a growing appetite for luxury, and a surge in household customization, all fueled by increasing disposable incomes. Furthermore, market innovations, like the introduction of premium offerings such as custom 3D wall coverings crafted using ink-jet printing, are resonating particularly well with affluent buyers.

- The North American market stands out for its focus on design and innovation in wall coverings. Manufacturers and designers are consistently rolling out new patterns, textures, colors, and finishes to align with evolving consumer tastes. The advent of digital printing technology has been a game-changer, enabling highly detailed and customizable wall coverings, from murals to photo-realistic designs and geometric patterns, further propelling the market in the region.

Wall Covering Industry Overview

The wall covering market is highly fragmented, with major players like Brewster Home Fashion, Adfors (Saint Gobain), Ahlstrom-Munksj Oyj, Asian Paints Ltd, and Benjamin Moore & Co. Players in the market adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- September 2023: Asian Paints' wall coverings brand, Nilaya, partnered with Tilla Studio, an Indian design firm, to unveil a nature-inspired collection. This collection showcases delicate hand illustrations in watercolors, gouache, and pencil, offering a fresh perspective on India's design ethos.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET INSIGHTS

- 5.1 Market Drivers

- 5.1.1 The Growing Construction and Real Estate Industry

- 5.1.2 Availability of Styled Products

- 5.2 Market Challenges

- 5.2.1 High Competition from the Paints Segment

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Product Type

- 7.1.1 Wall Panel

- 7.1.2 Wall Paper

- 7.1.2.1 Vinyl Wallpaper

- 7.1.2.2 Non-woven Wallpaper

- 7.1.2.3 Paper-based Wallpaper

- 7.1.2.4 Fabric Wallpaper

- 7.1.2.5 Other Wallpaper Types

- 7.1.3 Tile

- 7.1.4 Metal Wall Covering

- 7.1.5 Other Product Types

- 7.2 By Application

- 7.2.1 Commercial

- 7.2.2 Residential

- 7.3 By Distribution Channel

- 7.3.1 Specialty Store

- 7.3.2 Home Center

- 7.3.3 Building Material Dealer

- 7.3.4 Furniture Store

- 7.3.5 Mass Merchandizer

- 7.3.6 E-commerce

- 7.3.7 Other Distribution Channels

- 7.4 By Geography

- 7.4.1 North America

- 7.4.1.1 United States

- 7.4.1.2 Canada

- 7.4.2 Europe

- 7.4.2.1 United Kingdom

- 7.4.2.2 Germany

- 7.4.2.3 France

- 7.4.2.4 Spain

- 7.4.2.5 Italy

- 7.4.3 Asia-Pacific

- 7.4.3.1 China

- 7.4.3.2 India

- 7.4.3.3 Japan

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.5.1 Brazil

- 7.4.5.2 Mexico

- 7.4.5.3 Argentina

- 7.4.6 Middle East and Africa

- 7.4.6.1 Saudi Arabia

- 7.4.6.2 United Arab Emirates

- 7.4.6.3 South Africa

- 7.4.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Brewster Home Fashion

- 8.1.2 Adfors (Saint Gobain)

- 8.1.3 Ahlstrom-Munksjo Oyj

- 8.1.4 Asian Paints Ltd

- 8.1.5 Benjamin Moore & Co.

- 8.1.6 A.S. Creation Tapeten AG

- 8.1.7 J. Josephson Inc.

- 8.1.8 Walker Greenbank PLC

- 8.1.9 Grandeco Wallfashion Group

- 8.1.10 York Wallcoverings Inc.