|

市場調查報告書

商品編碼

1640390

金融服務虛擬桌面虛擬化:市場佔有率分析、產業趨勢與成長預測(2025-2030 年)Financial Services Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

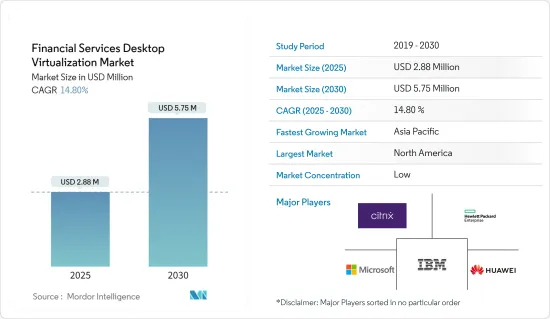

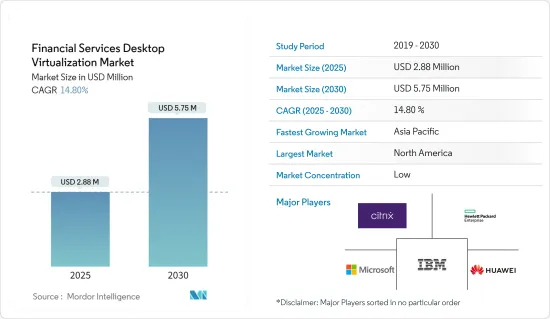

2025 年金融服務虛擬桌面市場規模估計為 288 萬美元,預計到 2030 年將達到 575 萬美元,預測期內(2025-2030 年)的複合年成長率為 14.8%。

公司正在轉向遠距工作來提高員工的效率和生產力。此外,遠端工作和雲端處理可以降低 IT 設備的成本。雲端已經發展成為一種基礎設施,能夠在動態可擴展的虛擬環境中以服務的形式快速交付處理資源。虛擬桌面的使用是由雲端運算使用量的增加以及企業偏好在雲端部署電腦所推動的。

主要亮點

- 金融機構有許多使用者類別和角色。每個使用者身分都需要組織內單獨的電腦桌面映像。這些角色包括前台和分店員工,如櫃員、客戶支援負責人和知識工作者。

- 這使得許多金融機構越來越難以支援多個 FSI 角色、適應季節性需求高峰、提供災難復原 (DR) 以及快速應對意外的區域或全球事件或災難 如今,設計一個高性能、可擴展的並且具有成本效益的VDI基礎設施是一個真正的挑戰。

- 鑑於 FSI 部門內不斷變化的勞動力動態、對虛擬基礎設施的需求不斷成長以及用戶類型多樣化,IT 團隊決定他們需要一個專業的圖形VDI 平台來處理先前在實體工作站上運行的應用程式。 、部署和配置和管理。

- 從融合式基礎架構(HCI) 到融合式基礎架構(CI),再到標準的三層設計,讓您可以定義和擴充自己的運算和儲存元件,哪種類型的IT基礎設施基礎架構最適合您的特定需求?

- 此外,各個金融領域對虛擬桌面的日益採用也推動了市場的成長。許多銀行正在放棄使用帶有硬碟的傳統個人電腦,轉而採用虛擬桌面。隨著金融機構進行這種轉變,他們經常部署虛擬桌面基礎架構 (VDI)。此伺服器運算範例支援桌面虛擬,並包含支援環境所需的硬體和軟體系統。

- 此外,簡化的管理、測量和監控是金融服務中虛擬桌面的一些促進因素。此外,隨著企業擴大採用虛擬,增強的資料安全性將使企業受益。虛擬電腦不能被帶走、拋棄或受到實體損害。孤立的虛擬桌面不再駐留在遠端站點,從而彌補了站點最薄弱的安全漏洞——電腦本身。

- 然而,由於許多複雜性和互通性問題,虛擬桌面可能難以配置和實施。在採用虛擬桌面解決方案之前,必須分析您的基礎架構需求,例如伺服器容量、網路頻寬和工作負載。在某些情況下,客戶可能會在所需的基礎架構配置上做出妥協,以將虛擬桌面虛擬化解決方案實施到他們目前的基礎架構中,進一步損害他們所實施的解決方案的有效性。此外,該行業還缺乏合格的人才。

金融服務虛擬桌面市場趨勢

金融機構擴大採用雲端服務,推動市場成長

- 隨著金融服務公司擴大採用雲端優先方法開發新應用,虛擬市場對雲端基礎的服務的需求也日益增加。此外,大多數金融服務公司已經在使用某種形式的公共雲端。根據 Google Cloud 的一項調查,受訪的金融服務公司中相當一部分(83%)表示,他們使用雲端技術作為其主要運算平台的一部分。最常見的雲設計是混合雲端(38%),其次是單一雲(28%)和多重雲端(17%)。值得注意的是, 多重雲端 % 的尚未採用多重雲端的受訪者表示,他們計劃在未來 12 個月內採用多雲。

- 根據企業雲端處理領先公司 Nutanix 最近發布的 2022 年全球企業雲端指數 (ECI),金融服務業對多重雲端和公共雲端的採用率較低,導致幾乎所有受訪者 (98%) 都表示在過去12個月內將一個或多個應用程式遷移到新的IT環境,其中許多是從傳統資料中心遷移到私有雲端。此外,美國銀行家協會報告稱,超過 90% 的金融機構在部分或全部銀行業務中使用雲端工具。

- 此外,基於雲端的應用程式串流在業界越來越受歡迎,許多企業選擇獨立的應用程式服務。雲端運算受到各個領域的青睞,因為它具有更好的可擴展性、資料管理和成本節省功能。

- 此外,雲端運算的採用使得在工作環境之間移動資訊變得更加容易。您還可以擴展您的需求併購買額外的運算能力或資料,而無需安裝實體伺服器。這種彈性使得資源管理更有效率。

- 此外,虛擬桌面基礎設施需要額外的儲存、操作頻寬和軟體,您可能需要購買昂貴的 SAN 和伺服器來容納和操作數百台電腦。具有內建 VDI 選項的公有雲可以降低實施和維護 VDI 的成本。

- 虛擬桌面作為一種雲端服務對於 BFSI 來說是一個特別有吸引力的選擇。金融服務面臨的主要挑戰仍然是資料安全,這也是該領域採用虛擬桌面的主要原因之一。

預測期內亞太地區將實現顯著成長

- 企業流程的快速數位化,以及對雲端基礎運算選項的不斷成長的需求(使公司能夠更好地保護其資料)是推動該地區市場發展的一些因素。此外,安全遠端存取和行動裝置的使用日益增多也推動了亞太地區的虛擬桌面業務的發展。

- 在金融服務業,亞洲是許多市場參與者熟悉的IT外包目的地。該地區的許多新興市場預計將比成熟經濟體實現更快的成長速度。

- 隨著這些市場的持續成長,對零售銀行、資產管理、保險和資本市場服務等金融服務的需求也不斷成長。許多行業參與者正在擴大在該地區的業務,以佔領這個快速成長的市場。

- 此外,該地區的金融機構擴大採用虛擬桌面虛擬化解決方案,以降低硬體和維護成本並簡化 IT 管理業務。因此,Citrix XenDesktop、VMware Horizon View 和 Microsoft 遠端桌面服務 (RDS) 等虛擬桌面選項正在迅速普及。此外,對更好的用戶體驗和效率的不斷成長的需求正在推動亞太地區虛擬桌面市場的發展。

- 遠距工作的日益成長的趨勢以及為員工提供從任何地方無縫存取業務程序和資料的需求促使組織採用虛擬桌面技術。這有效地解決了工人地理可及性差的問題,提高了工人的生產效率,並使組織決策更有效。此外,BYOD(自帶設備)和WaaS(工作場所即服務)的日益普及也刺激了市場擴張。

金融服務虛擬桌面產業概覽

金融服務虛擬桌面市場競爭激烈,主要企業包括 Citrix Systems, Inc.、東芝公司、IBM 公司、微軟公司和華為技術有限公司。為了擴大影響力,大多數主要企業與金融機構簽訂長期協議,根據客戶需求提供客製化解決方案。

2022 年 12 月,Nerdio 宣布已在由知名成長型股權公司 Updata Partners主導的資金籌措。的虛擬桌面。 Nerdio 提供數百種簡化管理的功能,為 Azure 虛擬桌面、Windows 365 和 Microsoft Intune 增加了價值,幫助企業組織和合作夥伴實現其 DaaS計劃和交付方法的現代化。

2022 年 11 月,VMware 宣布其 Anywhere Workspace 平台的增強功能,以協助減輕 IT 團隊的管理負擔並透過自動化提高效率。 VMware Anywhere Workspace 支援透過統一端點管理 (UEM)、VDI 和 DaaS、數位員工體驗 (DEX) 和工作區安全實現靈活的工作。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響評估

第5章 市場動態

- 市場促進因素

- 金融機構擴大採用雲端服務

- 透過虛擬桌面實現無機成長

- 市場限制

- 企業面臨的基礎設施限制對市場成長構成挑戰

- 專業技能人才短缺

第6章 市場細分

- 桌面交付平台

- 託管虛擬桌面 (HVD)

- 託管共用桌面 (HSD)

- 其他桌面交付平台

- 依部署方式

- 本地

- 雲

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Citrix Systems, Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Microsoft Corporation

- Huawei Technologies Co. Ltd

- Evolve IP, LLC

- Parallels International GmbH(Corel Corporation)

- Dell Inc.

- NComputing Co., Ltd.

- Ericom Software Ltd.

第8章投資分析

第9章 市場機會與未來趨勢

The Financial Services Desktop Virtualization Market size is estimated at USD 2.88 million in 2025, and is expected to reach USD 5.75 million by 2030, at a CAGR of 14.8% during the forecast period (2025-2030).

Enterprises are concentrating on working remotely to make their employees more effective and productive. Moreover, remote working and cloud processing could lower the cost of IT equipment. Clouds have evolved as an infrastructure, allowing for rapidly distributing processing resources as a service in a dynamically scalable and virtualized environment. The use of desktop virtualization is driven by higher cloud uptake rates and corporate preferences for implementing computers on the cloud.

Key Highlights

- Financial organizations frequently have numerous user categories or personas. Each user identity requires a distinct computer desktop image within the organization. These characters include front-office and branch employees such as tellers, customer support reps, and knowledge workers.

- So, for many financial organizations, designing a high-performance, scalable, and cost-effective VDI infrastructure that can support these multiple FSI personas, as well as meet seasonal demand spikes, provide disaster recovery (DR), and respond quickly to unexpected regional and global events or disasters, is a real challenge.

- IT teams find that the design, deployment, configuration, and management of professional graphics VDI platforms for applications that have previously run on physical workstations is becoming increasingly difficult in view of changing workforce dynamics, rising demand for virtual infrastructures as well as a variety of user types within the FSI sector.

- Different organizations may have vastly different requirements in terms of the type of IT infrastructure that is best suited to their specific needs, which can range from hyper-converged infrastructure (HCI) to converged infrastructure (CI) to standard three-tier designs that can define and scale the compute and storage components on your own.

- Moreover, The rising adoption trends of desktop virtualization across various financial sectors drive market growth. Many banking organizations are moving away from the conventional PC path with the hard drive towards desktop virtualization. Financial institutions to make the transition frequently implement a Virtual Desktop Infrastructure (VDI). This server computing paradigm allows desktop virtualization and includes the hardware and software systems required to support the environment.

- Further, simplicity in management, measuring, and monitoring are a few factors driving desktop virtualization in financial services. Moreover, the enhanced data security benefits the firms in the increased adoption of virtualization. Virtual computers cannot be taken, abandoned, or physically compromised. A disconnected virtual desktop no longer appears at the distant site, closing the site's most vulnerable security gap: the computer itself.

- However, configuring and implementing desktop virtualization is challenging due to the numerous complexities and interoperability problems. Before adopting desktop virtualization solutions, it is essential to analyze the infrastructure needs, such as server capacity, network bandwidth, and workload. Several times, a user compromises on the necessary infrastructure configuration and attempts to implement a desktop virtualization solution on the current infrastructure, which may further hamper the effectiveness of the implemented solution. Furthermore, qualified workers are scarce in the industry.

Financial Services Desktop Virtualization Market Trends

Increasing Adoption of Cloud Services in Financial Institutions to Drive the Market Growth

- As financial services companies are increasingly adopting a cloud-first approach to new applications, demand for cloud-based services increased as well in the virtualization market. Moreover, most financial services firms are already utilizing some type of public cloud. According to the Google Cloud survey, a significant percentage of surveyed financial services firms (83%) report that businesses are using cloud technology as part of their main computing platforms. The most common cloud design is hybrid cloud (38%), followed by single cloud (28%) and multi-cloud (17%). Notably, 88% of respondents without a multi-cloud implementation said they plan to implement a multi-cloud plan in the next 12 months.

- According to the global 2022 Enterprise Cloud Index (ECI) released recently by Nutanix, a prominent player in enterprise cloud computing, Almost all financial services respondents (98%) have migrated one or more apps to a new IT environment in the last 12 months, most likely from conventional datacenters to private clouds, given the industry's low multi-cloud and public cloud penetration. Moreover, the American Bankers Association reported that more than 90% of financial organizations use cloud tools for some or all of their banking activities.

- Further, application streaming over the cloud is gaining popularity in the industry, with many enterprises choosing standalone application services. Cloud is preferred across sectors, as it provides better scalability, data management, and cost savings.

- Moreover, the deployment of cloud makes it easy for information to move between working environments. They may also make use of the ability to scale up their requirements and purchase additional computing power and data without having to install a physical server. More effective management of resources is enabled by this flexibility.

- Furthermore, infrastructure for virtual desktops necessitates extra storage, operational bandwidth, and software, which might require the purchase of expensive SANs and servers to house and operate hundreds of computers. VDI implementation and maintenance costs can be reduced in public cloud settings that include built-in VDI options.

- Due to the available additional layer of security, it also provides data and applications while ensuring that user experiences are maximized; desktop virtualization as a cloud service is an especially attractive option in BFSI. The primary issue of financial services remains the data security problem, which continues to be one of the main reasons why desktop virtualization is being adopted in this sector.

Asia-Pacific to Register Significant Growth Rates During the Forecast Period

- The rapid digitization of company processes, as well as the growing demand for cloud-based computing options that can enhance enterprise data protection, are a few factors driving the market in the region. Additionally, the increasing utilization of safe remote access and mobile devices propels the Asia Pacific desktop virtualization business forward.

- In the financial services industry, Asia hosts some prominent IT outsourcing destinations for a number of market players. It is expected that many emerging markets in the region will also experience higher growth rates than those of the mature economies.

- As these markets continue to grow in this trajectory, the need for financial services, such as retail banking, asset management, insurance, capital market service, and others, is also increasing. Many industry players have been increasing their presence in the region to capture the market in this fast-growing region.

- Furthermore, financial organizations in the area are increasingly turning to specialized desktop virtualization solutions to reduce hardware and maintenance expenses and ease IT administration operations. This has resulted in the fast adoption of desktop virtualization options such as Citrix XenDesktop, VMware Horizon View, and Microsoft Remote Desktop Services (RDS). Furthermore, the growing demand for better user experience and efficiency propels the Asia Pacific desktop virtualization market.

- The growing tendency of remote work and the need to provide workers with seamless access to work programs and data from any location has led to the adoption of Desktop Virtualization technology by organizations. This effectively solved the problem of workers' restricted geographic accessibility, increasing their productivity and allowing more effective organizational decision-making. Furthermore, the market's expansion has been anticipated to be fueled by the growing popularity of Bring Your Own Device (BYOD) and Workplace-as-a-Service (WaaS) among businesses in the area.

Financial Services Desktop Virtualization Industry Overview

The financial services desktop virtualization market is a competitive market with prominent players like Citrix Systems, Inc., Toshiba Corporation, IBM Corporation, Microsoft Corporation, and Huawei Technologies Co. Ltd, among others. To increase their footprint, most of the significant players are signing long-term agreements with Financial Institutions and providing customized solutions based on the needs of the clientele.

In December 2022, Nerdio, the primary solution for organizations seeking to implement virtual desktops employing native Microsoft technologies, reported the completion of a USD 117 million Series B financing round led by Updata Partners, a prominent growth equity firm. Nerdio added value to Azure Virtual Desktop, Windows 365, and Microsoft Intune by providing hundreds of features to ease administration, assisting business organizations and partners in modernizing their DaaS projects and delivery methods.

In November 2022, VMware unveiled enhanced features across its Anywhere Workspace platform to help IT teams reduce administrative burdens and increase efficiency through automation. VMware Anywhere Workspace allowed flexible work through the use of Unified Endpoint Management (UEM), VDI and DaaS, Digital Employee Experience (DEX), and Workspace Security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Cloud Services in Financial Institutions

- 5.1.2 Desktop Virtualization Supports Inorganic Growth

- 5.2 Market Restraints

- 5.2.1 Infrastructural Constraints of Enterprises will Act as a Challenge for the Growth of the Market

- 5.2.2 Lack of Skilled Professionals

6 MARKET SEGMENTATION

- 6.1 By Desktop Delivery Platform

- 6.1.1 Hosted Virtual Desktop (HVD)

- 6.1.2 Hosted Shared Desktop (HSD)

- 6.1.3 Other Desktop Delivery Platform

- 6.2 By Deployment Mode

- 6.2.1 On-premises

- 6.2.2 Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Citrix Systems, Inc.

- 7.1.2 Hewlett Packard Enterprise Development LP

- 7.1.3 IBM Corporation

- 7.1.4 Microsoft Corporation

- 7.1.5 Huawei Technologies Co. Ltd

- 7.1.6 Evolve IP, LLC

- 7.1.7 Parallels International GmbH (Corel Corporation)

- 7.1.8 Dell Inc.

- 7.1.9 NComputing Co., Ltd.

- 7.1.10 Ericom Software Ltd.