|

市場調查報告書

商品編碼

1628733

虛擬桌面:市場佔有率分析、產業趨勢、成長預測(2025-2030)Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

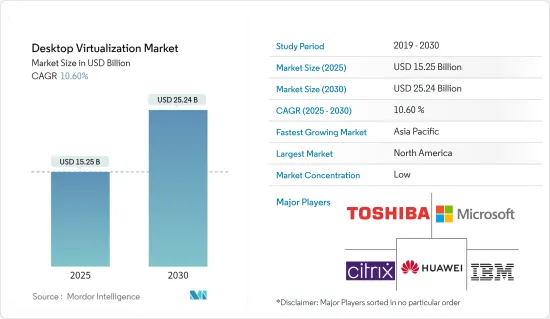

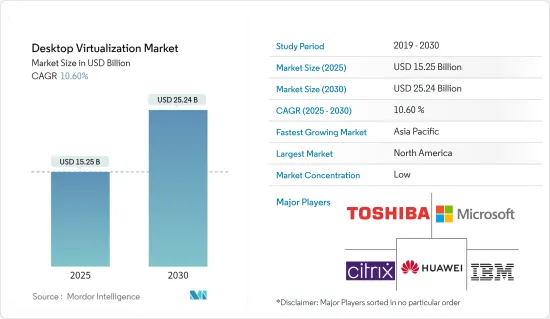

虛擬桌面市場規模預計到 2025 年將達到 152.5 億美元,預計到 2030 年將達到 252.4 億美元,預測期內(2025-2030 年)複合年成長率為 10.6%。

虛擬桌面與降低成本完美同步。因此,成本效益預計將成為市場成長的關鍵驅動力。

主要亮點

- 虛擬桌面對於中小型企業很有價值,因為它可以減少硬體支出並降低系統管理和維護成本。它提供了出色的計算體驗並解決了一些複雜的問題。因此,虛擬桌面提供了多種好處,例如降低營運成本和提高用戶滿意度,預計這將在預測期內推動虛擬桌面市場的成長。

- 雲端處理的日益普及和職場對 BYOD 的需求不斷增加是推動該市場的關鍵因素。透過實施虛擬桌面,雇主可以利用 BYOD 來提高遠端和辦公室員工的靈活性和安全性。虛擬桌面虛擬化允許員工從幾乎任何地方、在任何裝置上存取安全、受監督的桌面。

- 虛擬桌面虛擬化擴大被各種類型的企業採用,因為它降低了複雜性並允許將應用程式交付給各種行動用戶。管理和儲存方面的進步使其成為更可行的選擇,並正在推動全球市場的採用。

- 基礎設施限制阻礙了市場成長。虛擬桌面增加了交付 Windows 桌面和應用程式的複雜性。為了使虛擬桌面能如預期運作,多層技術必須協調工作。對新基礎設施的需求和相關成本是虛擬桌面市場成長的主要限制因素之一。

- 自 COVID-19 以來,隨著許多公司轉向遠端工作,該市場受到關注。封鎖和社交距離準則迫使許多公司立即做出必要的調整,並建立必要的電腦基礎設施來支援遠端工作人員。企業長期以來一直在使用虛擬桌面解決方案。

虛擬桌面市場趨勢

雲端採用模式預計將顯著成長

- 許多公司正在使用雲端運算來降低營運成本。雲端託管的易於部署、可存取性和靈活性預計將推動組織採用雲端運算。雲端部署包括DaaS(桌面即服務)、WaaS(工作空間即服務)和SaaS(應用程式/軟體即服務)等服務模式。虛擬桌面作為雲端網路上的服務提供,所有運算和支援基礎設施以雲端部署模式託管在服務供應商側。

- 透過雲端進行的應用程式串流在業界越來越受歡迎,許多公司選擇獨立的應用程式服務。雲端是各行業的首選,它提供更好的可擴展性、資料管理和成本節約。據 Flexera Software 稱,到 2023 年,47% 的受訪者將已經在 Amazon Web Services (AWS) 上運行關鍵工作負載。

- 企業可以輕鬆地為員工創建新的桌面,而無需購買實體 PC。當不再需要這些資源時,可以將它們關閉,此時客戶將不再需要收費。儘管定價模式多種多樣,但基於用量的定價是雲端桌面的獨特優勢。

- 採用雲端可以更輕鬆地在工作環境之間遷移資料。它還允許企業擴展其需求並獲得額外的運算能力和資料,而無需實體安裝。 DaaS 的這種彈性可以實現更好的資源管理。

- 2023年6月,雲端軟體集團宣布與Midis Group建立合作關係,開始共同服務東歐、中東和非洲的通路和消費者。這項合作關係為雲端軟體集團提供了支援消費者進行變革性技術合作所需的本地資源,以及擴大其在這些地區的業務所需的規模。

- 服務提供者託管的伺服器和設備無需技術人員和 IT 資源來維護和作業系統。透過雲端部署部署的虛擬桌面解決方案,公共事業和應用程式會自動更新。用戶不需要被「推送」更新。用戶幾乎可以使用任何設備訪問虛擬桌面和程序,因此無論他們選擇PC、Mac、Linux、iOS還是Android,他們都可以看到以相同方式工作的應用程式,並且在需要時使用起來很方便。

預計北美將佔據最大的市場佔有率

- 北美地區被認為是許多行業的全球中心,也是虛擬桌面最大的區域市場。美國是北美最大的虛擬桌面消費者。美國多家雲端服務供應商的存在以及託管伺服器數量的增加正在促進北美市場的成長。

- 美國主要企業的存在正在推動整個全部區域的市場成長,在靠近已開發國家的加拿大設立了新的工作空間,並強調採用環保和節能的做法。

- 該地區組織早期採用新技術是全球主導地位的主要驅動力。主要雲端服務供應商在該地區雲端基礎的虛擬桌面部署的成長中發揮著重要作用。

- 北美的 IT 和通訊業是所有其他區域市場中最大的。銀行、醫療保健和政府機構等行業處理敏感資訊的大型資料庫。這些公司對虛擬桌面感到興奮,虛擬桌面它為用戶提供了靈活性,同時保留了其智慧財產權的完整性。

虛擬桌面虛擬化產業概況

虛擬桌面市場高度分散,主要公司包括思傑系統公司、IBM公司、華為科技公司、微軟公司和東芝公司。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2023 年 11 月 - Microsft 宣布全面推出全新的 Azure 虛擬桌面 Web 用戶端使用者介面。此更新允許使用者將 Web 用戶端設定重設為預設值、在淺色和深色模式之間切換以及以網格或清單格式檢視資源。

- 2023 年 7 月 - Citrix 與客戶參與軟體領域的全球領導者 Twilio 合作。此次合作致力於為 Citrix DaaS 和 Twilio Flex 環境提供整合的高效能解決方案。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 對自備設備的需求不斷成長

- 擴大雲端運算的採用

- 市場限制因素

- 基礎設施限制

第6章 市場細分

- 透過桌面產品

- 託管虛擬桌面 (HVD)

- 託管共用桌面 (HSD)

- 其他桌面產品

- 按發展

- 本地

- 雲

- 按最終用戶產業

- 金融服務

- 衛生保健

- 製造業

- 資訊科技/通訊

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Citrix Systems Inc.

- IBM Corporation

- Huawei Technologies Co. Ltd

- Microsoft Corporation

- Toshiba Corporation

- DELL Technologies Inc.

- Parallels International GmbH

- Red Hat Inc.

- NComputing Co. Ltd.

- Ericom Software Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Desktop Virtualization Market size is estimated at USD 15.25 billion in 2025, and is expected to reach USD 25.24 billion by 2030, at a CAGR of 10.6% during the forecast period (2025-2030).

Desktop Virtualization is completely in sync with cost reduction. Hence, cost-effectiveness is expected to be a key driving factor for the growth of the market.

Key Highlights

- Desktop virtualization is valuable for small and medium businesses, as it lowers expenditure on hardware and reduces system administration and maintenance costs. It provides a superior computing experience and solves several complex problems. As a result, desktop virtualization has several benefits, such as a reduction of operational costs and increased user satisfaction, which is expected to fuel the growth of the desktop virtualization market during the forecast period.

- The growing adoption of cloud computing and increasing demand for BYOD in the workplace are significant factors driving this market. By implementing desktop virtualization, employers can leverage BYOD to boost the flexibility and security of both a remote workforce and those working in the office. Employees that use desktop virtualization have access to a secure, monitored desktop from almost any location and on any device.

- The ability to lower complexity and deliver apps to various mobile users is boosting the adoption of desktop virtualization in all types of businesses. The advancements in management and storage make it a more viable option, which is driving the adoption of the market worldwide.

- Infrastructural constraints are hindering the growth of the market. Desktop virtualization increases the complexity of delivering Windows desktops and applications. For virtual desktops to perform as intended, several layers of technology have to work in harmony. The need for new infrastructure, along with the costs associated with it, is one of the major constraints for the growth of the desktop virtualization market.

- The market has been brought to focus since COVID-19 because many businesses have turned to remote working. The lockdown and social distancing guidelines forced many businesses to make the necessary adjustments immediately and build the computer infrastructure needed to support their remote workers. Businesses have been using desktop virtualization solutions for a long time.

Desktop Virtualization Market Trends

Cloud Deployment Mode is Expected to Witness Significant Growth

- Various organizations are using cloud computing to reduce businesses' operational costs. Easy implementation, accessibility, and flexibility of cloud hosting are expected to drive organizations' adoption of cloud computing. Cloud deployment includes service models, such as Desktop-as-a-Service (DaaS), Workspace-as-a-Service (WaaS), and Application/Software-as-a-Service (SaaS). Desktop virtualization is offered as a service over cloud networks, with all computing and supporting infrastructure hosted on the service provider's end in the cloud deployment mode, which makes the migration of data between working environments easy.

- Application streaming over the cloud is gaining popularity in the industry, with many businesses choosing standalone application services. Cloud is preferred across industries, providing better scalability, data management, and cost savings. According to Flexera Software, in 2023, 47 percent of respondents are already running significant workloads on Amazon Web Services (AWS).

- Businesses can easily create new desktops for their workforce without needing to purchase physical PCs. When these resources are no longer needed, they can be turned off, at which point the customer is no longer billed. Although there are various pricing models, consumption-based pricing is a unique benefit of cloud desktops.

- Cloud deployment makes the migration of data between working environments easy. Also, companies have the option to scale up their requirements and procure additional computing power and data without the need for physical installation. This flexibility of DaaS enables better resource management.

- In June 2023, Cloud Software Group announced a partnership with Midis Group, in its collaboration to serve its channel and consumers in Eastern Europe, the Middle East, and Africa. The collaboration offers Cloud Software Group the local resources consumers need to help their transformative technology collaboration and the scale required to expand its presence in these regions.

- With servers and equipment hosted on the service provider's side, the need for technical staff and IT resources to maintain and operate systems is eliminated. In cloud-deployed desktop virtualization solutions, utilities and applications are updated automatically. Users do not need to be "pushed" for updates. The fact that users may access their virtual desktop or programs using almost any device means that regardless of whether they prefer PC, Mac, Linux, iOS, or Android, they will see the same applications that work in the same way and have them conveniently available whenever they need them.

North America is Expected to Hold the Largest Market Share

- The North American region is considered to be the global hub for many industry verticals, and as a result, it is the largest regional market for desktop virtualization. The United States is the largest consumer of desktop virtualization in North America. The presence of several cloud service providers and an increasing number of hosted servers in the United States have contributed to the growth of the market in North America.

- The presence of major companies in the United States has led to the setting up of new workspaces in Canada due to the proximity of its developed counterpart and emphasis on installing eco-friendly and energy-saving practices, thus bolstering the growth of the market across the region.

- The early adoption of new technologies by organizations in the region is the primary driving force behind global dominance. Large cloud service providers play a significant role in the growth of cloud-based desktop virtualization deployment in the region.

- The North American IT and telecommunications industry is the largest among other regional markets. Industries, such as banking, healthcare, and government organizations, handle large databases of sensitive information. They are looking forward to using desktop virtualization deployments, as they preserve the integrity of the intellectual property and simultaneously provide flexibility to users.

Desktop Virtualization Industry Overview

The Desktop Virtualization market is highly fragmented with the presence of major players like Citrix Systems Inc., IBM Corporation, Huawei Technologies Co. Ltd, Microsoft Corporation, and Toshiba Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023 - Microsft has announced the General Availability of the latest new Azure Virtual Desktop Web Client User Interface. With this update, Users can Reset web client settings to their defaults, Switch between Light and Dark Mode, and View their resources in a grid or list format.

- July 2023 - Citrix has partnered with Twilio, one of the global leaders in customer engagement software. This partnership represents the commitment to provide integrated, high-performance solutions for the Citrix DaaS and Twilio Flex environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Bring Your Own Device

- 5.1.2 Growing Adoption of Cloud Computing

- 5.2 Market Restraints

- 5.2.1 Infrastructural Constraints

6 MARKET SEGMENTATION

- 6.1 By Desktop Delivery Platform

- 6.1.1 Hosted Virtual Desktop (HVD)

- 6.1.2 Hosted Shared Desktop (HSD)

- 6.1.3 Other Desktop Delivery Forms

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-User Vertical

- 6.3.1 Financial Services

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 IT & Telecommunications

- 6.3.5 Other End-User Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Citrix Systems Inc.

- 7.1.2 IBM Corporation

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Microsoft Corporation

- 7.1.5 Toshiba Corporation

- 7.1.6 DELL Technologies Inc.

- 7.1.7 Parallels International GmbH

- 7.1.8 Red Hat Inc.

- 7.1.9 NComputing Co. Ltd.

- 7.1.10 Ericom Software Inc.