|

市場調查報告書

商品編碼

1640500

零售虛擬桌面虛擬化:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Retail Desktop Virtualization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

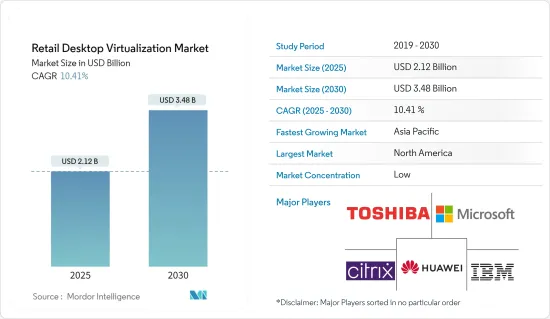

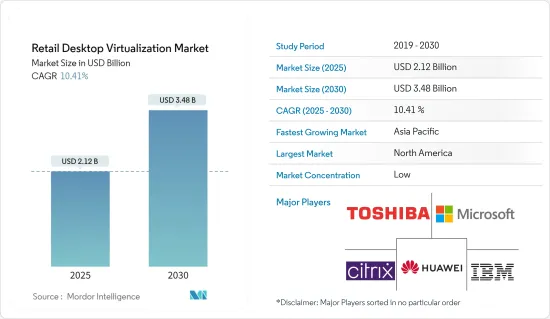

零售虛擬桌面市場規模預計在 2025 年為 21.2 億美元,預計到 2030 年將達到 34.8 億美元,預測期內(2025-2030 年)的複合年成長率為 10.41%。

由於雲端運算的快速普及和各領域自動化程度的提高,零售虛擬桌面市場正在經歷顯著的成長。虛擬桌面,即在中央伺服器上託管的虛擬機器 (VM) 內運行桌面作業系統,已成為尋求提高靈活性、安全性和成本效益的企業的關鍵解決方案。該技術通常透過虛擬桌面基礎架構 (VDI) 或桌面即服務 (DaaS) 平台提供,可實現遠端桌面解決方案和應用程式虛擬,從而實現無縫虛擬工作空間。

據產業分析師稱,虛擬桌面對現代IT基礎設施越來越重要,尤其是隨著多重雲端環境的興起和對終端用戶運算 (EUC) 解決方案的需求不斷成長。虛擬機器 (VM) 和軟體定義資料中心 (SDDC) 也在這一領域發揮著至關重要的作用,使企業能夠有效率地部署虛擬桌面。競爭非常激烈,Citrix Systems、VMware 和 Microsoft 等主要企業引領市場,超融合式基礎架構(HCI) 和精簡型用戶端領域正在發生重大創新。

隨著企業繼續優先考慮靈活性和遠端工作能力,對虛擬桌面部署的需求預計會增加。市場前景顯示雲端桌面的採用將穩定成長,尤其是在資料安全性和可存取性至關重要的行業。這種變化也反映在市場細分上,與本地解決方案相比,雲端部署模式的趨勢明顯更明顯,尤其是在北美和歐洲等地區。

雲端運算在推動虛擬桌面中的作用

關鍵亮點

- 改變IT基礎設施:雲端運算改變了傳統的IT基礎設施,使得虛擬桌面成為適合各種規模企業的可行解決方案。透過利用雲端基礎的服務,企業可以更有效率地部署虛擬桌面並減少對大型實體基礎架構的需求。這種轉變是實現虛擬桌面基礎架構 (VDI) 和桌面即服務 (DaaS) 解決方案可擴展性的主要驅動力。雲端桌面提供的靈活性使企業能夠動態管理資源,這在工作負載分配和災害復原至關重要的多重雲端環境中尤其有利。

- 提高可訪問性和成本效益:雲端運算促進了可訪問性和成本效益的提高,使企業無需大量的前期投資即可支援遠端桌面解決方案和應用程式虛擬。虛擬機器 (VM) 的普及使得企業能夠為員工提供安全、一致的虛擬工作空間訪問,無論他們身在何處。在當今的「隨處辦公」文化中,這種能力至關重要,因為行動性和資料安全是首要任務。此外,與傳統桌面設定相比,雲端桌面更易於管理和更新,從而降低了整體擁有成本 (TCO)。

零售業自動化推動虛擬需求

關鍵亮點

- 簡化零售業務:零售業自動化程度的提升是虛擬桌面需求的主要原因。零售商擴大採用自動化技術來簡化業務、改善客戶體驗並簡化供應鏈。虛擬桌面透過提供一個平台來集中管理多個位置的應用程式、庫存系統和客戶資料,從而幫助實現這些工作。透過部署遠端桌面解決方案,零售企業可以保持業務同步,並實現快節奏環境中必不可少的即時資料存取和處理能力。

- 支援全通路策略:隨著零售商不斷發展其全通路策略,實體平台和數位平台之間的無縫整合的需求變得顯而易見。虛擬桌面允許零售商創建一個統一的工作區,支援各種功能,從銷售點 (POS) 系統到客戶關係管理 (CRM) 工具。這種整合對於跨通路提供一致的客戶體驗至關重要。此外,虛擬桌面的廣泛採用使零售商能夠維護強大的安全通訊協定和資料保護措施,這在處理敏感的客戶資訊時至關重要。

零售虛擬桌面市場趨勢

虛擬桌面虛擬化中雲端應用的興起

- 雲端採用趨勢:雲端採用是虛擬桌面市場的重要趨勢,其促進因素是對具有成本效益、可擴展且易於管理的解決方案的需求。由虛擬桌面基礎設施 (VDI) 和 DaaS(桌面即服務)主導的從傳統的內部部署模式轉向基於雲端的模式的轉變正在日益加劇。這種轉變將使企業能夠快速部署虛擬桌面,同時降低前期成本並提高靈活性。多重雲端環境的採用進一步加速了這個趨勢。希望避免供應商鎖定並提高營運彈性的企業正在推動在各種雲端平台上採用虛擬機器 (VM)。

- 採用雲端的關鍵促進因素:雲端運算的興起改變了虛擬桌面格局,使企業能夠更有效地管理資源。超融合融合式基礎架構(HCI) 提供的運算、儲存和網路資源的無縫整合正在推動偏好對雲端運算的採用。此外,軟體定義資料中心 (SDDC) 的興起使企業能夠更輕鬆地管理虛擬工作負載並實現更高的營運效率。因此,越來越多的中小型企業採用雲端桌面解決方案來最佳化其 IT 資源,進一步推動市場成長。

預計北美將佔很大佔有率

- 北美引領全球市場:在先進的技術基礎設施和數位轉型策略的高度採用的推動下,北美有望主導虛擬桌面虛擬化市場。該地區注重創新且能夠快速整合新技術,已成為市場成長的關鍵樞紐。遠距工作和在家工作的增加推動了對遠端桌面解決方案的需求不斷成長,這是支持這種主導地位的關鍵因素。隨著該地區的企業採用 VDI、DaaS 和雲端桌面解決方案,北美的市場佔有率預計將大幅成長。

- 美國作為主要企業:作為北美最大的虛擬桌面消費國,美國在該地區市場領導中發揮關鍵作用。美國主要雲端服務供應商的存在和託管伺服器數量的不斷成長正在推動雲端基礎的虛擬桌面的成長。此外,其與加拿大的距離以及對新工作空間的環保實踐的重視進一步推動了該地區的市場擴張。這種區域互聯互通支援更廣泛地採用虛擬桌面解決方案,並加強了北美的領導地位。

零售虛擬桌面虛擬化產業概覽

市場分散:零售虛擬桌面市場高度分散,沒有一家廠商能夠佔據主導市場佔有率。這種細分描述了大型跨國公司和小型專業公司所處的競爭環境。我們提供廣泛的解決方案,從基本的虛擬到複雜的客製化部署。

企業虛擬桌面市場中採用多種方法的領先公司包括 Citrix Systems Inc.、東芝公司、Red Hat Inc.、IBM 公司、華為技術有限公司和微軟公司。這些公司以其強大的全球影響力、廣泛的產品系列和持續的創新而聞名。 Citrix 和 Microsoft 以其全面的虛擬平台而聞名,而 Red Hat(IBM 旗下)和華為則專注於整合開放原始碼和雲端基礎的解決方案。東芝公司的業務更加細分化,服務於特定行業的需求。

創新和整合是未來成功的關鍵虛擬桌面市場的關鍵趨勢包括對雲端基礎的解決方案的需求不斷成長、安全性不斷提高以及與現有IT基礎設施的無縫整合。成功的市場參與企業必須專注於這些領域,並提供靈活、安全的解決方案,以滿足企業不斷變化的需求。持續創新、策略夥伴關係和擴大服務範圍將成為在這個分散的市場中保持競爭力的關鍵策略。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況(包括新冠疫情的影響)

- 產業吸引力-波特五力分析

- 購買者/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場動態

- 市場促進因素

- 雲端運算的廣泛應用

- 零售業自動化的成長

- 市場限制

- 基礎架構部署限制

第6章 市場細分

- 透過桌面交付平台

- 託管虛擬桌面 (HVD)

- 託管共用桌面 (HSD)

- 依實施類型

- 本地

- 雲

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Citrix Systems Inc.

- Toshiba Corporation

- Red Hat Inc.(IBM Corporation)

- Huawei Technologies Co. Ltd.

- Microsoft Corporation

- Parallels International GmbH

- Dell Inc.

- Ncomputing, Inc.

- Ericom Software Inc.

- Tems, Inc

- Vmware Inc.

第8章投資分析

第9章:市場的未來

The Retail Desktop Virtualization Market size is estimated at USD 2.12 billion in 2025, and is expected to reach USD 3.48 billion by 2030, at a CAGR of 10.41% during the forecast period (2025-2030).

The desktop virtualization market has gained significant traction, driven by the rapid adoption of cloud computing and increasing automation across various sectors. Desktop virtualization, which involves running a desktop operating system within a virtual machine (VM) hosted on a centralized server, has become a crucial solution for businesses aiming to enhance flexibility, security, and cost efficiency. This technology, often delivered through platforms like Virtual Desktop Infrastructure (VDI) or Desktop as a Service (DaaS), enables remote desktop solutions and application virtualization, fostering a seamless virtual workspace.

Industry analysis reveals that desktop virtualization is becoming increasingly integral to modern IT infrastructures, especially with the rise of multi-cloud environments and the growing demand for end-user computing (EUC) solutions. Virtual machines (VMs) and software-defined data centers (SDDCs) are also playing a pivotal role in this landscape, enabling organizations to deploy virtual desktops efficiently. With companies like Citrix Systems Inc., VMware Inc., and Microsoft Corporation leading the market, the competition is intense, with significant innovation occurring in hyper-converged infrastructure (HCI) and thin clients.

As businesses continue to prioritize flexibility and remote work capabilities, the demand for virtual desktop deployment is expected to grow. The market outlook suggests a steady rise in the adoption of cloud desktops, particularly in industries where data security and accessibility are paramount. This shift is reflected in the market's segmentation, with a noticeable trend towards cloud deployment modes over on-premise solutions, particularly in regions like North America and Europe.

Cloud Computing's Role in Driving Desktop Virtualization

Key Highlights

- Transformation of IT Infrastructure: Cloud computing has transformed traditional IT infrastructures, making desktop virtualization a feasible solution for businesses of all sizes. By leveraging cloud-based services, companies can deploy virtual desktops more efficiently, reducing the need for extensive physical infrastructure. This shift has been instrumental in enabling the scalability of virtual desktop infrastructure (VDI) and Desktop as a Service (DaaS) solutions. The flexibility offered by cloud desktops allows organizations to manage resources dynamically, which is particularly advantageous in multi-cloud environments where workload distribution and disaster recovery are critical.

- Enhanced Accessibility and Cost Efficiency: Cloud computing facilitates greater accessibility and cost efficiency, enabling organizations to support remote desktop solutions and application virtualization without significant upfront investment. With the proliferation of virtual machines (VMs), businesses can provide employees with secure and consistent access to virtual workspaces, regardless of location. This capability is essential in today's work-from-anywhere culture, where mobility and data security are top priorities. Moreover, cloud desktops allow for more straightforward management and updates, which reduces the total cost of ownership (TCO) compared to traditional desktop setups.

Automation in Retail Boosting Virtualization Demand

Key Highlights

- Streamlining Retail Operations: The growth in automation within the retail sector is significantly contributing to the demand for desktop virtualization. Retailers are increasingly adopting automation technologies to streamline operations, enhance customer experience, and improve supply chain efficiency. Desktop virtualization supports these efforts by providing a centralized platform for managing applications, inventory systems, and customer data across multiple locations. By implementing remote desktop solutions, retailers can ensure that their operations are synchronized, with real-time data access and processing capabilities that are critical in a fast-paced environment.

- Supporting Omnichannel Strategies: As retailers continue to develop omnichannel strategies, the need for seamless integration across physical and digital platforms becomes more pronounced. Desktop virtualization enables retailers to create a unified workspace that supports various functions, from point-of-sale (POS) systems to customer relationship management (CRM) tools. This integration is vital for delivering a consistent customer experience across channels. Additionally, with the rise of virtual desktop deployment, retailers can maintain robust security protocols and data protection measures, which are essential in handling sensitive customer information.

Retail Desktop Virtualization Market Trends

The Rise of Cloud Deployment in Desktop Virtualization

- Cloud Deployment Trends: Cloud deployment has become a pivotal trend in the desktop virtualization market, driven by the need for cost-effective, scalable, and easily managed solutions. Businesses are increasingly transitioning from traditional on-premise setups to cloud-based models, with Virtual Desktop Infrastructure (VDI) and Desktop as a Service (DaaS) leading the way. This shift allows companies to deploy virtual desktops swiftly while reducing upfront costs and enhancing flexibility. The adoption of multi-cloud environments is further accelerating this trend, as businesses seek to avoid vendor lock-in and enhance operational resilience, driving the proliferation of virtual machines (VMs) across various cloud platforms.

- Key Factors Boosting Cloud Deployment: The widespread adoption of cloud computing is transforming the desktop virtualization landscape, offering organizations the ability to manage resources more efficiently. The growing preference for cloud deployment is due to the seamless integration of computing, storage, and networking resources provided by hyper-converged infrastructure (HCI). Additionally, the rise of Software-Defined Data Centers (SDDCs) is making it easier for enterprises to manage virtualized workloads, significantly improving operational efficiency. As a result, small to medium-sized enterprises (SMEs) are increasingly embracing cloud desktop solutions to optimize their IT resources, further driving market growth.

North America is Expected to Hold Major Share

- North America Leading the Global Market: North America is set to dominate the desktop virtualization market, driven by its advanced technological infrastructure and high adoption rates of digital transformation strategies. The region's strong focus on innovation and its ability to rapidly integrate new technologies have positioned it as a critical hub for market growth. The increasing demand for remote desktop solutions, fueled by the rise in remote work and telecommuting, is a key factor supporting this dominance. As businesses across the region adopt VDI, DaaS, and cloud desktop solutions, North America's market share is expected to grow significantly.

- United States as a Key Player: The United States, as the largest consumer of desktop virtualization in North America, plays a crucial role in the region's market leadership. The presence of major cloud service providers and an increasing number of hosted servers in the U.S. are driving the growth of cloud-based desktop virtualization. Additionally, the proximity to Canada and the emphasis on eco-friendly practices in new workspaces are further bolstering the market's expansion across the region. This regional interconnectivity supports the broader adoption of desktop virtualization solutions, reinforcing North America's leadership position.

Retail Desktop Virtualization Industry Overview

Highly Fragmented Market: The desktop virtualization market is highly fragmented, with no single company holding a dominant market share. This fragmentation indicates a competitive environment where both large global corporations and smaller specialized companies operate. The market's nature reflects the diversity of end-user needs, with players offering a wide range of solutions from basic virtualization to complex, customized deployments.

Market Leaders with Diverse Approaches: The leading players in the desktop virtualization market include Citrix Systems Inc., Toshiba Corporation, Red Hat Inc. (IBM Corporation), Huawei Technologies Co. Ltd., and Microsoft Corporation. These companies are distinguished by their strong global presence, extensive product portfolios, and continuous innovation. Citrix and Microsoft are particularly noted for their comprehensive virtualization platforms, while Red Hat (under IBM) and Huawei focus on integrating open-source and cloud-based solutions. Toshiba's presence is more niche, catering to specific industry needs.

Future Success Strategies Revolve Around Innovation and Integration: Key trends in the desktop virtualization market include the growing demand for cloud-based solutions, security enhancements, and seamless integration with existing IT infrastructures. For market players to succeed, they must focus on these areas, providing flexible and secure solutions that can adapt to the changing needs of businesses. Continuous innovation, strategic partnerships, and expanding service offerings will be crucial strategies for staying competitive in this fragmented market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview ( Includes the Impact due to COVID-19)

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Cloud Computing

- 5.1.2 Growth in Automation in Retail

- 5.2 Market Restraints

- 5.2.1 Infrastructure Deployment Constraints

6 MARKET SEGMENTATION

- 6.1 By Desktop delivery platform

- 6.1.1 Hosted Virtual Desktop (HVD)

- 6.1.2 Hosted Shared Desktop (HSD)

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Citrix Systems Inc.

- 7.1.2 Toshiba Corporation

- 7.1.3 Red Hat Inc. (IBM Corporation )

- 7.1.4 Huawei Technologies Co. Ltd.

- 7.1.5 Microsoft Corporation

- 7.1.6 Parallels International GmbH

- 7.1.7 Dell Inc.

- 7.1.8 Ncomputing, Inc.

- 7.1.9 Ericom Software Inc.

- 7.1.10 Tems, Inc

- 7.1.11 Vmware Inc.