|

市場調查報告書

商品編碼

1629783

製造業中的虛擬桌面-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Desktop Virtualization In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

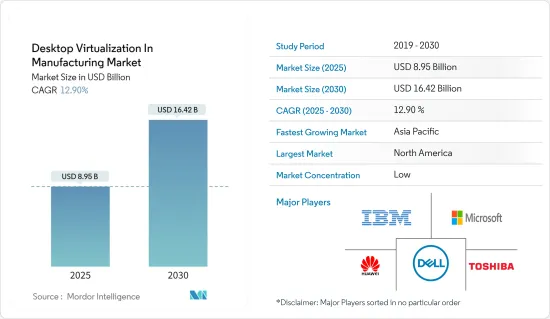

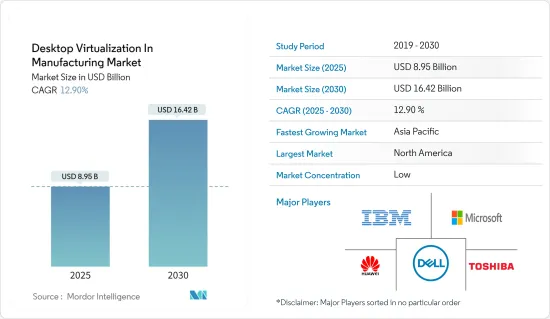

製造業虛擬桌面市場規模預計到 2025 年將達到 89.5 億美元,到 2030 年將達到 164.2 億美元,預測期內(2025-2030 年)複合年成長率為 12.9%。

製造業中的虛擬桌面對於擁有大型資料中心的公司非常有用,這些資料中心的實體基礎設施要求(空間、電力、冷卻等)和硬體採購(購買新伺服器)通常會產生高昂的成本。一個不斷成長的市場,提供更高的效率和成本。

主要亮點

- 雲端運算的普及正在推動市場。雲端運算正在推動企業數位轉型,製造商將其資訊技術 (IT) 預算轉移到雲端。雲端運算正在降低工業領域的電力和資源管理成本,並推動虛擬桌面的需求。

- 從資訊科技 (IT) 的角度來看,成本降低正在推動市場發展,因為虛擬桌面有助於最大限度地縮短交付新桌面所需的時間以及管理桌面和管理員的成本,從而避免在不同的工廠進行投資。專家表示,典型PC的總擁有成本(TCO)為50-70%,與管理和維護PC硬體和軟體有關。

- 然而,基礎設施限制限制了部署,因為網路基礎架構必須管理虛擬桌面帶來的增加的頻寬。否則,將需要更新。廣域網路 (WAN) 電路必須能夠處理遠端 DV 消費者並防止重大市場問題。

- 在 COVID-19 大流行期間,全球虛擬桌面市場穩步成長。這是因為,由於 COVID-19 造成的封鎖和嚴格的社交距離措施,數位滲透率急劇上升,增加了對虛擬桌面工具等遠端操作工具的需求。 Anunta Tech的最新報告顯示,COVID-19疫情對虛擬桌面產業產生了影響,使虛擬桌面基礎設施(VDI)的需求增加了70%以上。

- 此外,隨著 COVID-19 病例數量的增加,許多公司開始利用遠距工作技術。根據 TechTarget 的報告,超過 67% 為應對新冠肺炎 (COVID-19) 的出現而實施在家工作政策的公司預計,即使在大流行之後,仍能讓員工享受遠距工作選擇。在此期間,這些因素刺激了全球虛擬桌面解決方案市場的擴張。

製造業虛擬桌面市場趨勢

雲端部署模式佔據主要佔有率

- 製造中的自動化/智慧雲端在降低製造成本和加速部署的重要性使得虛擬桌面基礎架構 (VDI) 具有吸引力。製造商在資料中心管理設計訊息,遠端使用者可以在筆記型電腦或行動裝置上即時查看這些資料。

- 雲端解決方案中「遠端虛擬桌面」的使用,透過快閃記憶體儲存和加速的讀寫能力,改善了製造業的使用者體驗,降低了其他製造工廠的管理成本,相較於傳統的桌面管理來說,它正在增加。

- 美光科技 (Micron Technologies) 使用資訊技術 (IT)虛擬來管理其半導體記憶體製造流程。此外,該公司還在其製造工廠開發、製造和維護虛擬/融合式基礎架構(HCI)生態系統的基本部分,這有效地推動了市場的發展。

北美正在經歷顯著的成長

- 在北美,工業部門在美國經濟中佔據主導地位,佔該地區經濟產出的82%,眾多的雲端服務供應商推動了對虛擬桌面的高需求。

- 該地區的製造業已大量採用 3D 列印,工業和學術機構不斷採用 3D 列印。美國的 NVIDIA虛擬平台擴展了 NVIDIA GPU 的可能性,並描述了 3D 應用程式中的本機桌面體驗。

- 美國是全球最大的製藥市場,佔製藥和生技產業研發支出的一半以上。由於控制系統如此之多,每個系統都需要網路拓撲、伺服器基礎架構和工廠車間的工作站,這使得虛擬桌面變得流行。

- 透過環保和節能實踐實現自動化和新技術投資的快速趨勢正在推動工業領域的價值創造,預計未來需求將會成長。

製造業虛擬桌面概述

製造業虛擬桌面市場細分,參與企業之間的競爭參與企業激烈,他們都在研發創新和投資新技術,以提高製造業的生產力。主要參與企業包括IBM、微軟公司和華為技術公司。近期市場趨勢如下。

2022 年 2 月,IBM 收購了 Microsoft Azure 顧問公司 Neudesic,以擴展其混合多重雲端服務產品,並在混合雲和人工智慧 (AI) 策略中擁有發言權。

2022 年 5 月,Citrix 宣布其下一代產品將由 Citrix 發布,該產品將全球首款雲端 PC Windows 365 與市場領先的高清用戶體驗 (HDX) 技術、強大的 IT 策略控制和生態系統靈活性相結合和微軟宣布合作。這使 IT 管理員可以輕鬆存取 Citrix 用戶許可,並允許員工透過 Microsoft Endpoint Manager 和 Windows 365 無縫過渡到 Citrix 用戶端。

2022 年 5 月,Citrix DaaS for IBM Cloud 現已在由 Intel Xeon 伺服器支援的 IBM Cloud Virtual Private Cloud (VPC) 中提供。透過自動擴展,此功能擴展了雲端中兼職工作負載的可能性,從而可以在幾分鐘內快速配置機器並動態部署應用程式和桌面電腦。

此外,在本機上執行虛擬桌面基礎架構 (VDI) 的現有 Citrix 用戶端可以遷移或突增到 VPC,並開始提供桌面即服務 (DaaS)。管理員可以使用電腦目錄選擇任何虛擬 私有雲端(VPC) 實例設定文件,以提供持久或非持久桌面和應用程式體驗。

2022 年 11 月,NComputing 發布了 RX300,這是一款支援雲端、雙螢幕、支援 Wi-Fi 的精簡型用戶端,適用於 Windows 和 Linux,基於最新的 Raspberry Pi 3(PI 系列開發板)。 NComputing 屢獲殊榮的虛擬桌面軟體 vSpace Pro 10 是 RX300 的目標平台。它具有類似 PC 的高效能體驗以及雲端就緒功能,包括支援 NComputing 的 vCAST 串流技術。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究假設和市場定義

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進和市場約束因素

- 市場促進因素

- 擴大雲端運算的採用

- 降低桌上型電腦/PC 成本

- 市場限制因素

- 基礎設施限制

- 價值鏈分析

- 產業吸引力-波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 透過桌面交付平台

- 託管虛擬桌面 (HVD)

- 託管共用桌面 (HSD)

- 其他桌面交付平台

- 依實施類型

- 本地

- 雲

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- IBM Corp.

- Microsoft Corporation

- Huawei Technologies Co. Ltd.

- Dell Inc.

- Toshiba Corporation

- Citrix Systems, Inc.

- Parallels International GmbH

- NComputing Co. LTD.

- Ericom Software

- VMware, Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Desktop Virtualization In Manufacturing Market size is estimated at USD 8.95 billion in 2025, and is expected to reach USD 16.42 billion by 2030, at a CAGR of 12.9% during the forecast period (2025-2030).

Desktop virtualization in manufacturing is a growing market that provides more efficient and cost-effective solutions for enterprises with large data centers, which often incur high costs due to physical infrastructure requirements (such as space, power consumption, and cooling) and hardware acquisition (purchase of new servers).

Key Highlights

- The increased popularity of cloud computing is driving the market. Cloud computing drives digital transformation in enterprises, and manufacturers are shifting their information technology (IT) budgets to the cloud. It lowers power and resource management costs in the industrial sector, driving demand for desktop virtualization.

- Cost savings are driving the market because, from an information technology (IT) standpoint, virtual desktops assist in minimizing the time it takes to provide new desktops, as well as desktop and admin administration and support expenses, by not investing in different plants. According to experts, the total cost of ownership (TCO) of a standard PC is between 50 and 70 percent related to managing and maintaining PC hardware and software.

- However, infrastructure restrictions limit the adoption since network infrastructure must manage the increased bandwidth that desktop virtualization will create. Otherwise, it will need to be updated. The Wide Area Network (WAN) lines must be able to handle remote DV consumers, preventing a significant market problem.

- During the COVID-19 pandemic, the global desktop virtualization market grew steadily, owing to dramatically increased digital penetration during COVID-19-induced lockdowns and stringent social distancing policies, which fueled demand for remote operational tools such as desktop virtualization tools. According to Anunta Tech's recent report, the COVID-19 pandemic affected the desktop virtualization industry, increasing demand for virtual desktop infrastructure (VDI) by more than 70%.

- Furthermore, the growing number of COVID-19 instances prompted many firms to use remote working technologies. According to a TechTarget report, more than 67% of firms who implemented work-from-home policies following the emergence of COVID-19 expected to maintain remote working alternatives accessible for their employees even after the pandemic. During this period, such factors fueled the expansion of the worldwide desktop virtualization solutions market.

Desktop Virtualization in Manufacturing Market Trends

Cloud Deployment Mode to Gain Significant Share

- The importance of the cloud in reducing automation/intelligent manufacturing expenses and speeding up adoption in the manufacturing industry has been a draw for Virtual desktop infrastructure (VDI). Manufacturers can maintain design information in the data center, and remote users can view this data in real-time on a laptop or mobile device.

- The use of remote desktop virtualization' in cloud solutions was growing as a result of their flash storage and accelerated reading and writing features, which improve the user experience in the manufacturing sector and lower the cost of managing other manufacturing plants when compared to traditional desktop administration.

- Micron Technology manages its semiconductor memory production processes using virtualization in information technology (IT). In addition, they develop, produce, and maintain fundamental pieces of the virtualization/hyper-converged infrastructure (HCI) ecosystem in their manufacturing plant, which efficiently pushes the market.

North America to Witness Significant Growth

- North America controls most of the market since the industrial sector dominates the United States economy, which accounts for 82% of the region's economic output, and a substantial number of cloud service providers, resulting in high demand for desktop virtualization.

- The region's adoption of 3D printing for manufacturing has been significant, with industry and academic institutions deploying 3D printing constantly. NVIDIA virtualization platform in the United States extends the potential of NVIDIA GPUs, delivering a native desktop experience in 3D applications.

- The United States is the world's largest drug market, accounting for over half of all R&D spending in the pharmaceutical and biotechnology industry. With numerous control systems, each system needs its network topology, server infrastructure, and workstations on the plant floor, where desktop virtualization is becoming more popular.

- The rapid trend toward automation and investments in new technologies through implementing eco-friendly and energy-saving practices are driving value creation in the industrial sector, which will enhance demand in the future.

Desktop Virtualization in Manufacturing Industry Overview

The desktop virtualization market in manufacturing is fragmented as the players are innovating and investing in new technologies in R&D to improve the manufacturing sector's productivity, which gives a high rivalry among the players. Key players are IBM, Microsoft Corporation, Huawei Technologies Co. Ltd, etc. Recent developments in the market are -

In February 2022, IBM purchased Neudesic, a Microsoft Azure consultancy, to expand its provision of hybrid multi-cloud services and have a say in its hybrid cloud and artificial intelligence (AI) strategies.

In May 2022, Citrix announced that it collaborated with Microsoft on an upcoming product combining Windows 365, the world's first cloud PC, with its market-leading high-definition user experience (HDX) technology, robust IT policy control, and ecosystem flexibility. This gave IT administrators easier access to Citrix user licensing and offered employees a seamless transition to Citrix clients through Microsoft Endpoint Manager and Windows 365.

In May 2022, Citrix DaaS for IBM Cloud was available on IBM Cloud Virtual Private Cloud (VPCs) powered by Intel Xeon servers. With autoscale, this feature opened up the potential for part-time workloads in the cloud, delivering quick machine provisioning in minutes and dynamically deploying apps and desktop computers.

Furthermore, existing Citrix clients who run virtual desktop infrastructure (VDI) on-premises can migrate or burst to VPC and start providing Desktop-as-a-Service (DaaS). Administrators can use a machine catalog to select any Virtual Private Cloud (VPC) instance profile to deliver persistent and non-persistent desktop and application experiences.

In November 2022, A cloud-ready, dual-screen, Wi-Fi-ready thin client for Windows and Linux called RX300 was launched by NComputing Co. LTD. and is based on the most recent Raspberry Pi 3 (development board in PI series). The award-winning vSpace Pro 10 desktop virtualization software from NComputing is the platform for which RX300 is intended. Along with cloud-ready features, including support for NComputing's vCAST streaming technology, it offers a high-performance PC-like experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions and Market Definition

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Adoption of Cloud Computing

- 4.3.2 Cost Saving in Desktop/PC

- 4.4 Market Restraints

- 4.4.1 Infrastructural Constraints

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Desktop Delivery Platform

- 5.1.1 Hosted Virtual Desktop (HVD)

- 5.1.2 Hosted Shared Desktop (HSD)

- 5.1.3 Other Desktop Delivery Platforms

- 5.2 By Deployment Mode

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corp.

- 6.1.2 Microsoft Corporation

- 6.1.3 Huawei Technologies Co. Ltd.

- 6.1.4 Dell Inc.

- 6.1.5 Toshiba Corporation

- 6.1.6 Citrix Systems, Inc.

- 6.1.7 Parallels International GmbH

- 6.1.8 NComputing Co. LTD.

- 6.1.9 Ericom Software

- 6.1.10 VMware, Inc.