|

市場調查報告書

商品編碼

1640455

馬來西亞可再生能源:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Malaysia Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

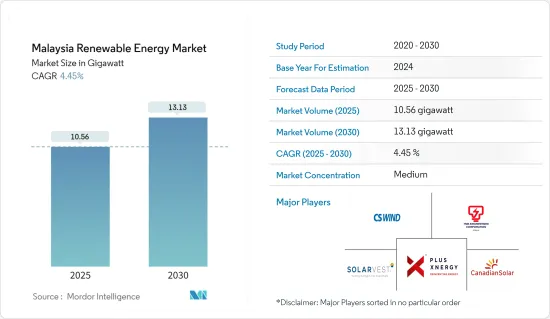

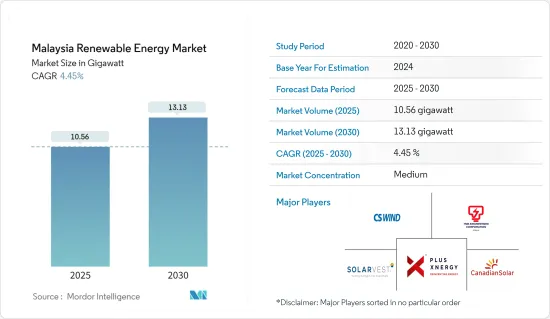

馬來西亞可再生能源市場規模預計在 2025 年達到 10.56 吉瓦,預計在 2030 年達到 13.13 吉瓦,預測期內(2025-2030 年)的複合年成長率為 4.45%。

新冠肺炎疫情的蔓延給市場帶來了嚴重打擊,導致投資下降,一些地區被迫關閉。

關鍵亮點

- 在預測期內,預計市場將受到投資增加和馬來西亞政府將電力源從石化燃料轉向可再生能源的努力的推動。

- 然而,在研究期間,擴大採用清潔替代能源(例如燃氣發電廠和核能計劃)可能會阻礙市場的成長。

- 馬來西亞的目標是到2050年安裝9GW的太陽能容量。因此,該國雄心勃勃的太陽能目標和太陽能租賃等經營模式預計將在不久的將來創造巨大的商機。

馬來西亞可再生能源市場趨勢

光伏(PV)佔市場主導地位

- 由於幾個關鍵因素,太陽能將主導馬來西亞的可再生能源市場。首先,馬來西亞位於赤道附近,全年陽光充足,太陽能資源十分豐富。這項自然優勢為太陽能裝置提供了堅實的基礎,使其成為非常可行的可再生能源選擇。太陽能發電技術成本的下降顯著提高了其成本競爭力,對投資者和能源消費者的吸引力越來越大。

- 馬來西亞政府推出扶持政策及獎勵,推動太陽能發展。淨能量計量(NEM)等計劃允許消費者安裝太陽能發電系統並將多餘的電力賣回給電網。同時,上網電價和稅收優惠政策也鼓勵了對太陽能發電工程的投資。

- 例如,2022年10月,馬來西亞政府決定延長第四期LSS4競標中大型太陽能光電(PV)計劃的購電協議期限。由原來的21年延長至25年。 LSS4 計劃已成功在 30 個計劃中分配總合容量 823.06 兆瓦。總體而言,LSS4 計畫分配了 2,457 兆瓦的發電能力,但截至 2022 年 6 月,只有 1,160 兆瓦投入運作。

- 技術進步在太陽能的興起中也發揮了關鍵作用。該行業已看到太陽能電池板的效率和整體性能顯著改善,從而降低了成本並提高了發電能力。

- 根據國際可再生能源機構預測,2021年至2022年,該國太陽能發電裝置容量預計將增加8%以上,這表明太陽能發電的採用率將持續提高。

- 因此,由於上述因素,預計公共產業行業將在預測期內主導馬來西亞可再生能源市場。

政府支持措施推動市場

- 政府政策在推動馬來西亞可再生能源市場方面發揮著至關重要的作用。政府已實施多項政策措施以刺激可再生能源的發展,包括建立上網電價制度和電力購買協議,為可再生能源生產商提供穩定的長期合約。制定雄心勃勃的可再生能源目標為投資者提供了明確的方向,並獎勵參與市場。

- 馬來西亞已設定目標,2025年達到20%的能源需求來自可再生能源。實現這一目標需要在可再生能源領域投資約80億美元。預期投資將來自政府資助、官民合作關係關係和私人融資。

- 政府打算鼓勵私人融資並增加私營部門對可再生能源領域的參與。除了現有的政府激勵措施(如綠色技術融資計畫、綠色投資稅收計畫和綠色所得稅減免)外,還將強調實施體制改革,以支持可再生能源的進一步發展。

- 根據國際可再生能源機構的數據,2018年至2022年間,該國的可再生能源裝置容量將大幅成長。這段期間的成長率一直維持在20%以上,顯示該地區可再生能源發展健康。

- 支持性法律規範和簡化的審核流程也減少了開發人員的障礙和官僚障礙,促進了可再生能源計劃的發展。

- 例如,2023 年 3 月,位於馬來西亞沙巴納閩的一個 10 MWAC 太陽能計劃透過 Solar PV Power Sdn Bhd (SPP) 實現融資結算。 SPP 是 Jetama Energy Sdn Bhd(Jetama)和 Symbior Solar Limited(Symbior)的合資企業。

- 因此,政府的支持政策和措施有望提高太陽能和可再生能源的佔有率。

馬來西亞可再生能源產業概況

馬來西亞的可再生能源市場適度細分。市場的主要企業(不分先後順序)包括 JA Solar Technology、Solarvest Holdings Berhad、TNB Engineering Corporation Sdn Bhd、CS Wind Malaysia 和 Plus Xnergy Holding Sdn Bhd。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第2章調查方法

第3章執行摘要

第4章 市場概況

- 介紹

- 可再生能源結構(馬來西亞,2022 年)

- 至2028年可再生能源裝置容量及預測(單位:MW)

- 政府法規和政策

- 最新趨勢和發展

- 市場動態

- 驅動程式

- 政府支持和獎勵

- 增加對可再生能源計劃的投資

- 限制因素

- 電網整合挑戰

- 驅動程式

- 供應鏈分析

- PESTLE分析

第 5 章按類型細分市場

- 太陽的

- 水力發電

- 生質能源

- 其他

第6章 競爭格局

- 併購、合資、合作、協議

- 主要企業策略

- 公司簡介

- First Solar Inc.

- Canadian Solar Inc.

- Plus Xnergy Holding Sdn Bhd

- TNB Engineering Corporation Sdn Bhd

- Solarvest Holdings Berhad

- JA SOLAR Technology Co. Ltd

- SunPower Corporation

- Trina Solar Co. Ltd

- CS Wind Malaysia

- TS Solartech Sdn Bhd

第7章 市場機會與未來趨勢

- 提高各部門的能源效率

The Malaysia Renewable Energy Market size is estimated at 10.56 gigawatt in 2025, and is expected to reach 13.13 gigawatt by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

The spread of COVID-19 hurt the market because investments dropped and some regions had to close down.Currently, the market has rebounded from pre-pandemic levels.

Key Highlights

- During the period covered by the forecast, the market is likely to be driven by things like more investments and the country's efforts to switch from fossil fuels to renewable energy as a source of power.The government of Malaysia has also put in place policies and incentives to help solar energy grow, which is expected to drive the market even more.

- However, on the other hand, factors such as the rising adoption of alternate clean power sources, such as gas-fired power plants and nuclear energy projects, are likely to hinder the market's growth during the study period.

- Malaysia is aiming to install 9 GW of solar energy capacity by 2050. Therefore, the country's ambitious solar energy targets and business models such as solar leasing are expected to create significant opportunities in the near future.

Malaysia Renewable Energy Market Trends

Solar Photovoltaic (PV) to Dominate the Market

- Solar PV is poised to dominate the renewable energy landscape in Malaysia due to several key factors. First and foremost, Malaysia enjoys abundant solar resources due to its location near the equator and high levels of sunlight throughout the year. This natural advantage provides a strong foundation for solar PV installations, making it a highly viable renewable energy option. The declining costs of solar PV technology have significantly improved its cost competitiveness, making it increasingly attractive for investors and energy consumers.

- The Malaysian government has implemented supportive policies and incentives to foster solar energy development. Programs like Net Energy Metering (NEM) allow consumers to install solar PV systems and sell excess electricity back to the grid. At the same time, feed-in tariffs and tax incentives encourage investment in solar PV projects.

- For instance, in October 2022, the Malaysian government decided to extend the duration of power purchase agreements for large-scale photovoltaic (PV) projects under the fourth LSS4 tender. The original period of 21 years was increased to 25 years. The LSS4 program successfully allocated a total capacity of 823.06 MW across 30 projects. Overall, the program has awarded 2,457 MW of capacity, but as of June 2022, only 1,160 MW of that capacity was operational.

- Technological advancements have also played a crucial role in the prominence of solar PV. The industry has witnessed significant improvements in solar panel efficiency and overall performance, driving down costs and enhancing power generation capabilities.

- According to the International Renewable Energy Agency, the installed capacity of solar photovoltaics in the country increased by more than 8% between 2021 and 2022, signifying the increasing adoption of solar photovoltaics in the country.

- Therefore, based on the factors above, the utility sector is expected to dominate the Malaysian renewable energy market during the forecast period.

Supportive Government Policies to Drive the Market

- Government policies play a pivotal role in driving the renewable energy market in Malaysia. The government has implemented various policy measures to stimulate the growth of renewable energy, including the establishment of feed-in tariffs and power purchase agreements that provide stable and long-term contracts for renewable energy producers, encouraging investment in the sector. Setting ambitious renewable energy targets provides a clear direction and incentive for investors to participate in the market.

- Malaysia has set a target to derive 20% of its energy from renewable sources by 2025. The country will require an investment of approximately USD 8 billion in its renewable energy sector to achieve this goal. The expected investments are anticipated to come from a combination of government funding, public-private partnerships, and private financing.

- The government intends to encourage private financing and enhance private participation in the renewable energy sector. In addition to the ongoing government incentives like the Green Technology Financing Scheme, the Green Investment Tax Allowance, and the Green Income Tax Exemption, the emphasis will be on implementing institutional reforms to support the growth of renewable energy further.

- According to the International Renewable Energy Agency, the installed capacity of renewable energy in the country increased significantly between 2018 and 2022. The growth rate during this period was recorded at more than 20%, signifying healthy growth of renewables in the region.

- A supportive regulatory framework with streamlined permitting processes has also reduced barriers and bureaucratic hurdles for developers, facilitating the development of renewable energy projects.

- For instance, in March 2023, the 10 MWAC Solar Project in Labuan, Sabah, Malaysia, achieved financial close through Solar PV Power Sdn Bhd (SPP). SPP is a joint venture between Jetama Energy Sdn Bhd (Jetama) and Symbior Solar Limited (Symbior).

- Therefore, supportive government policies and initiatives are expected to drive the share of solar and renewable energy.

Malaysia Renewable Energy Industry Overview

The Malaysian renewable energy market is moderately fragmented. Some of the major players in the market (in no particular order) include JA Solar Technology Co. Ltd, Solarvest Holdings Berhad, TNB Engineering Corporation Sdn Bhd, CS Wind Malaysia, and Plus Xnergy Holding Sdn Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Malaysia, 2022

- 4.3 Renewable Energy Installed Capacity and Forecast in MW, till 2028

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Supportive Government Policies and Incentives

- 4.6.1.2 Increasing Investments in Renewable Energy Projects

- 4.6.2 Restraints

- 4.6.2.1 Grid Integration Challenges

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - BY TYPE

- 5.1 Solar

- 5.2 Hydro

- 5.3 Bio-energy

- 5.4 Other types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Canadian Solar Inc.

- 6.3.3 Plus Xnergy Holding Sdn Bhd

- 6.3.4 TNB Engineering Corporation Sdn Bhd

- 6.3.5 Solarvest Holdings Berhad

- 6.3.6 JA SOLAR Technology Co. Ltd

- 6.3.7 SunPower Corporation

- 6.3.8 Trina Solar Co. Ltd

- 6.3.9 CS Wind Malaysia

- 6.3.10 TS Solartech Sdn Bhd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Improving Energy Efficiency Across Various Sectors