|

市場調查報告書

商品編碼

1640520

釔 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Yttrium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

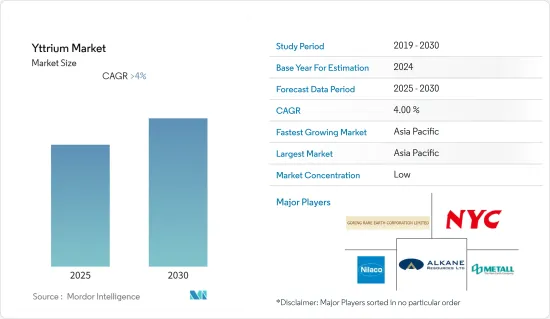

預測期內,釔市場預計將以超過 4% 的複合年成長率成長

關鍵亮點

- 2020 年,新冠疫情對市場產生了負面影響。不過,預計 2022 年市場將達到疫情前的水平,並持續穩定成長。

- 預計預測期內陶瓷和電子行業不斷成長的需求將推動市場成長。另一方面,預計某些應用中鈧的替代將阻礙市場成長。

- 國防部門應用的增加可能會帶來有利影響。亞太地區佔全球市場主導地位,其中印度和中國等國家消費量最高。

釔市場趨勢

高溫耐火材料需求增加

- 氧化釔在耐火材料領域有許多應用。它的用途包括作為需要高溫穩定性的應用的化合物。氧化釔與氧化鈣 (CaO)、氧化鎂 (MgO) 和氮化硼 (BN) 一樣,因其高達 2,200°C 的極高溫度穩定性而被認為是絕緣體塗層的理想材料。

- 高溫耐火材料主要用於鋼鐵工業,例如用於煉鋼的爐襯、用於加工前加熱鋼材的爐襯、用於盛放和運輸金屬和爐渣的容器以及用於輸送熱氣體。

- 釔是稀土元素,廣泛用於鋼鐵生產。鋼鐵產量的增加將導致對金屬加工的需求增加,以將鋼鐵製成所需的形狀,從而對釔市場產生積極影響。

- 根據世界鋼鐵協會 (WSA) 的數據,2022 年 9 月全球 64 個國家的粗鋼產量為 1.517 億噸,較 2021 年 9 月成長 3.7%。此外,2022 年 1 月至 11 月全球整體產量為 16.914 億噸(Mt)。

- 由於國內鋼鐵產量上升和建設活動活性化,對高溫耐火材料的需求大幅增加。預計這將在預測期內對釔市場產生正面影響。

亞太地區佔市場主導地位

- 中國是世界上最大的釔產品生產國和消費國。從消費量來看,光是中國就佔了亞太地區氧化釔市場40%以上的比重。由於稀土蘊藏量豐富,該國也是金屬釔和氧化釔的主要生產國。

- 大部分氧化釔蘊藏量和礦山主要集中在中國,因此該產品的國際貿易受到限制。根據美國地質調查局(USGS)的《礦產商品摘要》(MCS),中國大部分的釔供應來自南方的風化粘土離子吸附礦床,主要分佈在福建、廣東和江西省以及廣西壯族自治區。棉蘭老島自治區和湖南省的少量礦床。

- 2021 年,美國進口的釔金屬和化合物幾乎全部來自中國加工的礦物精礦。美國約94%的釔化合物從中國進口,從日本和韓國各進口1%。此外,根據美國地質調查局測量與測量服務部的數據,2022 年中國釔化合物和金屬出口量為 2,400 噸。主要出口目的地為日本、美國、韓國和德國。

- 預計所有上述因素都將在預測期內增加市場需求。

釔行業概況

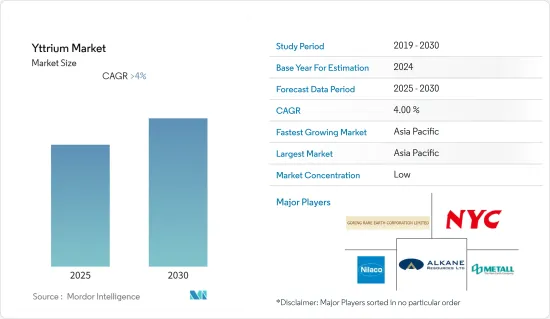

釔市場較為分散。市場的一些主要企業包括 Goring Rare Earth Corporation Limited、Metall Rare Earth Limited、Alkane Resources Ltd、The Nilaco Corporation 和 Nippon Yttrium。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 陶瓷製造商的需求

- 平面顯示器市場的成長

- 限制因素

- 在某些應用中取代鈧

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(以金額為準的市場規模)

- 產品類型

- 合金

- 金屬

- 化合物

- 應用領域

- 磷光體

- 陶瓷製品

- 電子設備(超導)

- 高溫耐火材料

- 雷射

- 冶金應用

- 固體氧化物燃料電池 (SOFC)

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Alkane Resources

- Chengdu Haoxuan Technology Co. Ltd.

- China Rare Earth Co. Ltd.

- Crossland Strategic Metals Limited

- Double Park International Corporation

- Ganzhou Hong De New Technology Development Ltd. Co.

- GBM Resources Ltd

- Goring Rare Earth Corporation Limited

- Inner Mongolia Nonferrous Mining Co. Ltd

- Metall Rare Earth Limited

- Nippon Yttrium Co., Ltd

- Shenzhen Chuanyan Technology Co., Ltd.

- Sichuan Lanthanum Rare Materials Limited

- The Nilaco Corporation

- Zhejiang Jinda Rare-earth Element Co. Ltd

第7章 市場機會與未來趨勢

- 擴大國防領域的應用

簡介目錄

Product Code: 54166

The Yttrium Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- Increasing demand from the ceramics industry and electronic devices industry is expected to drive market growth during the forecast period. On the other hand, the substitution of the product by scandium in specific applications is expected to hinder the market's growth.

- Increasing applications in the defense sector are likely to act as an opportunity. Asia-Pacific dominates the global market with the largest consumption in a country such as India, China, etc.

Yttrium Market Trends

Increasing Demand from High-Temperature Refractories

- Yttrium oxide is used in many applications in the refractory field. The application range includes the use as a compound for applications that require stability at high temperatures. Yttrium oxide, along with calcium oxide (CaO), magnesium oxide (MgO), and boron nitride (BN), is considered an aspirant material for insulator coating due to its extremely high-temperature stability up to 2,200°C.

- High-temperature refractories are majorly used in the iron and steel industry, including in internal linings of furnaces to make iron and steel, furnaces for heating steel before further processing, vessels for holding and transporting metal and slag, and in the flues or stacks through which hot gases are conducted, among others.

- As a rare earth metal, yttrium is extensively employed in producing iron and steel. The increasing production of steel leads to a higher demand for metalworking to mold the steel in its desired form, thus positively impacting the market for yttrium.

- According to the World Steel Association (WSA), global crude steel production for the 64 countries was151.7 million tonnes (Mt) in September 2022, representing an increase of 3.7% compared to September 2021. Furthermore, 1 691.4 million tonnes (Mt) was produced across the globe from January-November 2022.

- The demand for high-temperature refractories is increasing significantly due to the increased iron and steel production and the increasing construction activities in the country. This is expected to impact the Yttrium market during the forecast period positively.

Asia-Pacific Region to Dominate the Market

- China is the world's largest producer and consumer of yttrium products. In terms of consumption, China alone accounts for more than 40% share of the yttrium oxide market in the Asia-Pacific. Due to the presence of a large number of reserves of rare earth metals, the country is also a key producer of yttrium metal and yttrium oxide.

- As most of the reserves and mines of yttrium oxide are concentrated mainly in China, the product has limited international trade. According to the US Geological Survey's (USGS) Mineral Commodity Summaries (MCS), China produced the majority of the world's yttrium supply from weathered clay ion adsorption ore deposits in the southern Provinces, primarily Fujian, Guangdong, and Jiangxi-and a smaller number of deposits in Guangxi and Hunan.

- In 2021, nearly all imports of yttrium metal and compound imports in the United States were generated from mineral concentrates processed in China. The United States imported about 94% of yttrium compounds from China and 1% each from Japan and Korea. Furthermore, according to the USGS-MCS, China's yttrium compounds and metal exports were 2,400 tons in 2022. Japan, the US, the Republic of Korea, and Germany were the top export destinations.

- All the aforementioned factors are likely to increase the demand for the market over the forecast period.

Yttrium Industry Overview

The yttrium market is fragmented in nature. Some of the major players in the market include Goring Rare Earth Corporation Limited, Metall Rare Earth Limited, Alkane Resources Ltd, The Nilaco Corporation, and Nippon Yttrium Co., Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Demand from Ceramic Manufacturers

- 4.1.2 Growing Market for Flat Panel Displays

- 4.2 Restraints

- 4.2.1 Substitution by Scandium in Specific Applications

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Alloy

- 5.1.2 Metal

- 5.1.3 Compounds

- 5.2 Application

- 5.2.1 Phosphors

- 5.2.2 Ceramics

- 5.2.3 Electronic Devices (Superconductors)

- 5.2.4 High Temperature Refractories

- 5.2.5 Lasers

- 5.2.6 Metallurgical Applications

- 5.2.7 Solid Oxide Fuel Cell (SOFC)

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alkane Resources

- 6.4.2 Chengdu Haoxuan Technology Co. Ltd.

- 6.4.3 China Rare Earth Co. Ltd.

- 6.4.4 Crossland Strategic Metals Limited

- 6.4.5 Double Park International Corporation

- 6.4.6 Ganzhou Hong De New Technology Development Ltd. Co.

- 6.4.7 GBM Resources Ltd

- 6.4.8 Goring Rare Earth Corporation Limited

- 6.4.9 Inner Mongolia Nonferrous Mining Co. Ltd

- 6.4.10 Metall Rare Earth Limited

- 6.4.11 Nippon Yttrium Co., Ltd

- 6.4.12 Shenzhen Chuanyan Technology Co., Ltd.

- 6.4.13 Sichuan Lanthanum Rare Materials Limited

- 6.4.14 The Nilaco Corporation

- 6.4.15 Zhejiang Jinda Rare-earth Element Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in the Defense Sector

02-2729-4219

+886-2-2729-4219