|

市場調查報告書

商品編碼

1685823

稀土元素:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Rare Earth Elements - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

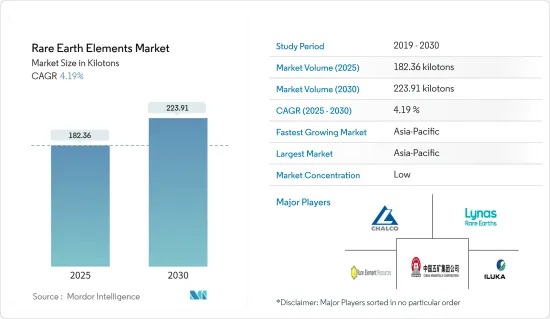

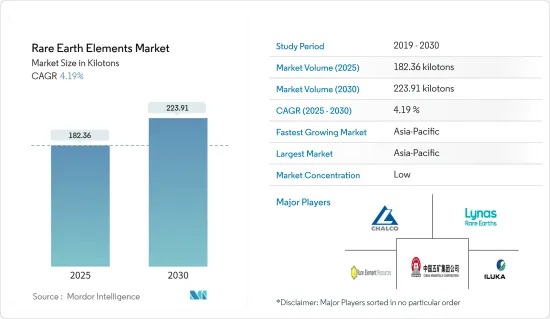

稀土元素市場規模預計在 2025 年為 182.36 千噸,預計在 2030 年達到 223.91 千噸,預測期內(2025-2030 年)的複合年成長率為 4.19%。

由於長期封鎖導致全球需求放緩,新冠肺炎疫情對稀土元素的需求產生了負面影響。不過,隨著全球經濟復甦、工業活動恢復,2021年情況逐漸改善。

主要亮點

- 市場的成長是由新興國家的高需求和對稀土元素對「綠色技術」的依賴所推動的。

- 另一方面,稀土元素供應不穩定可能成為市場成長的障礙。

- 預測期內,鈧在航太應用中的使用日益增多可能為市場提供機會。

- 由於稀土元素產量增加以及家電等行業的需求上升,亞太地區在全球市場佔據主導地位。

稀土元素市場趨勢

磁鐵需求不斷增加

- 磁鐵是稀土元素的最大用途之一。磁鐵廣泛應用於各行業,包括電子、汽車、發電和醫療。

- 磁鐵用於電腦硬碟、微波功率管、防鎖死煞車系統、汽車零件、磁碟馬達驅動馬達、無摩擦軸承、發電、磁冷凍、麥克風和揚聲器、通訊系統、核磁共振成像等。

- 汽車、電子和醫療保健等發展中產業正在經歷創新和發展,從而推動對磁鐵的需求。

- 到2021年,大約85%的汽車製造商將使用含釹永磁馬達,一些預測顯示,到2022年汽車對稀土元素的需求將增加25%。

- 電動車和風力發電機中使用的磁鐵是釹、镨和鏑,而釤和鈷是可能進一步推動市場發展的潛在替代品。

- 此外,磁鐵也用於核磁共振造影系統、心律調節器、睡眠呼吸中止症機器和胰島素幫浦等醫療設備。醫療保健產業在亞太地區、中東和非洲的投資非常大。

- 因此,預計所有這些趨勢都將推動對磁鐵的需求,從而進一步增加未來幾年對稀土元素的需求。

亞太地區可望主導市場

- 亞太地區佔據全球市場佔有率的主導地位。由於醫療保健行業的投資增加以及陶瓷的需求和產量不斷成長,預計該地區的稀土元素消費量將顯著增加。

- 全球大部分高價值稀土元素的供應都來自中國,這使得全球稀土元素市場供應對中國製造業的變化非常敏感。根據美國地質調查局的資料,2021年全球78%的稀土元素產量來自中國。

- 根據OICA統計,2021年中國和印度的汽車產量分別為2608萬輛和439萬輛。結果,中國汽車產量與前一年同期比較%,印度汽車產量年增30%。

- 亞太地區是全球電子產品製造中心,新冠疫情揭露了中國供應鏈問題,吸引了印度、越南和日本等國多家公司的投資。

- 稀土元素對印度經濟的總貢獻接近2000億美元。印度的稀土元素蘊藏量位居世界第五,大約是澳洲的兩倍。然而,中國偶爾需要的大多數稀土元素成品都是從地緣政治競爭對手中國進口的。

- 日本希望增加稀土元素礦儲備。它也有望幫助國內企業入股海外礦山,將原料加工成下一代汽車和通訊設備等最尖端科技所需的寶貴礦物。根據聯合國商品貿易統計資料的數據,日本在10年內將從中國的稀土元素進口量從90%以上減少到58%。我們的目標是到 2025 年將這一比例降至 50% 以下。

- 此外,亞太地區的陶瓷需求量和產量最高。航太和國防、能源、醫療保健和消費品等產業對陶瓷的需求不斷成長,推動了該地區的陶瓷生產。

- 因此,這樣的市場趨勢將對未來幾年的稀土元素市場產生重大影響。

稀土元素產業概況

稀土元素市場較為分散,大量參與者持有的股份不足以單獨影響市場動態。市場上的一些知名參與者包括萊納斯稀土有限公司、五礦建設有限公司、中國鋁業有限公司、Iluka Resources Limited 和 Rare Element Resources Limited(排名不分先後)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 新興經濟體需求旺盛

- 綠色科技對稀土元素的依賴

- 限制因素

- 稀土元素穩定供應

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔

- 元素

- 鈰

- 氧化物

- 硫化物

- 其他元素

- 釹

- 合金

- 鑭

- 合金

- 氧化物

- 其他元素

- 鎝

- 鋱

- 釔

- 鈧

- 其他元素

- 鈰

- 應用

- 催化劑

- 陶瓷

- 磷光體

- 玻璃和拋光

- 冶金

- 磁鐵

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Aluminum Corporation of China Ltd

- ARAFURA RESOURCES

- Avalon Advanced Materials Inc.

- Minmetals Land Limited

- China Nonferrous Metal Industry's Foreign Engineering and Construction Co. Ltd

- Eutectix

- Iluka Resources Limited

- Lynas Rare Earths Ltd

- MEDALLION RESOURCES LTD

- NORTHERN MINERALS

- Peak Resources

- Rare Element Resources Ltd

- Rio Tinto

- Shin-Etsu Chemical Co. Ltd

- Ucore Rare Metals Inc.

- Xiamen Tungsten Co. Ltd

第7章 市場機會與未來趨勢

- 鈧在航太航太領域的應用日益廣泛

The Rare Earth Elements Market size is estimated at 182.36 kilotons in 2025, and is expected to reach 223.91 kilotons by 2030, at a CAGR of 4.19% during the forecast period (2025-2030).

COVID-19 negatively impacted the demand for rare earth elements as the global demand witnessed a slowdown following stringent containment restrictions for a long time. However, the situation gradually improved in 2021 with the global economy's revival and industrial activities' resumption.

Key Highlights

- The factors driving the market's growth are the high demand from emerging economies and dependency on "Green Technology" on rare Earth elements.

- On the flip side, an inconsistent supply of rare earth elements may act as a barrier to the market's growth.

- The increasing scandium usage in aerospace applications will likely provide opportunities for the market during the forecast period.

- Asia-Pacific dominated the global market, owing to the increasing production of rare Earth metals and rising demand from industries such as consumer electronics.

Rare Earth Elements Market Trends

Increasing Demand for Magnets

- Magnets stand to be one of the largest applications for rare earth elements. Magnets find extensive applications in various industries, such as electronics, automotive, power generation, and medical.

- Magnets are used in computer hard drives, microwave power tubes, anti-lock brakes, automotive parts, disk drive motors, frictionless bearings, power generation, magnetic refrigeration, microphones and speakers, communication systems, and MRI.

- Industries such as automotive, electronics, and healthcare have witnessed innovation and development, driving the demand for magnets.

- In 2021, approximately 85% of automakers were using neodymium-incorporated permanent magnet motors, and there are projections that the automotive demand for rare earth will rise by 25% in 2022.

- Magnets used for EVs and wind turbines are neodymium, praseodymium, and dysprosium, with samarium and cobalt as potential substitutes, which may further drive the market in the future.

- Additionally, magnets are used in medical equipment, such as MRI machines, pacemakers, sleep apnea machines, and insulin pumps. The healthcare industry has seen considerable investments in Asia-Pacific, the Middle East, and Africa.

- Hence, all such trends are expected to drive the demand for magnets, which is further projected to increase the demand for rare earth elements in the coming years.

The Asia-Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region dominated the global market share. With increasing investments in the healthcare industry and the rising ceramic demand and production, the consumption of rare earth elements is projected to increase noticeably in the region.

- Most of the world's supply of these high-value rare earth elements originates from China, making the global rare earth elements market supply sensitive to changes in China's manufacturing sector. In 2021, 78% of the worldwide production of rare earth elements came from China, as per data from the US Geological Survey.

- According to OICA, the total number of motor vehicles produced in 2021 in China and India was 26.08 million and 4.39 million units, respectively. Thus, motor vehicle production in China grew by 3% and 30% in India compared to the previous year.

- Asia Pacific has been the electronics production base of the world, with investments coming in from several companies establishing their presence in countries like India, Vietnam, and Japan, as the COVID-19 pandemic exposed the supply chain problems with China.

- Rare earth elements contribute a total value of nearly USD 200 billion to the Indian economy. India has the world's fifth-largest reserves of rare earth elements, roughly twice as much as Australia. Still, it imports most of its occasional Earth needs in finished form from its geopolitical rival, China.

- Japan is looking forward to increasing its stockpiles of rare earth minerals. Furthermore, the country is expected to help domestic companies to obtain stakes in overseas mines and to process raw materials into the valuable minerals required for next-generation vehicles, communications equipment, and other cutting-edge technologies. According to UN Comtrade data, Japan slashed rare earth supplies from China from over 90% of imports to 58% within a decade. It aims to bring that below 50% by 2025.

- Furthermore, the demand and production of ceramics are the highest in Asia-Pacific. The increasing ceramic demand from industries such as aerospace and defense, energy, healthcare, and consumer goods is driving the production of ceramics in the region.

- Hence, such market trends will significantly impact the rare Earth elements market in the coming years.

Rare Earth Elements Industry Overview

The rare Earth elements market is fragmented, with numerous players holding insignificant shares to affect the market dynamics individually. Some prominent players in the market include (not in any particular order) Lynas Rare Earths Ltd, Minmetals Land Limited, Aluminum Corporation of China Ltd, Iluka Resources Limited, and Rare Element Resources Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 High Demand from Emerging Economies

- 4.1.2 Dependency of 'Green Technology' on Rare Earth Elements

- 4.2 Restraints

- 4.2.1 Inconsistent Supply of Rare Earth Elements

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Element

- 5.1.1 Cerium

- 5.1.1.1 Oxide

- 5.1.1.2 Sulfide

- 5.1.1.3 Other Elements

- 5.1.2 Neodymium

- 5.1.2.1 Alloy

- 5.1.3 Lanthanum

- 5.1.3.1 Alloy

- 5.1.3.2 Oxide

- 5.1.3.3 Other Elements

- 5.1.4 Dysprosium

- 5.1.5 Terbium

- 5.1.6 Yttrium

- 5.1.7 Scandium

- 5.1.8 Other Elements

- 5.1.1 Cerium

- 5.2 Application

- 5.2.1 Catalysts

- 5.2.2 Ceramics

- 5.2.3 Phosphors

- 5.2.4 Glass and Polishing

- 5.2.5 Metallurgy

- 5.2.6 Magnets

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aluminum Corporation of China Ltd

- 6.4.2 ARAFURA RESOURCES

- 6.4.3 Avalon Advanced Materials Inc.

- 6.4.4 Minmetals Land Limited

- 6.4.5 China Nonferrous Metal Industry's Foreign Engineering and Construction Co. Ltd

- 6.4.6 Eutectix

- 6.4.7 Iluka Resources Limited

- 6.4.8 Lynas Rare Earths Ltd

- 6.4.9 MEDALLION RESOURCES LTD

- 6.4.10 NORTHERN MINERALS

- 6.4.11 Peak Resources

- 6.4.12 Rare Element Resources Ltd

- 6.4.13 Rio Tinto

- 6.4.14 Shin-Etsu Chemical Co. Ltd

- 6.4.15 Ucore Rare Metals Inc.

- 6.4.16 Xiamen Tungsten Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Scandium Usage in Aerospace Applications