|

市場調查報告書

商品編碼

1640583

AGV(自動導引運輸車):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)AGV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

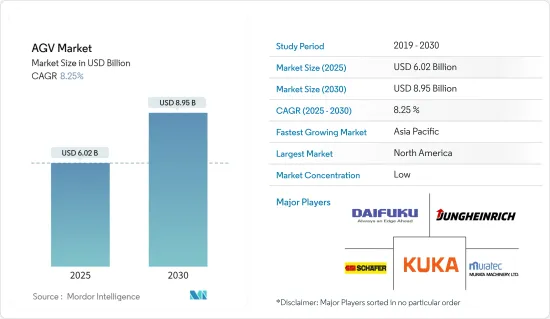

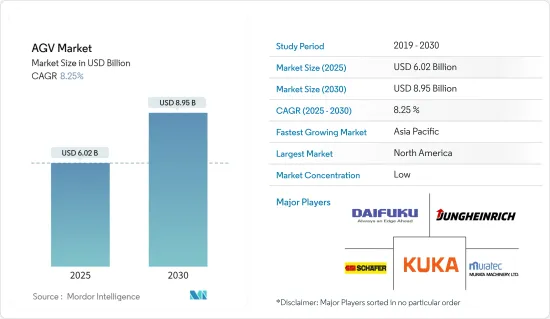

AGV(自動導引運輸車)市場規模預計在 2025 年為 60.2 億美元,預計到 2030 年將達到 89.5 億美元,預測期內(2025-2030 年)的複合年成長率為 8.25%。

主要亮點

- 技術進步的不斷提高、工業自動化需求的不斷成長、製造和倉儲設施對機器人的需求不斷成長以及新興市場的成長是推動自動導引車市場成長的關鍵因素。

- 近年來,自動化徹底改變了製造業,並提高了生產力、效率和安全性。自動化技術的最新突破是自動導引運輸車(AGV)。 AGV 因其能夠確保人類安全並滿足最佳效率的要求而獲得了製造工廠的廣泛認可。技術的進步使得製造商能夠根據其營運要求製造 AGV,並有效地將其部署到各種應用中。

- 汽車產業在生產車間擴大採用自動化和 AGV。例如,西雅特位於西班牙馬爾托雷爾的工廠正在轉型成為數位化智慧工廠。該公司推出了具有 SLAM 導航、4G 連接和感應電池充電功能的 AGV。該設施擁有 8 輛用於戶外作業的 AGV,以及 200 多輛用於在馬托雷利和巴塞隆納工廠的組裝車間內運輸零件的 AGV。

- 全球勞動市場極為緊張,這是自動化堆高機成長的主要原因。儘管失業率已達到 50 年來的最低水平,物流中心和倉庫仍在努力尋找和留住可靠的工人。自動化可以透過全天候提供持續、可靠的性能來幫助縮小勞動力缺口。

- 此外,市場上的多家供應商正專注於推出用於室內停車場的 AGV,從而進一步推動市場成長。例如,2024 年 4 月,Autech Otis Parking Systems 推出了自動導引運輸車(AGV) 停車機器人。這是一個融合人工智慧與物聯網(IoT)技術的自動駕駛系統。目的是自動為自動停車場找到最佳路線並實現無人停車。

- 不斷增加的研發支出和全球不斷成長的生產單位數量正在推動中型工業,特別是食品加工和製藥行業對自動化的需求。

- 此外,使用 AGV 實現供應鏈或製造流程自動化的公司必須進行大量投資。這包括購買 AGV、安裝 AGV 以及調整工作空間以適應 AGV 的價格。此外,由於成本過高,製造商可能不願意使用 AGV。中小型企業可能難以採用 AGV,因為他們無法負擔自動化系統,而必須使用傳統的手動堆高機。

- 此外,景氣衰退、通貨膨脹、戰爭、氣候變遷、貿易爭端、能源取得和工業間諜等其他威脅也是直接影響 AGV 在最終用戶領域中的作用的一些因素。

AGV(自動導引運輸車)市場趨勢

電子商務的快速成長要求更高的效率

- 儘管製造業正在成長,但倉儲和物流行業的龐大需求仍集中在電子商務活動。例如,其加拿大倉儲業務主要由電子商務組成,估計佔該國倉儲業務的 50% 以上。

- AGV的引入為電子商務的許多不同領域提供了機會。具體來說,AGV 適用於涉及大量小訂單且 SKU 範圍廣泛且分佈在大型倉庫區域的履約業務。使用自主機器人進行水平導航可以提高訂單履行的效率。

- 永遠線上電子商務的引入、對更快響應時間的需求以及以更少的錯誤管理更多庫存單位的需求,正在推動倉庫擴大規模並為智慧、高效的自動化倉庫設定標準。全球化的不斷推進以及線上零售和大眾零售的興起,增加了零售業對 AGV 的需求。

- 隨著已開發經濟體和新興經濟體的電子商務企業對日益成長的一日送達訂單的需求不斷成長,此類計劃的商業性可行性正在帶來顯著的效率提升。電子商務倉庫正在藉助 AGV 實現一日送達。

- 電子商務行業的成長以及全球對高效倉儲和庫存管理的需求正在推動所研究市場的發展。例如,根據美國商務部人口普查局的數據,2023年第四季電子商務將占美國零售總額的15.6%,高於上一季。 2023年10月至12月,美國零售電商銷售額超過2,850億美元,以季度為基礎新高。

- 快速變化的零售市場迫使物流中心探索和實施創新、靈活和自動化的電子商務訂單履行方法。預計電子商務購買量的成長將鼓勵企業在其營運流程中引入自動化物料輸送設備,以增強工作流程的順暢。

- 此外,供應鏈已開始在物流中心使用 AGV,以滿足日益成長的電子商務需求,從而使行業能夠高生產力運作。在製藥等領域,AGV 的使用範圍正在擴大,以滿足需求並保持衛生。醫院和其他醫療機構使用 AGV 進行食物、垃圾、亞麻布和無菌消耗品的非接觸式運輸。

亞太地區預計將顯著成長

- 中國的 AGV 市場主要受該國製造業成長的推動。中國擁有世界上最大的製造業,為國家經濟成長貢獻巨大。

- 由於零售業的不斷擴張和投資的不斷增加,中國有望成為自動駕駛汽車的關鍵市場。消費率的上升和對更大倉庫的需求的不斷成長也推動了對自動導引運輸車的需求。

- 此外,中國是工業4.0的領先採用者,該地區擁有世界上最先進的製造設施,領先歐盟、美國和日本等地區。

- 根據世界經濟論壇統計,目前全球有69家工廠採用工業4.0技術,其中中國有20家,歐盟有19家,美國有7家,日本有5家。自動化儲存和搜尋系統除了作為整個工廠自動化的基礎之外,也是工業 4.0 的基礎。

- 此外,隨著印度、中國及鄰國等新興經濟體電子商務需求的成長,電子商務公司正在其倉庫中大量採用 AGV。根據 IBEF 預測,到 2026 年,印度電子商務的複合年成長率將達到 27%,規模達到 1,630 億美元。同樣,23會計年度,印度電子商務商品交易總額(GMV)達到600億美元,與前一年同期比較去年同期成長22%。

- 此外,一些公司正在採用 AGV 來支援業務的自動化,從而進一步推動市場的發展。例如,2024年4月,釜山新港東遠世界碼頭(DGT)舉行了正式落成典禮。這是韓國港口自動化過程中的一個重要里程碑,該碼頭是韓國第一個使用 AGV 進行水平運輸的碼頭。 DGT 將成為釜山新港的第七個貨櫃碼頭。釜山新港的其他六個碼頭均已安裝自動化場內起重機,也稱為「轉運起重機」。然而,這是DGT第一次使用AGV。

- 同樣,2023 年 8 月,馬來西亞西港宣布計劃調查在其未來碼頭開發計劃中使用電動自動導引運輸車的可行性。

AGV(自動導引運輸車)產業概況

全球 AGV(自動導引運輸車)市場較為分散,許多參與者爭奪市場佔有率。數位轉型、工業4.0與物聯網融合等因素正在為該產業帶來巨大的成長機會。引領該產業的是庫卡股份公司、DAIFUKU CO. LTD.、SSI Schaefer AG、村田機械和永恆力股份公司等主要企業。

- 2024 年 3 月,FFT 宣布與感應式充電技術供應商 Wiferion 建立合作夥伴關係,透過新的自動導引運輸車系統擴展其產品組合。 FFTigv 和 Wiferion 充電系統已在萊比錫的寶馬集團工廠安裝。 FFT 建立了新的製造工廠,利用無線充電和 AGV 來提高產量和效率。

- 2024 年 3 月,Cypher Robotics 宣布推出 Captis AGV(自動地面車輛),用於高效、準確的循環盤點和工業掃描。 Captis AGV 可自行在倉庫內移動。它不需要改變基礎設施,也不會與人或物體發生碰撞。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 電子商務的快速成長要求更高的效率

- 增加對科技和機器人技術的投資

- 市場限制

- 由於通訊延遲導致的即時無線控制的限制

第6章 市場細分

- 依產品類型

- 自動堆高機

- 汽車牽引車/曳引機/拖曳船

- 單元貨載

- 組裝

- 特殊用途

- 按最終用戶產業

- 飲食

- 車

- 零售

- 電子/電氣

- 一般製造業

- 藥品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- KUKA AG

- Jungheinrich AG

- Murata Machinery Ltd

- Daifuku Co. Ltd

- SSI Schaefer Systems International DWC LLC

- Swisslog Holding

- Dematic Corp.

- Toyota Material Handling

- Scott Technology Limited

- John Bean Technologies(JBT)Corporation

- Systems Logistics SPA

- Seegrid Corporation

第8章投資分析

第9章:市場的未來

The AGV Market size is estimated at USD 6.02 billion in 2025, and is expected to reach USD 8.95 billion by 2030, at a CAGR of 8.25% during the forecast period (2025-2030).

Key Highlights

- Rising technological advancements, increased demand for automation in industries, increased demand for robots in manufacturing and warehousing facilities, and growing emerging markets are the key factors driving the growth of the automated guided vehicles market.

- In recent years, automation has revolutionized the manufacturing sector, resulting in enhanced productivity, efficiency, and safety. Among the latest breakthroughs in automation technology are automated guided vehicles (AGVs). AGVs have gained considerable recognition in manufacturing facilities due to their ability to ensure human safety and meet the demand for optimal efficiency. Technological advancements have empowered manufacturers to create AGVs tailored to their operational requirements and effectively implement them for various applications.

- The automotive industry is increasingly incorporating automation and AGVs into its manufacturing floors. For instance, the SEAT plant in Martorell, Spain, is transforming into a digitalized and smart factory. The company implemented AGVs with SLAM navigation, 4G connectivity, and induction battery charging. The facility has eight AGVs for outdoor operation and over 200 AGVs that deliver parts inside the assembly workshops at the Martorell and Barcelona factories.

- The global labor market is extremely tight, which is the primary reason for the growth of automated forklifts. Despite the fact that unemployment is at its lowest level in fifty years, distribution centers and warehouses find it difficult to find and keep trustworthy workers. Automation could provide continuous, reliable performance around the clock, helping to close the labor gap.

- Furthermore, several vendors in the market are focusing on launching AGVs for parking in the buildings, further supporting the market's growth. For instance, in April 2024, Autech-Otis Parking Systems launched an automatic guided vehicle (AGV) parking robot utilizing artificial intelligence (AI) technology. It is an autonomous driving system that combines AI and Internet of Things (IoT) technologies. Its goal is to automatically find the best routes for self-driving parking lots so that unmanned parking can be made easier.

- The continuously increasing R&D expenditure and the rising number of production establishments worldwide are driving the demand for automation worldwide in mid-range industries, especially in the food processing and pharmaceutical sectors.

- Moreover, companies that automate their supply chains or manufacturing processes with AGVs have to invest a lot of money. This takes care of the price of buying, setting up, and adjusting the workspace to make it more AGV-friendly. Moreover, manufacturers might be dissuaded from using AGVs due to their high cost. Smaller businesses may find it difficult to adopt AGVs since they cannot afford automated systems and must instead use traditional, manual forklift trucks.

- Furthermore, other threats such as recession, inflation, war, climate change, trade disputes, energy access, and industrial espionage are some of the factors that are responsible for directly shaping the role of AGVs in end-user sectors.

Automated Guided Vehicles Market Trends

Rapid Growth of E-commerce Demanding Higher Efficency

- Despite growth in the manufacturing industry, considerable demand from the warehousing and logistics sector is dedicated to e-commerce activity. For instance, the Canadian warehouse portfolio is mainly comprised of e-commerce, which is estimated to make up more than 50% of the country's warehouse business.

- The deployment of AGVs provides an opportunity for different areas in e-commerce. Specifically, the AGVs are suited for fulfillment operations involving large quantities of small orders for large SKU ranges spread across large warehouse areas. Using autonomous robots to perform horizontal traveling can increase order fulfillment efficiency.

- With the introduction of always-on e-commerce, the demand for faster responses, and the need to manage a more significant number of stock-keeping units with fewer errors, warehouses need to scale up and meet the standards of an intelligent, efficient, and automated warehouse. Such increasing globalization and the rise of online retail and bulk retail have increased demand for AGVs in the retail industry.

- The rising demand for e-commerce companies to cater to the increasing number of single-day delivery orders, both in advanced and emerging economies, has resulted in a significant increase in efficiency owing to the commercial viability of these schemes. E-commerce warehouses carry out the single-day delivery method with the aid of AGVs.

- The growth in the e-commerce industry, along with the need for efficient warehousing and inventory management across the world, are driving the market studied. For instance, according to the Census Bureau of the Department of Commerce, in the fourth quarter of 2023, the share of e-commerce in total US retail sales stood at 15.6%, up from the previous quarter. From October to December 2023, retail e-commerce sales in the United States hit over USD 285 billion, the highest quarterly revenue in history.

- The rapidly changing retail market compels distribution centers to seek out and implement innovative, flexible, and automated approaches to e-commerce order fulfillment. Such a rise in e-commerce purchases is expected to push companies to deploy automated material handling equipment in their operation process to enhance smooth workflow.

- Moreover, supply chains began using AGVs in distribution centers in response to increased e-commerce demand, allowing industries to function at high productivity. AGVs' use has expanded in sectors like pharmaceuticals to keep up with demand and maintain sanitation. Hospitals and other healthcare facilities utilize AGVs to undertake the contactless transfer of food, trash bins, linens, and sterile supplies.

Asia-Pacific Expected to Witness Significant Growth

- The AGV market in China is primarily driven by the country's proliferating manufacturing industry. China has the largest manufacturing industry in the world, and it is also a key contributor to the country's economic growth.

- China is anticipated to be a crucial market for automated guided vehicles, given the expanding retail sector and increased investments. Rising consumption rates and the growing demand for larger warehouses are also driving the need for AGVs.

- Moreover, China is a major adopter of Industry 4.0, and the region is home to some of the most advanced manufacturing facilities in the world, ahead of regions like the European Union, the United States, and Japan.

- According to the World Economic Forum, of the 69 factories around the world now considered leaders using Industry 4.0 technologies, China is now home to 20, followed by 19 in the European Union, 7 in the United States, and 5 in Japan. Besides being the foundation for plant-wide automation, the automated storage and retrieval system also serves as a foundation for Industry 4.0.

- Moreover, with the increasing demand for e-commerce in emerging countries, such as India, China, and neighboring countries, e-commerce companies have been deploying AGVs at warehouses significantly. According to the IBEF, Indian e-commerce is projected to witness a CAGR of 27% to reach USD 163 billion by 2026. Similarly, in FY23, the gross merchandise value (GMV) of e-commerce in India reached USD 60 billion, increasing 22% over the previous year.

- In addition, several companies are adopting AGVs to support automation in the business, further driving the market. For instance, in April 2024, Busan Newport's Dongwon Global Terminal (DGT) held its formal inauguration ceremony. This was a significant milestone in Korea's port automation journey, as the terminal is the first in the country to use AGVs for horizontal transportation. At Busan Newport, DGT is the seventh container terminal. Automated yard cranes, also known as "transfer cranes," are present in all six of the other terminals at Busan New Port. However, DGT is the first to use AGVs.

- Similarly, in August 2023, Westports Malaysia announced plans to investigate the potential of using electric automated guided vehicles in future terminal development plans.

Automated Guided Vehicle Industry Overview

The global automated guided vehicle market is fragmented, with numerous players vying for market share. The industry is witnessing significant growth opportunities, driven by factors like digital transformation and the integration of Industry 4.0 with IoT. Leading the pack are prominent players, including Kuka AG, Daifuku Co. Ltd, SSI Schaefer AG, Murata Machinery Ltd, and Jungheinrich AG.

- March 2024: FFT announced the expansion of its portfolio with a new automated guided vehicle system by partnering with inductive charging tech provider Wiferion, which automaker BMW is now using. The charging systems from FFTigv and Wiferion have been implemented at the BMW Group plant in Leipzig. FFT created a new manufacturing facility, thereby utilizing wireless charging and AGVs to increase output and efficiency.

- March 2024: Cypher Robotics announced the release of the Captis Autonomous Ground Vehicle (AGV) for efficient and accurate cycle counting and industrial scanning. The Captis AGV is capable of navigating warehouses by itself. It does not require any changes to the infrastructure and will not collide with people or objects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Growth of E-commerce Demanding Higher Efficiency

- 5.1.2 Increasing Investments in Technology and Robotics

- 5.2 Market Restraints

- 5.2.1 Limitation of Real-Time Wireless Control Due to Communication Delays

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Automated Fork Lift

- 6.1.2 Automated Tow/Tractor/Tugs

- 6.1.3 Unit Load

- 6.1.4 Assembly Line

- 6.1.5 Special Purpose

- 6.2 By End-User Industry

- 6.2.1 Food & Beverage

- 6.2.2 Automotive

- 6.2.3 Retail

- 6.2.4 Electronics & Electrical

- 6.2.5 General Manufacturing

- 6.2.6 Pharmaceuticals

- 6.2.7 Other End User Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 KUKA AG

- 7.1.2 Jungheinrich AG

- 7.1.3 Murata Machinery Ltd

- 7.1.4 Daifuku Co. Ltd

- 7.1.5 SSI Schaefer Systems International DWC LLC

- 7.1.6 Swisslog Holding

- 7.1.7 Dematic Corp.

- 7.1.8 Toyota Material Handling

- 7.1.9 Scott Technology Limited

- 7.1.10 John Bean Technologies (JBT) Corporation

- 7.1.11 Systems Logistics SPA

- 7.1.12 Seegrid Corporation