|

市場調查報告書

商品編碼

1640665

發酵化學品-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Fermentation Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

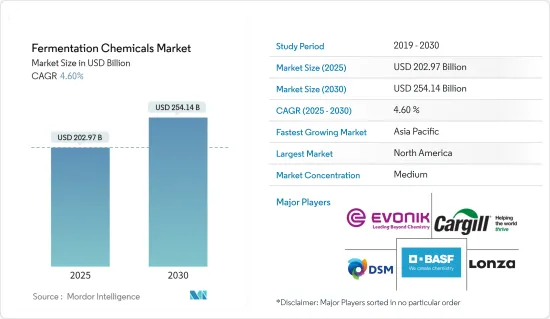

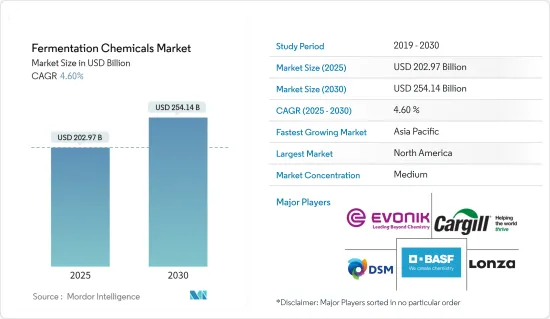

發酵化學品市場規模預計在 2025 年為 2,029.7 億美元,預計到 2030 年將達到 2,541.4 億美元,預測期內(2025-2030 年)的複合年成長率為 4.6%。

COVID-19 疫情對發酵化學品市場產生了負面影響。然而,2021年市場已明顯復甦。

關鍵亮點

- 短期內,甲醇和乙醇產業的需求增加以及製藥業的需求增加是推動研究市場成長的關鍵因素。

- 然而,製造流程複雜導致的高成本可能會抑制市場的成長。

- 隨著綠色化學機會的不斷增加,全球市場很可能很快就會出現有利可圖的成長機會。

- 北美地區佔據發酵化學品市場的主導地位,其中美國、加拿大和墨西哥等國家佔消費量最大。

發酵化學品市場趨勢

食品和飲料產業佔據市場主導地位

- 發酵通常意味著需要微生物作用。發酵會產生葡萄酒、啤酒和蘋果酒等酒精飲料。發酵也用於乳製品的生產和麵包的興起。

- 發酵化學品在食品和飲料行業的需求很高,因為它們是人類用來生產更安全、更穩定和更好的食品的最古老的生物技術。

- 在亞太地區,由於生活方式的改變、人們可支配收入的增加、速食以及對快餐的偏好日益增加,對加工食品的需求正在成長。消費者喜歡烹飪時間較短、新鮮且包裝精美、堅固的已調理食品。

- 此外,預計中國仍將是亞洲最大的食品市場,而印度和東南亞的食品支出將出現最強勁的成長。

- 由於人們對包裝食品的嚴重依賴以及食品加工公司的強大支撐,北美食品加工市場表現強勁。百事可樂、泰森食品和雀巢是該地區一些主要的食品加工公司。

- 德國是歐洲最大的食品和飲料市場,擁有超過 8,300 萬全球最富裕的消費者。 2023年,德國食品市場預計將創造2,455億美元的銷售額。預計 2023 年至 2027 年間,市場年增率將達到 3.64%。

- 根據國際葡萄與葡萄酒組織(OIV)的數據,2022 年全球葡萄酒產量約為 2.58 億百公升。

- 此外,2022 年,義大利是世界上最大的葡萄酒生產國,並且出口量最多,達到 2,190 萬百升。另外兩個主要葡萄酒生產國是最大的出口國。法國出口了 1,400 萬百升,西班牙出口了 2,120 萬百升。

- 這些因素可能會支持食品和飲料領域對研究市場的需求。

北美佔據市場主導地位

- 北美目前佔據全球發酵化學品市場的最大佔有率。

- 在美國,製藥業是北美市場的主要推動力,正努力轉型為綠色產業。

- 在北美,美國佔據全球醫藥銷售收益的最大佔有率。據阿斯特捷利康稱,預計2024年美國在藥品上的支出將在6,050億美元至6,350億美元之間。

- 加拿大是全球第九大醫藥市場,佔全球銷售額的2.1%。在政府的直接支持下,加拿大的製藥業正在不斷發展。例如,2021年8月,加拿大政府宣布對糖尿病研究進行新的投資。

- 最近,美國食品和飲料行業經歷了顯著的成長,這可能會推動市場研究。

- 2022年3月,雀巢宣布計畫在美國亞利桑那州鳳凰城大都會區投資6.75億美元,生產包括燕麥奶咖啡奶精在內的飲料。該工廠計劃於 2024 年投入運作。

- 此外,加拿大和墨西哥對製藥、食品和飲料行業使用的發酵化學品的需求日益增加。

- 因此,上述因素將導致預測期內北美發酵化學品市場的需求增加。

發酵化學品產業概況

全球發酵化學品市場部分整合。主要參與企業包括(不分先後順序):BASF公司、嘉吉公司、贏創工業股份公司、帝斯曼和龍沙。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 甲醇和乙醇產業的需求不斷成長

- 製藥業的需求不斷成長

- 其他促進因素

- 限制因素

- 製造流程複雜,成本高

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第 5 章 市場區隔(以金額為準的市場規模)

- 產品類型

- 酒精

- 有機酸

- 酵素

- 其他

- 應用

- 工業的

- 飲食

- 醫學與營養

- 塑膠和紡織品

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- AB Enzymes

- Ajinomoto Co., Inc.

- ADM

- BASF SE

- Biocon

- BioVectra

- Cargill, Incorporated.

- Chr. Hansen Holding A/S

- DSM

- Evonik Industries AG

- Lonza

- MicroBiopharm Japan Co., Ltd.

- Novasep

- Novozymes

- Teva Pharmaceutical Industries Ltd.

第7章 市場機會與未來趨勢

- 綠色化學的成長機會

- 其他機會

The Fermentation Chemicals Market size is estimated at USD 202.97 billion in 2025, and is expected to reach USD 254.14 billion by 2030, at a CAGR of 4.6% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the fermentation chemicals market. However, the market recovered significantly in 2021.

Key Highlights

- Over the short term, the growing demand from the methanol and ethanol industry and increasing demand from the pharmaceutical industry are major factors driving the studied market's growth.

- However, high costs due to the complexity involved in the manufacturing process are likely to restrain the growth of the studied market.

- Nevertheless, growing green chemistry opportunities will likely create lucrative growth opportunities for the global market soon.

- The North American region dominates the fermentation chemicals market, with the largest consumption coming from countries like the United States, Canada, and Mexico.

Fermentation Chemicals Market Trends

Food and Beverage Sector to Dominate the Market

- Fermentation usually signifies that the action of microorganisms is desirable. Fermentation produces alcoholic beverages such as wine, beer, and cider. Fermentation is also used to produce dairy products and leavening bread.

- Fermentation chemicals are highly demanded by the food and beverages industry as it is the oldest biotechnology used by human beings to produce safer, more stable, and better foodstuff.

- In the Asia-Pacific region, the demand for processed food is growing due to increasing lifestyle changes, disposable income of people, working professionals, and preferences for fast food. Consumers prefer ready-to-eat foods as these require considerably lesser time for cooking, are fresh, and include attractive and sturdy packaging.

- Also, China is expected to continue to be Asia's largest food market, and India and Southeast Asia will witness the most significant increases in food spending.

- The market for food processing in North America is robust due to the excessive dependence of people on packaged food products and the strong foothold of the food processing companies. PepsiCo, Tyson Foods, and Nestle are large food processing companies operating in the region.

- Germany is by far Europe's largest market for foods and beverages, home to more than 83 million of the world's wealthiest consumers. In 2023, the German food market is expected to generate USD 245.50 billion in revenue. The market is expected to grow annually by 3.64% between 2023 to 2027.

- According to OIV (International Organisation of Vine and Wine), global wine production in 2022 amounted to about 258 million hectoliters.

- Additionally, in 2022, Italy was the world's top wine producer and exported the most wine, amounting to 21.9 million hectoliters. The top exporters were the other two top wine producers. France exported 14 million hectoliters, while Spain exported 21.2 million.

- Such factors likely support the demand for the studied market from the food and beverages segment.

North America to Dominate the Market

- North America currently accounts for the highest global fermentation chemicals market share.

- The pharmaceutical industry highly drives the market for North America in the United States and its growing focus to turn itself into a green industry.

- In North America, the United States accounts for the largest share of the revenue generated by global pharmaceutical sales. In 2024, the United States is projected to spend between USD 605 and 635 billion on medicines, according to AstraZeneca. It will make the country achieve the highest pharmaceutical spending by far.

- Canada's pharmaceuticals market is the ninth-largest globally, with a 2.1% share of global market sales. The pharmaceutical sector in Canada is progressing under direct support from the government. For instance, in August 2021, the government of Canada announced new investments in diabetes research.

- Recently, the food & beverage industry witnessed major growth in the United States, likely to drive the market studied.

- In March 2022, Nestle announced its plans to invest USD 675 million in a new plant in Metro Phoenix, Arizona, the United States, to produce beverages, including oat milk coffee creamers, as consumer demand for plant-based products increases. The plant is expected to be operational in 2024.

- Additionally, there is an increasing demand for fermentation chemicals from Canada and Mexico for use in the pharmaceutical, food & beverage industries.

- Therefore, the abovementioned factors contribute to the increasing demand for the fermentation chemicals market in North America during the forecast period.

Fermentation Chemicals Industry Overview

The global fermentation chemicals market is partially consolidated in nature. The major players include BASF SE, Cargill, Incorporated., Evonik Industries AG, DSM, and Lonza, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Methanol and Ethanol Industry

- 4.1.2 Increasing Demand from the Pharmaceutical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost Due to the Complexity Involved in the Manufacturing Process

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Alcohols

- 5.1.2 Organic Acids

- 5.1.3 Enzymes

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Industrial

- 5.2.2 Food and Beverage

- 5.2.3 Pharmaceutical and Nutritional

- 5.2.4 Plastics and Fibers

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AB Enzymes

- 6.4.2 Ajinomoto Co., Inc.

- 6.4.3 ADM

- 6.4.4 BASF SE

- 6.4.5 Biocon

- 6.4.6 BioVectra

- 6.4.7 Cargill, Incorporated.

- 6.4.8 Chr. Hansen Holding A/S

- 6.4.9 DSM

- 6.4.10 Evonik Industries AG

- 6.4.11 Lonza

- 6.4.12 MicroBiopharm Japan Co., Ltd.

- 6.4.13 Novasep

- 6.4.14 Novozymes

- 6.4.15 Teva Pharmaceutical Industries Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Opportunities for Green Chemistry

- 7.2 Other Opportunities