|

市場調查報告書

商品編碼

1641934

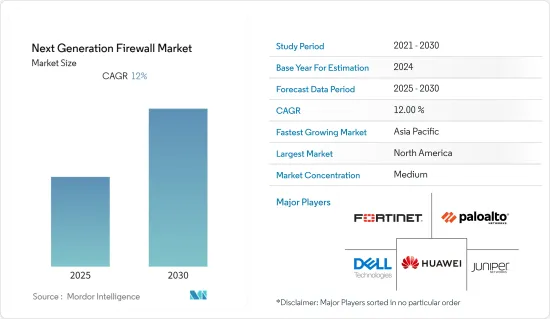

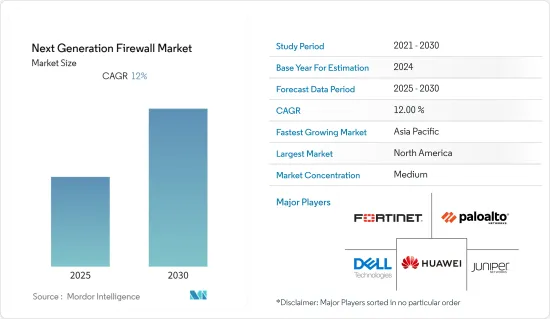

新一代防火牆:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Next Generation Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

預計新一代防火牆市場在預測期內的複合年成長率將達到 12%。

主要亮點

- 推動下一代防火牆市場成長的主要因素之一是物聯網世界的日益普及。由於新一代防火牆的普及,市場正在不斷擴大,這些防火牆可以有效地管理日誌,同時保持日誌的完整性並提高業務連續性,以及處理大量電腦生成的日誌資料的需求不斷成長。力成功。

- 採用下一代安全解決方案有助於企業提高產品和營運效率。新一代端點安全採用機器學習、人工智慧 (AI) 和更緊密的網路連接,以提供更全面、更自適應的保護。下一代安全系統分析使用者和系統行為並即時檢查可執行檔。現有的安全技術正在發展成為情境感知運算技術,使企業能夠識別高階威脅。 IT基礎設施系統故障導致的付款問題可能會擾亂全球貿易,而網路連線的遺失可能會影響執法等政府職能。在預測期內,這方面有望為下一代防火牆供應商創造機會。

- 基於網際網路的網路安全工具已廣泛用於保護雲端基礎的應用程式。網路的使用增加增加了資料外洩和簡單資料操縱的可能性,而這些是內部安全系統不可能實現的。因此,組織必須開始使用基於網際網路的安全解決方案或識別網際網路防火牆管理工具。提供者提供明確的、多因素的安全解決方案,以達到可接受的保護等級。企業也必須為潛在的 DoS(拒絕服務)攻擊做好準備。然而,如果沒有適當的保護措施和解決方案,安全分析解決方案就相對難以識別這些攻擊。因此,對新一代防火牆系統的需求可能會增加,以維持強大且有效率的安全系統。

- 公司正在將新的應用/解決方案融入其產品中以滿足客戶需求。例如,2021 年 7 月,全面、整合和自動化網路安全解決方案領域的知名企業 Fortinet 宣佈建立合作夥伴關係,以保護擁有混合資料中心的企業免受日益成長的威脅形勢和勒索軟體攻擊。新一代防火牆(NGFW) FortiGate 3500F 具備 TLS 1.3 和自動加密後威脅預防功能,具有業界領先的效能指標。此外,憑藉安全主導的網路策略,FortiGate 3500F 配備零信任網路存取 (ZTNA) 功能,可為每個使用者(無論身在何處)提供一致的安全性和無縫的使用者體驗。

- 在新一代防火牆市場中,有多種限制因素阻礙了市場的成長。下一代防火牆雖然有效,但價格昂貴,中型企業難以購買。下一代防火牆的主要限制之一是系統成本高。由於該系統成本高昂,只有大公司才有能力使用。另一個市場限制是,中小企業使用傳統方法和過時的技術,並且希望保留這些技術。

- 政府機構已撥出策略性資金來加強疫情時代的數位介面。例如,2021 年,法國總統馬克宏宣布計劃投資10 億歐元(約12 億美元)加強法國的網路安全,以應對最近醫院的資料外洩事件。 (約4 億美元)的資金,用於

新一代防火牆市場趨勢

BFSI 部門預計將佔據主導市場佔有率

- 銀行、金融服務和保險 (BFSI) 行業是關鍵基礎設施領域之一,由於其服務的客戶群和金融資訊龐大,該行業面臨多次資料外洩和網路攻擊。網路犯罪分子正在最佳化一系列惡意的網路攻擊,以破壞金融部門。這些攻擊威脅包括木馬、ATM、勒索軟體、手機銀行惡意軟體、資料外洩、組織入侵、資料竊取和財務外洩。

- 透過制定保護 IT 流程和系統、保護敏感客戶資料和遵守政府法規的策略,公共和私人銀行機構正在採用最新技術來防止網路攻擊。此外,客戶期望的不斷提高、技術力的提高和監管要求的不斷提高迫使銀行機構採取積極主動的安全措施。隨著網路銀行、手機銀行等科技和數位管道的興起,網路銀行已成為客戶首選的銀行服務。銀行迫切需要利用先進的身份驗證和存取控制流程。

- 今年 2 月,菲律賓司法部(DoJ)與產業組織菲律賓銀行家協會(BAP)簽署了一份合作備忘錄,旨在提高菲律賓的網路安全意識並打擊網路犯罪。 BAP 將加強銀行業的網路彈性,並與司法部建立合作夥伴關係,透過資訊共用和合作,在該國網路犯罪案件不斷增加的情況下促進協調、集體和戰略應對。

- 預計大量銀行將推動下一代防火牆市場的需求。例如,截至今年 9 月,印度已有 34 家私人和公共部門銀行獲得許可。資料外洩會導致成本急劇增加,並造成寶貴客戶資訊的遺失。資料外洩不僅會導致費用急劇增加,還會造成關鍵客戶資訊的遺失。根據身分盜竊資源中心統計,去年第三季美國銀行業和金融業資料外洩受害者數量達到1.6億,高於第一季和第二季的總和。網路攻擊者正在尋找最簡單的方法,對眾多金融服務企業發動有利可圖的攻擊。

- 今年一月,美國聯邦銀行監管機構宣布了網路安全規則,要求及時通知資料外洩事件。擬議的規則將為許多電腦安全事件提供預警。該規則要求銀行公司在確定事件發生後應盡快通知,但不得晚於 36 小時。這些規定可以控制美國銀行業的網路攻擊。

北美佔據市場的大部分佔有率

- 北美地區目前佔據全球市場主導地位。這是因為企業高度關注大量機密和敏感資料的安全偏好,並且組織不斷採用高效能網路安全解決方案。

- 最近,美國各大公司遭受了致命的「WannaCry」勒索軟體攻擊,該病毒加密了資料並要求以加密貨幣支付贖金。這次攻擊的發生是因為數百萬客戶的資料未受到保護。這導致政府推出了嚴格的消費者隱私監管規定。預計該因素將推動該地區的市場成長。

- 美國聯邦法律《健康保險互通性與課責法案》於去年1月作為《醫療保健資料外洩報告》發布,報告指出2020年資料外洩事件與前一年同期比較增加了25%,達到29,298,012起。

- 該國其他產業也同樣發現重大網路安全問題增加。例如,根據 Shredit 的 2021 年資料保護報告,與 2020 年相比,去年遭遇資料外洩的企業(大型和小型企業)的百分比大幅增加。在大型企業中,這一比例從去年的 74% 上升至 2020 年的 43%,與前一年同期比較% 。

- 此外,今年 4 月,鑑於俄羅斯與烏克蘭之間的衝突以及針對俄羅斯的威脅宣傳活動和漏洞披露幾乎無休止的循環,美國國務院成立了一個新機構——網路空間和數位政策辦公室 (CDP)。拜登政府尋求將網路安全融入美國外交關係,他負責制定網路防禦和隱私政策和方向。

下一代防火牆產業概覽

下一代防火牆市場適度整合,國內和國際市場上都有許多大大小小的參與者。市場競爭集中度適中,主要企業採取的關鍵策略是產品創新與併購。市場的主要企業包括Juniper Networks、戴爾科技和華為技術。

2022 年 8 月,創新且易於存取的網路安全解決方案供應商 Hillstone Networks 宣布推出其 A 系列新一代防火牆 (NGFW) 的兩款新型號:A7600 和 A6800。 A7600 和 A6800 可協助企業保護不斷擴展的網路邊緣,提供強大的網路安全功能,並透過緊湊的 1RU外形規格解決方案促進永續性。

2022年10月,歐洲關鍵任務應用網路安全公司Clavister宣布續約,以繼續與諾基亞的長期合作,滿足日益成長的5G安全需求。作為新合作的一部分,諾基亞將把 NetShield 整合到其諾基亞託管防火牆服務 (MFS) 和諾基亞託管安全服務 (MSS) 解決方案產品中。 Nokia MFS 將 Clavister 領先的通訊業者級功能(處理技術)與其領先的以防火牆為中心的服務模式相結合,為諾基亞客戶提供全面的解決方案。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果和先決條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 從資料中心遷移到公共雲端的趨勢日益成長

- 對終端設備內部和外部威脅的擔憂日益增加

- 市場限制

- 引進網路系統成本高

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 按公司規模

- 中小型企業

- 大型企業

- 按解決方案

- 雲端基礎

- 硬體

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 政府

- 衛生保健

- 製造業

- 零售

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲國家

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 公司簡介

- Juniper Networks Inc.

- Palo Alto Networks Inc.

- Dell Technologies

- Huawei Technologies Co. Ltd

- Fortinet Inc.

- Barracuda Networks Inc.

- Forcepoint LLC

- WatchGuard Technologies Inc.

- Check Point Software Technologies Ltd.

- Hillstone Networks

- Sophos Technologies Pvt. Ltd(Cyberoam)

- Untangle Inc.

- Zscaler Inc.

第7章投資分析

第8章 市場機會與未來趨勢

The Next Generation Firewall Market is expected to register a CAGR of 12% during the forecast period.

Key Highlights

- One of the primary factors driving the growth of the next-generation firewall market is the rising global adoption of the Internet of Things. The increased adoption of next-generation firewalls for effectively managing logs while preserving the integrity and better business continuity and the increasing demand for dealing with massive amounts of computer-generated log data drive market expansion.

- Adopting next-generation security solutions helps increase the company's product and operational efficiencies. Machine learning, artificial intelligence (AI), and tighter network connectivity are used in next-generation endpoint security to provide more comprehensive and adaptable protection. Next-generation security systems use real-time user and system behavior analysis to examine executables. Existing security technologies advancing toward context-aware computing technology enable businesses to recognize sophisticated threats. Payment problems caused by system failures in IT infrastructure can disrupt global commerce, while network connection loss affects government functions such as law enforcement. Over the projected period, this aspect is expected to generate possibilities for next-generation firewall vendors.

- Internet-based cybersecurity tools are available and commonly utilized to defend cloud-based applications. More internet usage increases the likelihood of data breaches and simple data manipulation, which is impossible in an internal security system. As a result, organizations need to start using internet-based security solutions or revealing internet firewall management tools. Providers provide clear and multifactor safety solutions for an acceptable level of protection. Businesses must also plan for potential DoS (Denial-of-Service) attacks. However, it is relatively difficult to identify these attacks by security analytics solutions without proper protective measures and solutions. As a result, demand for next-generation firewall systems is likely to rise to maintain robust and efficient security systems.

- The companies are incorporating new applications/Solutions in their products to meet customers' demands. For instance, in July 2021, The FortiGate 3500F next-generation firewall (NGFW) was announced by Fortinet, a prominent player of comprehensive, integrated, and automated cybersecurity solutions, to defend enterprises with hybrid data centers from the ever-growing threat landscape and ransomware attacks. The FortiGate 3500F has some of the highest performance metrics in the business, incorporating TLS1.3 and automated threat protection after encryption. With its security-driven networking strategy, the FortiGate 3500F also includes zero-trust network access (ZTNA) capabilities, ensuring consistent security and a seamless user experience for any user at any location.

- Several constraints in the next-generation firewall market are preventing it from growing. A next-generation firewall is highly effective but expensive, making it difficult for medium-sized businesses to buy it. One of the primary constraints in the next-generation firewall is the high cost of systems. Because of the high cost of the systems, only large corporations can afford to use them. Another market limitation is that small and medium firms use traditional methods and antiquated technology and want to keep their technology the same, which constitutes a market restraint.

- Government agencies are allotting strategic funds to strengthen their digital interface in the post-pandemic era. For instance, In 2021, following recent hospital breaches, French President Emmanuel Macron announced a plan to invest EUR 1 billion (USD 1.2 billion) to strengthen cybersecurity in France, with EUR 350 million (approx. USD 400 million USD) set aside for hospitals.

Next Generation Firewall Market Trends

BFSI Sector is Expected to Capture Prominent Market Share

- The banking, financial services, and insurance (BFSI) industry are one of the critical infrastructure segments that face multiple data breaches and cyber-attacks, owing to the massive customer base that the sector serves and the financial information at stake. Being a highly lucrative operation model that has phenomenal returns along with the added upside of relatively low risk and detectability, cybercriminals are optimizing a plethora of diabolical cyberattacks to immobilize the financial sector. These attacks' threat landscape ranges from Trojans, ATMs, ransomware, mobile banking malware, data breaches, institutional invasion, data thefts, fiscal breaches, etc.

- With a strategy to secure their IT processes and systems, secure customer critical data, and comply with government regulations, public and private banking institutes are implementing the latest technology to prevent cyber attacks. Besides, with greater customer expectations, rising technological capabilities, and regulatory requirements, banking institutions are pushed to adopt a proactive security approach. With the growing technological penetration and digital channels, such as internet banking, mobile banking, etc., online banking has become customers' preferred choice for banking services. There is a significant need for banks to leverage advanced authentication and access control processes.

- In February this year, the Department of Justice (DoJ) and industry group Bankers Association of the Philippines (BAP) signed a memorandum of understanding (MoU) to raise cybersecurity awareness and combat cybercrime in the Philippines. The BAP aims to strengthen the banking industry's cyber-resilience and develop a collaborative partnership with the Justice Department to achieve a coordinated, collective, and strategic cyber response through information sharing and collaboration in the wake of rising cybercrime incidents in the country.

- Many banks are expected to drive the demand for the next-generation firewall market. For instance, According to, in India, there were 34 licensed private and public banks as of September this year. Data breaches lead to an exponential cost increase and loss of valuable customer information. Data breaches result in an exponential increase in expenditures as well as the loss of critical client information. According to the Identity Theft Resource Center, the number of data compromise victims in the banking and financial sector of the United States climbed to 160 million in Q3 last year, up from Q1 and Q2 combined. Cyber attackers are looking for the simplest way to build a financial gain assault against many financial services businesses.

- In January this year, the federal banking regulators of the United States issued a cybersecurity rule requiring prompt notification of a breach. The proposed rule is poised to provide the agencies with an early warning of numerous computer security incidents. It would need notification as soon as possible and by 36 hours after a banking enterprise determines that an incident has occurred. Such regulations could control cyber attacks in the banking sector of the United States.

North America Accounts for a Major Share of the Market

- The North American region currently dominates the global market, owing to the high preference of businesses for the security of the high volume of sensitive and important data used by them and the continuous adoption of high-performing network security solutions by organizations.

- In recent times, the major firms in the United States suffered from the fatal WannaCry ransomware attack when data was encrypted, and ransom was asked in cryptocurrency. The attack happened because the data of millions of customers was unsecured. Hence, stringent government regulations regarding consumer privacy were imposed. This factor is expected to drive the market's growth in this region.

- The Health Insurance Portability and Accountability Act, a federal statute of the United States, reported the increase of breaches by 25% year-over-year in 2020 in the Healthcare Data Breach Report published in January last year, with 29,298,012 healthcare records breached.

- Other sectors are also equally witnessing growth in the major cyber security issues in the country. For instance, according to the Data Protection Report 2021 from Shred It, the rate of companies (Large and SMBs) experiencing a data breach increased incredibly last year compared to 2020. The rate increased to 74% for large businesses the previous year compared to 43% in 2020, whereas the rate increased to 61% for SMBs from a low rate of just 12% on a year-on-year basis.

- Moreover, in light of the Russia - Ukraine conflict and a virtually endless cycle of threat campaigns and vulnerability disclosures towards the country, the US State Department, in April this year, launched a new agency, the Bureau of Cyberspace and Digital Policy (CDP), responsible for developing online defense and privacy-protection policies and direction as the Biden administration seeks to integrate cybersecurity into America's foreign relations.

Next Generation Firewall Industry Overview

The next-generation firewall market is moderately consolidated, with the presence of many small and big players in the domestic as well as the international market. The market is moderately concentrated with the key strategies adopted by the major players in product innovation and mergers and acquisitions to stay ahead of the competition. Some major players in the market are Juniper Networks Inc., Dell Technologies, and Huawei Technologies Co. Ltd, among others.

In August 2022, Hillstone Networks, a provider of innovative and accessible cybersecurity solutions, introduced two new models in its A-Series next-generation firewalls (NGFWs), the A7600 and A6800, to assist enterprises in securing their expanding network edge, delivering powerful network security capabilities and driving sustainability with solutions in a compact 1RU form factor.

In October 2022, Clavister, a European cybersecurity company for mission-critical applications, announced a renewed agreement with Nokia to continue their long-standing collaboration and satisfy the growing demand for 5G security. Nokia will integrate NetShield among the solutions offered in Nokia Managed Firewall Services (MFS) and Nokia Managed Security Services (MSS) as part of the new collaboration arrangement. Nokia MFS blends Clavister's superior telco-grade capabilities (which handle the technology) with the key services model centered on the firewall to provide a comprehensive solution for Nokia's customers as a service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables & Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Trend in the Migration from the Data Center to the Public Cloud

- 4.2.2 Growing Concern of Internal and External Threats Across Endpoint Devices

- 4.3 Market Restraints

- 4.3.1 High Cost of Installation across the Network System

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Size of Enterprise

- 5.1.1 Small and Medium Enterprises (SMEs)

- 5.1.2 Large Enterprises

- 5.2 By Solution

- 5.2.1 Cloud-Based

- 5.2.2 Hardware

- 5.3 By End-User Industry

- 5.3.1 BFSI

- 5.3.2 IT and Telecom

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Manufacturing

- 5.3.6 Retail

- 5.3.7 Other End-User Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Juniper Networks Inc.

- 6.1.2 Palo Alto Networks Inc.

- 6.1.3 Dell Technologies

- 6.1.4 Huawei Technologies Co. Ltd

- 6.1.5 Fortinet Inc.

- 6.1.6 Barracuda Networks Inc.

- 6.1.7 Forcepoint LLC

- 6.1.8 WatchGuard Technologies Inc.

- 6.1.9 Check Point Software Technologies Ltd.

- 6.1.10 Hillstone Networks

- 6.1.11 Sophos Technologies Pvt. Ltd (Cyberoam)

- 6.1.12 Untangle Inc.

- 6.1.13 Zscaler Inc.