|

市場調查報告書

商品編碼

1683813

硬體防火牆:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Hardware Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

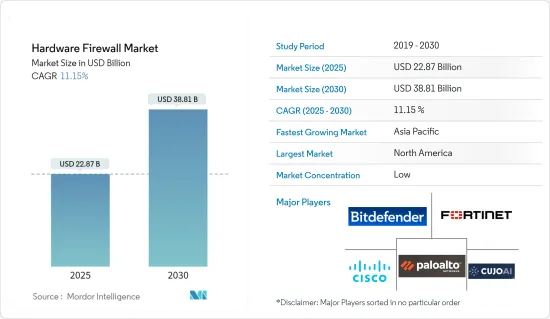

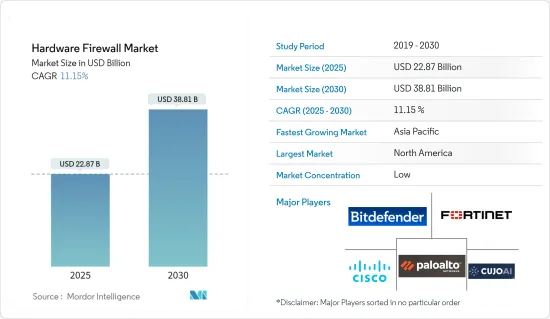

硬體防火牆市場規模預計在 2025 年為 228.7 億美元,預計到 2030 年將達到 388.1 億美元,預測期內(2025-2030 年)的複合年成長率為 11.15%。

網路安全威脅增加了網路攻擊危害其他組織和個人系統的風險。攻擊者的動機是獲取資訊以獲取經濟利益。此類攻擊引發了人們對基礎設施安全的擔憂,並增加了對硬體防火牆的需求。

主要亮點

- 隨著企業採用新技術並擴大其數位影響力,硬體防火牆將繼續成為網路安全策略的重要組成部分。硬體防火牆市場的未來成長可能受到多種因素的推動,包括日益增加的網路安全威脅、雲端基礎的服務的成長、物聯網的擴展以及對更複雜的安全解決方案的需求。

- 從產業來看,IT及通訊業佔比較大。隨著人們越來越依賴數通訊和資料傳輸,採用硬體防火牆的 IT 和通訊業預計未來將迎來技術進步,並更加重視安全性。

- 雲端基礎的防火牆解決方案的需求正在成長,尤其是在部署雲端平台以確保網路安全的大型企業。在金融領域,嚴重的網路威脅使得網路詐騙預防和安全措施成為必要。此外,效能、威脅識別和緩解能力、雲端整合、與其他安全技術的交互作用以及自動化方面的進步預計將推動硬體防火牆市場的發展。

- 雲端資料外洩的增加和超越設備的 NGFW(新一代防火牆)的成長正在推動對防火牆即服務解決方案的需求,這成為市場的一個限制因素。此項服務不涉及硬體,且僅需極少的維護。與硬體防火牆不同,防火牆即服務不需要複雜的設定。硬體防火牆比軟體防火牆更昂貴,因為初始投資取決於您想要的保護程度。因此,預計該因素將成為防火牆即服務服務業的成長催化劑。

- 自新冠肺炎疫情爆發以來,全球企業面臨的網路攻擊不斷增加,導致全球對網路安全的投資不斷增加。加強安全性預計將佔網路IT硬體投資的很大一部分。在預測期內,防火牆等網路安全設備可能會佔全球企業 IT 支出的很大一部分。

硬體防火牆市場趨勢

醫療保健產業有望成為成長最快的終端用戶

- 近年來,醫療保健產業已成為網路犯罪分子關注的熱門話題。由於醫療保健產生的寶貴資料,醫療保健最近很容易受到網路攻擊。根據 HIPAA 雜誌的報導,醫療保健組織將在 2023 年報告 725 起資料外洩事件,超過 1.33 億筆記錄「面臨外洩的風險」。報告還發現,從2018年1月到2023年9月30日,醫療保健產業與駭客相關的資料外洩將呈指數級增加239%,而勒索軟體攻擊將在同一時期增加278%。

- 在 COVID-19 爆發後,駭客大大改進了他們的攻擊策略,以利用人們日益升級的恐懼情緒,這促使人們需要採取網路安全實踐來應對不斷變化的威脅形勢,尤其是在醫療保健領域。例如,富士通於 2023 年 3 月宣布推出一個新的雲端基礎的平台,使用戶能夠安全地收集資料,從而推動醫療保健領域的數位轉型。該公司計劃從2023年3月起向日本製藥和醫療公司提供其新平台。該平台可自動轉換醫療機構記錄中的醫療資料,並使用標準框架(HL7 FHIR)對其進行規範,以確保文件安全。

- 公開呼籲世界各國政府與私營部門和學術機構合作,確保醫療機構免受網路威脅,這引發了產業合作的浪潮。例如,2023 年 10 月,網路安全與基礎設施安全局 (CISA) 和衛生與公眾服務部 (HHS) 宣佈召開圓桌會議,討論美國醫療保健和公共衛生 (HPH) 部門面臨的網路安全挑戰。他們推出了針對醫療保健和公共衛生部門的網路安全套件和資源。討論提出了網路安全和隱私風險管理活動的提案。

- 美國聯邦調查局(FBI)、訊號局澳洲網路安全中心(ASD的ACSC)以及網路安全和基礎設施安全局(CISA)宣布,將於 2023 年 12 月發布聯合網路安全建議(CSA),作為他們持續幫助組織預防網路攻擊的努力的一部分。全球登記的事故數量正在增加。例如,澳洲於 2023 年 4 月發現第一起 Play 勒索軟體事件,隨後在 2023 年 11 月又發現另一起事件。建議建議實施復原計劃,在實體上獨立的安全位置保存敏感資料的多個副本。我們還建議提供基於時間的敏感資料訪問,並維護加密、不可變的離線資料備份。

- 許多組織開始意識到對其網路安全基礎設施進行有計劃的投資的必要性。例如,HIMSS 醫療網路安全部門進行的一項調查發現,受訪者表示其醫療網路安全預算增加(約 55.31%),而其他人則表示其預算保持不變(23.46%)。

預計北美將佔據較大的市場佔有率

- 北美是技術最發達的地區之一。隨著技術的不斷應用,該地區預計將在未來幾年發生重大變化。有可能改變文明的關鍵技術進步包括機器人技術、感測器技術、巨量資料和人工智慧,這將導致大量資料的產生,並進一步要求加強資料安全性。

- 近年來,隨著組織和個人面臨的網路威脅和攻擊的總數急劇增加,網路安全已成為美國越來越重要的領域。根據身分盜竊資源中心的數據,2023 年,美國資料外洩事件總數約為 3,205 起。同時,到2023年,將有超過3.53億個人受到資料外洩的嚴重影響,包括洩密、資料外洩和暴露。

- 市場正在見證主要企業的合併、收購和投資,這是他們改善業務、接觸客戶和擴大影響力以滿足各種應用需求的策略的一部分。政府已經採取重要舉措保護國家免受網路攻擊。

- 例如,2023年3月,白宮發布了《國家網路安全戰略》,為更安全的電腦網路空間樹立了積極的願景,為實現我們的共同願望創造了機會。國家網路安全戰略要求實現兩個重要的根本性轉變:重新調整獎勵以支持長期投資,並平衡保衛電腦網路空間的責任。

- 因此,預計在整個預測期內,增加包括網路安全相關的併購、投資和政府舉措在內的市場活動將推動該地區對網路安全解決方案的需求。

硬體防火牆產業概覽

硬體防火牆市場較為分散,主要參與者包括 Bitdefender、思科系統公司、Cujo LLC、Fortinet 公司和 Palo Alto Networks 公司。市場上的公司正在採用聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024年6月,印度IT和顧問公司Tech Mahindra加強了與美國主要通訊設備製造商思科的合作關係。兩家公司共同致力於為全球客戶提供領先的新一代防火牆 (NGFW) 現代化解決方案。此次合作將透過跨內部和雲端環境的統一策略管理等功能增強防火牆的功能。此外,透過整合思科的 Talos 威脅情報,它為網路和端點提供了強大的惡意軟體防護。

- 2024 年 4 月:IBM Cloud 和 Fortinet 透過在 IBM Cloud 上推出 Fortinet 虛擬 FortiGate 安全設備 (vFSA) 加強了夥伴關係。 Fortinet 的新解決方案將 FortiGate 硬體防火牆的強大功能與虛擬設備的靈活性相結合。 vFSA 為客戶提供 IBM Cloud 基礎架構中 FortiGate 新一代防火牆 (NGFW) 的進階安全功能。此措施旨在保護客戶網路並確保持續的高可用性,特別是處理敏感資料的網路。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 防火牆市場主要區域供應商及生產基地覆蓋情況

- 涵蓋供應側動態

- 通訊業者案例研究

- 本機防火牆與虛擬防火牆

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 疫情後防火牆需求覆蓋範圍

第5章 市場動態

- 市場促進因素

- 政府監理推動網路安全應用防火牆

- 針對關鍵基礎設施的攻擊日益複雜

- 市場限制

- 大量資本投入和防火牆即服務的日益普及

- 硬體防火牆價格趨勢分析

- 硬體防火牆 - 技術藍圖

- 防火牆類型分析

- 封包過濾防火牆

- 電路級閘道器

- 應用層級閘道器

- UTM 防火牆

第6章 市場細分

- 按組件

- 設備/系統

- 服務(實施服務)

- 按組織規模

- 中小型企業

- 大型企業

- 按最終用戶產業

- 衛生保健

- 製造業

- 政府

- 資訊科技和電訊

- 教育

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 馬來西亞

- 泰國

- 越南

- 新加坡

- 菲律賓

- 印尼

- 中東和非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Bitdefender

- Cisco Systems Inc.

- CUJO LLC

- Fortinet Inc.

- Palo Alto Networks Inc.

- Netgate

- Sonicwall Inc.

- Sophos Ltd

- WatchGuard Technologies Inc.

- Check Point Software Technologies Ltd

8.供應商市場佔有率分析

第9章投資分析

The Hardware Firewall Market size is estimated at USD 22.87 billion in 2025, and is expected to reach USD 38.81 billion by 2030, at a CAGR of 11.15% during the forecast period (2025-2030).

Cybersecurity threats increase the risk of cyberattacks, which can breach the systems of another organization or an individual. The attacker's motives are to access information for financial gain. Such attacks raise concerns about infrastructure safety, increasing the demand for hardware firewalls.

Key Highlights

- Hardware firewalls are anticipated to remain an important component of enterprises' and organizations' cybersecurity strategies as they adopt newer technologies and extend their digital presence. The future growth of the hardware firewall market will most likely be driven by various factors, such as increased network security threats, the growth of cloud-based services, the expansion of IoT, and the demand for more sophisticated security solutions.

- The IT and telecom segment held a substantial market share by industry. Due to the increasing reliance on digital communication and data transmission, the future of IT and telecom employing hardware firewalls is expected to witness technological advancements and a greater emphasis on security.

- The demand for cloud-based firewall solutions is rising, especially in large organizations that deploy cloud platforms for network security. The financial sectors experience a need for cyber fraud prevention and security measures due to significant cyber threats. Additionally, advancements in performance, threat identification and mitigation capabilities, cloud integration, interaction with other security technologies, and automation are projected to drive the hardware firewall market.

- Increased cloud data breaches and the growth of NGFW (next-generation firewall) across devices are boosting the demand for firewalls as service solutions, which act as a market constraint. Since there is no hardware involved in this service, maintenance is quick. Unlike a hardware-powered firewall, a firewall as a service does not require complex configuration. A hardware firewall is more expensive than a software firewall since an initial investment depends on the degree of protection. As a result, this factor is expected to act as a growth catalyst for the firewalls-as-a-service industry.

- Post the COVID-19 pandemic, global enterprises have been facing an increasing number of attacks on their networks, leading to an increase in investments in safeguarding networks worldwide. A significant share of the IT hardware investment in the network is expected to be focused on enhancing security. Over the forecast period, network security equipment like firewalls may become a key part of enterprise IT spending worldwide.

Hardware Firewall Market Trends

Healthcare Industry is Expected to be the Fastest-growing End User

- Over the past few years, the healthcare industry has become a target of significant interest among cybercriminals. Due to its generation of valuable data, healthcare has recently become vulnerable to cyber-attacks. As per a HIPAA Journal report, healthcare institutions reported 725 data breaches, of which more than 133 million records were under 'exposed risk' in 2023. The report also stated that the healthcare industry reported a 239% exponential rise in hacking-related data breaches from January 2018 to September 30, 2023, and a 278% rise in ransomware attacks during the same period.

- Post the COVID-19 outbreak, hackers vastly evolved their tactics to exploit the fears escalating among the population, spurring the need to adopt cybersecurity practices to keep pace with changing threats, especially in healthcare. For instance, in March 2023, Fujitsu announced the launch of a new cloud-based platform that allowed users to collect data safely to promote digital transformation in the healthcare domain. The company planned to offer a new platform to pharmaceutical and medical companies in Japan starting in March 2023. The platform ensures the automatic conversion of medical data from the medical records of medical institutions to regulate with the standards framework (HL7 FHIR) and ensure the safety of documents.

- Various collaborations have been taking place in the industry following a public call asking governments worldwide to join forces with the private sector and academia to ensure that medical facilities are protected from cyber threats. For instance, in October 2023, the Cybersecurity and Infrastructure Security Agency (CISA) and the Department of Health and Human Services (HHS) announced a roundtable regarding the cybersecurity challenges that the US healthcare and public health (HPH) sector experiences. They released a cybersecurity toolkit and customized resources for the healthcare and public health sectors. This discussion provided suggestions around cybersecurity and privacy risk management activities.

- As part of their ongoing efforts to help organizations prevent cyberattacks, the US Federal Bureau of Investigation (FBI), the Signals Directorate's Australian Cyber Security Centre (ASD's ACSC), and the Cybersecurity and Infrastructure Security Agency (CISA) announced a collaboration to release the joint Cybersecurity Advisory (CSA) in December 2023. A growing number of incidents are being registered across the world. For instance, the first Play ransomware incident in Australia was observed in April 2023 and then in November 2023. The advisory recommended executing a recovery plan to maintain the multiple copies of sensitive data in a physical, separate, and secure location. It also suggested having time-based access to highly sensitive data and maintaining offline data backup that is encrypted and immutable.

- Many organizations are becoming more aware of planned investments in cybersecurity infrastructure. For instance, as per a survey conducted by the HIMSS Healthcare Cybersecurity, respondents suggested an increase in healthcare cybersecurity budgets (by around 55.31%), while other respondents suggested their budgets stayed the same (23.46%).

North America is Expected to Hold a Major Market Share

- North America is one of the most technologically developed regions. The growing adoption of technology is expected to result in important changes in the region in the coming years. Some key technological advancements that have the prime potential to alter civilization include robotics, sensor technology, Big Data, and artificial intelligence, resulting in a vast amount of data generation that further needs enhanced data security.

- In recent years, cybersecurity has become an increasingly important area of focus in the United States due to a surge in the total count of cyber threats and attacks faced by organizations and individuals. As per the Identity Theft Resource Center, in 2023, the total number of data compromises in the United States stood at around 3,205 cases. Meanwhile, in 2023, over 353 million individuals were greatly affected by data compromises, including leakage, data breaches, and exposure.

- The market is witnessing mergers, acquisitions, and investments by key players as part of their strategies to improve businesses and their presence to reach customers and meet their requirements for various applications. The government has taken significant initiatives to secure the country against cyberattacks.

- For instance, in March 2023, the White House released its National Cybersecurity Strategy to establish an affirmative vision for a more secure cyberspace that creates opportunities to achieve collective aspirations. The National Cybersecurity Strategy calls for two key fundamental shifts: realigning incentives to favor long-term investments and rebalancing the responsibility to defend cyberspace.

- Thus, a rise in such market activities involving mergers, acquisitions, investments, and government initiatives related to cybersecurity is anticipated to drive the demand for network security solutions within the region throughout the forecast period.

Hardware Firewall Industry Overview

The hardware firewall market is fragmented with the presence of major players like Bitdefender, Cisco Systems Inc., Cujo LLC, Fortinet Inc., and Palo Alto Networks Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2024: Tech Mahindra, an Indian IT and consulting firm, strengthened its partnership with US telecom equipment leader Cisco. Together, they aim to deliver advanced next-generation firewall (NGFW) modernization solutions to their global customer base. This collaboration enhances firewall functionalities with features such as unified policy management across both on-premises and cloud environments. Additionally, it incorporates Cisco's Talos threat intelligence, providing robust malware defense for networks and endpoints.

- April 2024: IBM Cloud and Fortinet strengthened their partnership by launching the Fortinet Virtual FortiGate Security Appliance (vFSA) on IBM Cloud. This new solution from Fortinet combines the powerful features of its FortiGate hardware firewall with the flexibility of virtual appliances. The vFSA provides clients with the advanced security capabilities of FortiGate's next-generation firewall (NGFW) within the IBM Cloud infrastructure. This initiative aims to protect clients' networks, particularly those handling sensitive data, ensuring their continuous high availability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Coverage of the Major Regional Vendors and Production Locations in the Firewall Market

- 4.3 Coverage of Supply-side Dynamics

- 4.4 Case Studies of Telcos

- 4.5 Coverage of Native vs Virtual Firewalls

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value Chain Analysis

- 4.8 Coverage of Firewall Demand in the Post-Pandemic Scenario

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Administrative Regulations Encouraging Network Security Application Firewall

- 5.1.2 Rising Sophistication of Attacks on Critical Infrastructure

- 5.2 Market Restraints

- 5.2.1 Heavy Capital Expenditure and Rising Adoption of Firewall-as-a-Service

- 5.3 Hardware Firewall Price Trend Analysis

- 5.4 Hardware Firewall - Technology Roadmap

- 5.5 Analysis of Types of Firewalls

- 5.5.1 Packet Filtering Firewalls

- 5.5.2 Circuit-level Gateways

- 5.5.3 Application-level Gateways

- 5.5.4 UTM Firewalls

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Device/System

- 6.1.2 Services (Installation Services)

- 6.2 By Organization Size

- 6.2.1 SMEs

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Healthcare

- 6.3.2 Manufacturing

- 6.3.3 Government

- 6.3.4 IT and Telecom

- 6.3.5 Education

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Malaysia

- 6.4.3.5 Thailand

- 6.4.3.6 Vietnam

- 6.4.3.7 Singapore

- 6.4.3.8 Philippines

- 6.4.3.9 Indonesia

- 6.4.4 Middle East and Africa

- 6.4.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bitdefender

- 7.1.2 Cisco Systems Inc.

- 7.1.3 CUJO LLC

- 7.1.4 Fortinet Inc.

- 7.1.5 Palo Alto Networks Inc.

- 7.1.6 Netgate

- 7.1.7 Sonicwall Inc.

- 7.1.8 Sophos Ltd

- 7.1.9 WatchGuard Technologies Inc.

- 7.1.10 Check Point Software Technologies Ltd