|

市場調查報告書

商品編碼

1641968

記憶體 IC:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Memory IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

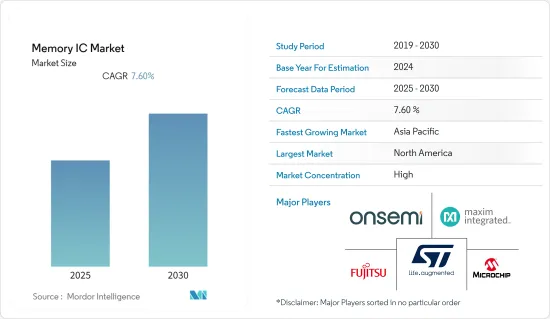

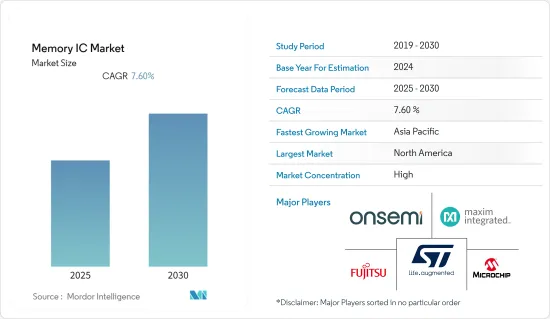

預計預測期內記憶體 IC 市場複合年成長率將達到 7.6%。

主要亮點

- 記憶體IC主要應用於基於記憶體的電子設備,例如行動電話、電腦、平板電腦、醫療設備、智慧卡、數位相機、通訊設備和其他數位電子設備。

- 記憶體IC的應用在智慧型手機、媒體播放機和USB驅動器中佔據主導地位。由於智慧型手機設備的普及和功能的增強,對複雜記憶體IC的需求預計將高速成長。平板電腦是另一種對記憶體 IC 需求量大的裝置。隨著平板電腦的日益普及,預計預測期內對記憶體IC的需求將會擴大。

- 此外,新冠肺炎疫情對製造業的衝擊也使全球經濟受到了嚴重影響。不過,疫情過後, OEM產量增加,刺激了行動電話和其他消費性電子產品的需求,有助於推動記憶體IC市場的成長。此外,許多終端用戶行業各種資本預算的擴大和正在進行的計劃也有助於增強全球經濟。

- 此外,醫療保健產業也是記憶體IC的主要應用領域。對緊急醫療資訊的安全存取的需求日益成長,推動了記憶體 IC 在醫療保健領域的使用。

- 配備記憶體IC的設備有助於管理各種醫療設備,包括血液分析儀、心電圖、診斷影像設備、醫療電腦和其他電子健康記錄系統。根據美國國家衛生統計中心的數據,到 2024 年電子健康記錄系統市場規模預計將達到 400 億美元。

- 過去幾年,雲端處理服務和解決方案的需求和供應激增,迫使供應商建置密集安裝電腦和儲存設備的伺服器和資料中心。這推動了記憶體積體電路的進步。智慧型手機的普及也促進了記憶體IC市場的成長。

- 另一方面,高昂的生產成本、新建和現有製造設施的建設和營運成本的增加以及巨額的資本支出可能會在未來幾年對全球產業構成挑戰。預計內存 IC 製造商將針對其已上市的記憶體產品開展營運開發計劃,以應對這些挑戰。

記憶體 IC 市場趨勢

智慧型手機、功能手機和平板電腦的增加

- 內存積體電路用於行動電話電路中,為行動電話作業系統和電話簿等可自訂功能提供儲存。整合電路用於實現放大器、振盪器、時間計數器、電腦記憶體和微處理器等功能。

- 由於智慧型手機產業的持續發展,積體電路市場預計將實現強勁成長。預計預測期內行動電話製造商之間的激烈競爭將進一步推動市場成長。三星最近宣布了一項解決方案,可在單一快閃晶片上實現Terabyte的儲存空間。該晶片預計將為下一代行動裝置帶來類似筆記本的用戶體驗。

- 智慧型手機應用市場的成長是由智慧型手機的普及以及這些設備中對記憶體 IC 的需求不斷成長所推動的。隨著雲端基礎的應用程式變得越來越普遍以及行動資料使用量的增加,智慧型手機應用程式市場正在成長,服務該市場的產業也蓬勃發展。

- 據愛立信稱,目前智慧型手機用戶已超過 60 億,預計未來幾年將成長數億。智慧型手機用戶最多的國家是中國、印度和美國。雖然近年來銷量低迷,但由於智慧型手機平均售價上漲,全球智慧型手機市場銷量有所成長。預計未來智慧型手機的成長將推動對記憶體積體電路的需求。

- 近距離場通訊(NFC)的發展預計將進一步推動收益成長,因為它將促進行動優惠券、行動票務和存取控制等動態解決方案的產生。

亞太地區成長強勁

- 目前,亞太地區人口占全球總人口的60%以上。該地區的人口和消費性電子產品消費目前正在經歷最高的成長率。預計預測期內該地區的記憶體 IC 市場將實現顯著成長。

- 這一成長主要得益於亞太地區終端用戶對高效能、低功耗記憶體 IC 的需求不斷成長。人工智慧 (AI) 和其他需要大量記憶體儲存的最尖端科技的使用日益廣泛,以及智慧型裝置的日益普及,正在推動對高效能、低功耗記憶體的需求。

- 南亞和太平洋地區的大量人口正在推動對家用電子電器的需求。由於該地區IT和通訊產業規模龐大,且雲端運算技術採用率不斷提高,預計該地區將經歷最高的複合年成長率。由於人口眾多,中國是全球智慧型手機用戶比例最高的國家。值得注意的是,中國是許多跨國公司電子產品線的主要製造地。

- 除了國際供應商外,來自中國國內外的國內供應商也實力雄厚。由於這些因素,中國記憶體積體電路市場競爭激烈。

- 印度在基礎設施、工業化和經濟發展領域也取得了許多進步,證明了電子設備能夠有效利用來實現這些發展目標。該國的經濟成長正在提高中階的購買力並擴大其家電市場。

- 該地區知名半導體公司的存在預計將推動市場成長。此外,製造積體電路所需的半導體材料供應商的增加也促進了記憶體積體電路的生產。由於醫療、汽車和家用電子電器產品的發展,亞太地區緊隨北美之後。

記憶體IC產業概況

預計預測期內記憶體積體電路(IC)市場將經歷整合。佔有較大市場佔有率的大公司都注重市場開發和策略合作,以增加市場佔有率和盈利。目前,Microchip Technology Inc.、STMicroelectronics Inc.、ON Semiconductor Inc.、Maxim 整合式 Products, Inc.、Fujitsu Limited、Cypress Semiconductor Corp.、ABLIC Inc.、Renesas Electronics Corp.、ROHM Semiconductor Corp. 和ABLIC Inc.、Renesas Electronics Corp.、ROHM Semiconductor Corp. 和ABLIC Inc. 均均為市場上的一些主要企業。

- 2022 年 11 月 - Alliance Memory 在展示其 2022 年電子元件博覽會 (IC) 技術陣容的同時,推出了其最新的 SRAM、DRAM、eMMC 和快閃記憶體解決方案,適用於通訊、運算、嵌入式、物聯網(IoT)、工業和消費市場。該公司還與多家記憶體 IC 分銷商合作。

- 2022 年 8 月 - SABIC 推出一種基於 LCP(液晶聚合物)的化合物,具有出色的導熱性和電絕緣性能。 LNP Konduit 8TF36E 複合材料的開發是為了滿足用於對雙倍資料速率 (DDR) 記憶體積體電路進行壓力測試的老化測試插座 (BiTS) 的嚴格要求。這種新材料非常適合用於 BiTS 組件的固定結構部件,例如閂鎖和適配器。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素與限制因素簡介

- 市場促進因素

- 智慧型手機、功能手機和平板電腦日益普及

- 攜帶式無線設備對低功耗記憶體的需求不斷增加

- 巨量資料儲存應用對固態硬碟 (SSD) 的需求不斷增加

- 市場限制

- 記憶體IC的開發成本高

第6章 市場細分

- 按類型

- DRAM

- 閃光

- NOR

- NAND

- 其他類型

- 按最終用戶產業

- 家電

- 車

- 資訊科技/通訊

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Microchip Technology Inc.

- STMicroelectronics

- ON Semiconductor Corporation

- Maxim Integrated Products, Inc.

- Fujitsu Ltd.

- Cypress Semiconductor Corporation

- ABLIC Inc.

- Renesas Electronics Corporation

- ROHM Semiconductor Co., Ltd.

- Adesto Technologies Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Memory IC Market is expected to register a CAGR of 7.6% during the forecast period.

Key Highlights

- Memory ICs are mainly applied in memory-based electronic devices such as mobile phones, computers, tablets, medical devices, smart cards, digital cameras, communication equipment, and other digital electronic devices.

- The application of memory IC is very predominant in smartphones, media players, and USB drives. The demand for sophisticated memory ICs is expected to grow at a high rate owing to increasing adoption and enhancements in smartphone devices. Tablets are one other device with a significant need for memory IC. With the increasing adoption of tablet PCs, the demand for memory ICs is expected to grow over the forecast period.

- Moreover, The global economy has been significantly impacted by COVID-19's effects on the manufacturing sector. But post-pandemic, OEM production has increased, and there is a rise in demand for mobile phones and other consumer electronics, which has boosted the growth of the memory IC market. Expanding various capital budgets and ongoing projects in numerous end-user industries will also help to strengthen the world economy.

- Additionally, the Healthcare industry is another key application area of memory ICs. The increasing need to provide secure access to emergency medical information creates a scope for memory ICs in the healthcare sector.

- Devices with memory ICs can help maintain patient records in various medical equipment like blood analysis devices, electrocardiographs, diagnostic imaging apparatus, medical PCs, and other electronic health record systems. According to the National Center for Health Statistics statistics, the market for electronic health record systems is expected to reach USD 40 billion by 2024.

- Over the past few years, the sharp rise in demand and supply for cloud computing services and solutions has compelled vendors to set up servers and data centers that are densely packed with computers and storage devices. This is fueling the advancement of memory-integrated circuits. The increasing use of smartphones is also contributing to the growth of the memory IC market.

- On the other hand, the high cost of manufacturing, increasing costs for new and existing fabrication facilities' construction and operation, and sizable capital investment could pose a problem for the global industry over the forecast years. Manufacturers of memory ICs are anticipated to carry out operational development programs for already-available memory products to address these challenges.

Memory IC Market Trends

Rising Proliferation of Smartphones, Feature Phones, and Tablets

- Memory integrated circuits are used in mobile phones' circuits to provide storage for the phone's operating system and customizable features, such as the phone directory. They are used to enable the functions of amplifiers, oscillators, time-counter computer memory, microprocessors, etc.

- The integrated circuit market is anticipated to record robust growth, owing to the ongoing developments in the smartphone industry. Intense competition among mobile manufacturers is expected to drive the market's growth further studied over the forecast period. Samsung's recent offering includes a solution that allows phones to have one terabyte of storage with a single flash memory chip. This chip is expected to bring a notebook-like user experience to the next generation of mobile devices.

- The growth of the smartphone application market is attributed to the popularity of smartphones and the increasing demand for memory ICs in these gadgets. The market for smartphone applications is growing, and the industry that serves this market is prospering as cloud-based applications gain popularity and mobile data usage increases.

- According to Ericsson, Over 6.0 billion people subscribe to smartphones, and over the next few years, that number is expected to increase by several hundred million more. The nations with the most smartphone users are China, India, and the United States. Despite stagnant unit sales over the past few years, the global smartphone market's revenue increased because the average selling price of smartphones increased. Such a rise in smartphones will boost the demand for Memory IC in the future.

- Development in near-field communication (NFC), which leads to the production of dynamic solutions for mobile couponing, mobile ticketing, and access control, is further expected to drive revenue growth.

Asia Pacific to Witness Significant Growth

- The Asia-Pacific region is home to more than 60% of the world's current population. The region's population and consumption of consumer electronics are growing at the highest rate today. The region is expected to record substantial growth in the memory ICs market over the forecast period.

- The growth is primarily attributed to the rise in demand for high-performance and low-power memory ICs from end users in the Asia Pacific region. The rising use of artificial intelligence (AI) and other cutting-edge technologies, which require large amounts of memory storage, as well as the rising popularity of smart devices, are contributing factors to the rising demand for high-performance and low-power memory ICs.

- Large populations in South Asia and the Pacific are driving up demand for consumer electronics. This region has a sizable IT and telecom sector, and cloud adoption is progressing well, enabling it to have the highest CAGR. Due to its high population, China has the highest percentage of smartphone users worldwide. It should be noted that China serves as a major manufacturing hub for a number of multinational corporations' electronic product lines.

- In addition to international vendors, there is a significant domestic vendor presence inside and outside China. These factors make China an extremely competitive market for memory-integrated circuits.

- India has also made a number of advancements in the areas of infrastructure, industrialization, and economic development, demonstrating the efficient use of electronic devices for these developmental objectives. The country's growing economy has given the middle class more purchasing power, which has increased the consumer electronics market.

- The presence of prominent semiconductor companies in the region is expected to boost the growth of the market. Besides, the increasing number of suppliers of semiconductor material required to manufacture ICs is boosting the production of memory ICs. Asia-Pacific is closely followed by North America owing to the development of the medical and automobile sector along with consumer electronics.

Memory IC Industry Overview

The Memory Integrated Circuit (IC) Market is expected to be consolidated over the forecast period. The major players with a prominent share in the market are focusing on product developments and strategic collaborative initiatives to increase their market share and profitability. Microchip Technology Inc., STMicroelectronics, ON Semiconductor Corporation, Maxim Integrated Products, Inc., Fujitsu Ltd., Cypress Semiconductor Corporation, ABLIC Inc., Renesas Electronics Corporation, ROHM Semiconductor Co., Ltd., and Adesto Technologies Corporation are some of the major players present in the current market.

- November 2022 - Alliance Memory highlighted its most recent SRAM, DRAM, eMMC, and flash memory ICs for the communications, computing, embedded, Internet of Things (IoT), industrial, and consumer markets when announcing its technology lineup for electronica 2022. The company has also partnered with various distributors for memory ICs.

- August 2022 - SABIC unveiled a compound with exceptional thermal conductivity and electrical insulation properties based on LCP (liquid crystal polymer). To meet the demanding requirements of burn-in test sockets (BiTS) used to stress-test double-data-rate (DDR) memory integrated circuits, the LNP Konduit 8TF36E compound was created. The new substance is ideal for fixed, structural components in BiTS assemblies, such as latches and adaptors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Introduction to Market Drivers and Restraints

- 5.2 Market Drivers

- 5.2.1 Rising Proliferation of Smartphones, Feature Phones, and Tablets

- 5.2.2 Growing Demand for Low-power Memory Requirements in Portable Wireless Devices

- 5.2.3 Increasing Demand for Solid State Drives (SSD) in Big Data Storage Applications

- 5.3 Market Restraints

- 5.3.1 High Development Cost of Memory ICs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 DRAM

- 6.1.2 Flash

- 6.1.2.1 NOR

- 6.1.2.2 NAND

- 6.1.3 Other Types

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 IT & Telecommunication

- 6.2.4 Healthcare

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microchip Technology Inc.

- 7.1.2 STMicroelectronics

- 7.1.3 ON Semiconductor Corporation

- 7.1.4 Maxim Integrated Products, Inc.

- 7.1.5 Fujitsu Ltd.

- 7.1.6 Cypress Semiconductor Corporation

- 7.1.7 ABLIC Inc.

- 7.1.8 Renesas Electronics Corporation

- 7.1.9 ROHM Semiconductor Co., Ltd.

- 7.1.10 Adesto Technologies Corporation