|

市場調查報告書

商品編碼

1641983

企業通訊基礎設施:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Enterprise Communication Infrastructure - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

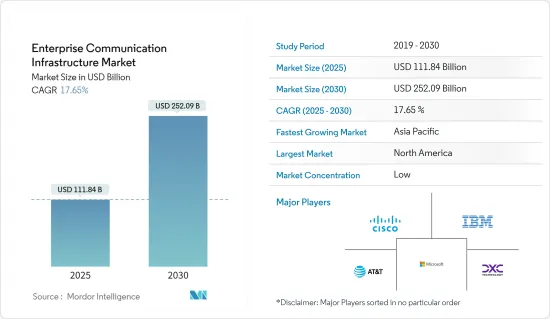

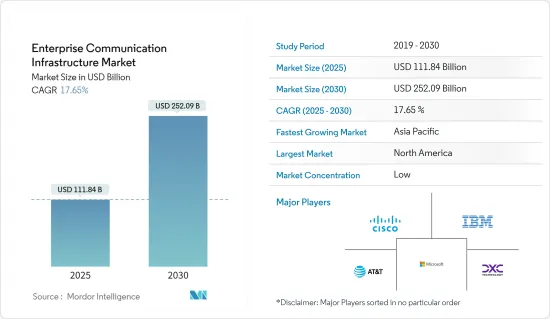

企業通訊基礎設施市場規模在 2025 年預計為 1,118.4 億美元,預計到 2030 年將達到 2,520.9 億美元,預測期內(2025-2030 年)的複合年成長率為 17.65%。

升級過時 IT通訊基礎設施的需求日益成長,推動了企業通訊基礎設施市場的投資。

企業通訊基礎設施市場投資的主要驅動力是新興和先進通訊技術的不斷發展和應用。此外,對先進協作工具的需求不斷成長、雲端基礎的通訊解決方案的採用日益增加以及對數位轉型的日益重視預計將極大地推動市場的成長機會。

此外,由於全球 BYOD 政策的不斷推廣,智慧型手機普及率的不斷上升也有望在預測期內為企業通訊基礎設施市場提供巨大的成長機會。

雲端服務的採用也持續影響企業支出。雲端基礎的解決方案還幫助企業創建更有效的統一內部和外部溝通平台。雲端服務的採用日益廣泛,尤其是在中小型企業中,正在推動市場進一步發展。

2023年9月是愛立信建構由網路API驅動的全球網路平台業務策略的一個重要里程碑。愛立信和德國電信 (DT) 宣佈建立商業合作夥伴關係,為企業和開發人員提供通訊和網路 API。建立一個全球平台,透過易於使用的網路 API 來展示先進的 5G 功能,例如按需品質、延遲、速度和位置,是愛立信企業策略的關鍵要素。這使得開發人員和企業能夠將網路功能捆綁到應用程式中,從而推動企業數位化,並為營運商創造新的方式來收益。

然而,人們對資料安全和薄弱的IT基礎設施的擔憂日益增加,尤其是在開發中地區,這抑制了預測期內的市場成長。

企業通訊基礎設施市場趨勢

零售領域佔據市場主要佔有率

- 組織和企業對各種雲端基礎的解決方案的採用激增,由於它們提供了靈活且可擴展的解決方案,在擴大市場成長機會方面發揮關鍵作用。雲端基礎的通訊服務使組織能夠簡化業務、加強協作並降低成本。這種轉變使企業能夠利用先進的通訊工具,而無需廣泛的內部基礎設施。

- 企業雲端通訊系統變得更加靈活和經濟實惠,取代了不靈活、昂貴的內部通訊解決方案。因此,現代通訊服務允許企業根據需要擴大或縮小整個基礎設施,而無需昂貴的硬體和維護。企業雲端通訊系統的各種功能使企業可以輕鬆地與全球任何人建立聯繫。能夠在任何地方使用任何設備開展工作的能力也是企業保持競爭力的必要條件,從而為市場成長機會提供巨大的推動力。

- 2023 年 3 月,全球企業雲端通訊公司 Bandwidth Inc. 推出了 Bandwidth Maestro。這個新一代雲端通訊平台使資訊長能夠解決在整合通訊、雲端客服中心和人工智慧平台上整合一流的即時語音應用程式的關鍵挑戰。 Bandwidth Maestro 讓企業輕鬆自訂全球通訊工作流程,以支援尖端的 CX 和 AI 功能,包括基於機器學習的詐欺偵測、對話式 AI、文字轉語音和文字轉語音工具。

- 2023 年 2 月,雲端電信業者MyOperator 宣布推出中小企業的數位電話線「Heyo Phone」。此數位電話連線可協助小型企業管理客戶互動,並透過單一企業號碼增強與客戶的整體通話和 WhatsApp 聊天體驗。

- 根據 Flexera 2023 年雲端運算狀況報告,約 47% 的受訪者在亞馬遜網路服務 (AWS) 上運行關鍵工作負載。預計這種利用將在預測期內成倍地擴大市場的成長機會。

北美佔有最大市場佔有率

- 預計北美將主導全球企業通訊基礎設施市場。這是因為市場上大多數主要參與者都位於美國,並且是該技術的早期採用者。此外,該地區終端用戶對雲端的採用率很高,為市場環境創造了進一步的成長機會。

- 該地區的許多市場供應商也在投資創新其產品的附加和獨特功能,以獲得競爭優勢並擴大客戶目標。隨著各種現有和新參與者進入該行業,整個市場的競爭非常激烈。產業參與者正在採用各種策略來保持競爭力,從而進一步推動市場的成長機會。

- 例如,2023年6月,全球雲端通訊公司Bandwidth Inc.與全球IT服務和顧問公司Miratech簽署了策略合作夥伴關係,為全球企業提供數位化客戶體驗轉型輔助。 Miratech 和 Bandwidth 正在透過聯合銷售安排積極尋找各種跨國客戶機會。這項合作關係將使全球 2000 強公司能夠將其整個後端環境與面向客戶的團隊整合在一起,這對於提高品牌參與度和忠誠度至關重要。

- 此外,愛立信將於 2023 年 9 月擴大與 Google Cloud 的合作,推出 Ericsson Cloud RAN,提供整合編配和自動化功能,利用 AI/ML 為通訊服務供應商帶來一系列優勢。 。位於GDC Edge上的愛立信Cloud RAN將實現全自動、超大規模分散式雲端的交付,從而提供可靠、高效、高效能和安全的以軟體為中心的無線接取網路基礎設施。

企業通訊基礎設施產業概覽

企業通訊基礎設施市場高度分散,參與者眾多。市場的主要企業包括思科、IBM 和微軟。市場近期的主要趨勢包括:

- 2024 年 5 月2024 年 5 月:全球著名通訊技術公司塔塔通訊 (Tata Communications) 與全球領先的科技公司思科 (Cisco) 加強合作夥伴關係。兩家公司的合資企業將在印度推出一項開創性服務:塔塔通訊 (Tata Communications) 的 Webex Calling。這項創新服務整合了思科的 Webex Calling 和塔塔通訊 GlobalRapide 平台的雲端語音服務,專為印度企業量身打造。

- 2023 年 11 月面向服務供應商的雲端通訊平台 Alianza 與 Amazon Web Services 簽署了一項多年期策略合作協議,旨在改變通訊服務供應商透過語音和雲端通訊服務收益和交付的方式。該解決方案主要在北美推出,目前已有 100 多家通訊服務供應商進行了部署,包括一級營運商和國家通訊業者Brightspeed、Lumen、Xplore、Bluepeak 和 Viasat。

- 2023 年 7 月 阿爾卡特朗訊企業公司提供針對客戶產業量身訂製的通訊、網路和雲端解決方案,在英國宣布推出阿爾卡特朗訊企業彩虹中心 (Alcatel-Lucent Enterprise Rainbow Hub)。 Rainbow Hub 是一種整合的整合通訊(UC) 和 PBX(專用交換機)解決方案,以完全雲端基礎的服務形式提供。這種全面的統一整合通訊即即服務解決方案 (UCaas) 使最終用戶能夠利用雲端基礎的平台的主要優勢,同時使通路合作夥伴能夠提供高級服務。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查結果

- 調查前提

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場動態

- 市場促進因素

- 行動性和 BYOD 日益成長的趨勢

- 擴大採用雲端基礎的解決方案,尤其是全球通訊解決方案

- 市場限制

- 資料安全和隱私問題

第6章 市場細分

- 按部署

- 本地

- 雲

- 按應用

- 消費者體驗

- 企業協作

- 數位業務

- 其他應用

- 按最終用戶

- 資訊科技和電信

- 製造業

- BFSI

- 衛生保健

- 政府

- 零售

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Microsoft Corporation

- Orange SA

- Avaya Inc.

- IBM Corporation

- Cisco Systems Inc.

- Alcatel-Lucent SA

- Verizon Communications

- DXC Technology

- NEC Corporation

- 88 Inc.

- Mitel Network Corporation

- AT&T Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Enterprise Communication Infrastructure Market size is estimated at USD 111.84 billion in 2025, and is expected to reach USD 252.09 billion by 2030, at a CAGR of 17.65% during the forecast period (2025-2030).

The rising need to upgrade outdated IT communication infrastructure drives organizations to invest in the enterprise communication infrastructure market.

The primary driver behind the investments in the enterprise communication infrastructure market has been the continuous evolution and application of new and advanced communication technologies. Moreover, the growing demand for advanced collaboration tools, the rising adoption of cloud-based communication solutions, and the increasing emphasis on digital transformation are estimated to drive the market growth opportunities considerably.

Also, the growing smartphone penetration rate, owing to the rising BYOD policies worldwide, is expected to provide immense growth opportunities for the enterprise communication infrastructure market during the forecast period.

The adoption of cloud services also continues to influence enterprise spending. Cloud-based solutions are also helping organizations create a more effective unified platform for internal and external communication. The growing adoption of cloud services, especially among SMEs, promotes further market development.

In September 2023, Ericsson declared a key milestone in the company's strategy to build a global network platform business with network APIs. Ericsson and Deutsche Telekom (DT) introduced a commercial partnership to provide communication and network APIs to enterprises and developers. Creating a global platform to expose advanced 5G capabilities, including quality on demand, latency, speed, and location through easy-to-consume network APIs, is one of the significant components of Ericsson's enterprise strategy. This would enable developers and enterprises to combine network features into their applications, enhancing enterprise digitalization and building new ways for operators to monetize their overall network investments.

However, the growing data security concerns and poor IT infrastructure, especially in developing regions, are some factors that can restrain the market growth during the forecast period.

Enterprise Communication Infrastructure Market Trends

The Retail Segment has a Significant Share in the Market

- The surge in adoption of various cloud-based solutions by organizations and companies plays a significant role in augmenting the market's growth opportunities since it offers flexible and scalable solutions. Cloud-based communication services allow organizations to simplify operations, enhance collaboration, and minimize costs. This shift enables organizations to leverage advanced communication tools without needing extensive on-premise infrastructures.

- The enterprise cloud communications systems have become more flexible and affordable, shifting away from inflexible and costly on-premise communications solutions. Hence, with modern communications services, companies can scale their overall infrastructure up or down as required without needing expensive hardware or maintenance. The different functions associated with enterprise cloud communication systems help businesses easily connect with anyone across the globe. The ability to work from anywhere, on any device, has also become necessary for companies to stay competitive, driving the market's growth opportunities significantly.

- In March 2023, Bandwidth Inc., a worldwide enterprise cloud communications company, introduced Bandwidth Maestro. This next-generation cloud communications platform mainly allows chief information officers to solve the significant challenge of integrating best-in-class real-time voice apps throughout their unified communications, cloud contact center, and artificial intelligence platforms, thereby resulting in faster time-to-value and improved employee and customer experiences. With Bandwidth Maestro, enterprises can easily customize global communications workflows and enhance state-of-the-art CX and AI capabilities like machine-learning-based fraud detection, conversational AI, and text-to-speech and speech-to-text tools, all interoperable and consumable by software.

- In February 2023, a cloud communication company, MyOperator, introduced Heyo Phone, a digital phone line for small and medium businesses. The digital phone connection can help small and medium-sized businesses manage customer interactions and improve their overall customer call and WhatsApp chat experience through a single business number.

- According to Flexera 2023 State of the Cloud Report 2023, around 47% of respondents run significant workloads on Amazon Web Services (AWS). This usage is expected to exponentially enable the market to witness substantial growth opportunities during the forecast period.

North America to Hold the Largest Market Share

- North America is anticipated to dominate the global enterprise communication infrastructure market. It is also because most of the major players in the market are US-based and are one of the early adopters of the technology. Also, cloud adoption among the regional end users is high, providing further growth opportunities to the market landscape.

- Many market vendors in the region also invest in innovating additional and unique features to their offerings to gain a competitive advantage and expand their customer target base. The overall competitive rivalry in the market is high, with various established and new market players entering this space. Industry players resort to various strategies to stay competitive, further boosting market growth opportunities.

- For instance, in June 2023, Bandwidth Inc., a worldwide cloud communications company, and Miratech, a global IT services and consulting company, signed a strategic collaboration to augment digital customer experience transformation for global enterprises. Miratech and Bandwidth actively engage with various multi-country enterprise customer opportunities in a co-selling motion. The partnership would allow the Global 2000 enterprises to integrate their overall back-end environment with customer-facing teams, which is critical to enhancing greater brand engagement and loyalty.

- Also, in September 2023, Ericsson extended its partnership with Google Cloud to build an Ericsson Cloud RAN solution on Google Distributed Cloud that delivers integrated orchestration and automation and leverages AI/ML for various additional communications service provider benefits. Utilizing Ericsson Cloud RAN on GDC Edge allows the delivery of a completely automated and very large-scale distributed cloud, resulting in a reliable, efficient, highly performant, and secured software-centric radio access network infrastructure.

Enterprise Communication Infrastructure Industry Overview

The enterprise communication infrastructure market is highly fragmented due to the presence of many players. Some of the key players in the market include Cisco, IBM, and Microsoft. Some key recent developments in the market include:

- May 2024: Tata Communications, a prominent global communications technology firm, and Cisco, a leading global technology giant, strengthened their partnership. Their joint venture introduces a pioneering service in India: Webex Calling by Tata Communications. This innovative offering integrates Cisco's Webex Calling with Tata Communications' cloud voice services from the GlobalRapide platform, which are specifically customized for Indian enterprises.

- November 2023: Alianza Inc., a cloud communications platform for service providers, entered a multi-year strategic collaboration agreement with Amazon Web Services to transform how communication service providers monetize and deliver voice and cloud communications services. The solution is mainly available in North America and has already been deployed by over 100 communication service providers, including Tier-1 and nationwide operators Brightspeed, Lumen, Xplore, Bluepeak, and Viasat.

- July 2023: Alcatel-Lucent Enterprise, a provider of communications, networking, and cloud solutions tailored to customers' industries, introduced Alcatel-Lucent Enterprise Rainbow Hub in the United Kingdom. It merges its unified communications and PBX solutions into an entirely cloud-based service. The comprehensive, unified communications as a service solution (UCaas) allows end users to leverage the key benefits of a cloud-based platform while enabling channel partners to provide advanced services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trends Toward Mobility and BYOD

- 5.1.2 Growing Adoption of Cloud-based Solutions Especially for Global Communication Solutions

- 5.2 Market Restraints

- 5.2.1 Data Security and Privacy Issues

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Application

- 6.2.1 Consumer Experience

- 6.2.2 Enterprise Collaboration

- 6.2.3 Digital Business

- 6.2.4 Other Applications

- 6.3 By End User

- 6.3.1 IT and Telecom

- 6.3.2 Manufacturing

- 6.3.3 BFSI

- 6.3.4 Healthcare

- 6.3.5 Government

- 6.3.6 Retail

- 6.3.7 Other End Users

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Orange SA

- 7.1.3 Avaya Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Alcatel-Lucent SA

- 7.1.7 Verizon Communications

- 7.1.8 DXC Technology

- 7.1.9 NEC Corporation

- 7.1.10 88 Inc.

- 7.1.11 Mitel Network Corporation

- 7.1.12 AT&T Corporation