|

市場調查報告書

商品編碼

1642036

地板覆蓋材料:全球市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Global Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

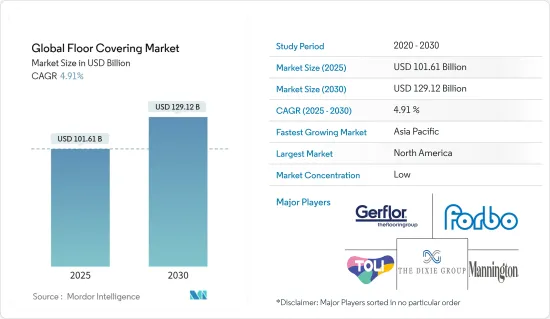

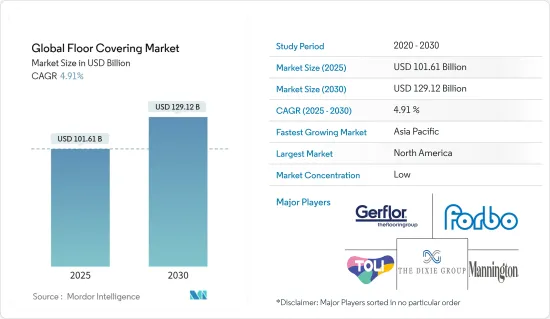

預計 2025 年全球地板覆蓋材料物市場規模為 1,016.1 億美元,到 2030 年將達到 1,291.2 億美元,預測期內(2025-2030 年)的複合年成長率為 4.91%。

預計地板覆蓋材料市場將受益於消費者對商業和生活空間高品質產品日益成長的需求。可支配收入的增加、住宅行業的蓬勃發展以及對優質地板覆蓋材料物需求的不斷成長預計將促進全球市場的成長。該領域的主要趨勢是住宅領域對地板覆蓋材料的需求不斷成長。根據最近對地板覆蓋材料業務的研究,推動市場擴張的主要因素之一是消費者對室內設計意識的不斷增強。

消費者在地毯和地墊等地板覆蓋材料上的支出正在增加,這些產品可以增強室內空間的美感。這種轉變導致消費者對家居和職場室內設計的興趣日益增加。消費者收入水準的提高、生活方式的改變以及對多種文化的接受都為室內裝飾市場提供了支持。消費者對豪華地板的認知度不斷提高,以及新穎形狀和圖案的豪華地板的推出預計將提供盈利的市場機會。

高階地板需求的不斷成長、住宅房地產價值的上升以及可支配收入的增加是推動全球地板產品需求成長的一些主要原因。消費者在家居設計和裝飾上的花費越來越多。這使得人們在諸如地毯和地墊之類的家具以及增強室內空間視覺吸引力的地板覆蓋材料上花費更多。

地板覆蓋材料市場趨勢

各類地板覆蓋物的銷售量增加

地毯和地毯因其美觀和功能特性而被使用,用來覆蓋地板並增強家居或辦公室裝飾的整體吸引力。地毯和地毯可以幫助保護您的地板。新興經濟體對地毯和地墊的需求最高。尼龍、聚酯和聚丙烯材料用於製造地毯和地墊。尼龍地毯堅固耐用,是工業和商業地毯等人流量大區域的理想選擇。

除了地毯外,還有乙烯基地板,也稱為彈性地板,它結合了天然和合成聚合物材料。它們以重複的結構單元形式排列。一種多功能合成地板材料,具有防水、防污的功能。乙烯基地板具有成本效益,並具有耐用性、靈活的操作和設計可能性等眾多特點,使其成為醫院、學校、辦公室和住宅的理想選擇。

北美主導地板覆蓋材料市場

由於美國對智慧基礎設施的需求快速成長以及基礎設施支出不斷增加,市場正在不斷擴大。北美擁有龐大的工業基礎、強大的購買力以及鼓勵創新的政府支持政策,是採用和創造新技術的最重要地點之一,尤其是在美國和加拿大等已開發國家。

由於北美零售商場和酒店等商業計劃的增加,乙烯基地板市場正在成長。這是因為乙烯基地板既價格實惠,又外觀漂亮。預計其時尚的設計、易於消毒和清潔、防水和防滑等特點將在整個預測期內推動其在商業應用中的需求。美國、加拿大和墨西哥等開發中國家住宅的快速擴張,是由房屋抵押貸款的可用性和消費者偏好的改變所驅動的。

地板覆蓋材料行業概況

地板覆蓋材料物市場較為分散,不同地區的企業佔據主導地位。隨著技術進步和產品創新,中小企業透過贏得新契約和開拓新市場來擴大其市場佔有率。 Mohawk Industries Inc.、Shaw Industries Group Inc.、Boral Limited、Gerflor Group 等是地板覆蓋材料市場的參與者。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 住宅面積增加推動市場

- 都市化進程加速推動地板覆蓋材料需求

- 市場限制

- 房地產建築市場對地板覆蓋材料需求的影響

- 影響市場的原物料價格波動

- 市場機會

- 具有以消費者為中心的功能和人造設計的地板覆蓋物推動了銷售

- 新興國家對地板覆蓋物的需求不斷增加

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 地板覆蓋材料市場的技術創新

- COVID-19 市場影響

第5章 市場區隔

- 按產品

- 地毯和塊毯

- 木地板

- 磁磚地板

- 強化木地板

- 乙烯基地板

- 石材地板

- 其他產品

- 按最終用戶

- 商業的

- 住宅

- 按分銷管道

- 家裝中心

- 旗艦店

- 專賣店

- 網路商店

- 其他分銷管道

- 按地區

- 北美洲

- 南美洲

- 歐洲

- 亞太地區

- 中東和非洲

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Shaw Industries Group Inc.

- Mohawk Industries Inc.

- Armstrong Flooring

- Gerflor Group

- Forbo Holding

- Mannington Mills Inc.

- TOLI Corporation

- Tarkett Group

- Dixie Group Inc.

- Milliken & Company*

第7章 市場趨勢

第8章 免責聲明及發布者

The Global Floor Covering Market size is estimated at USD 101.61 billion in 2025, and is expected to reach USD 129.12 billion by 2030, at a CAGR of 4.91% during the forecast period (2025-2030).

The floor-covering market is expected to benefit from a large population of consumers seeking high-quality products in their commercial and residential space. The increasing disposable income, booming housing industry, and rising demand for luxury flooring options are anticipated to contribute to the growth of the market globally. The sector's major trend is the rising demand for floor covering in the residential sector. A recent review of the floor covering business indicates that one of the main factors propelling the market expansion is consumers' growing inclination for interior decor.

Spending by consumers on floor coverings that enhance the aesthetic appeal of interior spaces, including carpets and rugs, is on the rise. Consumer interest in the interior design of their homes and workplaces grew as a result of this change. It is supported in terms of interior decor by rising consumer income levels, shifting lifestyles, and the acceptance of many cultures. Profitable market opportunities are anticipated as a result of rising consumer awareness of premium flooring as well as the launch of high-end flooring in novel shapes and patterns.

Rising demand for luxury flooring options, rising residential real estate values, and increased disposable income are some of the main reasons driving the demand for flooring products globally. Consumers are increasingly spending more money on the design and interiors of their homes. It encourages them to spend more on furnishings like carpets, rugs, and other floor coverings that enhance the visual appeal of interior spaces.

Floor Covering Market Trends

Rising Sales Of Different Types Of Floor Covering

Carpets and rugs are used for their aesthetic and functional properties and to cover the floors, improving the overall appeal of a home or office decor. Rugs and carpets lend a protective layer to floors. The demand for carpets and rugs is highest in developed economies. Nylon, Polyester, and Polypropylene materials are used in manufacturing the carpets and rugs. The carpets made from Nylon are of high strength, making them suitable for high foot traffic, such as in industrial and commercial carpeting.

Other than Carpet, Vinyl flooring, better known as resilient flooring, combines natural and synthetic polymer materials. These are placed in repeating structural units. It is a versatile synthetic flooring material that is resistant to water and stains. Vinyl flooring is cost-effective and exhibits numerous features, such as durability, flexible handling, and design possibilities, making it suitable for hospitals, schools, offices, and houses.

North America is Dominating the Floor Covering Market

The market is expanding because of the rapidly increasing demand for smart infrastructure and increased infrastructure spending in the United States. Because of its large industrial base, strong purchasing power, and supportive government policies that encourage innovation, North America is one of the most important locations for adopting and creating new technologies, particularly in industrialized nations like the US and Canada.

The vinyl floor market is growing due to the increasing number of commercial projects in North America, like retail malls and hotels. It is because vinyl floors are both reasonably priced and visually appealing. The demand for these goods in commercial applications is expected to be driven by their trendy designs, ease of sterilization and cleaning, and resistance to water and slippage throughout the projection period. The fast expansion of the housing sector in developing nations like the US, Canada, and Mexico is being driven by the accessibility of home loans and changing consumer tastes.

Floor Covering Industry Overview

The floor-covering market is fragmented, with regional players occupying their respective markets. With technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Mohawk Industries Inc., Shaw Industries Group Inc., Boral Limited, and Gerflor Group are some players in the floor-covering market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Residential Space Driving The Market

- 4.2.2 Rising Urbanization Driving Demand for Floor Coverings

- 4.3 Market Restraints

- 4.3.1 Impact on Real Estate Construction Market Affecting Floor Covering Demand

- 4.3.2 Volatility in Price of Raw Material Affecting the Market

- 4.4 Market Opportunities

- 4.4.1 Artificially Designed Floor Coverings with Consumer Centric Features are Driving Sales

- 4.4.2 Rising Demand for Floor Coverings in Emerging Economies

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in Floor Covering Market

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Carpet and Area Rugs

- 5.1.2 Wood Flooring

- 5.1.3 Ceramic Tiles Flooring

- 5.1.4 Laminate Flooring

- 5.1.5 Vinyl Flooring

- 5.1.6 Stone Flooring

- 5.1.7 Other Products

- 5.2 By End User

- 5.2.1 Commercial

- 5.2.2 Residential

- 5.3 By Distribution Channel

- 5.3.1 Home Centers

- 5.3.2 Flagship Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Stores

- 5.3.5 Other Distribution Channels

- 5.4 By Region

- 5.4.1 North America

- 5.4.2 South America

- 5.4.3 Europe

- 5.4.4 Asia-Pacific

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Shaw Industries Group Inc.

- 6.2.2 Mohawk Industries Inc.

- 6.2.3 Armstrong Flooring

- 6.2.4 Gerflor Group

- 6.2.5 Forbo Holding

- 6.2.6 Mannington Mills Inc.

- 6.2.7 TOLI Corporation

- 6.2.8 Tarkett Group

- 6.2.9 Dixie Group Inc.

- 6.2.10 Milliken & Company*