|

市場調查報告書

商品編碼

1642069

印度地板覆蓋材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)India Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

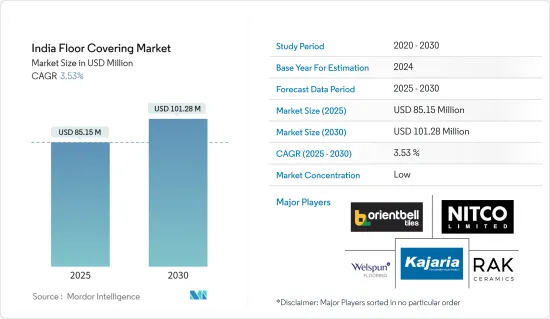

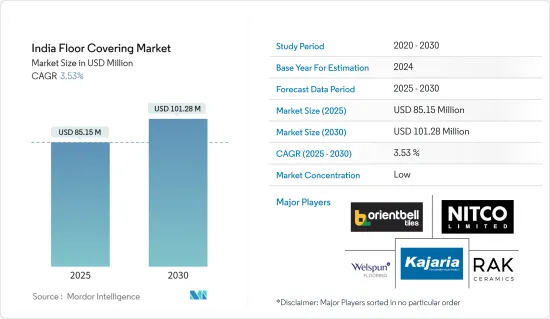

印度地板覆蓋材料物市場規模預計在 2025 年為 8,515 萬美元,預計到 2030 年將達到 1.0128 億美元,預測期內(2025-2030 年)的複合年成長率為 3.53%。

在印度,地板覆蓋材料行業的成長趨勢與建設產業的其他部分相似。地板材料產業發展的驅動力是對品質的日益重視以及按時、在預算內交貨的需要。客戶尋求的是高品質、功能性和長期性能,並且價格有競爭力的產品。這就對易於清潔和維護且耐磨性強的地板產生了需求。工業化和蓬勃發展的城市基礎設施支撐的健康成長率可能會促進市場成長。

同樣,地鐵計劃的增加以及對地鐵站優質地板材料的需求也為市場創造了新的應用。印度市場的一個趨勢是商業地板領域正在趕上工業地板市場的成長速度。預計市場發展將很快擴大。多項政策舉措可能會促進印度地板覆蓋材料市場的成長。印度已成為全球重要的地板材料產品市場。

印度地板覆蓋材料市場趨勢

印度瓷磚需求不斷成長:地板材料產業的福音

印度瓷磚行業已獲得國際認可,成為全球瓷磚市場的參與者和外匯來源。瓷磚如今已成為印度住宅裝修不可或缺的一部分。儘管整體經濟放緩,印度的瓷磚業務仍穩步擴大。印度瓷磚市場的主要驅動力是住宅行業的成長和政府的支持計劃。印度零售業的擴張也影響了奢侈品的需求。國家的經濟對印度瓷磚行業的成長有重大影響。該行業資本密集度較高,但基本上是本土產業,具有豐富的原料資源、技術訣竅和基礎設施。

工業化推動市場成長

在過去的 20 年裡,建築業的地板材料領域取得了重大發展。透過引入創新技術和增加使用專用設備,地板材料產業發生了翻天覆地的變化,尤其是在工業和商業地板材料領域。印度正迅速成為創新技術的領先市場,近年來工業和商業地板材料類別經歷了健康成長。印度地板材料產業的成長基於商業地板材料保持與工業地板材料市場相對應的成長曲線。

印度地板覆蓋材料產業概況

印度地板覆蓋材料市場較為分散,競爭對手眾多。本研究介紹了涉足印度地板材料行業的主要外國公司。 Kajaria、Welspun Flooring Ltd、Prism Johnson、Asian Granito、RAK Ceramics、S Orient Bell Ceramics 和 Nitco。目前,少數領導企業佔據了瓷磚行業大部分的市場佔有率。然而,產品創新和技術改進正在幫助中小企業贏得新契約並進入尚未開發的領域,從而增加市場佔有率。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察與動態

- 市場概況

- 市場促進因素

- 都市化和人口成長

- 建築業的成長推動市場

- 市場限制

- 經濟不確定性

- 市場競爭加劇

- 市場機會

- 地板材料產業技術創新不斷湧現(智慧地板)

- 價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業創新洞察

- COVID-19 市場影響

第5章 市場區隔

- 按類型

- 地毯和塊毯

- 地板

- 陶瓷地磚

- 強化木地板

- 石材地板

- 乙烯基片材和地磚

- 按分銷管道

- 家裝中心

- 旗艦店

- 專賣店

- 線上

- 按最終用戶

- 住宅

- 商業的

第6章 競爭格局

- 公司簡介

- Responsive Industries Ltd

- RMG Polyvinyl India Ltd

- Squarefoot

- Cengres Tiles Ltd

- Mohawk Industries Inc.

- Armstrong Flooring, Inc.

- Marvel Vinyls Limited

- Nitco Limited

- OrientBell Limited

- Welspun Flooring Ltd

- Indiana International Corporation Flooring Pvt. Ltd

- Forbo Holding AG

- Accord Floors

- Oras Floorings

- Somany Ceramics Ltd

- RAK Ceramics PJSC

- Kajaria Ceramics Ltd

- 其他公司

第7章 市場機會與未來趨勢

第8章 免責聲明及發布者

The India Floor Covering Market size is estimated at USD 85.15 million in 2025, and is expected to reach USD 101.28 million by 2030, at a CAGR of 3.53% during the forecast period (2025-2030).

In India, the growth trends of the floor-covering industry have been similar to those of other segments in the construction industry. The flooring industry's developments are being driven by a growing emphasis on quality and the need to adhere to tight deadlines while staying within budget. Customers require quality, functionality, and long-term performance, all at competitive prices. Thus, floors that are easy to clean and maintain and offer excellent wear resistance are in demand. The healthy growth rate supported by industrialization and the buoyant urban infrastructure scenario may help the market's growth.

Similarly, the increase in metro rail projects and the subsequent demand for quality flooring at metro stations are emerging applications for the market. One of the trends in the Indian market is that the commercial flooring segment has been keeping up with the growth pace of the industrial flooring market. The market development is expected to increase shortly. Several policy initiatives can potentially propel the growth of the Indian floor-covering market. India is emerging as a critical global market for flooring products.

India Floor Covering Market Trends

Growing Demand for Ceramic Tiles in India: A Boon for the Floor Covering Industry

The Indian tile industry has gained international recognition as a global player and a source of foreign exchange in the ceramic tile market. Ceramic tiles are now a necessary component of home remodeling in India. Despite the general economic slowdown, the Indian tile business is still expanding at a good rate. The primary drivers of the ceramic tile market in India are the growth of the housing sector and government programs to support it. The expansion of the Indian retail sector has also impacted the demand for higher-end goods. The country's economy has greatly impacted the growth of India's ceramic tile industry. The sector is very capital-intensive, but it has the unique feature of being primarily indigenous and having a wealth of raw resources, technical know-how, and infrastructure.

Industrialization is Helping the Market to Grow

During the past 20 years, significant developments have occurred in the flooring sector of the construction business. The flooring industry has seen significant transformation due to the introduction of novel technologies and the growing utilization of specialized equipment, particularly in the industrial and commercial flooring sectors. India is becoming a major market for innovative technology, and the industrial and commercial flooring categories have been growing at a healthy rate in recent years. The growth of the flooring industry in India is based on the fact that commercial flooring has maintained a growth curve that corresponds to that of the industrial flooring market.

India Floor Covering Industry Overview

The floor-covering market in India is fragmented, with numerous competitors. The study includes key foreign companies involved in the Indian floor-covering industry. Kajaria, Welspun Flooring Ltd, Prism Johnson, Asian Granito, RAK Ceramics, S Orient Bell Ceramics, and Nitco. Several top companies now hold the majority of the market share in the tile industry. However, because of product innovation and technical improvement, mid-size and smaller businesses are expanding their market share by landing new contracts and breaking into untapped sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Urbanization and Population Growth

- 4.2.2 Growth in the Construction Industry is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Economic Uncertainty

- 4.3.2 Increasing Competition in the Market

- 4.4 Market Opportunities

- 4.4.1 Rising Technological Innovations (Smart Flooring) in the Floor Covering Industry

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Innovations in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Carpet and Area Rugs

- 5.1.2 Wood Flooring

- 5.1.3 Ceramic Floor Tiles

- 5.1.4 Laminate Flooring

- 5.1.5 Stone Flooring

- 5.1.6 Vinyl Sheet and Floor Tiles

- 5.2 By Distribution Channel

- 5.2.1 Home Centers

- 5.2.2 Flagship Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online

- 5.3 By End-user

- 5.3.1 Residential

- 5.3.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Responsive Industries Ltd

- 6.1.2 RMG Polyvinyl India Ltd

- 6.1.3 Squarefoot

- 6.1.4 Cengres Tiles Ltd

- 6.1.5 Mohawk Industries Inc.

- 6.1.6 Armstrong Flooring, Inc.

- 6.1.7 Marvel Vinyls Limited

- 6.1.8 Nitco Limited

- 6.1.9 OrientBell Limited

- 6.1.10 Welspun Flooring Ltd

- 6.1.11 Indiana International Corporation Flooring Pvt. Ltd

- 6.1.12 Forbo Holding AG

- 6.1.13 Accord Floors

- 6.1.14 Oras Floorings

- 6.1.15 Somany Ceramics Ltd

- 6.1.16 RAK Ceramics PJSC

- 6.1.17 Kajaria Ceramics Ltd

- 6.1.18 Other Companies*