|

市場調查報告書

商品編碼

1644319

美國非彈性地板覆蓋材料:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)United States Non-Resilient Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

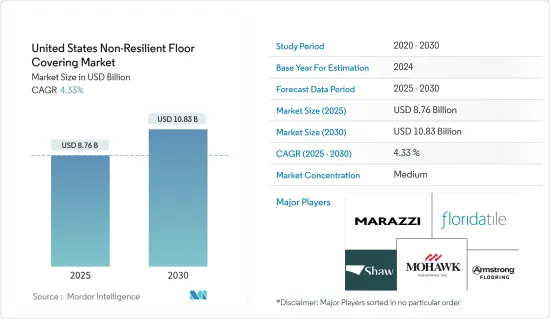

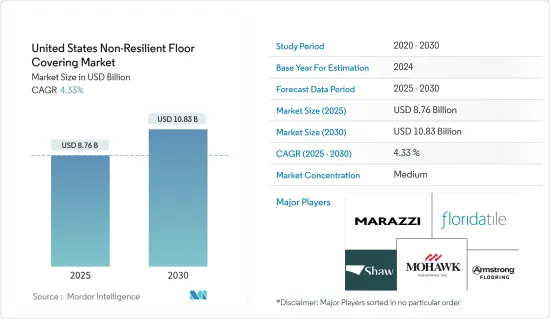

預計 2025 年美國非彈性地板覆蓋材料物市場規模為 87.6 億美元,到 2030 年預計將達到 108.3 億美元,預測期內(2025-2030 年)的複合年成長率為 4.33%。

美國是全球第二大地板材料市場,預計預測期內將以中等速度成長。預計建築市場(尤其是住宅建築)的成長將推動市場發展。新技術主導的設計有利於非彈性地板材料的地板材料,這使其成為不斷成長且需求旺盛的地板材料市場之一。由於非彈性地板是與混凝土黏合在一起的,維護簡單且價格便宜,因此消費者青睞非彈性地板市場,導致非彈性地板的需求增加。

無回彈地板行業的需求正在增加,尤其是隨著住宅、建築和施工投資和計劃的增加。在預測期內,公眾興趣的不斷成長和政府對購買住宅的舉措將進一步推動非彈性地板材料的整體市場需求。

在新技術和使用壽命延長的推動下,美國非彈性地板市場提供了各種各樣的新穎和創新設計,包括手繪或多種數位藝術作品,顏色和配件類型多樣。在美國非彈性地板市場,陶瓷、石材、木材、層壓板和混凝土已成為最突出的類別。

具體來說,由這些材料組成的部分佔據了當前非彈性地板市場的最大佔有率。這些地板材料因其耐用性、美觀性和多功能性而廣受歡迎,滿足了消費者的多樣化需求。

混凝土地板的一大優點是它完全可自訂;顏色選擇、紋理、圖案和飾面選項相結合,可實現無限的設計可能性。此外,混凝土地板非常耐用、使用壽命長且易於維護。因此,由於混凝土地板材料提供了多種選擇,其需求預計會成長,因此非抗震地板材料的市場也有望擴大。

美國非彈性地板覆蓋材料市場趨勢

建築業的成長推動了美國非彈性地板材料市場的發展

- 非彈性地板覆蓋材料市場受到美國建設產業擴張的推動,因為新建築和重建通常需要地板材料。

- 根據美國人口普查局(USCB)的報告,近年來建築支出穩步成長,這可能推動地板材料市場的擴張。

- 對於新建築和綜合體,大多數客戶喜歡非彈性材料而不是彈性材料,因為它們具有較高的耐用性和永續性。

技術進步推動美國非彈性地板材料市場發展

- 為了將這一類別推向新的高度,國內外製造商都在利用這些技術,推出強調全面創新的新產品和產品線。近年來,由於裝飾和上漿技術的進步,非彈性地板覆蓋材料行業發生了翻天覆地的變化。它受益於眾多技術發展,例如防水性、Pergo Extreme、Quartz Surface 和 Revotile。

- 非彈性地板材料具有無毒、防過敏等特點,隨著技術的進步,非彈性地板越來越受歡迎,成為過敏或呼吸系統疾病患者的良好選擇。此外,在擔心滑倒的地方可以使用具有防滑塗層的瓷磚。

美國非彈性地板覆蓋材料產業概況。

美國非彈性地板覆蓋材料市場在全國競爭激烈,競爭對手眾多。地板材料製造商之間的創新和合作正在創造市場機會。因此,美國非彈性地板覆蓋材料市場競爭激烈且強勁。

在佛羅裡達瓷磚、Marrazi等跨國連鎖店及其品牌廣為人知的同時,Shaw Industries、Mohawk Industries等美國非彈性地板覆蓋材料集團在併購後,正致力於透過加強技術創新合作,為非彈性地板材料產品提供更多的平台,從而將美國非彈性地板覆蓋材料市場推向新的高度,預計在整個預測期內都將保持成長。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第 3 章總結

第4章 市場洞察與動態

- 市場概況

- 市場促進因素

- 市場限制

- 產業價值鏈分析

- 洞察技術變革對市場的影響

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 市場影響

第5章 市場區隔

- 依產品類型

- 磁磚地板

- 石磚地板

- 強化磁磚地板

- 木地板磁磚

- 其他產品類型

- 按最終用戶

- 住宅

- 商業的

- 按分銷管道

- 線上

- 離線

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Mohawk Industries Inc

- Shaw Industries

- Florida Tile Inc

- Marazzi

- Armstrong Flooring Inc

- Mannington Mills Inc

- Bruce flooring

- Kronotex USA

- FloorMuffler

- Moreland Company USA*

第7章 市場機會與未來趨勢

第8章 免責聲明及發布者

The United States Non-Resilient Floor Covering Market size is estimated at USD 8.76 billion in 2025, and is expected to reach USD 10.83 billion by 2030, at a CAGR of 4.33% during the forecast period (2025-2030).

The United States is the second-largest floor-covering market in the world and is forecasted to register moderate growth during the forecast period. The growing construction market, especially residential construction, is forecasted to drive the market. It is one of the growing and highly demanded flooring markets as people prefer the combo of natural and man-made flooring from technology-driven and new designs for which non-resilient flooring is appropriate. The consumer much prefers the non-resilient flooring market because it's easier and cheaper to maintain as these floors are glued down to the concrete leading to an increase in demand for non-resilient flooring.

With rising investment and projects, especially towards housing, building, and construction, the non-resilient flooring industry is witnessing an increase in demand. Growing public interest and government initiatives toward buying new houses is further enhancing the overall market demand for non-resilient flooring during the forecast period.

The United States non-resilient flooring market offers a huge variety of newly innovated designs with hand paintings or many digital artworks in different colours and fitting types, made up with new technologies and increased longevity. In the non-resilient flooring market of the United States, the ceramic, stone, wood, laminate, and concrete segment has emerged as the most prominent category.

Specifically, the segment comprising these materials holds the largest share in the non-resilient flooring market in the current year. These flooring options have gained significant popularity due to their durability, aesthetics, and versatility, meeting the diverse needs of consumers.

One of the major advantages of having concrete floors is they are completely customizable, and colour choices, textures, patterns, and finish options combine for limitless design possibilities. In addition, concrete floors are extremely durable, long-lasting, and easy to maintain. Therefore, due to the wide variety of choices it gives, the concrete flooring demand is expected to grow, and owing to this, the non-resilient market will also rise.

United States Non-Resilient Floor Covering Market Trends

Growth of Construction Sector is Driving the United States Non-Resilient Flooring Market

- The market for non-resilient floor coverings is being driven by the expansion of the construction industry in the United States because flooring is typically needed for new construction and renovations.

- The United States Census Bureau (USCB) reports that construction spending has been steadily rising in recent years, which may be helping the floor-covering market expand.

- In new buildings and complexes, the majority of customers prefer non-resilient materials over resilient ones due to their high durability and sustainability.

Technological Advancements Driving Non-Resilient Flooring Market of United States

- To raise the category to new heights, domestic and foreign manufacturers have benefited from those technologies by introducing new goods and product lines emphasizing innovation across the board. The non-resilient floor covering industry has transformed over the past few years due to technological advancements in decoration and sizes. The vision has benefited from numerous technological developments, including water resistance, Pergo Extreme, Quartz Surface, revo-tiles, and many others.

- Since they are non-toxic and hypoallergenic, non-resilient flooring options are becoming more popular thanks to technological advancements, making them a good option for those with allergies or respiratory problems. Additionally, non-slip options such as textured tiles can be used in locations where slip and fall accidents are a concern.

United States Non-Resilient Floor Covering Industry Overview

The United States non-resilient floor covering market is highly competitive across the country, offering a huge number of competitive players. Innovations and partnerships by flooring players yield opportunities in the market. Thus it has made the United States non-resilient floor covering market very competitive and strong.

Multinational chains and their brands, such as Florida Tiles, Marrazi, and others, are widely famous, but altogether the United States non-resilient floor covering groups such as Shaw Industries, Mohawk Industries, and many more after mergers and acquisitions have been focusing on tying up with enhanced technology innovations and offering more platforms for non-resilient flooring products, thus, leading the United States non-resilient floor covering market to the new heights and expected to grow throughout the forecasted period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXCEUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Value Chain Analysis

- 4.5 Insights on impact of technology and innovation in the Market

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrant

- 4.6.2 Bargaining Power of Buyer/ Consumer

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Product

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Ceramic Tiles Flooring

- 5.1.2 Stone Tiles Flooring

- 5.1.3 Laminate Tiles Flooring

- 5.1.4 Wood Tiles Flooring

- 5.1.5 Other Product Types

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Online

- 5.3.2 Offline

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Mohawk Industries Inc

- 6.2.2 Shaw Industries

- 6.2.3 Florida Tile Inc

- 6.2.4 Marazzi

- 6.2.5 Armstrong Flooring Inc

- 6.2.6 Mannington Mills Inc

- 6.2.7 Bruce flooring

- 6.2.8 Kronotex USA

- 6.2.9 FloorMuffler

- 6.2.10 Moreland Company USA*