|

市場調查報告書

商品編碼

1642074

印尼瓷磚:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Indonesia Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

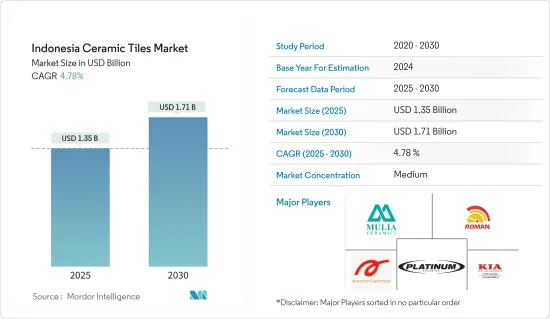

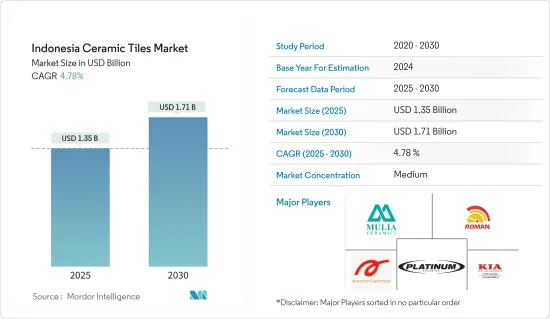

印尼瓷磚市場規模預計在 2025 年為 13.5 億美元,預計到 2030 年將達到 17.1 億美元,預測期內(2025-2030 年)的複合年成長率為 4.78%。

印尼瓷磚廣泛用於地板材料和牆壁材料。該國的陶瓷產業蓬勃發展,許多製造商生產各種款式、顏色和尺寸的瓷磚。印尼瓷磚有幾個優點,包括獨特的設計和使用天然材料。磁磚的生產採用數位印刷概念,保證了產品的高品質。在國際市場特別是東協地區享有盛名。印尼在瓷磚行業擁有雄厚的資本,並擁有足夠的技術和工廠能夠生產瓷磚,以滿足國內和國際的需求。

市場受到建築支出增加和住宅行業蓬勃發展的推動。都市化和人口成長預計將推動瓷磚行業的發展。由於其出色的美觀性、可靠性和耐用性,這些瓷磚在許多建築工程中的需求量很大。由於可支配收入的增加和經濟的擴張,印尼瓷磚市場為行業相關人員提供了大量機會。此外,領先的公司正在擴大業務以加強其市場地位並展示其最新的陶瓷產品。

印尼磁磚市場趨勢

印尼磁磚消費量

由於多種因素,印尼的瓷磚消費量一直穩步成長。該國的人口成長、都市化和可支配收入的提高正在推動建設活動、住宅和基礎設施行業的發展。

政府重視道路、機場和公共建築等基礎建設也推動了對瓷磚的需求。此外,瓷磚在印尼的受歡迎程度還在於其耐用性和美觀性。這些瓷磚廣泛用於商業、住宅和工業建築的地板材料、牆壁材料等。

總體而言,在印尼經濟成長和正在進行的基礎設施發展計劃的推動下,印尼的瓷磚消費量預計將繼續成長。

商業計劃對瓷磚的需求不斷增加

由於創新材料和簡單應用方法的開發,商業地板材料行業正在經歷強勁成長。陶瓷地板材料因其抗菌、防滑和防水性能在醫療保健和其他領域等設施中越來越受歡迎。由於該產品具有成本效益並能增強美感,酒店和購物中心等商業計劃對該產品的需求也在成長。

此外,設計師和建築師對商業場所使用陶瓷瓷磚和地板材料的影響力日益增強,預計也將推動對瓷磚的需求。預計在預測期內,這些材料易於清潔、設計時尚、防污防水等特點將推動其在商業地板材料應用方面的需求。

印尼磁磚行業概況

印尼瓷磚市場比較分散,有許多國際和本土公司在印尼市場運作。企業越來越注重創新、永續性和擴大產品範圍,中小企業透過技術進步擴大市場佔有率並在新市場贏得新契約。主要參與者包括 Platinum Ceramics 工業、PT Arwana Citramulia TBK、PT Keramika Indonesia Assosiasi (KIA)、PT Muliakeramik Indahraya 和 PT Roman Ceramic International。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 房地產建設成長推動市場

- 都市化進程加速推動市場

- 市場限制

- 安裝困難、昂貴且耗時

- 難以長時間保暖

- 市場機會

- 製造技術創新帶來市場機遇

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場創新洞察

- COVID-19 市場影響評估

第5章 市場區隔

- 按產品

- 釉藥

- 瓷

- 無刮痕

- 其他產品

- 按應用

- 地磚

- 牆磚

- 其他用途

- 按最終用戶

- 住宅

- 商業的

- 依建築類型

- 新建築

- 更換和翻新

- 按分銷管道

- 離線

- 線上

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Platinum Ceramics Industry

- PT Arwana Citramulia TBK

- PT Keramika Indonesia Assosiasi

- PT Muliakeramik Indahraya

- PT Roman Ceramic International

- PT Gemilang Mitra Sejahtera

- PT Jui Shin Indonesia

- PT Terracotta Indonesia

- PT Niro Ceramic Nasional Indonesia

- PT Eleganza Tile Indonesia*

第7章 市場趨勢

第8章 免責聲明及發布者

The Indonesia Ceramic Tiles Market size is estimated at USD 1.35 billion in 2025, and is expected to reach USD 1.71 billion by 2030, at a CAGR of 4.78% during the forecast period (2025-2030).

Ceramic tiles in Indonesia are a popular choice for flooring and wall coverings. The country has a vibrant ceramic industry, with many manufacturers producing various tiles in various styles, colors, and sizes. Indonesian ceramic tiles offer several advantages, including unique designs and the use of natural raw materials. Production of the tiles is through the digital printing concept, ensuring high-quality products. They are well-known in the international market, particularly in the ASEAN region. Indonesia has huge capital in the ceramic tile industry, with sufficient technologies and factories capable of producing ceramic tiles to meet demands both at domestic and international levels.

The market is driven by increased construction spending and rapid growth in the housing sector. Urbanization and population growth are expected to fuel the development of the ceramic tiles industry. These tiles are in high demand for constructing numerous structures due to their superior aesthetics, reliability, and durability. The Indonesian ceramic tiles market offers numerous opportunities for industry players due to increasing disposable income and economic expansion. Additionally, major companies are expanding their operations to enhance their market position and showcase the latest ceramic products.

Indonesia Ceramic Tiles Market Trends

Consumption of Ceramic Tiles in Indonesia

The consumption of ceramic tiles in Indonesia has been steadily increasing, driven by several factors. The country's growing population, urbanization, and rising disposable income have led to an increase in construction activities, housing, and infrastructure sectors.

The government's focus on developing the country's infrastructure, such as roads, airports, and public buildings, has further boosted the demand for ceramic tiles. Moreover, the popularity of ceramic tiles in Indonesia can be attributed to their durability and aesthetic appeal. These tiles are widely used in commercial, residential, and industrial buildings for flooring, wall cladding, and other purposes.

Overall, the consumption of ceramic tiles in Indonesia is expected to continue to grow in the future, driven by the country's economic growth and ongoing infrastructure development projects.

Rise in Demand for Ceramic Tiles in Commercial Projects

The commercial flooring sector has experienced significant growth due to the development of innovative materials and easy installation methods. Ceramic flooring is becoming increasingly popular in institutions and other sectors, including healthcare, due to its antibacterial, anti-slip, and water-resistant properties. The product's cost-effectiveness and improved aesthetics have increased demand from commercial projects such as hotels and shopping malls.

Designers' and architects' growing influence on the use of porcelain tiles and flooring in commercial settings is also expected to drive demand for ceramic tiles. The ease of cleaning, fashionable designs, and stain and water resistance offered by these materials are likely to fuel demand in commercial flooring applications during the forecast period.

Indonesia Ceramic Tiles Industry Overview

The ceramic tiles market in Indonesia is fragmented, with many international and local players operating in the Indonesian market. Companies are focusing increasingly on innovation, sustainability, and expanding their product range, while smaller firms are expanding their market presence through technological advancements and securing new contracts in new markets. The key players include the Platinum Ceramics Industry, PT Arwana Citramulia TBK, PT Keramika Indonesia Assosiasi (KIA), PT Muliakeramik Indahraya, and PT Roman Ceramic International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Real Estate Construction is Driving the Market

- 4.2.2 Rise in Urbanization is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Installation is Difficult, Pricey, and Time-Consuming

- 4.3.2 Long-term Heat Retention is Difficult

- 4.4 Market Opportunities

- 4.4.1 Innovations in Manufacturing Technologies are Providing Opportunities for the Market

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights of Technology Innovations in the Market

- 4.8 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Other Products

- 5.2 By Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Applications

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Replacement and Renovation

- 5.5 By Distribution Channel

- 5.5.1 Offline

- 5.5.2 Online

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Platinum Ceramics Industry

- 6.2.2 PT Arwana Citramulia TBK

- 6.2.3 PT Keramika Indonesia Assosiasi

- 6.2.4 PT Muliakeramik Indahraya

- 6.2.5 PT Roman Ceramic International

- 6.2.6 PT Gemilang Mitra Sejahtera

- 6.2.7 PT Jui Shin Indonesia

- 6.2.8 PT Terracotta Indonesia

- 6.2.9 PT Niro Ceramic Nasional Indonesia

- 6.2.10 PT Eleganza Tile Indonesia*