|

市場調查報告書

商品編碼

1683432

德國瓷磚市場:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Germany Ceramic Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

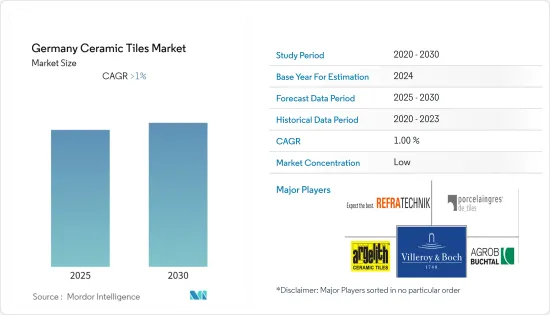

預計預測期內德國瓷磚市場的複合年成長率將超過 1%。

德國是歐洲領先的瓷磚市場之一。該國受益於高度開發和先進的陶瓷產品,例如屋頂瓦片、磚塊和衛浴設備。此外,消費者在住宅建築上的高支出也推動了市場的成長。建築業的繁榮得益於國家投資和低利率。新住宅基礎設施的需求不斷增加是影響德國瓷磚市場成長的主要因素。德國是歐洲主要的高嶺土生產國之一。

在德國,瓷磚市場也在成長。 2020年磁磚進口量成長9.8%,總合1.136億平方公尺。根據統計,平均進口價格在每平方公尺4.00歐元至13.85歐元之間。通常,購買的數量越多,價格越低。義大利的進口量維持穩定在6,020萬平方公尺左右,其次是土耳其(1,470萬平方公尺)、西班牙(1,120萬平方公尺)、波蘭(1,120萬平方公尺)和捷克共和國(750萬平方公尺)。進口量增加的原因是,其他國家的製造商在本土市場崩壞後轉向更穩定的德國市場。同時,這種轉變意味著,約三分之一的產品用於出口的德國製造商在某些情況下失去了重要的出口市場。

德國瓷磚市場的趨勢

建設活動的增加推動市場

建築支出的增加正在推動德國瓷磚市場的發展。室內建築業對瓷磚的高採用率和地磚的高收益預計將推動德國瓷磚市場的成長。由於德國建築業前景看好,預計預測期內對瓷磚的需求將會加速。快速的工業化和都市化導致住宅、商業和工業建設活動的增加,從而增加了對瓷磚的需求。在德國,2007年至2020年間,住宅建築許可證的總數增加。在此期間,發放的許可證總數從18.2萬份增加到36.8萬多份,增幅超過100%。

地板板塊引領市場

陶瓷磚由細密的粘土製成,並在極端溫度下燒製,使其具有出色的耐用性,適合用於人流量大的地板材料。新產品的開發和便利的應用技術正在推動商務用地板材料瓷磚市場的發展。陶瓷地板材料具有抗菌、防滑和防水的特性,正在成為醫療保健和機構建築等各個領域的經濟高效且環保的解決方案。消費者對時尚而又實惠的地板材料的需求以及對高品質地磚的需求不斷增加等因素推動了德國瓷磚市場的成長。

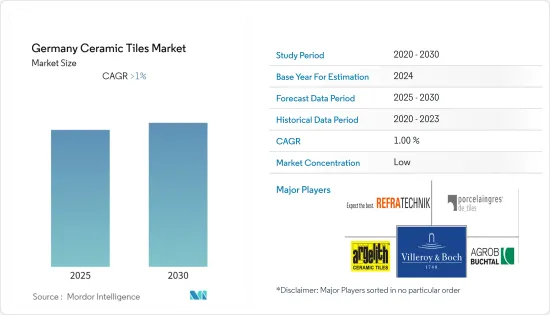

德國瓷磚行業概況

本報告介紹了在德國瓷磚市場中運作的國際主要參與者。從市場佔有率來看,目前少數幾家大公司佔據著市場主導地位。然而,隨著技術進步和產品創新,中小企業正在透過贏得新契約和開拓新市場來擴大其市場佔有率。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 市場限制

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 洞察產業技術趨勢

- COVID-19 市場影響

第5章 市場區隔

- 產品

- 釉藥

- 瓷

- 無刮痕

- 其他

- 應用

- 地磚

- 牆磚

- 其他磁磚

- 建築類型

- 新建築

- 更換和翻新

- 最終用戶

- 住宅

- 商業

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Villeroy & Boch

- Agrob Buchtal

- Argelith Ceramic Tiles Inc

- Porcelaingres GmbH

- Refratechnik Ceramics GmbH

- Golem

- Alois Korzilius Interbau.

- klingenberg dekoramik gmbh

- Tonality gmbh

- Steuler Fliesen GmbH*

第7章 市場機會與未來趨勢

第8章 免責聲明及發布者

The Germany Ceramic Tiles Market is expected to register a CAGR of greater than 1% during the forecast period.

Germany is one of the European region's major markets for ceramic tiles. The country has the benefits of highly developed and most advanced ceramic products like roof tiles, bricks, sanitary ware, etc. The significant consumer expenditure on residential and housing construction is another factor that benefits the market growth. The booming prospects of the construction sector are attributed to state investments and low-interest rates. The rising demand for new residential infrastructures is the principal factor influencing the German ceramic tiles market growth. Germany is one of the significant producers of kaolin in the European region.

In Germany, the ceramic tile market has grown similarly. Imports of tiles in 2020 climbed by 9.8%, totaling 113.6 million square meters. According to statistics, average import prices range from 4.00 to 13.85 euros per square meter. Frequently, a larger volume was purchased at a lower price. Italy's imports remain stable at roughly 60.2 million square meters, followed by Turkey (14.7 million square meters), Spain (11.2 million square meters), Poland (11.2 million square meters), and the Czech Republic (7.5 million square meters). The increased imports can be explained by the fact that after their home market collapsed, manufacturers in other countries shifted to the stable German market. At the same time, this shift means that German manufacturers, who export around a third of their products, have lost a significant export market in some situations.

Germany Ceramic Tiles Market Trends

Rising Construction Activities are Driving the Market

Increasing construction spending is the key factor in driving the ceramic tiles market in Germany. The high adoption rate of ceramic tiles in the interior construction industry and high revenue generation from the floor tiles are anticipated to boost the German ceramic tiles market growth. Due to the promising construction industry in Germany, the demand for ceramic tiles is expected to accelerate over the projected period. Rapid industrialization and urbanization have resulted in increased residential, commercial, and industrial construction activities, thereby escalating the demand for ceramic tiles. Germany had a general increase in the total number of permits issued for residential property construction between 2007 and 2020. In that period, the total number of permits issued increased from 182 thousand to over 368 thousand, an increase of over 100%.

Floor Segment is Driving the Market

Ceramic tiles are made from fine, denser clay and fired at extreme temperatures, offering superior durability to the flooring with exposure to high traffic. Developing new products and hassle-free installation techniques have considerably driven the ceramic tiles market in commercial flooring. Ceramic floorings are emerging as cost-effective and eco-friendly solutions in various sectors, including healthcare and institutional buildings, owing to the product's antibacterial, anti-slip, and water-resistant properties. Factors such as consumers seeking stylish and less expensive flooring options and escalating demand for high-quality floor tiles will contribute to the growth of the German ceramic tiles market.

Germany Ceramic Tiles Industry Overview

The report covers major international players operating in the German Ceramic Tiles Market. Regarding market share, some of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Technological Trends in the Industry

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Glazed

- 5.1.2 Porcelain

- 5.1.3 Scratch Free

- 5.1.4 Others

- 5.2 Application

- 5.2.1 Floor Tiles

- 5.2.2 Wall Tiles

- 5.2.3 Other Tiles

- 5.3 Construction Type

- 5.3.1 New Construction

- 5.3.2 Replacement and Renovation

- 5.4 End User

- 5.4.1 Residential

- 5.4.2 Commercial

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Villeroy & Boch

- 6.2.2 Agrob Buchtal

- 6.2.3 Argelith Ceramic Tiles Inc

- 6.2.4 Porcelaingres GmbH

- 6.2.5 Refratechnik Ceramics GmbH

- 6.2.6 Golem

- 6.2.7 Alois Korzilius Interbau.

- 6.2.8 klingenberg dekoramik gmbh

- 6.2.9 Tonality gmbh

- 6.2.10 Steuler Fliesen GmbH*